The 20th century was undoubtedly the American century. The United States economy rose to prominence after WWII, led by an unprecedented technological boom that pushed the country — along with the rest of the world — into the digital age.

As America’s economy boomed, so did its stock market. Since January 1950 to December 2020, the S&P 500 has returned 22,190%. The U.S. is still the number one economy in the world right now, but China’s swift rise means that the 21st century is shaping out to be hugely different. Over the last 15 years, the Shanghai Composite Index grew 177% and largely kept paced with the S&P 500 which grew 231%.

Will the U.S. continue to remain number one in the decades to come? Or will China overtake the U.S. and become the world’s largest and most important economy? Let’s take a look at some of the factors that could affect the growth of each economy and where we should invest for the future.

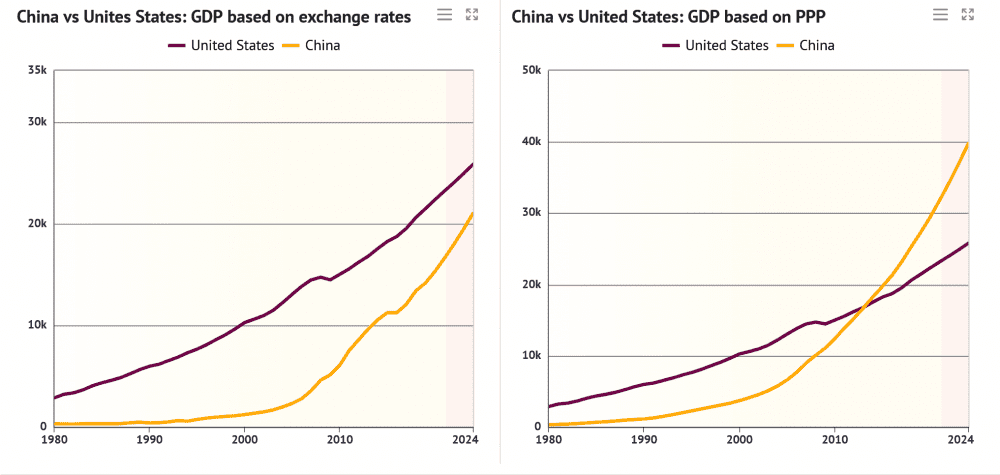

1. China is already the world’s largest economy based on purchasing power parity (PPP). The U.S. economy is still the largest based on nominal GDP. In 2020, U.S. nominal GDP was US$20.93 trillion compared to China’s nominal GDP of CN¥101.6 trillion (approximately US$14.7 trillion).

Nominal GDP is still the standard measure when it comes to measuring the size of economies, but it doesn’t take into account the cost of living in different countries. For example, a Big Mac costs US$5.66 in the U.S. but only CN¥22.40 (US$3.44) in China. While I’m just using the Big Mac Index as an example, what this basically means is that China’s economy is a lot bigger when you remove currency exchange rates and equalize the purchasing power of both countries.

GDP comparisons using PPP are more useful when comparing the size of a country’s economic productivity. Based on GDP by PPP, China already overtook the U.S. in back in 2014.

The fact that China’s economy is already bigger than the U.S. should come as no surprise give that former has four times the population of the latter; it is inevitable that China’s economy will surpass the U.S. in terms of sheer numbers. China’s annual GDP growth also outpaces the U.S. and its economy is projected to overtake the U.S. by nominal GDP by 2028.

2. Despite its size, China is still a growing, developing nation. While China has the second highest number of billionaires in the world, its GDP (PPP) per capita is ranked 70th in the world. In comparison, the U.S. is ranked seventh on the same table. China still has some ways to go to match the purchasing power of the American consumer.

Even so, China’s middle class will continue to expand and fuel the country’s domestic consumption. By 2027, it is estimated that 1.2 billion Chinese will be in the middle class, making up a quarter of the world’s total. Many homegrown Chinese companies can grow to become industry titans serving China’s massive domestic market alone (Alibaba, Tencent, etc).

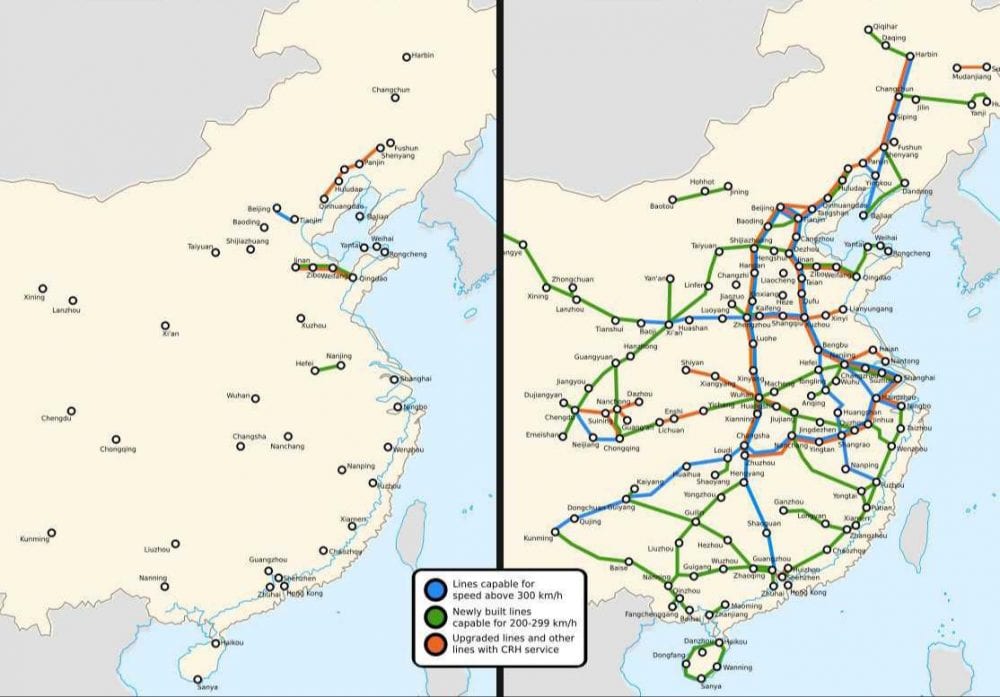

3. China continues to invest heavily in infrastructure, while America idles. Since 2008, China has steadily stepped up its infrastructure spending as it continues to lay the groundwork for the future growth of its economy. As a percentage of GDP, China’s average infrastructure spending in 2018 was 10 times higher than that of the United States. And it continues to build.

China’s high-speed rail network was first unveiled in 2008 in time for the Beijing Olympics. Today, it is the world’s largest with over 37,900 kilometres of high-speed rail crisscrossing the country. In comparison, the U.S. only has one high-speed rail line between Washington D.C. and Boston.

In 2020, China announced that it would invest CN¥10 trillion (US$1.4 trillion) on building new ‘digital’ infrastructure over the next five years in the areas of 5G networks, industrial internet, inter-city transportation and rail system, data centers, AI, ultra-high voltage power transmission, and new-energy vehicle charging stations. The last time the U.S. embarked on an infrastructure project of this scale was the Interstate Highway System in the 1950s.

‘Infrastructure investment requires large upfront investment, but provides productivity gains in the long run. Time and cost savings for commuters, improved market access, healthier competition, increased exchange of ideas and enlarged innovation capacity are a springboard for economic development.’ – Qu Hongbin, HSBC

4. American companies still hold a tech lead, but China is fast gaining ground. We’re no strangers to American technology, we live in the age of the microchip, personal computer, the Internet, and smartphone – all of which are American inventions. And American companies like Tesla and Impossible Foods continue to be at the forefront of new and disruptive industries.

At the same time, China is fast becoming a global tech leader in its own right and is already a frontrunner in many innovations including 5G, renewable energy, and digital currency. China also has 989 million internet users and 852 million mobile payment users as of end-2020. The ground is ripe for many new, disruptive companies to take root and succeed in China… and beyond.

China is also the top filer of international patents since 2019 (overtaking the U.S.), and filed the highest number of blockchain patents in 2020.

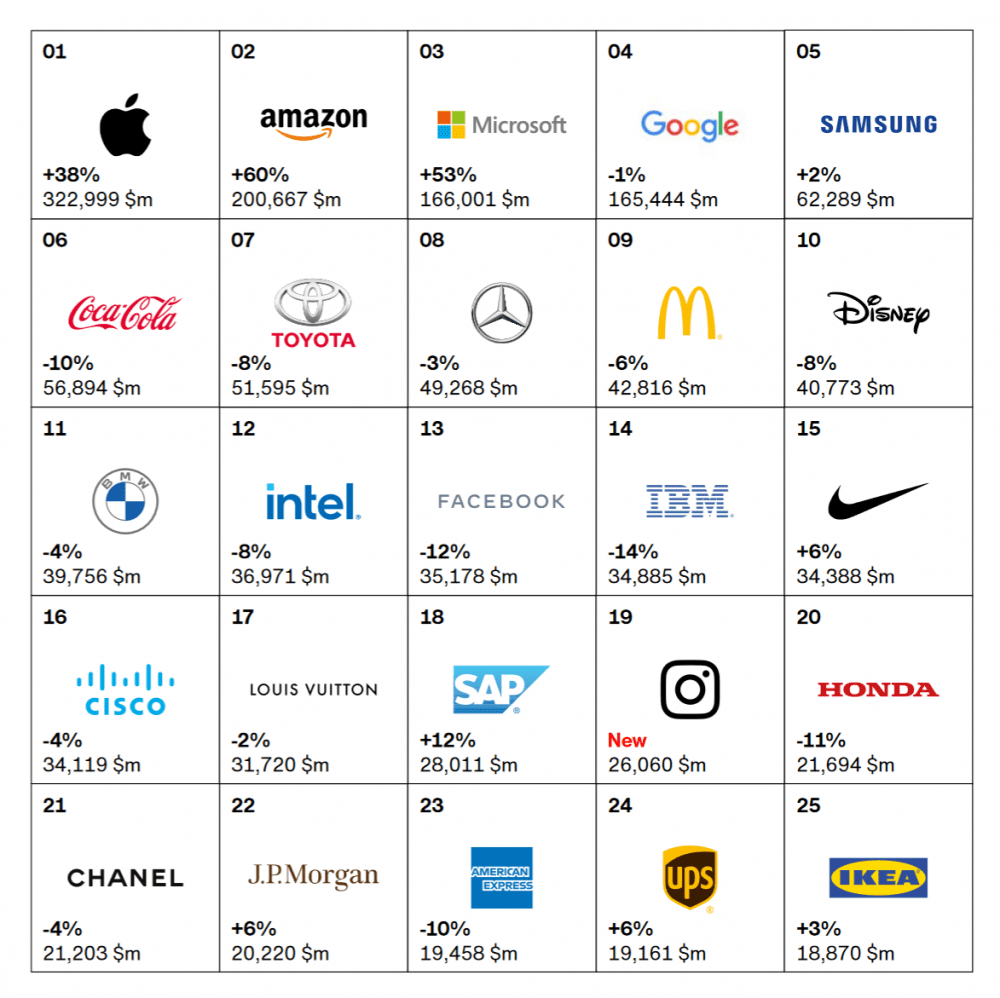

5. U.S. brands and corporations still dominate the world. A simple look at our lifestyles will reveal that many of us consume several American products and services – we buy Apple products, wear Nike shoes, eat Big Macs, and watch Netflix Originals. A quick glance at the top 100 global brands will reveal a list dominated by American companies; Huawei is the highest-ranked Chinese brand at number 80.

While Chinese companies have dominated their home economy, few have made the leap globally so far. American corporations currently have a larger global footprint and better access to foreign markets and consumers.

6. China still suffers from a shoddy reputation for corporate governance. Due to scandals in the past, and most recently when Luckin Coffee was found to have inflated its sales, investors have reason to be wary of Chinese stocks. After the Luckin scandal, the U.S. exchanges moved to delist Chinese stocks if they don’t meet U.S. auditing standards.

The U.S. has had its fair share of scandals in the past, most notably Enron, but the fact/perception remains that its corporate governance is far more transparent and robust. It may take years for Chinese corporations to eventually move toward international standards of corporate governance. For this reason, investors may prefer to consider Chinese stocks listed in Hong Kong which has stronger corporate governance standards in place.

The fifth perspective

The U.S. is still the leading economy in the world and continually attracts the brightest talents to its shores. The country is also blessed with natural advantages with enough space and resources to expand its population for many decades.

China, however, is fast catching up. It will become the largest economy in the world in the coming years and is already a world leader in new groundbreaking areas in technology. While the U.S. remains preeminent, China’s growing economic influence will mean that investors will seek growth opportunities in the two largest markets in the world.

If you want to invest in the U.S. and China stock markets, you can consider opening a brokerage account with Tiger Brokers. They offer one of the lowest trading commissions in the industry for U.S., China, and Hong Kong stocks (minimum fee per trade of US$1.99, CNH15, and HK$15 respectively).

Tiger Brokers holds brokerage licenses in the U.S., Singapore, Australia, and New Zealand. Tiger Brokers is also listed on the Nasdaq and backed by Interactive Brokers and Xiaomi. You can find out more about Tiger Brokers here.

Kindly check the ranks here

https://brandirectory.com/rankings/global/table

ICBC is #8

WeChat #10

Huawei #15

Hi Rao,

Thanks for sharing! I used the Interbrands ranking which is also broadly similar to Forbes. This is not to say that Chinese brands aren’t doing well but we can agree that American brands are still more global in their appeal for now. I expect this change in the coming years as China becomes richer and perceptions shift.

https://interbrand.com/best-global-brands/

https://www.forbes.com/the-worlds-most-valuable-brands/#6631749d119c

Thanks for the post. I had included some China equity in my portfolio and believe, it will keep increase.

Yes, these two are the biggest economies and will continue to grow. All the best!

nice article. very insightful. thanks

Today-11MAy2021, China listed HKSE stock given us some opportunity to start position