At the last annual general meeting, DBS Group CEO Piyush Gupta predicted that interest rates would remain stable throughout 2023 and decrease starting in 2024. While the rate cut hasn’t materialised yet, recent developments seem to align with his forecast, suggesting a high possibility of it happening in 2024.

Investors are anticipating a potential interest rate cut this year and are concerned about the impact on bank stocks, particularly a decline in their net interest margin (NIM). This year, I attended the DBS Group AGM to gain insight into the management’s perspective on interest rates and the implementation of Basel 4, which could potentially free up more capital for DBS and allow for strategic capital allocation.

Here are seven things I learned from the 2024 DBS Group AGM.

1. CEO Piyush Gupta opened the AGM by highlighting that DBS Group had achieved record total income, net profit, and return on equity (ROE). He mentioned that the achievement is not due to an increase in NIM alone, as there was also a strong rebound in fee income and effective cost management, which allowed the bank to record a cost-to-income ratio of 39%. He further emphasised that only a few banks in the world are able to achieve a 40% cost-to-income ratio.

2. Over the past three years, DBS Group has successfully integrated banks it acquired in India and Taiwan. CEO Piyush Gupta highlighted the benefits of these acquisitions, which are already reflected in rising market share and total income. For instance, the Indian business experienced a growth of 20% last year.

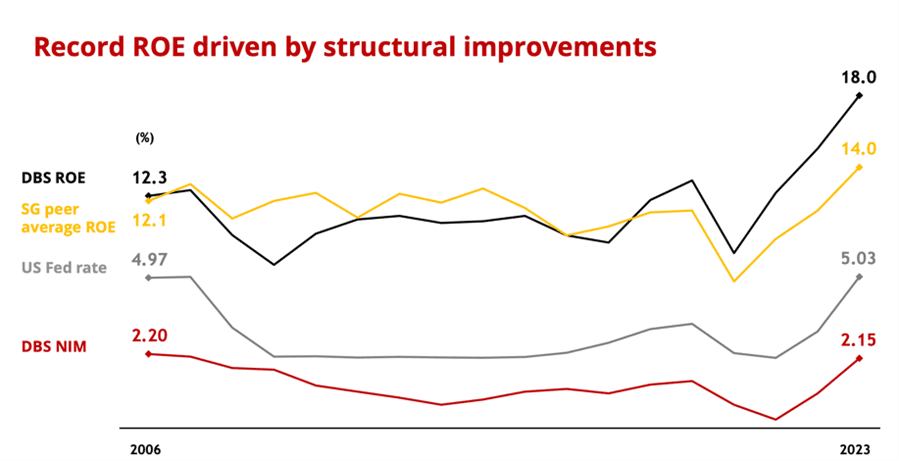

3. CEO Piyush Gupta discussed commentary suggesting that DBS Group’s recent performance is primarily attributed to rising NIM. He countered this notion, presenting data from Bloomberg to illustrate that in 2015, DBS Group’s ROE ranked 46th among the world’s 100 largest banks; it now holds the 7th position. He emphasised that the outperformance in ROE was not solely due to the high NIM environment.

Referring to the chart below, he pointed out that despite a decrease in NIM from 2.20% in 2006 to 2.15% in 2023, ROE increased from 12.3% to 18.0% over the same period, highlighting the efficient management of DBS Group.

4. The CEO expressed confidence in DBS Group’s ability to achieve a medium-term ROE ranging between 15% and 17%. He anticipates that the normalised interest rates will approach 3%, and even under such conditions, DBS Group is well positioned to maintain its expected ROE.

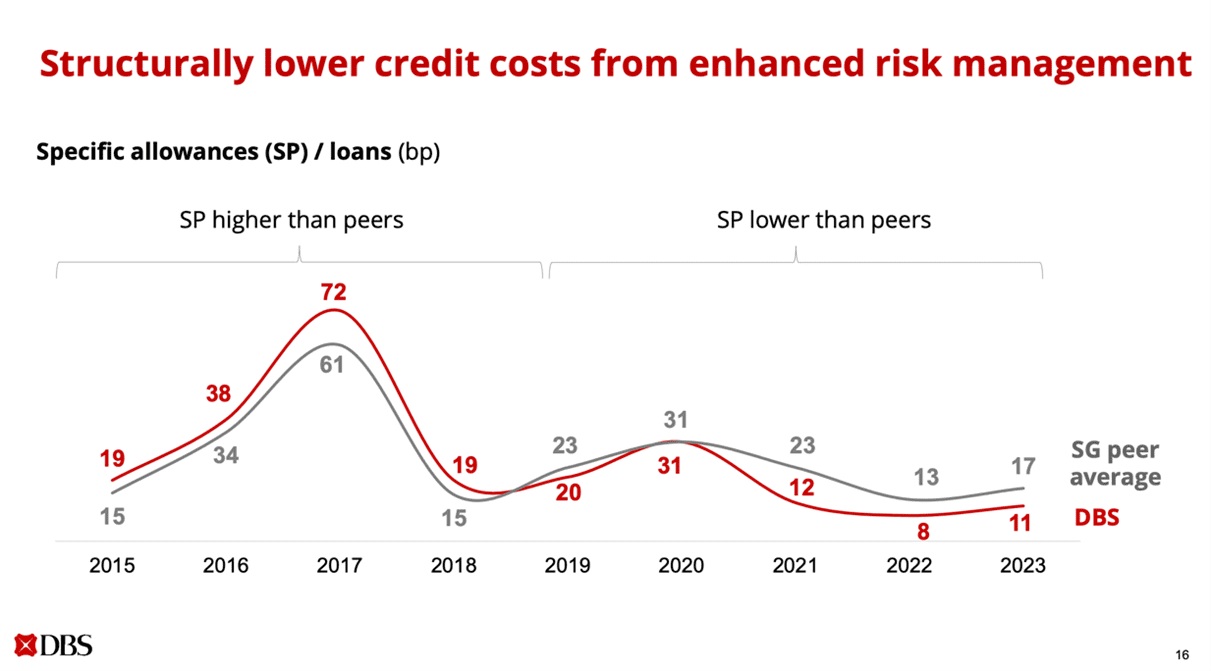

5. Over the past eight years, DBS Group has made significant strides in improving its cost of credit and risk management. Prior to 2018, DBS Group consistently had higher cost of credit compared to its peers, particularly evident during the 2016 oil crisis, which led to a surge in credit costs for the bank. However, through initiatives such as digitalisation and leveraging on data analytics, DBS Group has successfully lowered its cost of credit, now below that of its peers.

6. A shareholder asked the CEO about DBS Group’s increased investment in Shenzhen Rural Bank (SRB). Gupta explained that SRB is a private bank that is not owned by the state, and DBS Group is currently the largest shareholder. He added that SRB has a good earning profile that generates high ROE and a good portfolio history with no real estate exposure, which is affecting China right now. The main reason why DBS Group is increasing its stake is because they are bullish on the Guangdong–Hong Kong–Macau Greater Bay Area.

7. Basel 4 regulations are anticipated to be implemented in the middle of this year. Over the transition period spanning the next 4-5 years, DBS is projected to sit on excess capital of S$5.9 billion. Gupta suggested the possibility of returning capital to shareholders if there are no worthwhile reinvestment opportunities.

The fifth perspective

The 2024 DBS Group AGM provided substantial insights into the strategic direction and financial health of the bank. CEO Piyush Gupta’s presentations highlighted the bank’s robust performance, showcasing record achievements not solely dependent on net interest margin but also supported by efficient cost management and diversified income streams. As the bank continues to integrate acquisitions and improve its cost of credit, investors and stakeholders can anticipate DBS Group maintaining a strong position in the regional banking landscape, adapting well to changing economic conditions and maintaining a competitive edge in efficiency and profitability.

Great insights! Sustainability and digital transformation are clearly key themes for DBS Group. Excited to see how they continue to innovate in these areas.