Where do you think your Pokémon, Pokéballs and user data in Pokémon Go are stored? In your phone? No. It’s in data centers.

In my earlier article about investing overseas, I mentioned about whole industries that are non-existent in Singapore’s markets. The recent IPO of Keppel DC REIT changed that a little – it added a new sector to the REIT industry in Singapore: data centers.

We’re all used to the usual few types of REITs in Singapore: retail, industrial, logistics, office, healthcare, and hospitality. It’s a large market for Singapore; in fact, Singapore’s REIT market is the third largest in Asia behind Japan and Australia and ahead of Hong Kong. It’s a pretty impressive feat considering Singapore is geographically one of the world’s smallest countries.

If data center REITs are new to our market, you must already wonder, what other types of REITs are out there that still aren’t in Singapore. Plenty – leave it to the Americans to securitize everything. And since they practically invented the idea of a REIT, it’s no surprise their REIT industry is the most diverse. The other types of REITs you might find in the United States:

- Mortgage REITs

- Cell tower REITs

- Farmland REITs

- Apartment REITs

- General infrastructure REITs (billboards, wind turbines, etc.)

- Student housing REITs

- Self-storage REITs

- Timber REITs

- And yes, of course, only in the US, you’d only be successful and recognized when someone comes along and securitizes a 2x leveraged mortgage REIT ETN in your industry, paying out a whopping dividend of 20%. (Like almost all leveraged ETFs and ETNs, they’re for ‘crazy’ people.)

So with the introduction of this data center REIT, what is a data center and how are they any different from the six mentioned above?

What are data centers?

Data centers are secured, infrastructure-dense facilities that house servers and other network systems. Most data center operators follow a wholesale or retail model, or both (hybrid model).

- Wholesalers lease out space, power, and cooling

- Retailers offer further value-added services like cloud services, interconnectivity (colocation) and smart hands (highly-skilled technicians on-site providing 24/7 service and management)

In the United States, because of non-disclosure agreements, security and competitive reasons, data center REITs often don’t reveal specific customer names. Once a decision is made to trust a third-party with valuable data, the customer relationship often grows. Many data centers in the States typically have at least half their leasing revenue from recurring customers. However, if there’s a security breach at the data center, it may cause serious damage to reputation and customers may pull out en masse.

Data centers tend to own the site/facility itself and much of the infrastructure but the servers tend to be owned by the tenant. Imagine a Cold Storage leasing space at a mall owned by Capitaland Mall Trust with security guards, maintenance, and general infrastructure management done by the REIT, but instead of grocery aisles and produce, you have its servers fitted into a data center REIT. It’s the same principle.

The industry is split in a services stack:

- At the bottom, it’s basic data transmission/communication, which is offered by telcos with their subsea cables and landing points

- In the middle, its data center services are offered by the many data center REITs or general data center managers

- Finally, at the top of the data stack is cloud services. So for example, a tenant that leased server space at a data center would then “sublet” or outsource its servers at an “infrastructure as a service” (IaaS) level to consumers.

The industry

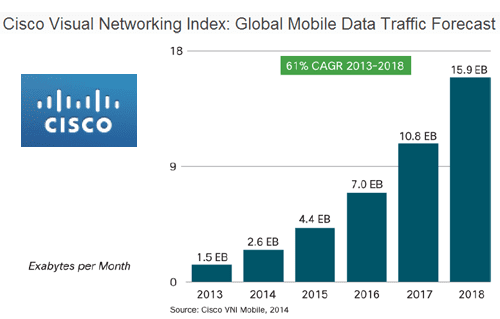

At the very source of data centers is data traffic. The explosive growth in data traffic globally will require more and more storage space which data centers will be eagerly providing. You do not have to venture too far or think too hard to know that data traffic is on the rise and that it’s not going to decline anytime soon. I mean look at the amount of Pokémon Go players blocking your path as you walk around in Singapore!

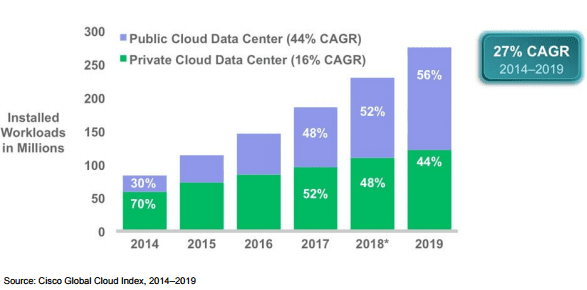

More and more data is being trafficked around the world, which means more storage as well as more enterprises and consumers preferring to use a cloud service rather than buy expensive hardware themselves to store data. Many cloud services offer pay-as-you-go payment structures which work out well for smaller enterprises that have to be cost-conscious.

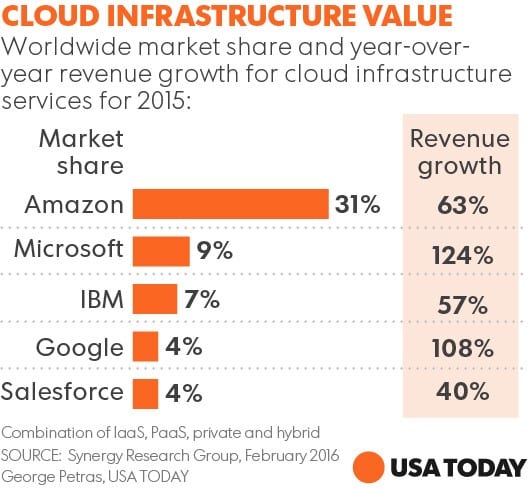

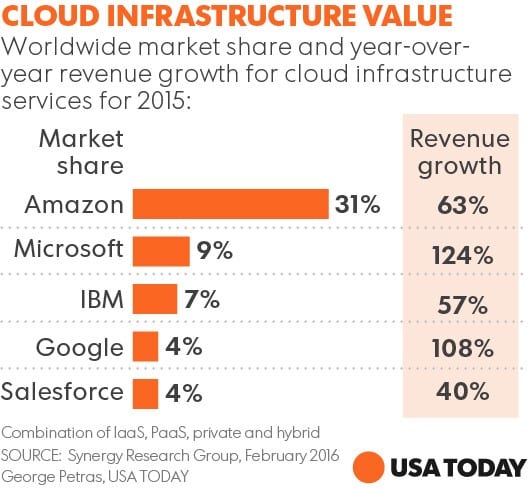

The global cloud industry is also growing at an exponential rate, with major technology companies fighting an arms race to dominate the sector. Currently, Amazon’s AWS (Amazon Web Services) dominates the cloud market with their market share larger than the next 5 competitors combined. Just how large is the largest cloud provider in the world? One out of every three internet users use AWS-based servers at least once a day, and 1 percent of total internet traffic uses Amazon’s infrastructure.

It’s now a three-way arms race with Amazon ahead and Microsoft and Google closing in fast. In Amazon’s earnings calls (and Google’s and Microsoft’s), there has been no indication of growth slowing; in fact, these companies are hiring more and spending more on cloud services and other value-added services like artificial intelligence and machine learning to augment their basic cloud services.

This hyper competitive market means only one thing: there can be no strong economic moat for the cloud market, it’s becoming commoditized as any service provider with cash (and tech companies have nothing but billions) can afford to create their own or lease infrastructure to offer cloud services and undercut the competition. Alphabet even went so far as to build an entire subsea cable system (traditionally built by telcos) that boasts 60 terabytes per second of total capacity – more than any active undersea cable system as they prepare to launch a new cloud platform in East Asia.

Jeff Bezos himself mentioned the commoditization of infrastructure computing in the book The Everything Store:

“You go back in time a hundred years, if you wanted to have electricity, you had to build your own little electric power plant, and a lot of factories did this. As soon as the electric-power grid came online, they dumped their electric-power generator, and they started buying power off the grid. It just makes more sense. And that’s what is starting to happen with infrastructure computing”

Microsoft and Facebook are not far behind, themselves investing and building undersea cables as the voracious global demand for data keeps exploding higher. Quoting from Wired:

“The fact that these Internet giants are laying their own cables—at their own expense—shows just how much data these giants must move. Consider the services they run: Google offers its eponymous search engine, Gmail, Google Docs, Google Maps, and so many more. Microsoft offers Bing, Office365, and its Azure cloud services. Facebook has its social network along with Facebook Messenger, WhatsApp, and Instagram. The data moved by just a few online giants now dwarfs that of most others, so much so that, according to telecommunications research firm Telegeography, more than two thirds of the digital data moving across the Atlantic is traveling on private networks—namely networks operated by the likes of Google, Microsoft, and Facebook. With so much data flowing across their systems, these companies are scrambling to build new infrastructure.”

What this means is that these companies would then have to either build and/or lease more and more data centers to keep up with demand and to compete with each other.

Pokémon Go

So for some context, Pokémon Go was just released in Singapore and it’s been a doozy globally. When it was first launched in the States, players experienced multiple service outages due to the sheer user demand and volume that Pokémon Go servers didn’t have the capacity to handle. Amazon’s CTO Werner Vogels then tweeted to Niantic Labs, the creators of the game, offering them help – Amazon’s AWS can easily handle this sudden rush of workload.

One way to handle something that goes from zero to a million in such a short time span without crashing is through hyperscale computing – “A distributed computing environment in which the volume of data and the demand for certain types of workloads can increase exponentially yet still be accommodated quickly in a cost-effective manner.” Which is employed by many data centers as they have to offer and handle requests that may suddenly go viral with zero downtime.

Hyperscale is also employed by banks as they outsource their back office processes to analyze customer trends, fraud, utilize blockchain technology and so on.

The players

Now we’ve seen the insanity of data growth and how big tech companies are spending billions in an infrastructure arms race, who are the beneficiaries in this value chain?

Singapore: Keppel DC REIT

Hong Kong: SunEVision

United States: Equinix, Digital Realty Trust, CyrusOne, CoreSite Realty, Dupont Fabros, QTS Realty, and several others.

As with any real estate mantra would go, location, location, location is crucial to data center REITs and is more crucial than an office REIT being 100 meters closer to Lau Pa Sat. 70% of global data traffic flows to just one place in the States: Northern Virginia – spy country (the CIA is based in N. Virginia). Many data center REITs have properties in Virginia, as well as the first AWS data center. Refer to this article to understand why data traffic is centered in that state alone.

And yes, some data centers have moats, not economic moats, but actual moats – Visa’s data center has one, and Portugal Telecom has one as well, pictured below:

Let’s take Equinix, the largest known data center REIT in the world as an example: their SG2 IBX data center in Singapore is located at 15 Pioneer Walk, and within proximity to the SEA-ME-WE3, SEA-ME-WE4 cable landing stations. Equinix’s SG3 Data Center is Equinix’ largest in the Asia Pacific that according to Equinix, “…is home to the Asia-Pacific Network Operation Center (NOC) with Internet exchange points access to one of the world’s three GRX peering points.”

GRX peering points, in essence, are switching infrastructure that facilitates the exchange of mobile internet traffic. Singapore’s market is perhaps one of the most deeply penetrated smartphone markets and it’s only natural to find Equinix wanting a slice of the action. In fact, Equinix also operates the other GRX peering points in Amsterdam as well as Washington DC. So Equinix operates all of the three GRX peering points that exist in the world.

Keppel DC REIT has a property under development in Germany called mainCubes Data Centre, which is also located near an internet exchange point, DE-CIX. Their existing property at Gore Hill also sits in a convenient data dense location in Sydney whilst their other properties are simply just data centers that may not offer low-latency services that entail close proximity to data traffic nodes.

Data center REITs do have higher maintenance capital expenditures than normal REITs as the infrastructure they offer are high-tech hardware which would depreciate fast and is more expensive to maintain due to paying higher labor costs for highly skilled technicians. This is one thing to keep in mind when thinking of investing in a data center REIT. Further, data centers would naturally consume A LOT of energy, so electricity prices should be factored in as well.

The fifth perspective

Whilst the story looks and sounds good for data center operators, the risks inherent in this subsector of the REIT industry is different:

Reputational risk – When there’s a security breach at the site, existing and future customers may not trust you. Data is highly sensitive and private unlike mom-and-pop retail stands in suburban malls, a breach is highly damaging to a data center operator.

Technology risk – Technology is moving at a rapid pace and hardware in a data center may become obsolete in the following year. An operator may have to spend more to earn more.

Client risk – Instead of leasing space on data centers, why not just build your own one? Big tech is doing it all over the world, with Amazon even building its own power substations to power its own data centers. The only reason why AWS and the other big boys are leasing space in data centers owned by third parties is because it’s faster to roll out services on existing infrastructure than to build new ones to keep up with demand.

Location – is highly crucial in the data center industry. Equinix has a small economic moat in that 90% of global data traffic passes through its global IBX network – They control valuable real estate located in network-dense locations such as Northern Virginia. They are the AWS of the data center REIT industry.

So if you’re looking to invest in data centers, do read widely and don’t just focus on Singapore-based stocks like I’ve mentioned in my earlier article, read about what other people around the world are doing, you’d be surprised to find out just how small we are compared to the titans out there.