The Hershey Company is one of the world’s largest and most iconic chocolate and confectionery companies. Founded in 1894 by Milton Hershey in Hershey, Pennsylvania, the company has grown to become a global leader in manufacturing and selling high-quality chocolate, candy, gum, mints, and other snack products. Hershey is best known for its flagship Hershey Milk Chocolate bar, a beloved classic for over a century. In addition to this iconic brand, the company’s portfolio includes other well-recognized names such as Hershey Kisses, Reese’s Peanut Butter Cups, KitKat, Twizzlers, and Ice Breakers.

Beyond its core chocolate and confectionery business, Hershey has strategically expanded into adjacent food categories in recent decades. This includes the acquisition of brands like Krave jerky, Skinny Pop popcorn, and Pirate’s Booty, allowing the company to diversify its product offerings and appeal to evolving consumer preferences for snacks and better-for-you options.

Business model

Hershey operates a global network of manufacturing facilities, distribution centres, and research and development labs to support its broad product portfolio. The company sells its branded chocolate, candy, and snack products through multiple channels, including directly to retailers, wholesalers and distributors, and increasingly through e-commerce and other digital platforms. Hershey also has a strong international presence, with operations and sales in over 90 countries worldwide.

The company’s strategy focuses on innovation to develop new products, brand-building to maintain consumer loyalty, and operational efficiency to control costs. Hershey also grows through strategic acquisitions to expand its portfolio and geographic reach. By leveraging its iconic brands, diverse product offerings, and global manufacturing and distribution capabilities, Hershey seeks to deliver consistent financial performance and shareholders.

Financial highlights

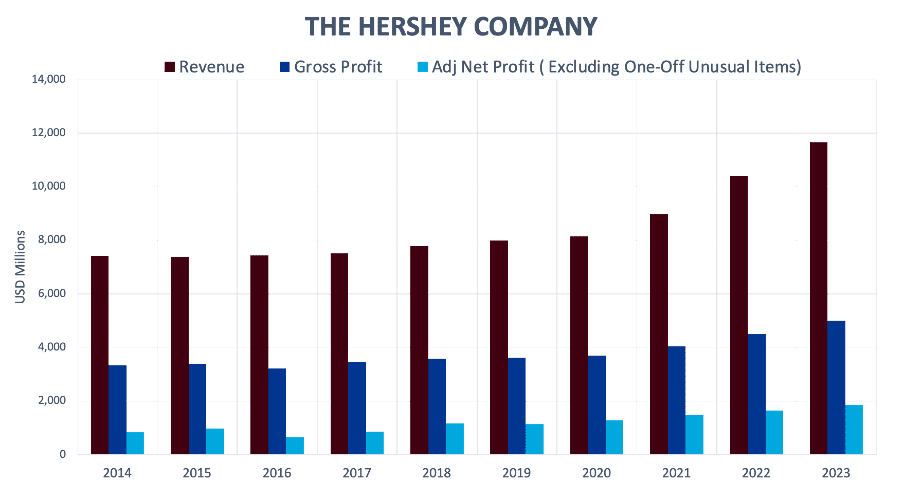

From 2014 to 2023, Hershey has recorded consistent financial growth. Over this period, the company achieved a compound annual growth rate (CAGR) of 4.71% in revenue, 4% in gross profit, and an even stronger 8.2% in net profit. This sustained financial performance demonstrates Hershey ability to effectively execute its strategy and drive profitability across its diversified business.

According to Hershey latest financial statements, the company derives the majority of its revenue (81.7%) from its North American confectionery segment. This core business unit includes Hershey iconic chocolate and candy brands like Hershey, Reese’s, Kisses, and KitKat, which have maintained a dominant market position in the lucrative North American confectionery market.

The International segment contributed 9.85% of Hershey total revenue, reflecting its successful efforts to expand its renowned brands into key overseas markets. Hershey has strategically invested in manufacturing, distribution, and marketing capabilities in regions like China, India, and Latin America. This allows it to capitalise on rising consumer demand for branded chocolate and confections in these high-growth markets.

The remaining 8.45% of Hershey revenue came from its newer business segments, primarily the North America Salty Snacks unit. This includes brands such as Pirate’s Booty, Skinny Pop, and Krave, which Hershey has acquired in recent years to diversify beyond its traditional confectionery focus and capture a greater share of the broader snack food category.

By leveraging its powerful brand portfolio, innovation pipeline, and multi-channel distribution network, Hershey has maintained its leadership position in North American confectionery while strategically expanding into international markets and adjacent snack categories. This diversified business model has allowed the company to deliver consistent financial performance and shareholder returns, even as consumer preferences and market dynamics continue to evolve.

Rising cocoa costs

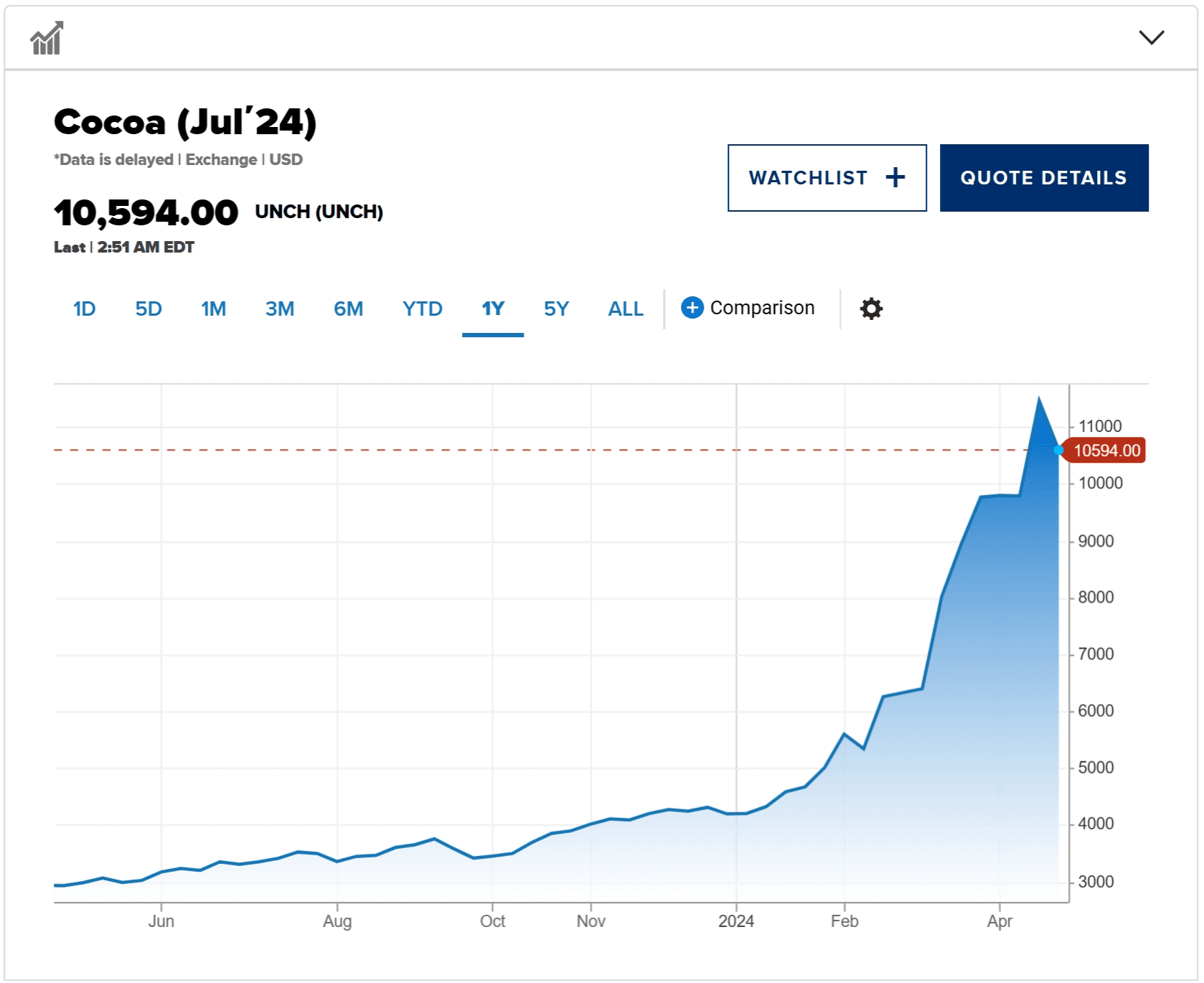

As a leading global participant in the cocoa market, Hershey has been significantly impacted by a supply shortage of this crucial raw material. The shortage has been driven by unfavourable weather patterns in West Africa, which accounts for most of the world’s cocoa production. Specifically, drier-than-usual conditions in the region have disrupted cocoa harvests, resulting in a supply crunch that has sent cocoa futures prices to over $10,000 per ton.

The steep rise in cocoa costs has put immense pressure on Hershey profit margins across its chocolate and confectionery product portfolio. In response, the company has implemented price increases on its iconic offerings, including Hershey Milk Chocolate bars, Hershey Kisses, and other grocery staples like chocolate baking chips and syrups.

However, Hershey has found that there are limits to how much it can raise prices before it negatively impacts consumer demand and sales volumes. In 2023, the company experienced declining sales volumes for its chocolate products as some price-sensitive consumers shifted away from its higher-priced confections.

Looking ahead, Hershey anticipates that the sustained elevation in cocoa prices will continue to weigh on its profitability beyond 2024. The company employs a multi-pronged approach, including strategic cocoa sourcing, supply chain optimisation, and targeted additional price adjustments to mitigate the impact. However, the ongoing cocoa shortage will remain a significant headwind that Hershey must navigate carefully in the near to medium term.

Valuation

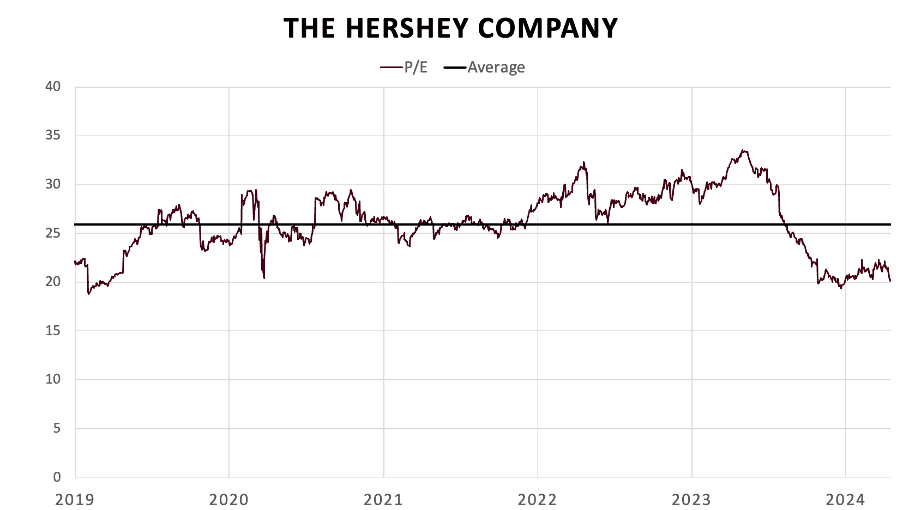

Hershey stock is currently trading at a trailing price-to-earnings (P/E) ratio of around 20, one of the lowest levels seen in the past five years for a business that has delivered consistently stable financial results.

While the elevated cocoa costs will likely remain a near-term headwind, the current valuation appears attractive, when compared to its 10-year historical P/E average of 27. Hershey track record of delivering reliable earnings growth and shareholder returns, even in the face of volatility in key input costs, suggests that patient investors may be rewarded by taking advantage of the current depressed valuation.

As cocoa prices stabilise, Hershey strong business operations and brand pricing power should enable it to expand profit margins and drive further earnings growth. Coupled with the company’s shareholder-friendly capital allocation policies, including a reliable dividend stream, this valuation anomaly appears to offer an attractive risk-reward proposition for patient, value-oriented investors.

The fifth perspective

Despite facing significant headwinds from rising cocoa costs, Hershey has managed to maintain a compelling financial performance, as evidenced by its consistent growth in revenue, gross profit, and net profit over nearly a decade. The current valuation, with a P/E ratio substantially below its 10-year average, suggests that the stock may indeed be undervalued. This presents a potentially attractive opportunity for patient, value-oriented investors who are prepared to weather the volatility of cocoa prices. However, prospective investors should remain cautious and consider the risks associated with prolonged high input costs and their possible effects on consumer pricing and demand.