What is the optimal number of stocks for your portfolio?

Diversification in stock investing is akin to the age-old wisdom of not putting all your eggs in one basket. While this concept may appear straightforward at first glance, delving deeper into diversification reveals layers of strategy and foresight crucial for long-term financial resilience.

By spreading your money across various sectors, industries, and financial instruments, you avoid putting all your eggs in one basket – reducing the impact of potential losses from any single investment choice.

Furthermore, diversified portfolios often exhibit smoother performance trajectories over time than concentrated assets. When certain sectors zig while others zag, the overall effect on your investments can be less volatile than if you were heavily invested in only one or two areas. This stability helps protect your capital during economic downturns. It provides a sense of security that allows you to weather short-term market fluctuations with greater peace of mind – essential for sustaining long-term financial plans and goals.

Optimal diversification strategy

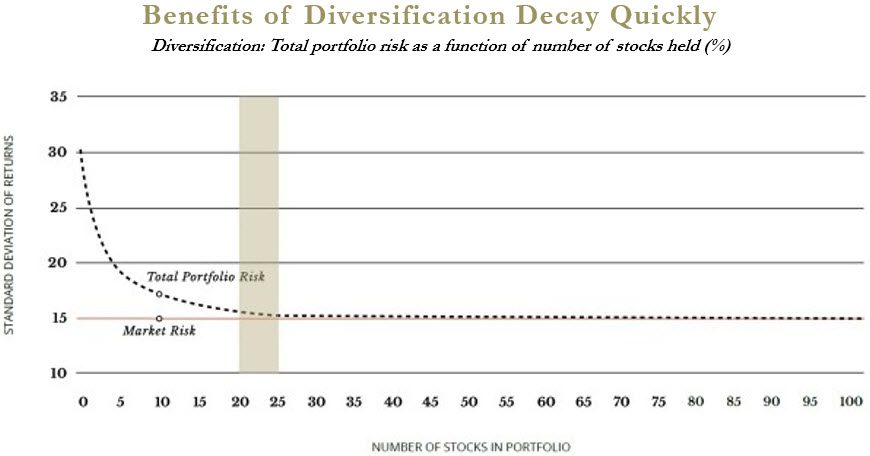

Determining the ‘optimal’ number of stocks to hold is a crucial consideration when diversifying your stock portfolio. While there isn’t a one-size-fits-all answer, experts generally suggest that holding around 20-30 individual stocks can balance effective risk diversification and manageability.

Maintaining a portfolio with fewer than 20 stocks may leave you overly exposed to the performance of a limited number of companies or sectors, increasing the risk of significant losses if any of those investments underperform. Conversely, holding more than 30 stocks can make monitoring and managing your investments challenging, potentially leading to suboptimal decision-making and diminishing returns on your time and effort.

The chart, based on insights from Burton Malkiel’s A Random Walk Down Wall Street, demonstrates that when a portfolio expands to around 20 holdings, any further additions minimally impact the reduction in volatility.

A study by Fisher and Lorie also found that a portfolio of 32 randomly selected stocks captured approximately 95% of the available diversification benefits, with negligible gains from adding more stocks. This finding has been supported by subsequent research, suggesting that 20-30 stocks can provide sufficient diversification for most investors.

A common mistake to avoid

One common misconception when diversifying your stock portfolio is that owning many stocks automatically translates to enhanced diversification. However, increasing the quantity of stocks without considering their correlation, sector exposure, and other risk factors can lead to over-concentration rather than true diversification. Investors must remember that the quality of assets matters more than sheer quantity. Effective diversification should focus on spreading risk by investing in assets that are not closely correlated, thereby providing a buffer against market fluctuations and systematic risks.

Merely holding many stocks within the same sector or industry can create a false sense of diversification. In reality, stocks within the same sector often move in tandem as similar economic factors, regulatory changes, and industry-specific trends influence them. Therefore, investing in multiple stocks within the same sector may not effectively mitigate risk, as they are likely highly correlated.

True diversification requires investing in various stocks across sectors, industries, market capitalisations, and geographic regions. By incorporating investments with low or negative correlations, investors can reduce the overall volatility of their portfolio and minimise the impact of adverse events affecting a specific sector or region.

Additionally, diversification should not be limited to stocks alone. A well-diversified portfolio should include a mix of asset classes, such as bonds, real estate, and alternative investments, each with risk and return characteristics. This multi-asset approach can further enhance diversification and provide a more robust buffer against market fluctuations.

When constructing a diversified portfolio, it’s also important to consider investment styles, such as growth, value, income, or momentum. Different investment styles tend to perform differently under various market conditions, and a balanced exposure to multiple styles can help smooth out returns over the long term.

Effective diversification is not just about the number of stocks held but rather about constructing a portfolio that balances risks and potential returns across various dimensions. Regular portfolio rebalancing and monitoring are essential to maintain the desired level of diversification and align investments with risk tolerance and investment objectives over time.

Allocation strategy

Regarding stock allocation methods within a diversified portfolio, one common approach that many experts recommend is the equally weighted or ‘1/N’ strategy, where investors allocate an equal percentage of their stock portfolio to each stock holding.

This method ensures that no single stock dominates or has an outsized influence on overall portfolio performance, thereby mitigating concentration risk. It offers simplicity by avoiding the complexities and potential biases associated with attempting individual stock forecasting or market timing. Regular rebalancing is inherent to this approach, as it is necessary to maintain equal weighting over time. As some stocks naturally outperform others, the portfolio will drift away from its original allocation targets. This disciplined rebalancing process can be beneficial, as it forces investors to adhere to a contrarian investment approach, trimming positions that have grown larger (selling high) and adding to positions that have become smaller (buying low), potentially enhancing returns over the long run.

Another option investors may consider is to allocate larger weights to stocks they perceive as having higher growth potential or better risk-adjusted returns, leading to a more concentrated portfolio aligned with their investment beliefs and goals. This approach allows investors to actively express their views on specific stocks or sectors, potentially enhancing returns if their predictions prove accurate. However, it also increases the risk of underperformance if those views are incorrect, as the portfolio’s performance becomes more dependent on the success of a smaller number of holdings.

Regardless of the allocation method chosen, regular rebalancing is crucial to maintain the desired level of diversification and risk exposure, ensuring that the portfolio remains aligned with the investor’s risk tolerance and investment objectives. This process helps prevent portfolio drift, where asset allocations deviate from their intended targets due to market movements, potentially introducing unintended risk exposures.

The fifth perspective

Diversification is not a one-time exercise but an ongoing process requiring regular monitoring and adjustment. As market conditions evolve and new opportunities arise, it’s crucial to revisit and rebalance your portfolio to maintain the desired level of diversification and ensure that your investments remain aligned with your risk tolerance and long-term goals. By embracing diversification as a core principle, you’re not only mitigating risks but also unlocking the potential for consistent, long-term growth that transcends the volatility of any single investment.