Here’s how I’d invest $10,000 during this COVID-19 crash

Little did I expect a pandemic to trigger the next economic crisis. The coronavirus outbreak that originated in Wuhan, China, has had a major impact on the global economy. Holding the largest share of global manufacturing output, China’s factory production halt has sent ripple effects throughout the world. Businesses reliant on China’s supply lines such as Apple have been affected by supply shortages.

Even if there were supplies, consumers lack spending appetite. As the growth in the number of COVID-19 cases shows no signs of abating, governments around the world have ordered their citizens to stay home to contain the spread of the virus. People are on furloughs or have lost their jobs since many businesses are hardly generating any revenue at all. As a result, consumers will tighten up their wallet and spend only on essential items such as food, toilet paper, surgical masks, and hand sanitizers until normalcy returns.

Gripped by fear, investors around the world have frantically sold down their portfolios. The S&P 500 has crashed 26.5% from its peak and is currently trading at a P/E of 16.2 — a level not seen since 2012. This black swan event has presented us with opportunities that comes once every decade, a great time to invest in quality companies that will generate good long-term returns.

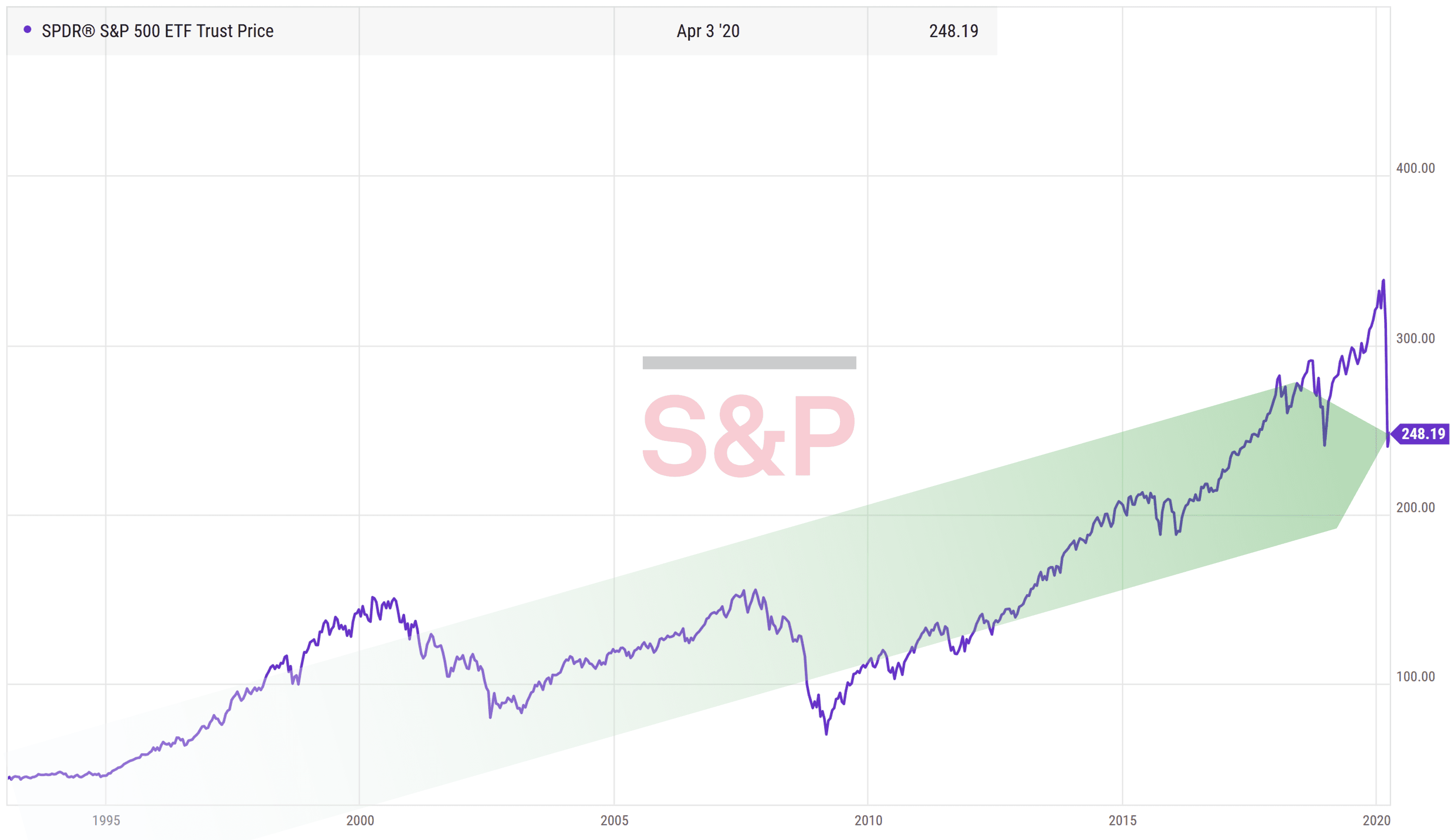

When the Global Financial Crisis hit in 2008, I was new to investing. I didn’t know how to take advantage of the opportunity that was in front of me. Typical of an amateur investor, I bought some stocks, held on to the bad ones for too long, and sold the good ones too early for a tidy profit. For the next 11 years, I watched the S&P 500 appreciate by 257.7% from 2009 to 2019. Had I simply invested my money in an index fund, I would have made an average annual return of 12.3%.

S&P 500 return, 1 January 2009 to 31 December 2019. Chart: YCharts

It was a painful lesson. I hope you don’t have to go through the same journey as I did back then. Therefore, I’m going to share with you how I would invest $10,000 during this COVID-19 crisis. This is a guide for you on how you can build a portfolio with small sums of money. But don’t copy blindly. Take the time to understand the thought processes behind this guide and adapt them to your own financial goals.

Can you hold on?

The key to success as a long-term investor is holding power. As we zoom out and see from the 30-year S&P 500 chart below, the market can fluctuate wildly in the short run but in the long run it goes up.

S&P 500, January 1990 to April 2020. Chart: YCharts

Even if you bought the S&P 500 ETF at the worst possible time, right before it crashed in 2008, you will still make money if you held the stock till today. That’s because the S&P 500 always comprises the 500 best listed companies in the U.S. — if a company underperforms, it is replaced by a better-performing company in the index.

Once you understand this, you should never stretch yourself financially to chase after returns in the stock market — only invest with the money that you can afford to set aside for the next 5-10 years. You don’t want to sell your stocks at the worst possible time – during an economic downturn — just because you need the money. Further, you need to ensure that your personal debt is at a manageable level; and you and your loved ones are well-insured. You also need to have an emergency fund that can cover your living expenses for 6-12 months in case you lose your job.

Focus on quality growth

It’s rare to find high-quality growth companies trading at a deep discount. So when a market crash like the one we have now presents an opening, I’d rather use the opportunity to load up on high-quality growth stocks rather than on dividend stocks.

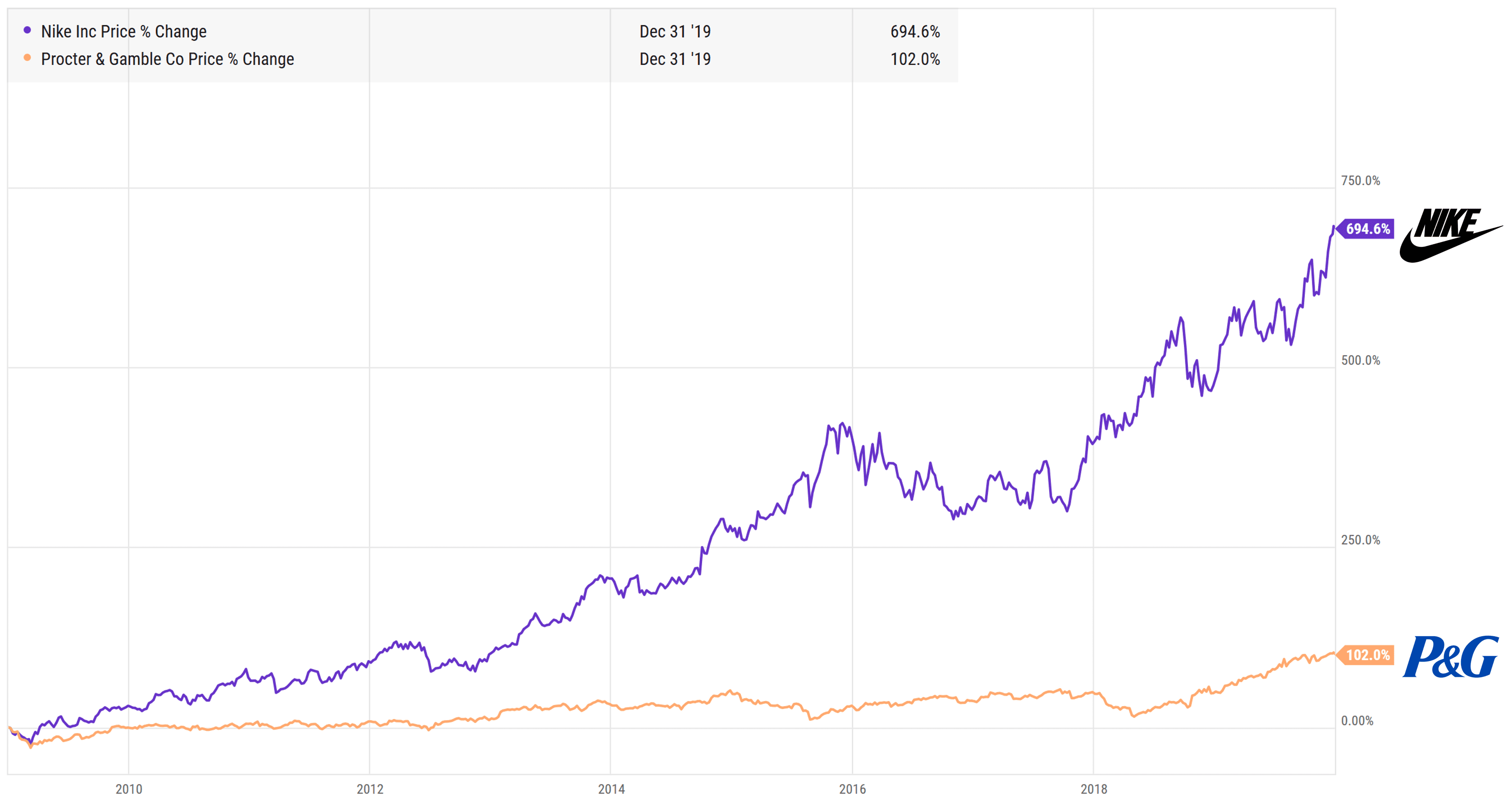

As you can see from the chart below, Nike, a faster-growing company, returned 694.6% from 2009 to 2019. In comparison, P&G, a Dividend Aristocrat, returned 102.0% over the same period.

Nike and P&G returns, 1 January 2009 to 31 December 2019. Chart: YCharts

It also makes more sense for me to invest for growth if I’m young to grow my capital faster. When I’m old, I can always reallocate that sum to dividend stocks to generate a passive stream of income to sustain my lifestyle. At the same time, dividend investing is great for those who cannot stomach volatility. The steady and growing stream of income from owning quality dividend stocks prevents them from panic selling.

For me, volatility is not necessarily risk. Price is simply a reflection of what the market thinks the company is worth at that point in time. When investors are optimistic about the outlook of the business, they are willing to pay more. When they are pessimistic about the future of the business, they will pay less. As investors, our job is to analyze and determine the right price to pay for the business.

High-quality companies possess wide economic moats, rock-solid balance sheets, and a long growth runway ahead of them. They are the ones most likely to bounce back higher after a crisis is over, grow their businesses, and create more value for shareholders which leads to higher stock prices.

How I would invest US$10,000

I want to own high-quality companies that I understand — mostly consumer-related businesses where I interact with their products/services daily. Understanding their businesses well enables me to be quick to spot if there are potential competitors out there by observing the behaviors of the people around me.

Here are my four personal picks:

- Alphabet (NASDAQ: GOOGL) or Google as we know it is the world’s largest online advertising platform. The company generated US$161.9 billion in revenue in 2019, mostly from advertisements from online properties like Google Search and YouTube. The road ahead is long and well-paved as the number of Internet users is projected to grow to 5.3 billion by 2023. The digital advertising industry is also expected to grow to US$517.5 billion by 2023.

- MasterCard (NYSE: MA) is one of the largest payment processing networks in the world. It has a ‘toll booth’ business model that generates revenue based on a percentage of payment transaction volume. The business benefits from the shift towards digital payments. Volume of card transactions in developed markets is forecasted to reach US$17.9 trillion in 2023.

- Facebook’s (NASDAQ: FB) business model is like Alphabet’s except that they sell advertisements through their social media platforms such as Facebook.com and Instagram. Since Q4 2009, Facebook’s number of monthly active users grew from 360 million users to 2.5 billion users in Q4 2019. This creates a network effect for them, making Facebook’s platform sticky as it’s very difficult for users to ditch their friends and family on the platform. Likewise, Facebook’s revenue has grown from US$777 million in 2009 to US$70.7 billion in 2019.

- Amazon (NASDAQ: AMZN) is the market leader in e-commerce and cloud computing. Through the years they have gained loyalty from customers from their sole obsession of making them happy — delivering high quality product at everyday low prices. Amazon passes down cost savings to its customers by spreading fixed costs over a larger number of goods sold. We must not forget that although Amazon is already huge with US$280.5 billion earned in revenue in 2019, they have more room to grow with a foot in multiple industries. The global e-commerce and cloud service market alone is expected to grow to US$5.7 trillion and US$331.2 billion respectively by 2022.

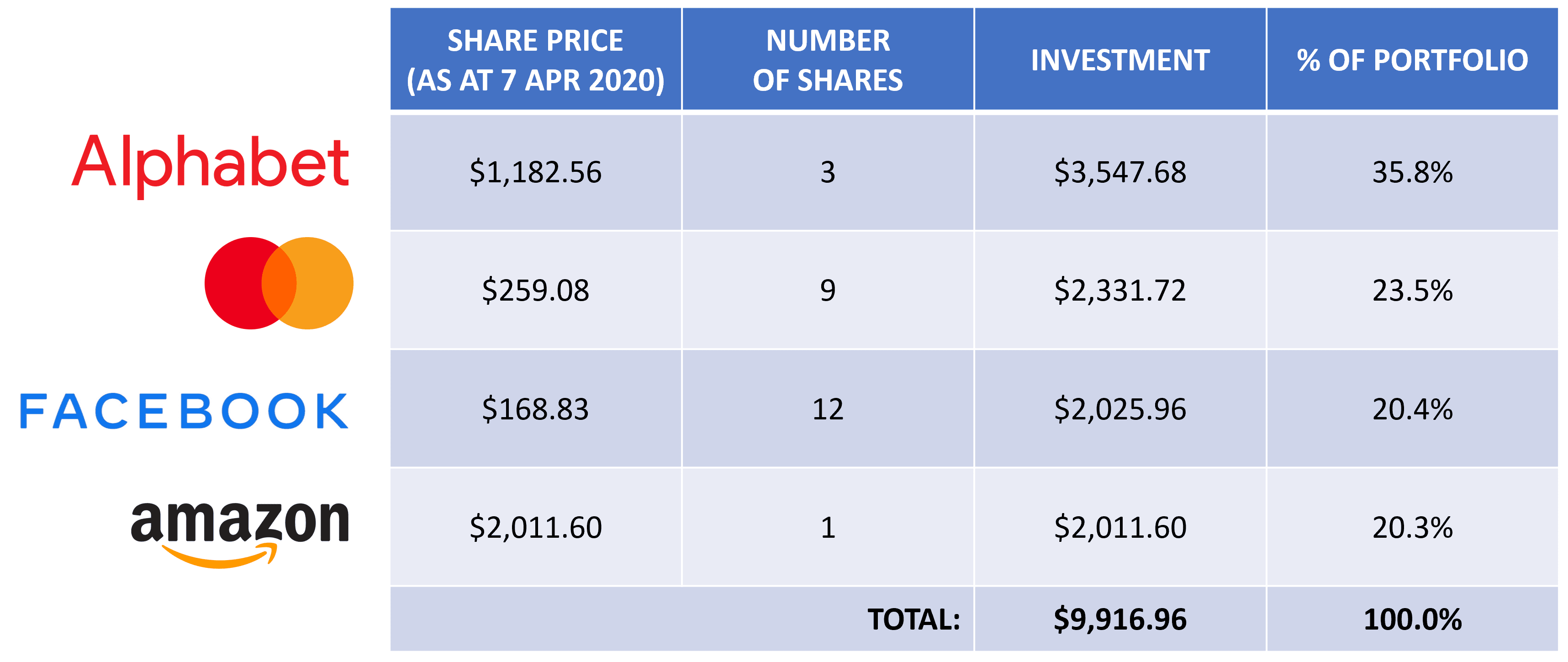

After doing my due diligence, I aim to allocate a quarter of my capital to each stock. While US$10,000 is great to start with, it is also not a very large sum and I’d prefer not to over-diversify my holdings as this incurs excessive brokerage fees. I have also greatly reduced my risk of permanent capital loss by owning great businesses with a margin of safety in place. If I want to, I can slowly build up my portfolio to 10 stocks later, investing in a new one each time I have another US$2,500 to spare.

Example of a US$10K portfolio. Note: This is neither a recommendation to purchase or sell any of the shares mentioned in this article, and the information here is for educational purposes and/or for study or research only.

As you can see, it’s not a perfect 25% per position because of the different prices. But I often allocate slightly more to companies that I’m highly certain of or if they are trading at a price much lower than their intrinsic values. What’s important is that these companies will not be heavily impacted by the COVID-19 crisis, and if any, the impact will be temporary. Most importantly, they all have strong balance sheets and enough liquidity to get through the economic downturn.

No-frills investing

However, if I have no clue about investing and don’t want to spend so much time looking through companies, then investing in ETFs (exchange traded funds) is the way to go. By investing in the Vanguard S&P 500 ETF (NYSE: VOO), you get to diversify your holdings among the top 500 companies in America through an index fund. The portfolio will be rebalanced on a quarterly basis, giving more weight to larger companies.

At the same time, the index eliminates companies that underperform and includes new ones that have grown to the required size. You can think of this as an automated hedge fund without the high fees. Expense ratio for the Vanguard S&P 500 ETF is very low at 0.03%, below the industry average of 0.44%. That means for every $10,000 invested in the ETF, only $3.00 will go towards paying the fund’s total annual expenses. Not bad, huh?

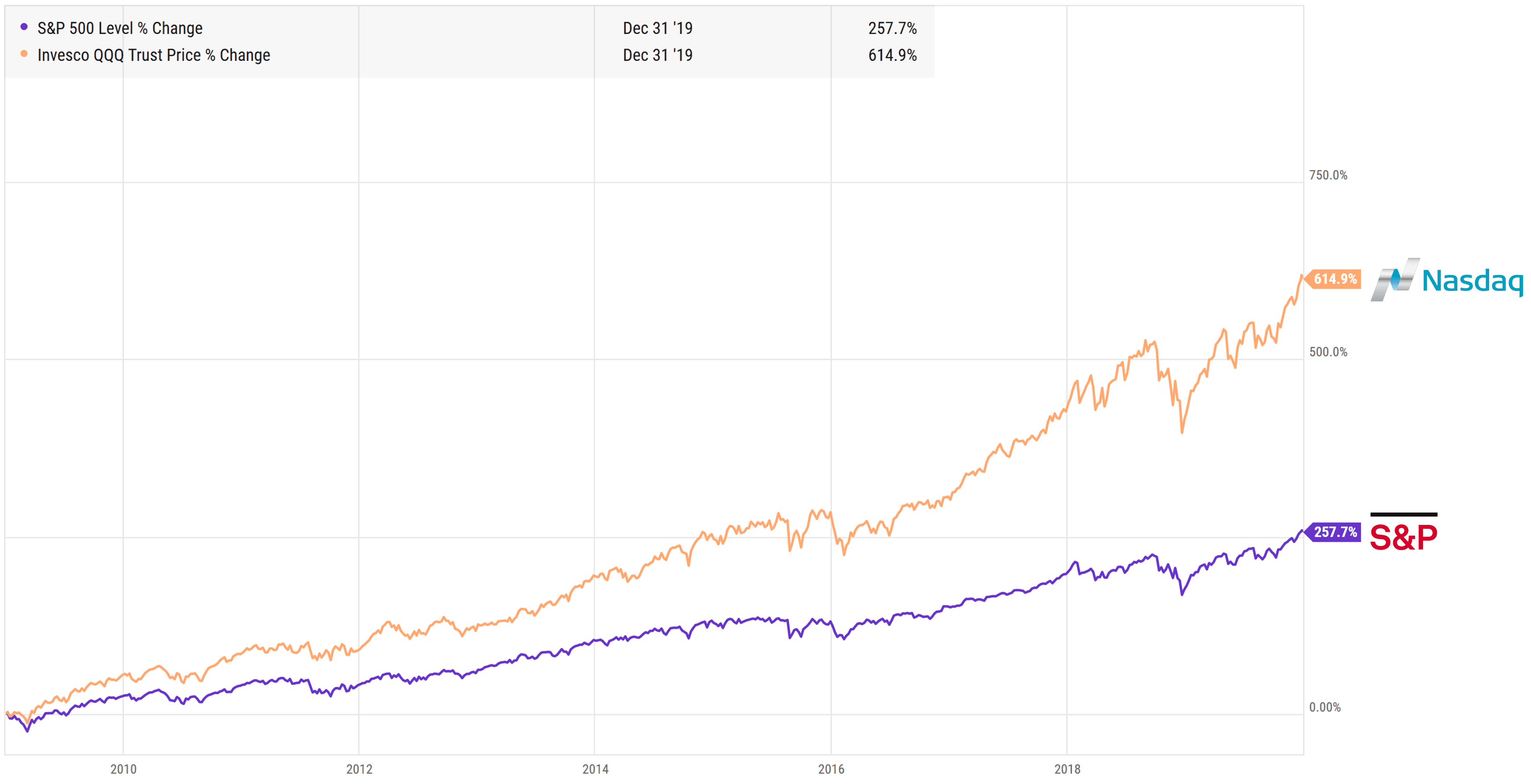

If you lean towards tech stocks, we can also consider the Invesco QQQ Trust (Nasdaq: QQQ). This ETF tracks the top 100 non-financial companies listed on the Nasdaq, comprising technology companies like Microsoft, Apple, Amazon, Facebook, and Alphabet.

The Invesco QQQ has performed remarkably well since the Global Financial Crisis till end-2019 – clocking a 614.9% growth during this period compared to the S&P 500’s 257.7%. In that case, we can do a fifty-fifty split and include Invesco QQQ in our portfolio too.

S&P 500 and Invesco QQQ returns, 1 January 2009 to 31 December 2019. Chart: YCharts

However, investing in Invesco QQQ is more expensive with an expense ratio of 0.20%, 6.7 times higher than the Vanguard S&P 500 ETF. However, I don’t mind paying $20 for every $10,000 invested if it continues to perform better than the S&P 500.

The fifth perspective

To conclude, I just want to say that this is NOT a recommendation for you to buy and sell any stocks. I’ve laid these out to give you some inspiration on how you can build your portfolio. Stocks wise, you can never substitute other people’s opinions for your own due diligence. Once you know what you are doing, you will not panic when the stock market turns against you. There’s no better time to invest in your future than in a market crisis.

To end off, on behalf of The Fifth Person, I want to thank all the healthcare and frontline workers putting their health on the line for us.

‘Night is always darker before the dawn and life is the same, the hard times will pass, everything will get better and sun will shine brighter than ever.’ – Ernest Hemingway.

No matter how difficult, this too will pass. Hang in there and we will all get through this together.

Stay safe and stay healthy my friends!

Read more: 5 things to consider before you invest during this COVID-19 crash

Hi, may i ask why mastercard and not visa or amex? Just want to learn from you how you decide on mastercard. Agree with Google, amazon and Facebook.

Hi Nicholas,

MasterCard has a higher return on capital compared to Visa and American Express. This leads to better price performance in the long run.

Just a question do we have to buy minimum 1000 shares for all US Stocks? or we can buy less than 10 shares?

Hey Kok Hao,

There’s no minimum. You can buy one share if you like.

How do I invest into the 2 ETFs:Vanguard S&P 500 ETF and Invesco QQQ Trust?

Hey Jerry,

You can own it through any brokerage account that trades in the US market.

What’s your intrinsic price for these 4 stocks?

Hi Chris,

I hesitate to simply give an intrinsic value lest they are treated as ‘target prices’ by investors. Investing in a company requires doing research to understand its business model and risks, and whether it suits your risk profile.

What I can share with you though is how we calculate a stock’s intrinsic value based on its historical valuation range. For example, Apple’s historical average P/E over the last 10 years is 15.8. So based on Apple’s latest annual earnings per share of US$12.66, that would give Apple an ‘intrinsic value’ of US$200.03.

You can do the same for the stocks mentioned here and derive their intrinsic value similarly.

Interesting article. GOOG, FB, APPL are the 3 tech titans, stable, cash rich which makes a good long term investment.

Besides these 4 stocks I would suggest Tesla as well. It is a very controversial company in many aspects, but worth a look, if you subscribe to Elon Musk’s vision of the future.

I do own these 4 already, these are my “anchor stocks” – in fact Facebook was one of my first US stock way back in 2012, that was 7 years ago. The price ? $24 a share back then. Held it until today, no regrets.

By the way this is the 3rd economic crisis I’m experiencing …. wonderful time to start investing, bargains galore.

Hi GC,

You’re right. Buying quality stocks as you mentioned during a financial crisis will pay off in the long run.

Tesla is not an investment for me. Everyone is paying a high price for Elon Musk’s vision without ever knowing when the company will be profitable. Like Uber, Tesla is a publicly listed venture capital investment. The company has been taking on more debt and burning more cash year after year with no end in sight. It’s tough to predict where Tesla will be in the next five to ten years.

I believe the vision that most people share is the price performance of the stock if they bought Tesla at over $20 when it IPOed to $573 today will happen again if they buy into the stock.

I could be wrong but I’d rather not risk my capital on an uncertain future.

Fair enough, we have have diff views and risk appetites. I do like TSLA despite some of the risks you correctly pointed out, that’s why I am keeping a “cautious allocation” of my portfolio for TSLA – less than 5% of total. Happy investing !

Thanks, GC! All the best to you as well!

Dear Kenny,

As a resident in Malaysia, how do I get started in buying US stocks?

Hi Nicholas,

When it comes to U.S. stocks, you can take a look at Interactive Brokers, TD Ameritrade, or Saxo. I’ll avoid local brokerages that charge high commissions. It’s not worth it.

You can find out more about U.S. brokerages here: https://fifthperson.com/how-to-buy-us-shares-in-singapore/

During this covid-19 crisis, whats your take in investing in the US market? Due to the reason we are unable to tell how much the market will tank

Hey Nicholas,

My take is to focus on an entry price that will give you good long term returns. Have a plan in place to prevent you from timing the bottom or chasing the stock after it has gone up. Stick to the plan!

Actually you can buy and sell US, Hong Kong and Singapore stocks via Mayabank Investment Bank in Malaysia. I was told that CIMB also offers such a service. It’s all done via the Internet, you can execute the buy/sell by yourself, no need to call anyone.

You can also try international brokers but I was told that the application process can be lengthy.

Why buy a US listed S&P500 ETF for 30% WHT when you can buy a London listed S&P 500 ETF for 15% WHT.

Hey MT,

It’s a matter of preference if you want to maximize your returns. Assuming a dividend yield of 3%, I’ll get only 0.45% more in dividend yield if I invested in the S&P 500 listed on the London Stock Exchange. It’s not much of a difference for me and I don’t want to go through the hassle of dealing with multiple currencies.

I invest in the U.S. stock market for capital gains, not dividends. The return of 257.7% that the S&P 500 generated for the past 11 years, from 1 January 2009 to 31 December 2019, was merely from capital appreciation. It’s something that I’m happy to live with if I don’t get any dividends from it at all.

Not sure if you’ve noticed, but you are allocating 50% of your portfolio on stocks which may perform poorly in a recession. The 2 stocks, Alphabet and Facebook, receive the bulk of their revenue from advertising, which is among the first expenses to be cut in a recession.

Hi Food,

During a recession, Google and Facebook gets a different mix of ad revenues. Instead of seeing ads from Apple selling you a MacBook Pro, you’ll probably see more 2-for-1 deals from Walmart for detergents.

In fact, Google’s revenue and net income increased every single year during the recession from 2007 to 2009. Revenue increased from $16.6 billion in 2007 to $23.7 billion in 2009, while net income increased from $4.2 billion in 2007 to $6.5 billion in 2009.

However, the Covid-19 crisis is a little different. Companies will be cutting back on their spending because consumers are staying at home. Those stores selling essential items don’t need to do any advertisements because most of them have problems coping with the overwhelming demand.

This will impact Google and Facebook. But, due to their strong balance sheets, I have no doubt they will emerge from this crisis far bigger and strong than before.

Disagree on your point on the different mix of ad revenues. Like what you later said, these shops sell essential items and have little need for further advertisement. What I’m more concerned is remarks from e.g. the Expedia chairman saying that Expedia will slash its advertising budget by 80% or more. This is a major player in the advertisement space saying that this year’s budget will be decreased substantially. That’s earnings guidance for Alphabet and Facebook right there.

And if you agree that Covid-19 will have an impact (possibly outsized) on these, shouldn’t your article also highlight some of the pitfalls of investing in these companies? Mastercard also gave a revenue warning and it is trading at a multiple that does not reflect a slowing of business.

Hi Jeremy,

I’m well aware of the impacts and I welcome them with open arms. These are high quality businesses with strong balance sheets that are able to withstand the hits. A sharp decline in share prices is temporary and it gives me a good point of entry as well.

The question is, do you believe that these business will continue to make more in the next three to five years? If so, prices will follow.

You’d have to do your own due diligence to determine the intrinsic values of the companies and the prices at which you like to enter. These are merely my opinions and you have the right to disagree. What’s right for me may not be right for you 🙂

Hi,

Very informative article. Do you invest in index funds/ETFs?

I am planning to do monthly investment kind of SIP in Index funds / ETFs. Could you please provide more information on what are the fees for platforms and better platforms from SAXO, TDA, SCB, IB etc for investing in international index funds / ETFs like S&P 500 ?

Hi Mittal,

I’m not investing in any ETFs at the moment because I simply enjoy the thrill of picking stocks.

The US market has a wide range of ETFs. You can use SAXO, FSMOne, or IB which, in my opinion, charge quite reasonable commissions.

If you want to find out more, you can check out the wonderful articles written by Adam:

– How to buy U.S. shares in Singapore (and open a U.S. brokerage account)

– How to open a brokerage account in Singapore (and choose the right broker)

Thanks Kenny,

I already went through the second article, I see that IB and TDA has inactivity fees, so I find SAXO is better option for me.

However, could you please explain more on custody fees as mentioned below ?

SAXO Markets – 0.12% p.a. of stock holding balance, custodian fee calculated daily using the end of day values and charged on a monthly basis

Is Custody fees charged monthly or annually ?

For example, if I buy Google share today with total investment of $5K and hold it for 2 years then what will be the custody fees?

Hey Mittal,

The foreign exchange rate is quite high for Saxo. The best way is to open a Saxo USD account. You convert you funds at your bank and transfer them over. That’ll save you some money.

Saxo’s custodian fees are calculated based on your daily balance and charged monthly to your account.

Let’s assume you have a $5,000 average balance per day for the sake of this example.

So here’s what you’re going to pay daily: $5000*(0.12%/365)= $0.016

And you multiply by the number of days in the month: $0.016*30= $0.48

So you’ll be charged $0.48 at the end of the month.

Hope this helps!

Hi Kenny,

Thanks for clearing my doubt on Saxo custody fees. Very well explained. (Y)

I didn’t know that you can open Saxo USD account can be opened from Singapore, that’s something new I came to know. Since I am working in Singapore so I thought my Saxo account should be opened in SGD currency.

1. Suppose I open Saxo USD account and majorly I will be investing in US markets but what if I want to invest in other countries markets like London, Hong Kong, etc then how ?

2. Do I have to first convert my SGD to USD and then I have to invest in Other currencies from my USD account ? imo its too much of hassle in that case..

I may be wrong, seeking your advise on above points. Cheers.

Hi Mittal,

My objective to is reduce as much frictional costs as possible, transfer and conversion fees, and convert my money at a favorable forex rate. These frictional costs might not seem much but it accumulates and eat into your capital before you sink a dollar into the market.

This may not be the best approach for you. You got to be clear about what you want out of the platform. For me, it’s to trade in the US and HK markets. Since I converted by SGD to USD at a rate that I’m satisfied with, converting to HKD won’t affect me much because it’s pegged to US dollar.

Hi Mittal,

Just to add onto Kenny. Saxo also allows you to settle trades using your base currency. For example, if your account is in SGD, you can still purchase US/foreign stocks and Saxo will automatically convert the cost to SGD.

The exchange rate may not be optimal, so some investors may prefer to do their conversion elsewhere and then fund their account directly in USD.

Hi Kenny, Adam,

Thanks for your response guys. So its better to open Saxo USD account and then to minimise currency conversion fees its fair to top up Saxo Account using Revolut or to use TransferWise to convert SGD to send money into USD account.

Yes, or you can also open a multi-currency account with Saxo. So you have both SGD and USD accounts which you can fund accordingly.

Hi Adam,

Thanks for your support. After giving much thought, I opened Saxo account today. However, while opening account there was one question to select the currency to open the account and I selected USD. Didn’t ask me to select Multi-currency account.

Is it still possible to open multi-currency account?

Yes, you can email their customer support to request for a multi-currency account.

Hi all,

Thanks for the very insightful advices both in the article, and the comment thread above.

Unfortunately I had already opened a saxo account with SGD as base currency. However I’m planning to only trade in the US market.

Since the base currency is different, is there any way to reduce the foreign currency conversion fees when I fund my account? Would the multi-currency account help?

Many thanks 🙂

Hi Wini,

It’s fine to have SGD as your base currency. Saxo will automatically convert any USD transactions in your account based on their exchange rate and settle them in SGD for you.

However, if you have a source of USD funds outside and you’d like to fund your Saxo directly in USD, then it’d be much better to open a multi-currency account and invest your USD without any need for conversion.

hi i’m 42 years old from malaysia and i have another 13 years for my retirement. if i want to start investment what would be your suggestions? dividend stocks, US index funds or else. Please give some pointers. thanks

Hi Sutharthan,

I’m not in a position to give any advice but here’s my opinion on this matter. What I laid out below might to fit you so adjust accordingly to your financial situation.

So… since you have considerable amount of time to retirement, it’s best for you invest for capital appreciation, compound at a higher rate before moving them to dividend stocks to give you a steady stream of passive income to supplement your retirement years. Although your target is to retire at 55, give it a buffer of one to two years because you want to exit in a good market to get the most bang for your bucks!

Once you got your strategy down, you got to find a way to get there. The first method is picking stocks. But before you do anything, I suggest that you educate yourself. Don’t gamble your hard-earned money in the markets without understanding what you are getting into. Stocks are fractional ownership to a business and as long as a business prosper, the price will follow.

Next up is investing in ETFs like the ones I mentioned in this article if you don’t want to analyze businesses. Don’t follow the dollar-cost average strategy. It’s the worst kind of advice out there. Instead, find out the historical average PE ratio of the indices and enter them at or below the average.

Lastly, this is up to your comfort level but I’ll look to invest in the US markets because overall it gives the best returns compared to other countries in terms of capital appreciation.

Hi Kenny

May I know how do we judge when is the good time to enter S&P 500 ETF, for stock we can calculate intrinsic value but what value should we look at for ETF? Also, does the trading platform provides historical price for ETF?

Thanks

Regards

Ee Teng

Hi Elim,

The S&P 500 has a historical average of 20x PE. I consider anything at or below that level of value.

Yes, you can get the historical prices of ETFs on any platform by keying in the ticker symbol. In fact, you just go to Yahoo Finance and search for SPY!

I hope this helps!

It’s been a year since this post and the stocks portfolio are at 79% profits. Thank you The Fifth Person for enlightening us in buying during the crisis.

https://thesmartsquirrel.wordpress.com/79-profit-in-a-year-yes-its-true/

Hey Grace,

So happy to hear that you took advantage of the Covid crisis and did well! Thanks for the wonderful post that made my day! 🙂

Hi folks, in your recent video about looking back at these picks one year after this post was made, a comment was made about staying invested to “compound your money”. Can you please clarify what you meant by “compounding” here if we’re just holding the stocks and not realizing the gains by selling it? Thank you!

Hi Terry,

Thanks for watching our roundtable! Yes, we look to invest in ‘compounders’ — high-quality companies that are able to successfully reinvest their profits into their business and grow even further. We hold onto these companies for the long term as they will grow more valuable over time.

Hey Adam, thanks for the speedy reply!

Right, so by “compounding”, you’re actually referring to the companies themselves as entities who are compounding their business returns back into the business itself to boost their value, and not from the lens of us investors. I hope that’s the right takeaway here. Thank you!

Yes, that’s right. Although we sometimes use the term ‘compounding’ when referring to our returns as well.