ViTrox Corporation Berhad develops, manufactures, and sells automated vision inspection systems and equipment. The equipment, which can be integrated into their clients’ production lines, is used to check for semiconductor defects.

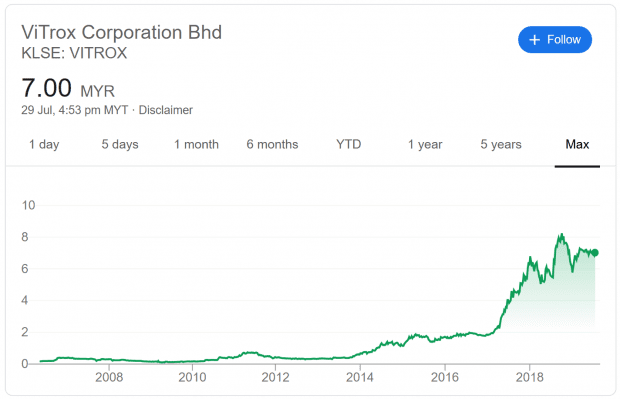

ViTrox was co-founded by Chu Jenn Weng and Siaw Kok Tong in 2000 and the pair remain as executive directors of the company. The company listed in 2005 and has been a multibagger for its investors; since its IPO, ViTrox’s stock has grown 70 times in value:

In this article, I’ll give an overview of the company’s business segments and long-term financial performance. Here are 11 things to know about ViTrox before you invest:

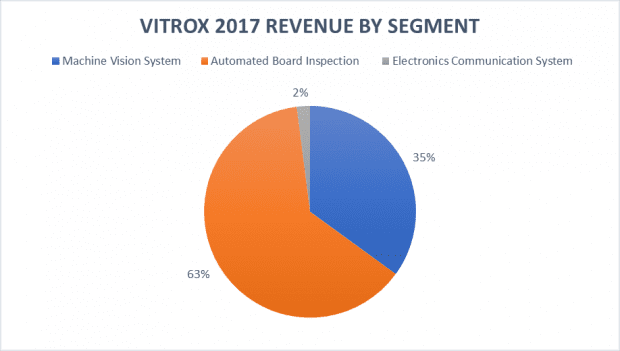

1. ViTrox’s business comprises three segments:

- Machine vision system – inspects for defects on integrated circuits in the semiconductor and electronic packaging industries.

- Automated board inspection – inspects for defects for several types of printed circuit boards for customers in the telecommunications and automotive industries, etc. These two industries amounted to 61.6% of segmental revenue in 2017.

- Electronics communication system – products for data communication and motion control to help integrate ViTrox machine vision systems with customers’ machines.

The automated board inspection segment is the company’s largest revenue contributor and accounted for 63% of revenue in 2017:

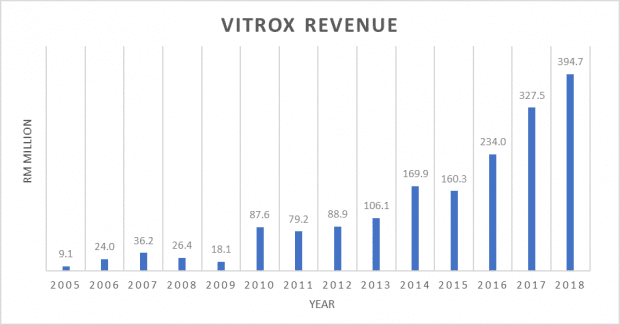

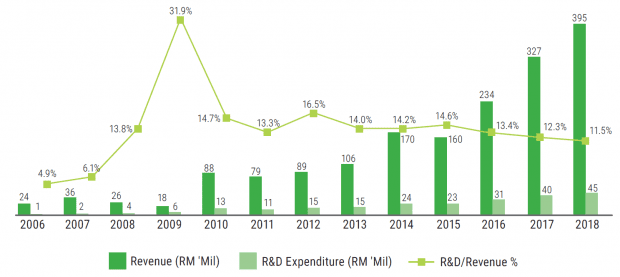

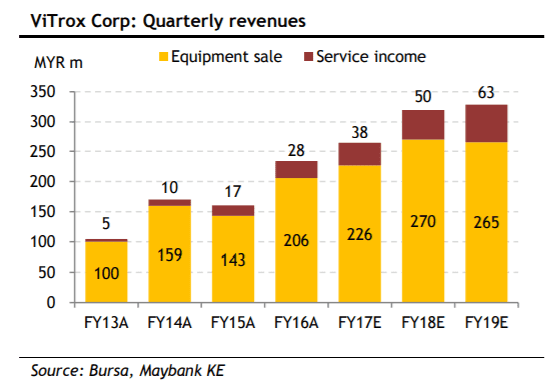

2. Revenue has increased at a compound annual growth rate (CAGR) of 33.6% over the last 14 years, from RM9.1 million in 2005 to RM394.7 million in 2018. The machine vision system segment was the major revenue contributor prior to 2009. In 2009, ViTrox secured a software development support agreement from Agilent to become its outsource service agent. ViTrox gained access to Agilent’s automated board inspection business, which the latter then exited. The deal led to the spike in revenue post-2009. Revenue has also increased over the years because of a growing diversified customer base.

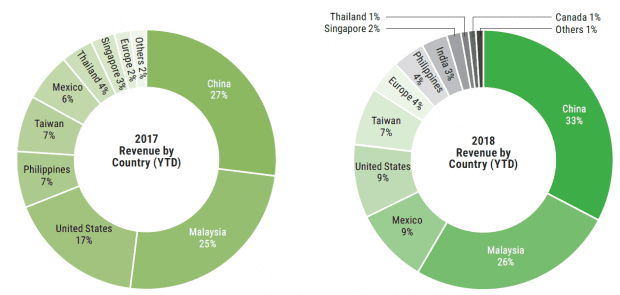

3. Revenue contribution from China totaled about one-third in 2018. Over the past eight years, revenue from China has grown at an impressive CAGR of 88.9% from RM1.5 million in 2011 to RM128.6 million in 2018. As China resorts to reduce its reliance on semiconductor imports via initiatives like ‘Made in China 2025’ plan and China National Integrated Circuit Industry Investment Fund, ViTrox’s financials may be affected in the future.

4. ViTrox two largest groups of customers contributed 18.8% and 11.0% of 2018 revenue respectively. The company has 413 customers as of 31 December 2018 and its top 10 customers accounted for 60% of revenue in 2018.

5. Over the past 13 years, ViTrox has spent, on average, 13.9% of its revenue on research and development (R&D). In 2009, R&D expenditure surged to 31.9% of revenue because of the lower revenue recorded. ViTrox increased its R&D expenditure amidst the global financial crisis as the management viewed that the company would benefit from the R&D in the years to come. As of 2015, the company held more than 20 patents across different technologies that it developed.

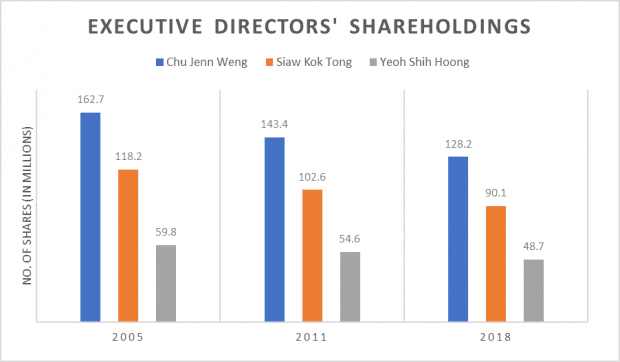

6. As of 29 March 2018, the three largest shareholders – Chu Jenn Weng, Siaw Kok Tong, and Yeoh Shih Hoong — have a collective stake of about 56%. As shown in the graph below, all three directors have gradually disposed some of their shares over the years.

| Percentage of Shareholding | ||||

|---|---|---|---|---|

| Name | Designation | 2005 | 2011 | 2018 |

| Chu Jenn Weng | Managing Director/President and CEO | 35.0% | 30.8% | 27.2% |

| Siaw Kok Tong | Executive Director/Senior Vice President | 25.4% | 22.1% | 19.2% |

| Yeoh Shih Hoong | Executive Director/Senior Vice President | 12.9% | 11.7% | 10.4% |

*Data is inclusive of direct and indirect shareholdings

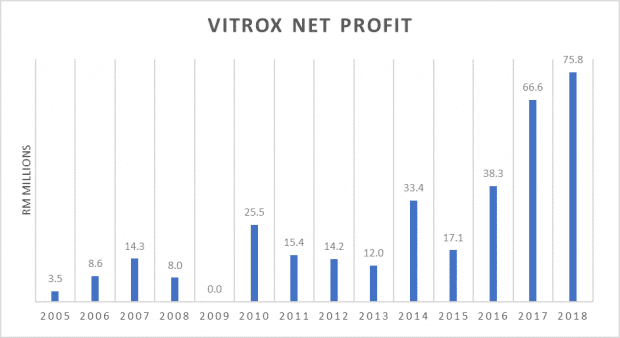

7. Net profit has grown at a CAGR of 26.7% over the last 14 years, from RM3.5 million in 2005 to RM75.8 million in 2018. From 2010-2013, ViTrox’s net profit was affected by the European Debt Crisis. Net profit was also affected in 2013 and 2015 because one-off extraordinary items which stood at RM12.1 million and RM27.3 million respectively (these have been excluded from the compilation of net profit shown below). Furthermore, ViTrox paid RM11.4 million as tax expenses in 2015 compared to RM0.9 million the previous year. This was due to the average effective tax rate increasing from 2.3% in 2014 to 20.1% in 2015.

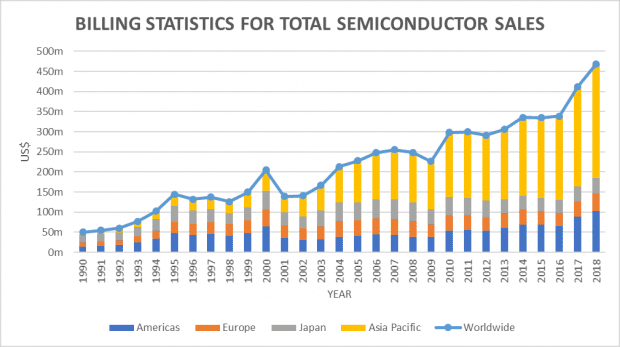

ViTrox’s business exhibits a mild cyclical pattern in its net profit which largely tracks the global billing statistics for semiconductor sales:

However, ViTrox is in the inspection business, which is a necessity of customers during both good and bad times. In 2Q 2019, revenue increased by 15.1% while net profit was up by 16.6%, compared to the previous corresponding quarter during the middle of the U.S.-China trade war. ViTrox’s 14-year return on equity averaged 17.1%.

8. Replacement demand of the equipment is estimated to be between 3-4 years. ViTrox’s equipment sales are generally one-off and on a per-order basis, whereas income generated from servicing the equipment is recurring and accounted for 12.0% of the company’s 2016 revenue.

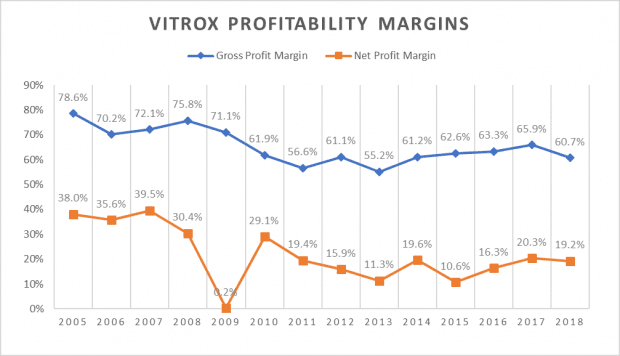

9. Average gross and net profit margins stood at 65.5% and 21.8% respectively over the past 14 years. Both margins are on a decreasing trend as ViTrox moves towards automated board inspection products after the Agilent deal, compared to machine vision systems which have a higher margin.

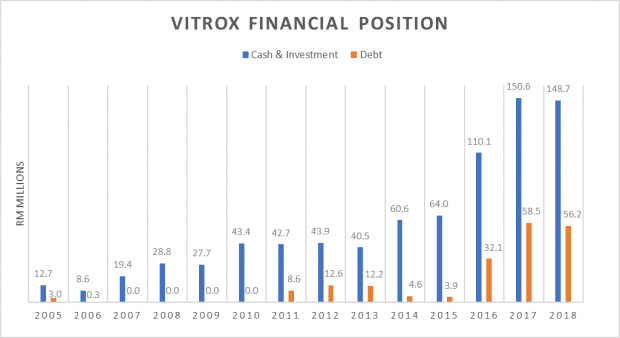

10. ViTrox has maintained little or no debt most of the time. In the early 2010s, debt was sought to finance the ViTrox Innovation Centre (Phase 2) project that was completed in 2012. In 2016, debt was raised to finance the construction of ViTrox 2.0 Campus which was completed in 2018 thereby increasing ViTrox’s production capacity.

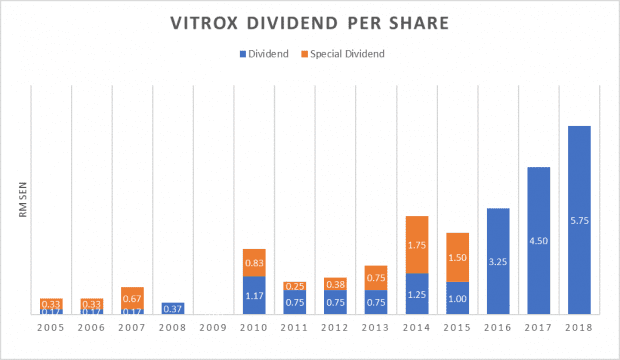

11. ViTrox has been paying increasing dividends to shareholders except 2009 when it was hit by the global financial crisis. ViTrox has a dividend yield of 2.2% on average while its 2018 yield was only 0.9%. Dividend payout ratio averaged at 37.3% over the past 14 years. ViTrox is still more of a growth company rather than a dividend-paying one.

The fifth perspective

ViTrox Corporation has performed extremely well in the stock in the past few years. However, this also probably means that its price has run ahead of the company’s business fundamentals — Vitrox’s current P/E is around 31.3 (based on share price of RM7.00 and 2018 earnings per share of 22.39 cents.

The company’s business model is also relatively cyclical and dependent on semiconductor demand. So at this valuation levels, it might be better to just wait and see.