In every bull market, the same question returns like a ghost.

“Is this a bubble?”

Depending on who you ask, today’s AI-driven rally is either the dawn of a new industrial revolution or a repeat of the dot-com mania that ended in tears. And if you scroll through the news and social media, you’ll see two different camps…

One camp consists of investors who see the A.I boom as a once-in-a-lifetime opportunity (like me) and investors who warn it’s the next dot-com bubble waiting to burst.

Both could be right.

The question isn’t whether A.I will change the world — it will (obviously).

The question is: How much of that change is already priced in?

When the Internet was the future

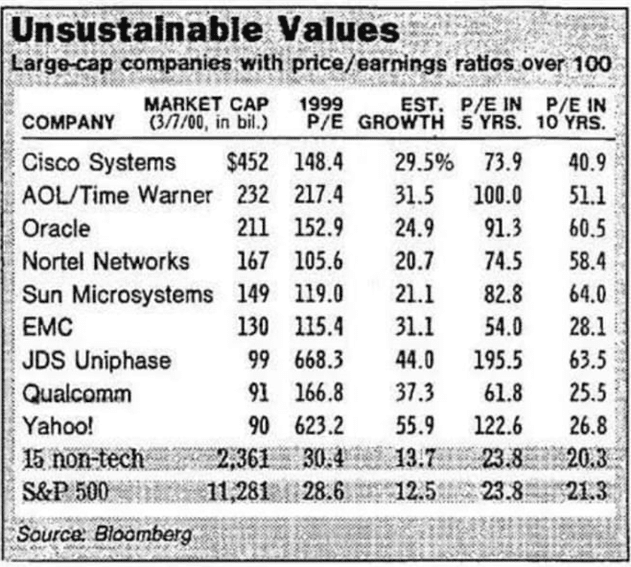

Recently, I found a viral post of an old Bloomberg table from March 2000 titled “Unsustainable Values.”

Cisco Systems was trading at a P/E of 148.

AOL Time Warner was at 217.

Yahoo was at 623, and JDS Uniphase was at 668.

Crazy.

Even the S&P 500 was trading at 28× earnings — nearly double its long-term average (well above its pre-2000 historical average of ~16).

Investors back then weren’t stupid. They knew the internet was the future. They knew the Internet was going to transform everything. Their mistake was thinking every company with a “.com” at the end would own the future.

When expectations outgrew earnings, the bubble popped. The Nasdaq collapsed 78%. Fortunes disappeared. But amid the wreckage, a few companies kept going… and they became the trillion-dollar titans of today’s market.

That’s the paradox of bubbles.

The technology wasn’t the problem…

The valuations were.

Why 2025 is different, yet familiar

Fast-forward 25 years. The story has changed… but the psychology hasn’t. Every company now claims to be “AI-powered.” (Sound familiar?)

Nvidia, Palantir, ARM, and Super Micro have soared. Analysts argue whether we’re in 1998 (early innings) or 1999 (the peak before the collapse).

Let’s compare eras:

| Dot-Com Era (2000) | AI Era (2025) | |

| Profitability | Mostly unprofitable | Largely profitable |

| Cash Reserves | Minimal | Record high |

| Business Models | Unproven eyeballs & clicks | Tangible infrastructure & software |

| Valuation Drivers | Hype & hope | Growth + AI monetization |

| Interest Rates | Falling | High/stabilizing |

| Core Leaders | Cisco, Yahoo, AOL | Nvidia, Microsoft, Amazon |

The key difference?

Real earnings power.

In 2000, profits were a future promise. In 2025, giants like Microsoft, Amazon, and Nvidia already mint billions in free cash flow. So are we safe?

Not exactly…

Because while business risk is lower, valuation risk is sky-high.

Rock-solid foundations, ruthless valuations

If you have been reading our articles and videos, you should have heard us talk about Nvidia, Microsoft, Alphabet, TSMC, ASML, Amazon. These are the digital railroads of the AI age. Their business risk is low. They are profitable, cash-rich, and critical components of the digital economy. But their valuation risk is high.

The lesson from Cisco in 2000 wasn’t that it was a bad business (it’s still a great one). The lesson was that buying at 148× earnings meant investors who bought the peak still haven’t broken even 25 years later.

Today’s core stocks are similarly priced for perfection. Any hint that their spectacular growth merely slows could trigger a 20%–50% valuation reset, even if their fundamentals remain dominant.

The reality about bubbles

A bubble is simply a story that gets too far ahead of reality.

The internet was transformative, but investors tried to compress 20 years of adoption into two years of stock prices. (And it doesn’t help if you keep looking at share prices every day.)

The same emotional cycle drives today’s AI rush: FOMO, momentum, and the illusion that technology will only move in straight lines. That’s how bubbles are formed. The key isn’t to escape the hype, but to stay clear-eyed while being aware of our own emotional stability and actions.

Because bubbles aren’t purely destructive; they also fund the infrastructure of progress:

- The dot-com boom built fibre optics and data centres

- The EV bubble accelerated battery innovation

- The AI wave is financing chips, data pipelines, and model ecosystems that will power the next decade

So instead of asking, “Is this a bubble?”

Ask: “How do we invest wisely through this AI wave?”

Profiting from the AI wave

The challenge for investors today isn’t recognizing that A.I. is transformative; everyone already knows that. What we worry about is whether a bubble is forming… and whether we’ll end up buying at the wrong price.

So the real challenge is in position sizing; how do you capture the upside of this technological revolution without getting swept into its excesses? Because like it or not, this AI wave will create both enduring winners and painful casualties. Navigating it well means separating conviction from hype and structuring your portfolio to profit from progress, not euphoria.

1. Own the core, but be patient

Companies like Microsoft, Nvidia, Amazon, Google, TSMC these are your core foundations. They’re powerful businesses, but their valuations are steep. So don’t rush in all at once; stagger your entries over time. Wait for pullbacks.

The strategy here is of valuation discipline, not price discovery. Let volatility work for you instead of against you. This core should make up 70% to 80% of your AI portfolio.

2. Satellites: Innovation and speculation

These are your moonshots… the smaller AI plays with promising 10× potential. We’ll try to allocate 20% to 30% here. But even here, not all satellites are equal. This is why we should stratify our satellites and approach this bucket through a tiered risk model:

Tier-1 satellites: Enablers

These are profitable, high-growth “picks and shovels” companies riding the AI infrastructure wave. Think Super Micro, ARM, Camtek, or Onto Innovation. Their risk lies in cyclicality and customer concentration, not survival. These are viable long-term holds, but expect volatility when chip demand cools.

Tier-2 satellites: Pure plays

These are your speculative “call options” on the AI future — companies like Palantir, C3.ai, or SoundHound. Their valuations rest almost entirely on narratives, not cash flow. The bet here is that one or two will create a new technological category that sticks. (Most won’t.)

So use small, clearly defined allocations… and be mentally ready to lose 100% on any single one.

This is not cynicism. It’s realism.

You’re investing in possibility, not certainty. And because your position sizing is disciplined, you don’t lose the farm if one fails. But one or two winners here can mean 10X, 20X or 30X… (e.g. Palantir, which has 12X for me thus far.)

3: Keep optionality

Always maintain 15–30% liquidity.

Cash isn’t dead money. It’s dry powder when corrections hit.

4: Track earnings inflection

Focus on when narrative stocks start printing real profits.

Because that’s when speculation turns into substance.

The fifth perspective

Bubbles don’t begin with greed… they begin with an ounce of truth.

In 2000, the truth was: the internet will change the world.

In 2025, the truth is: A.I. will change the world.

The mistake comes when we confuse that truth with the belief that every company in the trend will win — and win soon. That’s why we always stick to this timeless rule: Buy businesses, not narratives.

Narratives are fleeting. Businesses that compound free cash flow endure.

When the inevitable correction comes, it won’t destroy the A.I. story — it will strengthen it through consolidation. The strongest companies will emerge even stronger, often buying weaker rivals for pennies on the dollar.

Your goal isn’t to time the top or the bottom…

It’s to own the businesses still standing when the dust settles.

The story always changes.

But the math?

It never does.

Disclaimer: The author holds positions in Alphabet, Microsoft, Amazon, Camtek, Palantir, and Onto Innovation. The views expressed are his own and do not constitute financial advice.

TQ for information! Very good strategy for any uncertain future!

Hey James! Happy to hear it helped.

The way I look at it… the goal is to enjoy the upside without stressing over the risk. You can even choose to take profit – especially on satellites. ie, When a position hits 2×, you can always take back your original capital and let the rest ride.

That way, you’ve already “won,” and whatever’s left in the market is basically a free lottery ticket. You might miss the full peak, but you’ve removed all downside.

Tks Kenji for such a balanced and insightful analysis. there r many gurus who still are asking investors to buy buy buy Nvidia, MS etc. Definitely it boils down to when to buy. I wonder if you have a model when you analyse the timing of entry? pls contact me!

Hey Ms Foo, Thanks so much for reading!😊

On timing — it’s perfectly okay to wait. Valuation still matters, even in an AI boom. If we miss a run-up, so be it; markets always give second chances.

Depending on your conviction, for me… core names like Nvidia/MSFT, paying a reasonable premium (10–20%) is fine if you’re long-term. These companies almost always trade at a premium anyway. But I still prefer staggering entries and letting pullbacks do the work.

Yea… Nvidia… but Nvidia isn’t the only AI winner. There are plenty of great enablers and infrastructure plays with better valuations today.

So yes, patience is a strategy. Have a watchlist (Core / Satellite) ready, let the market come to you. You don’t need the perfect price, just avoid the clearly overstretched ones.

Hi, i notice that the Singapore REIT data is not complete. is it intentional? i am looking for NetLink NBN REIT details. Thank you

Hi SM, Netlink NBN Trust is not a REIT.