How to buy U.S. shares in Singapore and open a U.S. brokerage account (updated 2024)

As remarkable as Singapore is as a first world financial hub, our local stock market is rather… humdrum. And the main reason for that is — with 5.6 million people — the Singapore market is just too small. So unless a home-grown Singaporean company is able to expand beyond its shores, its potential growth remains limited.

However, expanding overseas into new markets brings a new host of challenges. In a region as culturally diverse as Asia, a company needs to understand different languages and local customs in each new market, and navigate the unique business regulations, tax codes, compliance laws of each country. So unless a company is able to successfully crack the humongous Chinese market, it remains challenging for many firms to grow bigger beyond Singapore.

Case in point: Old Chang Kee generates 99.5% of its revenues in Singapore (with the rest trickling in from Malaysia and Australia). Old Chang Kee’s curry puff stalls already dot the island nearly everywhere; how much larger can it grow staying in Singapore?

From sea to shining sea…

Now compare this to the United States where its home-grown companies have access to a wealthy, homogenous market of over 330 million consumers who speak the same language, share the same customs, and spend the same dollar. It’s no surprise that American corporations are some of the largest and most successful in the world. Even if they delay venturing overseas, they can rely on their domestic market alone to grow to a tremendous size.

For example, Walmart was founded in 1962 but only opened its first international store in Mexico City in 1991. Today, Walmart has since expanded to over 5,000 locations internationally, but U.S. operations still contributed almost 70% of the company’s FY2023 revenue of US$611.3 billion.

Not only that, the U.S. is also home to some of the most innovative companies in the world. This mixture of invention and a large domestic market to test new ideas means we’ll continue to see fast-growing American companies with the potential to disrupt new industries in years to come.

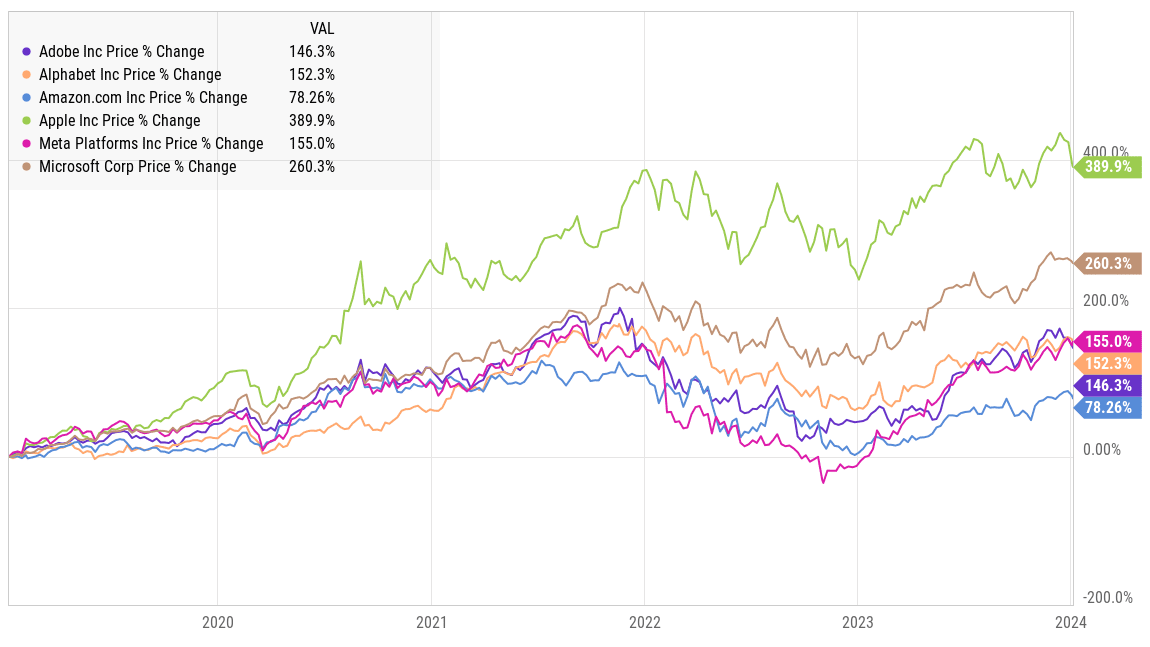

Have a look at the returns of some of the best U.S. companies over the last five years:

Even a company already as large as Apple was able to grow 389.9% in just five years. You’d be hard-pressed to find any companies of similar scale and quality if you only stick to investing within Singapore.

How to buy U.S. shares in Singapore

As a foreigner investing in the U.S. market, it’s important to note that even though you don’t face any capital gains tax on your stocks investments, you do pay a 30% withholding tax on dividends. (You also face estate taxes on U.S. stocks and assets when one passes on).

Knowing this, it makes sense to invest in U.S. stocks for growth and capital appreciation. (On the other hand, Singapore doesn’t have a dividend tax — which makes many Singapore stocks/REITs a great vehicle for dividend income.)

If you’ve never bought a U.S. stock before and you’ve always wondered how you can do so, it’s pretty straightforward. In this article, I’ll list the brokerage options available for Singapore residents, and the pros and cons of each of the top choices.

| Brokerage | Min. Fees (US$) | Trading Commissions | Custodian Fees |

|---|---|---|---|

| CGS-CIMB Securities | 20 | 0.30% | S$2 per counter per month* |

| Citibank Brokerage | 25 | 0.30% | 0.0165% of your monthly average stockholding balance |

| CMC Invest | 4 | 0.04% | No custodian fees |

| DBS Vickers | 27.75 | 0.16% | S$2 per counter per month* |

| FSMOne | 3.80 | 0.08% | No custodian fees |

| HSBC | 10.90 | 0.15% | No custodian fees |

| Interactive Brokers | 1 | US$0.005 per share, up to a maximum of 1.0% of trade value | No custodian fees |

| KGI Securities | 20 | 0.30% | None stated |

| Lim & Tan Securities | 20 | 0.30% | S$2 per counter per month* |

| Maybank Securities | 20 | 0.30% | S$2 per counter per month* |

| Moomoo* | 0.99 | - | No custodian fees |

| OCBC Securities | 20 | 0.30% | S$2 per counter per month* |

| Phillip Nova | 5 | 0.01% | No custodian fees |

| Phillip Securities | 20 | 0.30% | Temporarily waved until 31 December 2024; S$2 per counter per month thereafter* |

| ProsperUs | 5 | US$0.01 per share | No custodian fees |

| Saxo Markets | 2 | 0.06% | 0.12% p.a. of stockholding balance or waived if clients opt into securities lending |

| Syfe Trade | 1.49 | - | No custodian fees |

| Standard Chartered | 10 | 0.25% | No custodian fees |

| Tiger Brokers^ | 1.99 | US$0.005 per share, up to a maximum of 0.5% of trade value | No custodian fees |

| UOB Kay Hian | 20 | 0.30% | S$2 per counter per month* |

| uSMART | 1.88 | US$0.009 per share, up to a maximum of 1.0% of trade value | No custodian fees |

Fees are for U.S.-listed stocks. Updated 31 December 2023. *Custodian fees of up to a maximum of S$150 per quarter (S$200 for OCBC Securities). ^Trading commissions of Tiger Brokers will revert to US$0.01 per share, up to a maximum of 1.0% of trade value or a minimum of US$1.99 per order after 180 days of free commission.

From the table above, you’d notice that many traditional Singapore brokerages charge a monthly custodian fee of S$2 per foreign stock. So if you own 10 foreign stocks, you’re paying an extra S$20 a month in custodian fees for your brokerage firm to hold the shares for you.

However, five brokerages stand out: Interactive Brokers, Saxo Markets, FSMOne, Tiger Brokers, and Moomoo. All are solid options if you’re looking for a cheaper way to access the U.S. market compared to the traditional Singapore brokerages.

Interactive Brokers

Interactive Brokers has one of the lowest minimum fees at just US$1. As of July 2021, Interactive Brokers has eliminated its US$10 monthly maintenance fee which makes it probably the most attractive option right now in terms of fees and market access. (Interactive Brokers also offers zero-commission trading accounts called IBKR Lite but that is only available in the U.S. at this moment.)

The advantage of Interactive Brokers is that it offers you global access to markets in the U.S., Europe, and Asia. So if you intend to invest outside of the U.S. as well, then Interactive Brokers would be more suitable for you.

Saxo Markets

Saxo Markets also offers relatively low minimum fees at US$2 for U.S. stocks and gives you access to more than 50 exchanges around the world including the U.S., Europe, China, Hong Kong, Japan, and Australia. However, they do charge an annual custodian fee of 0.12% (or waived if clients opt into securities lending).

Saxo also offers access to ETFs, bonds, mutual funds, CFDs, commodities, forex, futures, options, and cryptocurrency. So if you’re investor or trader that requires access to wide range of products, then Saxo would likely be the one-stop platform for you.

FSMOne

FSMOne is a solid option if you prefer to stick with a Singapore brokerage. Their minimum fee is higher (US$3.80) for U.S. stocks and they only offer access to the Singapore, Malaysia, Hong Kong, UK, and U.S. exchanges as well as China A-shares. But if you plan to invest only in those markets, this shouldn’t be an issue.

The one advantage of FSMOne — as a Singapore brokerage — is that they can be linked to your CPF. So you plan to invest in Singapore stocks using your CPF funds, then keeping all your Singapore and U.S. holdings under one brokerage account might be more convenient for you.

Tiger Brokers

Tiger Brokers is a recent entrant to the Singapore brokerage scene. Founded in 2014, Tiger Brokers is a Chinese online stock brokerage startup that’s backed by Interactive Brokers and listed on the Nasdaq. They also offer one of the lowest minimum fees (US$1) for U.S. stocks and provide access to Singapore, China, Hong Kong, Australia, and U.S. exchanges.

As a Chinese firm, the main advantage of Tiger Brokers is their low-cost access to the Shanghai and Shenzhen exchanges. If you want to invest in the U.S. and China — two of the largest economies in the world — then Tiger Brokers is a great option.

Moomoo

Moomoo is another international broker that recently entered the Singapore market. They offer lifetime commission-free trading for U.S. stocks. Moomoo is owned by Hong Kong-based Futu Holdings which is backed by Tencent, one of China’s largest companies. Futu is also listed on the Nasdaq.

Moomoo also offers low-cost access to the Singapore and Hong Kong stock markets at just S$1.98 and HK$18 minimum per trade respectively. If the U.S., Singapore, Hong Kong, and China A-shares are your main markets and you’re looking for some of the lowest fees around, Moomoo would be your choice.

The fifth perspective

The strength and ingenuity of the American economy over the last hundred years means that the U.S. stock market is home to many of the best companies in the world. Until Asia catches up over the next few decades, the U.S. will arguably remain the most attractive equities market for investors everywhere.

If you also plan to invest in the U.S., then the five brokerages we highlighted would be your best options, especially when compared to the excessive fees charged by many Singapore brokerages.

Thanks for sharing. Would you mind sharing based on your experience, which of the following provide best saving ?

1. FSMONE

2. Standard Charted

3. Interactive Brokerage

Hi Gem,

If you refer to the tables in the article above. FSMOne has lower fees than Standard Chartered. Interactive Brokers has the lowest fees overall, but charges a monthly maintenance fee of US$10 which is waived if you have US$100,000 equity in your trading account.

Dear Adam,

Thanks for your reply! Understood.

Hi Adam

Can help advise which platform has stoploss, looking trade from singapore, help to advise

Hi Dsm,

All five brokerages we highlight in this article have stop loss orders.

Hi~

Can I buy US ipo use Singapore account?

Hi Adam

I have investment foreign exchange from bursa Malaysia , I have a issued problem for my moneys transfer to my Sing account can pls advise what should I do now

Hi Wilson,

What kind of issues are you facing?

Dear Adam,

How did you move broker? Any fees involved?

Thank you,

Hgn

Hi Hgn,

You first have to open the new brokerage account. Once it’s approved, you can email your new broker for the instructions to do the transfer. They will then ask you to complete some forms, after which they will liaise with your broker to make the transfer. Yes, there are transfer fees depending on the brokerage.

Alternatively, you can choose to liquidate all your holdings and then transfer the cash to your new brokerage. This may make more sense if trading commissions are low and you’re ok with a slight price movement when you reinvest.

Hi,

Have you had the chance to try out iFast?

I was recently introduced to iFast. FSMOne belongs to them but it’s still a different platform. Apparently, they have 2 types of account. 1 is a DIY Wrap account which is ideal for people who trades often.It charges a 0.5% p.a. wrap fee and 0.06% min USD8 commission. Another Non-Wrap account for investors who just want to buy and hold. It charges a 0.12% commission fee and that’s it.

I would also like to add on that TD Ameritrades charge a withdrawal fee of USD25 every withdrawal.

Ifast account gives u 0.4% interest if you leave your cash in their account.

Have also heard that Stand Chart doesn’t charge custody fee. But need to open an e$aver bank account with them and maintain $1000.

Hi Ming Shu,

Thanks for sharing! I haven’t had the chance to use iFast Financial.

Hi Adam, I am stuck in the same situation as you with the closing of Charles Schwab, as I understand Charles Schwab has an office in Singapore and the funds parked with them are insured up to the first $500k. Do you see a risk in US trading platform like Interactive Brokers?

Accounts at Interactive Brokers are also insured for a maximum coverage of $500K, and up to an additional $30 million per account through Lloyd’s of London.

https://www.interactivebrokers.com/en/index.php?f=2334&p=acc

Hi Adam what it means by with a cash sublimit of $250,000? Meaning if the broker does goes into liquidation; e.g. my total shares are worth $500,000 at that point of time, they will pay to me $250,000 in cash? What about the rest?

Your total account (securities and cash) is protected up to $500K by SIPC. But the cash portion is only protected up to $250K. So for example, if you have $200K in stocks and $300K in cash, your coverage is $450K (200K +250K).

Do note that Interactive Brokers has additional coverage up to $30 million ($900K cash sublimit) per account.

Hi Adam,

Thanks for your write-up on Brokerages. Very timely.

I note your confirmation that funds parked with Schwab and IB are insured up to US$500k. Could you please confirm if FSMOne insures funds parked with them, similar to Schwab & IB?

FSMOne Portal indicates that Cash Acct monies are deposited in a bank account opened with Standard Chartered Bank (SCB). This bank account is designated as a Trust Account, in which the monies on held on behalf of the customers and cannot be used to offset any debts owed by FSMOne to SCB. But the Portal doesn’t mention anything about Deposits Insurance for funds parked with FSMOne. So would like your comment on this. Thanks.

Also, could you also confirm if IB and SAXO have manned offices where we could call their hotline for help? FSMOne has a manned office and this feature is very important for investors who are able to DIY their trades but still need instant and accessible Hotline Help when the need arise. Thanks!

Hi Anon,

Schwab and IB are U.S. brokerages which is why their accounts are insured up to US$500K under the SIPC: https://www.sipc.org/

FSMOne accounts are not insured but held in a trust. This means if anything were to happen to the brokerage, the shares have to be returned to you.

Saxo has a Singapore office but not Interactive Brokers at the moment: https://www.home.saxo/en-sg/contact-us

Hey there Adam, thanks for the write up. Appreciate the effort. You mentioned your pick is saxo unless your account is over 100k USD. But FSMone has no custodian fees. Wouldn’t they be the best pick even though they have slightly higher commission charges? Is the only reason you picked saxo because they have access to a much larger range of markets? Cheers

Thanks, Matt. Yes, that’s right and the fact that I can deal with options as well. However, if you only invest in SG, US and HK stocks/ETFs, then FSMOne is perfectly fine as well.

Hi Adam

How do you find the exchange rate charged by Saxo when trading US shares? Also,they seem to charge a conversion fee of 0.75%. If that is the case, will It be on par with FSM and Standchart?

I actually have funds in USD and a multi-currency account with Saxo, so I’m fine with using them right now. In any case, I think a fee of 0.75% is still reasonable although it could be lower.

Hi Adam,

With Charles Schwab buying over TD, do you think the consolidation will affect TD closing their Singapore office? Since Charles Schwab moved out of Singapore after 2 years here.

There’s definitely a possibility since Schwab pulled out themselves.

Thanks Adam. Any recommendations you have for alternative silimar to TD in Singapore?

Vincent C

The closest I can think of right now is Saxo. It has access to U.S. stocks/ETFs/options and comparable pricing at US$4 per trade.

Having been forced to close my not long open Schwab Singapore account and then opting to open a TD Ameritrade Singapore account instead, I dont know whether to laugh or cry at the news Schwab is now buying up TD Ameritrade. In my opinion their behaviour is anti competitive and should not be permitted. I would not be surprised if TD Ameritrade Singapore is closed too. I will not he adding more money to the account and will now be seeking alternatives accounts as a hedge against Schwab again acting in the same manner.

Hi Simon,

Do share if you find something good as TD.

Thanks

Hi Adam,

I’ve actually opened and account with TD Ameritrade but wasn’t aware that the zero commission fees does not apply to Singaporean accounts! So thanks for mentioning this in your article!

I would like to get your opinion on which brokerage should I go for then.

I’ve never done any trading before (unless you count parking some money with StashAway), but would like to get started with value investing in US stocks. I don’t expect to be trading frequently, only perhaps every now and then between months? Frequency might increase as I learn and “practice” more, but that’s not the primary objective for the next 6-9 months at least.

With this in mind, would you recommend Saxo or IB (or any other local brokerages)?

Thanks!

Hi Adam,

Awesome article! Really helpful for people like me who just started out. Can i just quickly confirm that Singaporeans can trade US ETFs on Interactive Brokers? I can’t seem to get the permission to do so. Wondering if you had encountered similar problems before.

Cheers

Hi Mel,

Thanks! We have no issues trading US ETFs on Interactive Brokers. You may want to drop them an email regarding this.

Hi Adam,

I Just opened an account with Saxo and bought some US stocks. I’ve noticed that GST of 7% is charged for every transaction eventhough it is from the US market. I am a Singapore resident. Just to check if Interactive Brokers have a similar GST charge as well? Nothing seems to indicate so on their website.

Also, as you mentioned to another reader above, you opened a multi-currency account with Saxo. How did you open that account? My funds are currently in SGD but hoping to get a multi-currency account with USD proceeds to avoid paying the conversion fees of 0.75%. Thanks for your time.

Hi John,

As far as I know, Interactive Brokers doesn’t have a Singapore entity as of now which is why there’s no GST for their transactions.

To open a multi-currency account, you can simply email your representative at Saxo who will do the necessary for you.

Hi adam

seeking your opinion

if the goal is to buy an etf like a rsp every month

would FSMone be a good selection? currently using SCB but the exchange rate is really bad.

Thank you

Hi Bosslee,

I assume you’re referring to US ETFs? Yes, FSMOne is an option you can go with.

You can compare the forex rates for FSMOne with the rates you’re currently getting with SCB: https://secure.fundsupermart.com/fsm/foreign-exchange-rates

Hi Adam, I live in Brunei and want to start investing in ETF’s and some stocks. I opened an account with Saxo and they sent me a SGX education course to complete. Is this common with all the financial institutions in Singapore? Thanks in advance for your help.

Hi Jon,

I didn’t have to go through that when I opened my Saxo account.

At the same time, financial institutions are required to formally assess your investment knowledge and experience before you can trade in specified investment products (SIPs) in Singapore. So I’m not sure if this is the course you’re required to complete.

https://www.moneysense.gov.sg/articles/2018/11/understanding-specified-investment-products-sips

Hello Adam,

Thank you for your comprehensive guide.

I am new to trading and would like to buy US shares. I’d like to find out if there are other consideration factors to take note of other than fees and commissions?

Hi Wesj,

The financial strength of the brokerage firm is also important and that your assets are kept separate from the firm itself.

For example, all funds deposited by clients with Saxo Markets will be kept in a segregated client funds account in accordance with Singapore regulation. This is the same for all other brokerages that operate in Singapore.

https://www.home.saxo/en-sg/legal/saxo-capital-markets-singapore

In the case of U.S. brokerages like Interactive Brokers, client assets are covered by the SIPC up to $500,000 in the event of a broker failure. Additionally, Interactive Brokers has coverage in excess of the SIPC policy up to $30 million.

https://www.interactivebrokers.com/en/index.php?f=2334&p=acc

Hi there,

We have a saxo account but it was recently frozen and we were told we needed to take a SGX course before we could trade again. Do you know anything about this? Is there a way to get around it?

thanks

Hi Nancy,

As far as I know, you’d need to complete an SGX course if you plan to trade in Specified Investment Products (SIPs). You’d need to complete the online course as this an SGX regulation.

https://sips.abs.org.sg/

Hi,

Nice article.

Im curious if for someone like me who lives in Brunei, would it actually be better to open a Singapore Brokerage account seperately then using Interactive Broker. I currently have already an Interactive Broker using USD currency as my base. Not sure how it would work if I was to buy STI ETF which is in SGD.

I’d stick with Interactive Brokers if they already offer you access to the SGX; their fees are just so much lower. You can simply convert some of your USD to SGD within Interactive Brokers who offer relatively competitive rates.

I am a Malaysian and wish to trade in the US Market what is my tax situation?

Is it similar to a Singaporean i.e. US Dividends subject to WHT and no capital gain tax?

Hi William,

Yes, as a U.S. non-resident, you have no capital gains tax and a 30% withholding tax on dividends.

Thanks for the answer. What about from the tax from the Malaysian side?

Hi William,

There is no capital gains tax on the sale of shares in Malaysia. Distributions from REITS will be taxed at 10% for individuals. But, there is no tax on dividends given by other companies.

hihi, tiger brokers has 0 custodian and conversion fees for US stocks, while saxo charges 0.12$ pa. if the stock is listed on both NYSE and an european stock exchg, which will be best choice to buy the stock for long term investment? taking into consideration the 30% withholding tax if i buy the stock on NYSE from TB versus the ongoing custodian fees and conversion fees by Saxo if i buy the stock on eur exchg ? many thanks!

Hi Natlh,

I believe the withholding tax on dividends still applies to European-listed stocks (except for the UK): https://taxsummaries.pwc.com/quick-charts/withholding-tax-wht-rates

I think it boils down to your personal choice. Tiger Brokers is cheaper but it’s offering lower rates as it’s new to the Singapore market, while Saxo Markets has been around for longer here.

Hi Adam,

Which Brokerage will you recommend if I intend to buy and hold US shares 5 to 10 years of more than USD100,000?

Hi Bak,

Interactive Brokers. Low fees and global access.

Why not FSMOne? I have an account with them because they have joint beneficiary account which is beneficiary for us long term investors. It appear other US Brokers do not have such facility. Further no custody charges for my US Stocks.

Hi William,

FSMOne is a perfectly fine choice as well.

Thanks,

Hi Adam,

I came across this statement.

If the unfortunate event if you pass away while holding on to stocks, bonds, ETFs, funds, cash in a US-based brokerage the U.S. government will apply an estate tax from 18 to 40% for assets worth more than US$60,000.

Would you know whether estate tax does not apply to holdings in non US based brokerages? I presume FSM is one such brokerage

Hi Teck Soong, the estate tax applies to all U.S. assets regardless of which brokerage holds them.

Hi Adam,

May I check with you, when transferring funds to these overseas brokers, how much fee will the Singapore banks charge for it?

Because if the bank transfer fee is higher than the counter fee, then no point also?

As for FSMOne, since it is a Singapore brokerage, do not have to worry about the bank transfer fee right? Since it is from a Singapore to Singapore account.

Hi James,

If it is to an overseas bank account, it will be the typical telegraphic transfer rate. If it’s to a Singapore bank account, there is no transfer fee. Most international brokerages have Singapore banks accounts including Interactive Brokers and Saxo.

Hi Adam,

Thanks! So if compared between Interactive Brokers and Saxo, as in-order to save on the telegraphic fee, which will you recommend?

IB FEE PER TRADE VALUE is 0.080%, and no custodian fee. But Saxo is 0.06% and have 0.12% custodian fee p.a. of stockholding balance. Seems that IB is the cheaper one?

Yes, Interactive Brokers is cheaper.

Hi Adam,

Presently I invest in FXVC INT Trading in Bitcoin USD, Apple, Amazon, Nvidia & AMD in small amount.

What do you think on such investor? It’s reliable and trustworthy?

So far from 1st invest on 4 Oct till to-date of US$25k has grown to US$28k in a month time.

Your advice please.

Hi Jaffar, I’m not familiar with FXVC or their reputation, so I’m unable to comment.

Congrats on your returns so far! Continue to invest prudently for the long term and I’m sure you’ll do well.

Hi,

I saw your YouTube video on US estate taxes (link given in above article). One suggestion given in that article is to buy Ireland domiciled ETFs (caller UCITs) which are mostly listed on London stock exchange. My question is this — what is the best broker to buy these UCITs? That is, which broker provides lowest fee for London listed ETFs?

Interactive Brokers