4 reasons why the stock market keeps rising over the long term

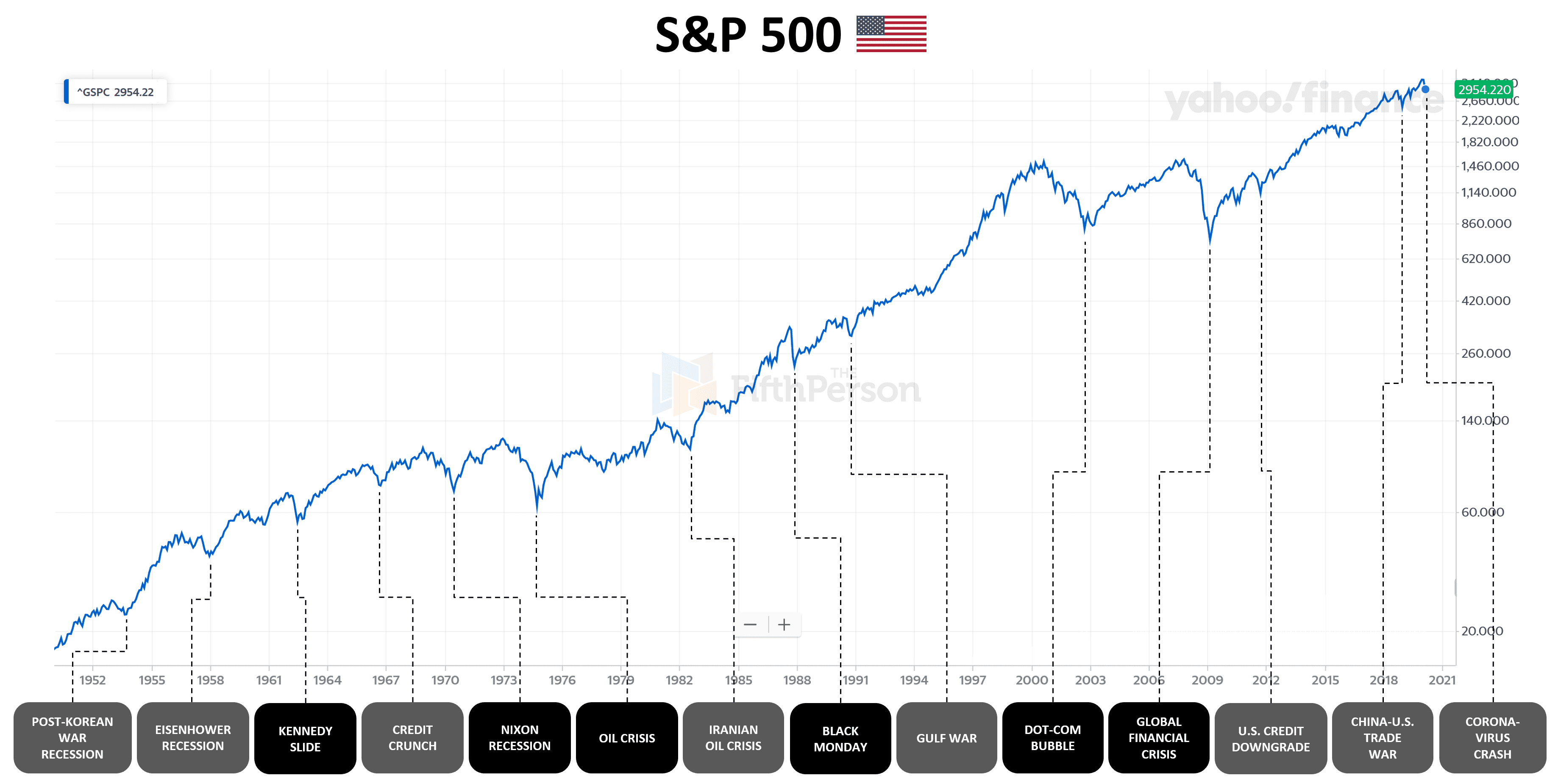

If you look at the S&P 500 from a long-term perspective, it is quite obvious to anyone that it keeps going up. Since 1950 to 2020, the S&P 500 has grown by a tremendous 22,190% (212,524.72% with dividends reinvested!). Despite world wars, pandemics, and every sort of crisis thrown in, the market keeps rising.

And this pattern tends to hold true not just in the U.S., but in many major economies around the world as well including China, Germany, UK, India, Canada, and South Korea. Over the long term, stock markets tend to rise. But why is this so?

Before we delve into the reasons, we first need to define what the ‘stock market’ is. When the news anchor reports that the stock market rose 2% today, they normally refer to a stock index. A stock index is essentially a basket of stocks that does its best to represent the overall stock market (or a subset of the stock market).

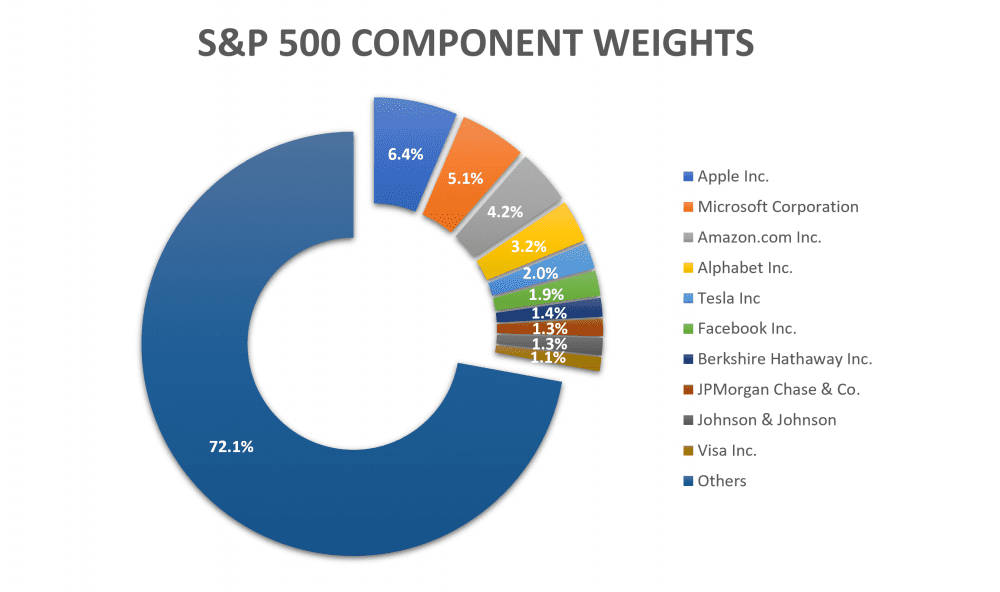

For example, the S&P 500 is a basket of 500 large U.S. stocks from various sectors of the U.S. economy including IT, healthcare, financials, consumer discretionary, communication services, industrials, consumer staples, energy, utilities, real estate, and materials. The index is also weighted according to market cap, so the larger companies constitute a larger proportion of the S&P 500. The top 10 largest companies account about 28% of the S&P 500’s weight.

So why does the value of the stock market index — and the companies within it — rise over time? Here are the four reasons why.

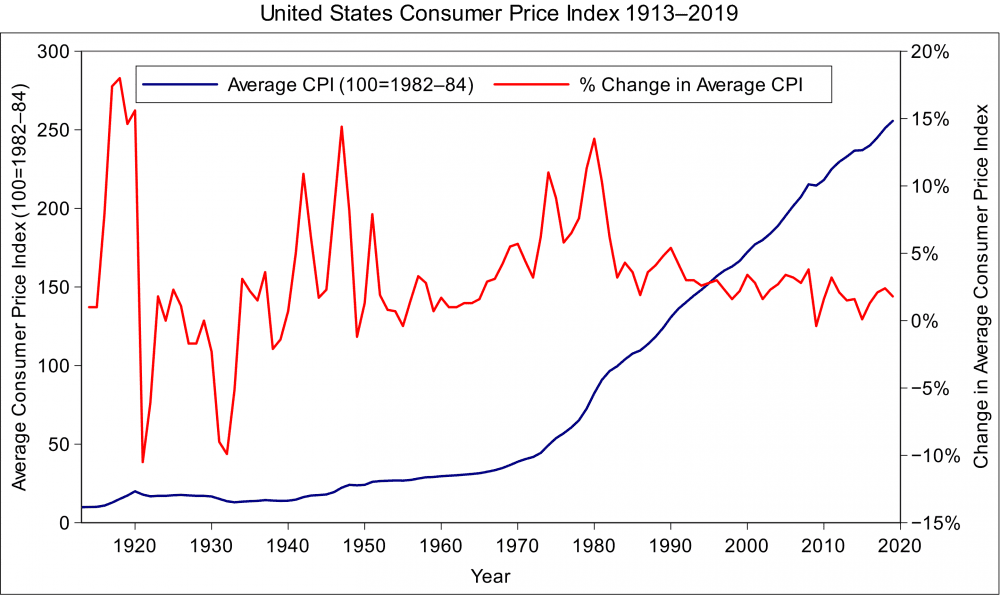

1. Inflation

Inflation is defined as the general rise in prices of goods and services in the economy. When prices steadily rise, companies generate higher revenue and profit over time (all things equal). And when companies increase their revenue and profit, their stock value grows in tandem. So part of the rise in stock index levels around the world is simply inflationary growth.

Inflation is also one of the reasons why it’s better being an investor compared to a saver. As an investor, your asset prices get to ride upward with inflation. But as a saver, the value of your money only diminishes over time.

However, the above only holds true when inflation is mild. According to the U.S. Federal Reserve, an annual inflation rate of 2% is beneficial to the economy. On the other hand, runaway inflation as seen in Venezuela and Zimbabwe will sow uncertainty and stifle economic growth, and push investors to look elsewhere for opportunities.

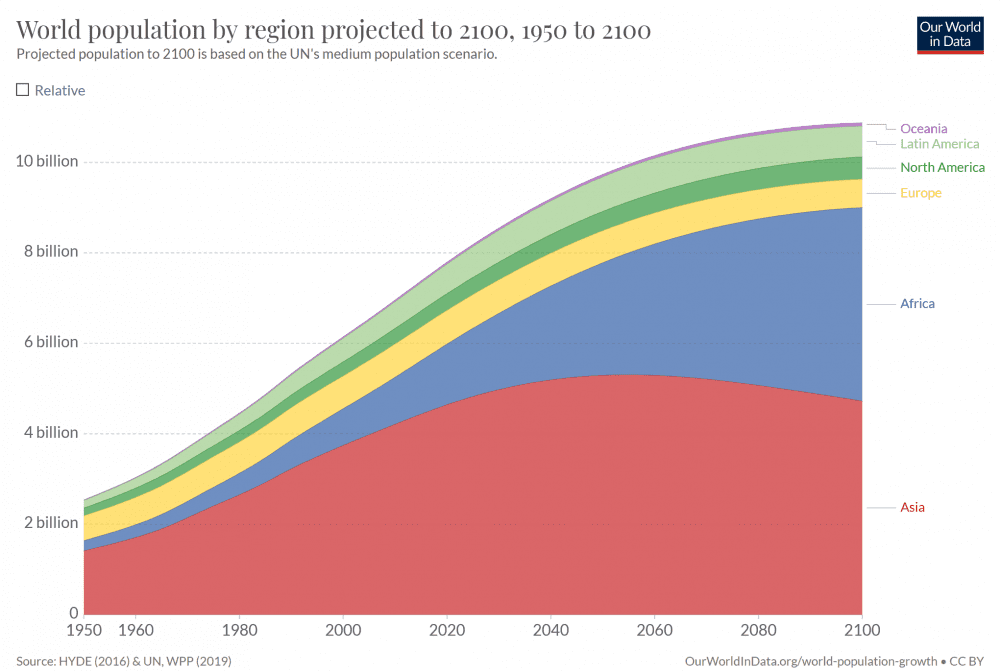

2. Population growth

As of January 2021, there are an estimated 7.8 billion people living in the world. And this number is expected to grow before topping off at 11 billion by 2100. A higher population typically means a larger addressable market for companies. And companies that successfully sell to a larger, growing market become more valuable over time.

A larger population can also support more specialised workers and industries. For example, a small developing economy of one million people may mainly comprise industries in agriculture, manufacturing, and raw materials. But a larger, more advanced economy of 100 million can boast specialised industries in technology, communications, finance, retailing, entertainment, tourism, professional services, etc.

Of course, there are smaller economies that are exceptions to the rule like Singapore and Switzerland. But, in general, a larger population generates more overall economic productivity and growth which translates to larger, more valuable companies.

3. Technology

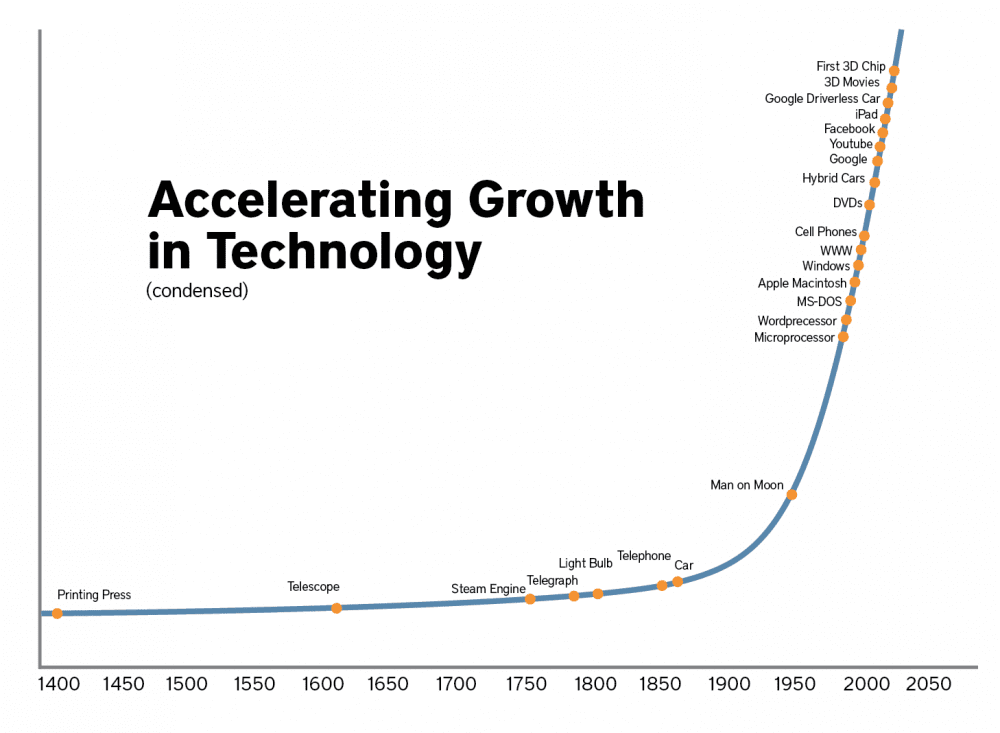

Statistically speaking, the more people we have, the more geniuses and inventors we will find among us. And as the world population has grown, so has the speed of human progress and innovation. Since the start of the Industrial Revolution in 1760, technology has exponentially powered human ability, efficiency, and productivity to new heights.

The application of the steam engine meant that factories and mills could now be located anywhere instead of next to rivers for waterpower. It also led to the invention of the railroad which opened up new frontiers. The light bulb meant that humans could now extend their productive hours into the night. And the microprocessor was a meta-invention that single-handedly enabled the invention of thousands of new technologies including the personal computer, the Internet, and the smartphone.

Today, a child can hold and access the sum of human knowledge in the palm of their hand — a feat that was unfeasible just 15 years ago. So long as human spirit and ingenuity continue to strive upward, so will the companies that march to the beat of progress.

4. Natural selection

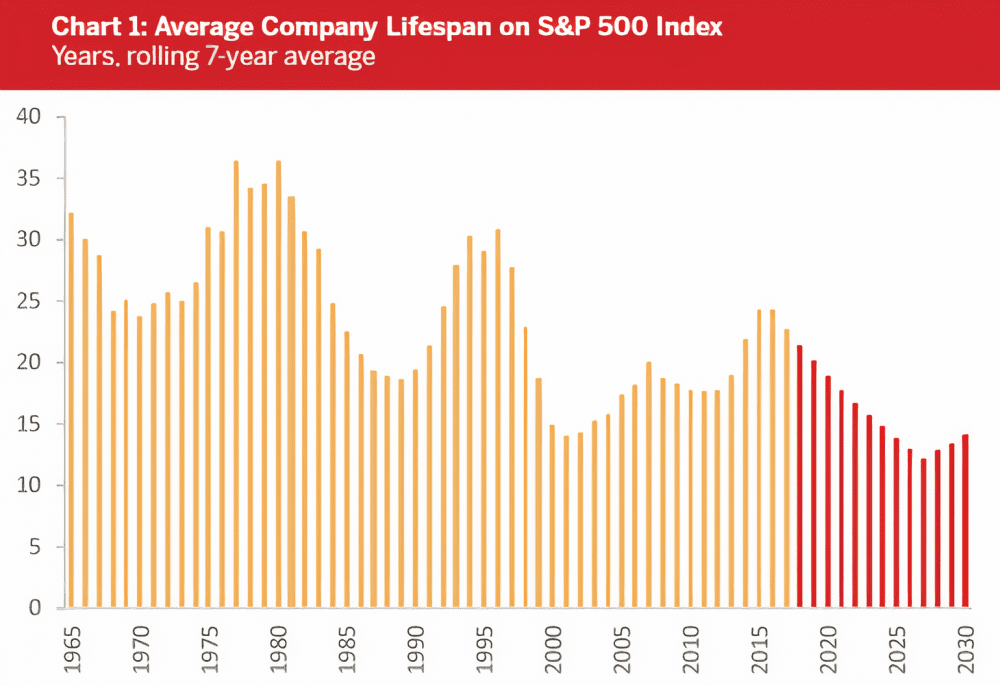

The final reason why the stock index rises over the long term is because the index always comprises the best companies in the market. For example, to be included in the S&P 500, a U.S. company must have a market cap of US$9.8 billion, and positive earnings in the most recent quarter and year, among other things. If a company fails any of the criteria, the next best company is ready to take its place.

As the pace of technological and economic change speeds up, so will the rate of new, more innovative companies displace old ones. In fact, the average company lifespan on the S&P 500 has fallen steadily over the years.

The five largest companies on the S&P 500 today are Apple, Microsoft, Amazon, Alphabet, and Tesla – companies on the forefront of technology. In 2000, the top five were General Electric, Exxon Mobil, Pfizer, Citigroup, and Cisco. We won’t know what the largest companies will be 20 years from now, but it doesn’t really matter — because they will be included in the index regardless.

Do all stock markets rise?

Not every stock market around the world rises over the long term. Take for example, Japan. Since its asset bubble collapsed in 1991, Japan entered a period of economic stagnation referred to as the Lost Decade. However, the ‘Lost Decade’ has gone on for 30 years.

Home of the Walkman and Shinkansen, Japan hasn’t created a new major innovation since its heyday in the 70s and 80s. In contrast, the U.S. gave rise to the Information Age, which China is now pushing to lead with its fintech and 5G technology. Coupled with an aging population and deflationary environment, Japan’s stock index — the Nikkei 225 — has barely grown over the last 30 years, returning a CAGR of 0.73% from 1991 to 2020.

The fifth perspective

Since the stock market tends to rise over the long run, investing in an exchange traded fund that tracks a stock market index can be an effective long-term strategy for passive investors. Since its inception in 1993, the SPDR S&P 500 ETF has given investors an annualised return of 10.04% (as of Jan 2021). However, this strategy only applies to investing in the stock market as a whole, given that individual companies have no assurance that they will always remain successful.

And as we’ve seen, not every stock market is created equal — stock markets only fundamentally rise when the underlying factors create the right conditions for long-term growth and innovation. So selecting the right stock market index to invest in is key.

So will the most robust and competitive stock markets and economies continue to grow and endure? As long as you believe in the best of human imagination and endeavour, the future looks bright.

None of these actually make sense for greater than inflation growth except maybe…the bigger companies keep getting bigger? They buy up smaller companies? They expand and take over other companies’ markets?

The index is also a selection of the ‘best’ companies. If the a company no longer makes the cut, it is replaced by a new one.

It is only inflation, all other dependent on inflation. The real rate of average inflation from 1988 is around 11% and the SP is giving 10%. Japan is in zero inflation from1991 that is why zero growth in NIKKEI Index.

Let me unwind your theory,

Population growth: As population grows more money is needed to support the constat PPI that is why Central bank infuse increase M2 money supply(it is growing with inflation from 1970 after Gold standard removal.

2.Technology: This is another minor factor which increases demand then central bank increase money supply.

3.Natural selection: This is to keep that Index health in long run and keeping the Index Average PE of 21. This again causes Central banks to increase M2 if they see stock market is going down.

All is ultimately tied to Inflation and real rate is 11%. There are many other factors like metal prices , commodity prices which also causes increases inflation.

What investment can return 5-10% over inflation? What do you think the index 500 will return in the next 5-10 years?

I think there is a 5th reason why sp500 always grows at long time period — greed

The largest companies are the most greed people on Earth, they will try everything they can to make more money, and SP500 is a collective of all the greed.