How to open a Singapore bank account for Malaysians

As a Malaysian who’s tried to invest in the U.S. and other Asian markets, you will probably understand the frustration of finding out that most international stockbrokers don’t accept Malaysian ringgit as a deposit currency.

Of course, there are alternatives such as using an international telegraphic transfer to make a direct deposit in currencies in U.S. or Singapore dollars. However, the fees and exchange rate may not be worth it.

Alternatively, fintech services such as Wise or Bigpay will allow you to deposit money at a reasonable fee. Still, these services won’t come with the same level of insurance and regulation that your bank accounts have. Deposits made through these fintech services may be rejected or delayed by your stockbroker due to money laundering concerns.

As such, having a personal offshore bank account might be a good idea for some Malaysians, so you can store your funds in a stronger currency and/or use it as an in-transit account. In this guide, I will show how Malaysians can open an offshore Singapore dollar bank account without needing to set foot in Singapore.

Before we begin with the steps, here are the requirements:

- Your Malaysia IC

- Your Tax Identification Number (TIN)

- A CIMB Malaysia bank account

- SGD1000 initial deposit

Open a CIMB Malaysia account

If you already have a CIMB Malaysia account, skip this part and move on to the next section.

To open a CIMB Singapore bank account, you must first have an existing CIMB bank account in Malaysia. You can open a CIMB bank account online or in person at any CIMB branch in Malaysia.

If you intend to apply online and are not a current CIMB Malaysia account holder, I strongly advise you to open the new, fully-digital CIMB OctoSavers Account-i to avoid the hassle of visiting a branch; your bank card will be delivered to your doorstep. All you have to do is apply via their CIMB Apply App.

Open a CIMB SG FastSaver Account

Step 1

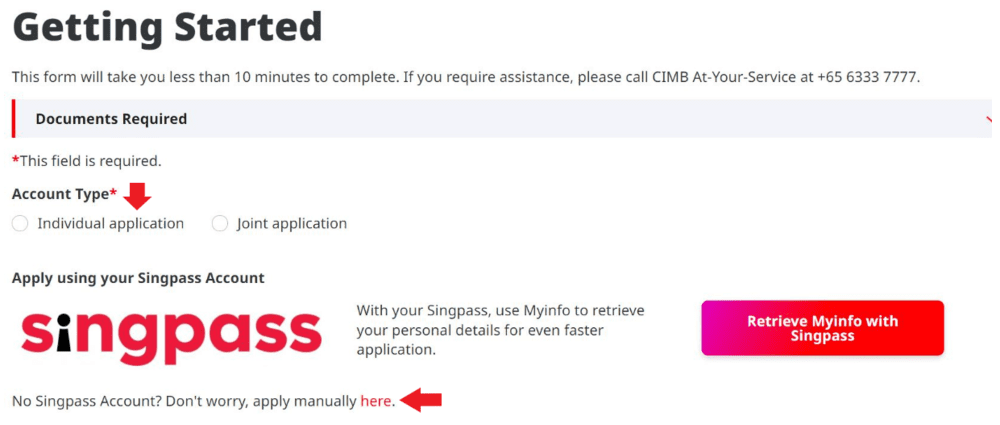

Visit the CIMB SG FastSaver product details page and fill in the application form.

Step 2

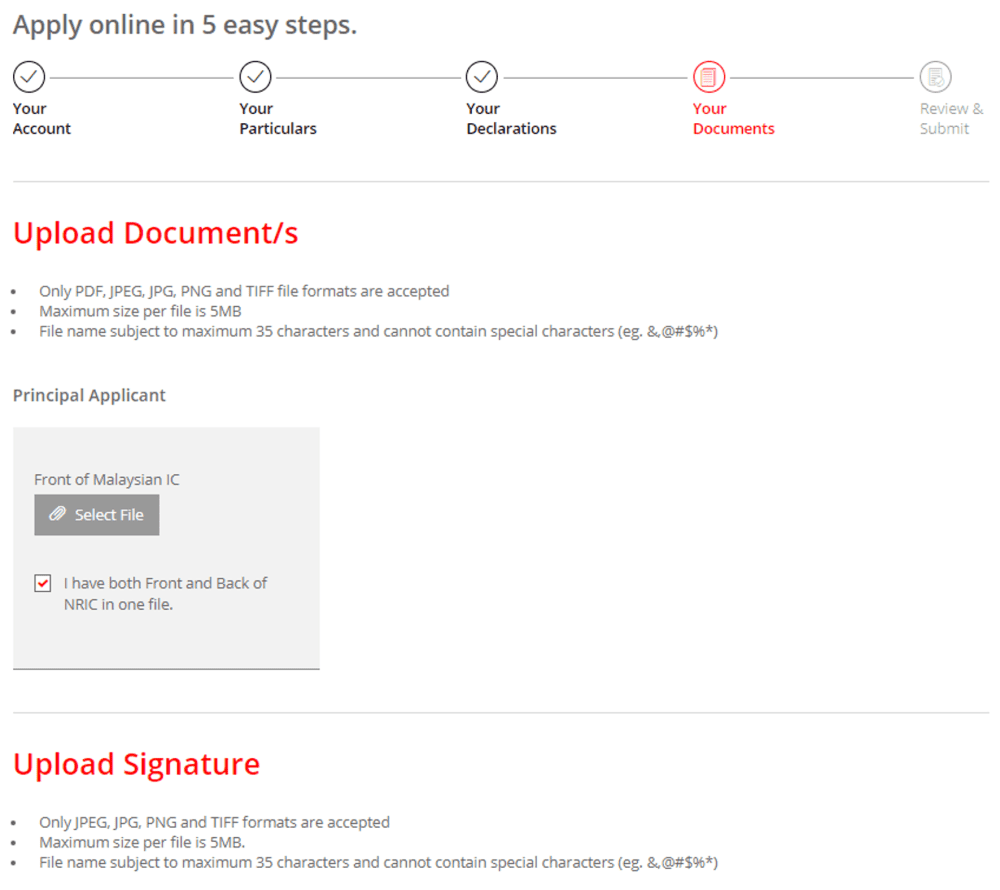

Provide all the necessary information:

- Upload a copy of your IC.

- Provide your Tax Identification Number (TIN) if you are a taxpayer (i.e., you pay tax to LHDN)

- Upload your e-signature

Step 3

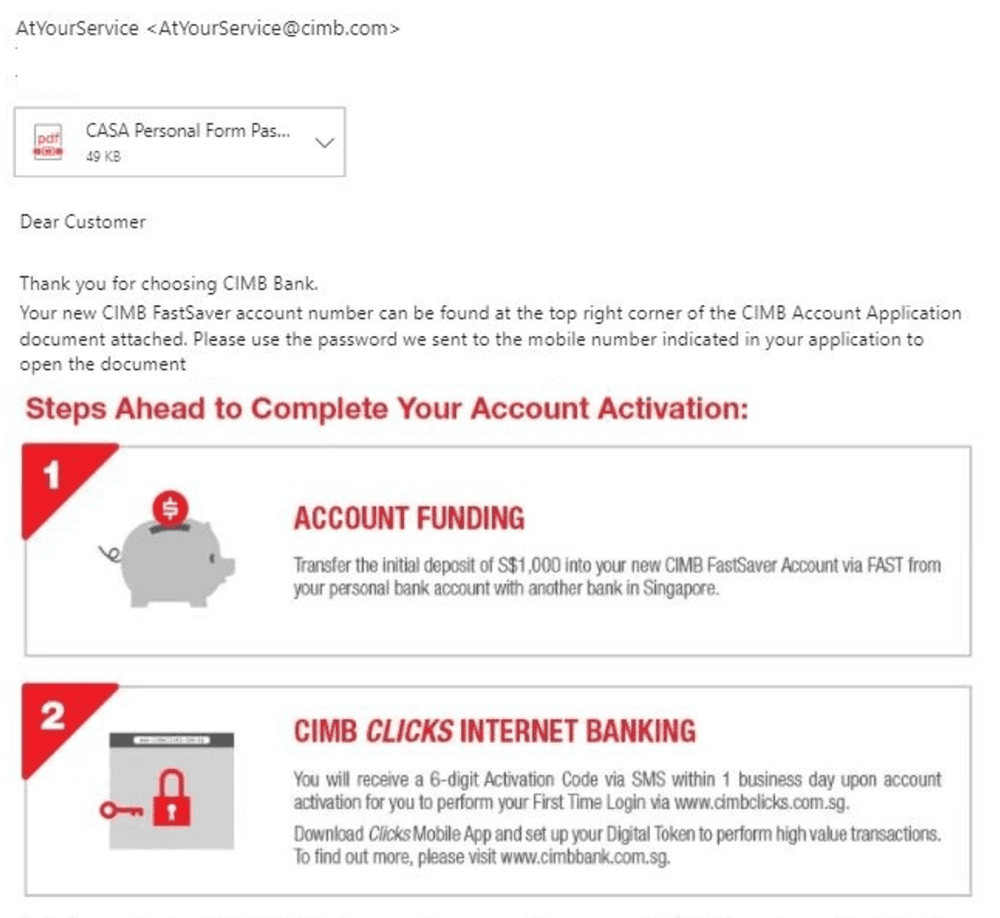

Upon completion, you should receive an email and SMS containing a summary of your application details.

Step 4

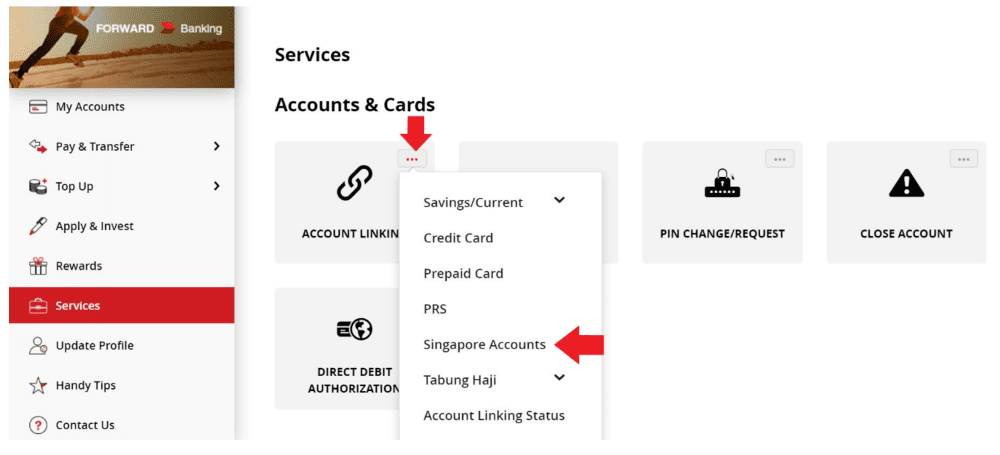

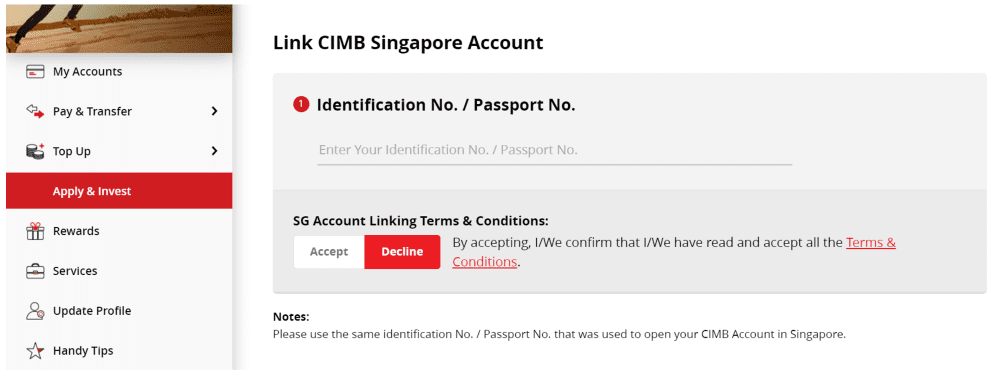

Link your CIMB Malaysia account to your CIMB Singapore account. Log in to your CIMB Clicks Malaysia account. Click on ‘Services’ > ‘Account Linking’. Select ‘Singapore Account’.

Step 5

Key in your Malaysia IC number.

Step 6

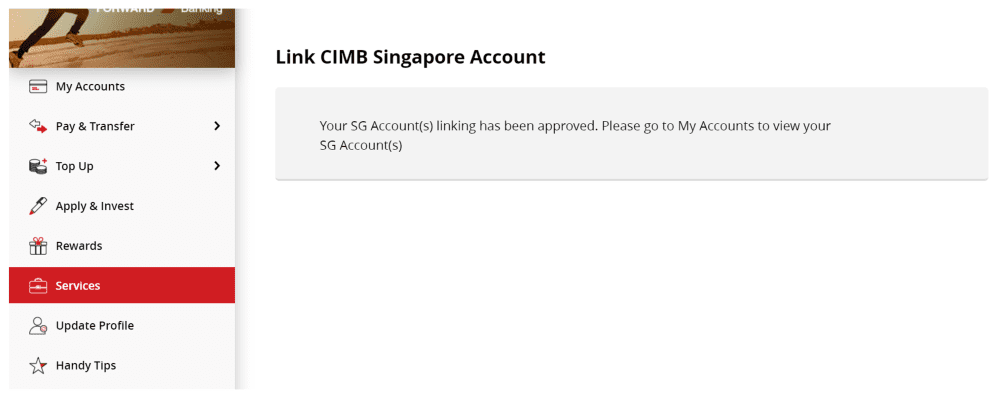

Wait for account linkage to complete after 1-2 business days.

Step 7

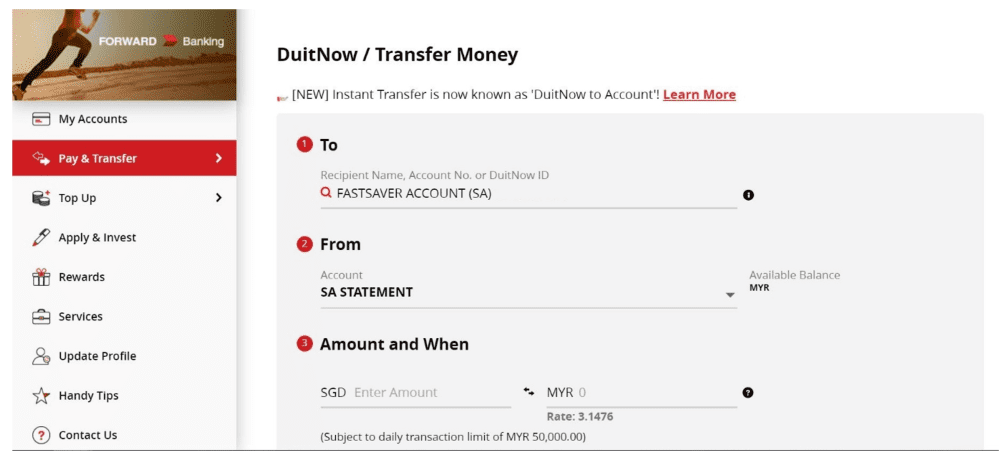

Once the account linkage is approved, proceed to make an eKYC initial deposit of SGD1,000 into your CIMB Singapore account. To activate your CIMB Singapore account, you must make your initial transfer through your own CIMB Malaysia account.

Note: It is also possible to save money on foreign exchange fees by making a small transfer of at least SGD 1 (via CIMB Malaysia) and the remainder (SGD 999) via fintech platforms such as BigPay or Wise.

Step 8

Wait for CIMB Singapore to finalise your bank account application. Expect a call from CIMB SG (+65 number) in the following 1-3 business days. They will ask for your IC number and how you plan to utilise the CIMB SG account.

Step 9

Wait another 1-5 business days for CIMB Singapore to authenticate all your details. If your CIMB SG account application is accepted, you should receive an account activation email and an SMS containing your CIMB SG activation code. If your bank account application is refused, your initial deposit will be refunded to you.

Step 10

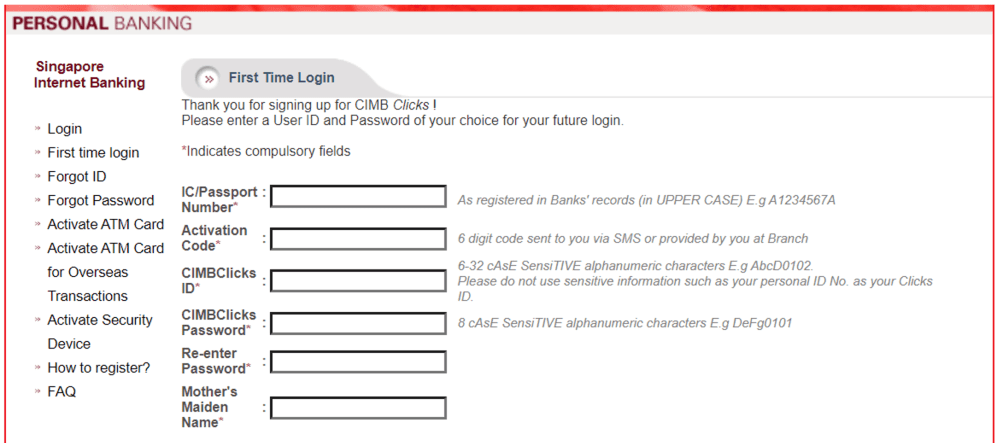

Sign up for CIMB Singapore internet banking. Visit CIMB Clicks Singapore, click on ‘First Time Login’. Create your username and password for CIMB Clicks Singapore, and type in the activation code.

Step 11

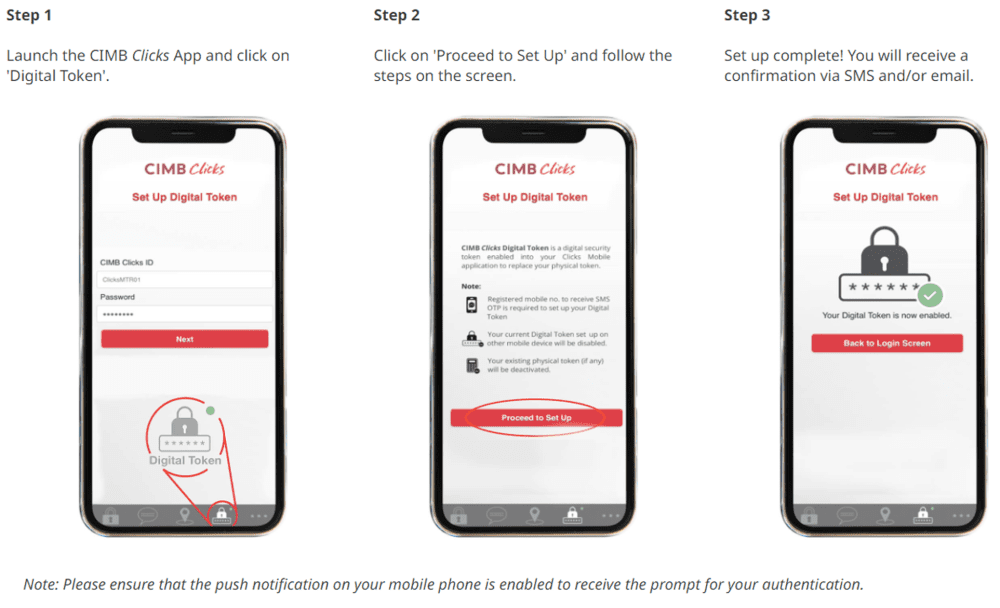

When you are finished, download and activate the CIMB Clicks SG app to launch the digital token. You must undertake this procedure to be able to perform all future transfers.

Step 12

All done!

Conclusion

Hopefully, this short guide will help to open an SGD bank account and ease your process in depositing funds with an international broker. If you have additional questions on bank accounts, do not hesitate to leave a comment, and I’ll get back to you as soon as I can.

Hi Choon,

Very useful article. I am a member of fifth person and just started the journey.

Want to know. For me Malaysian,

1. Is cimb the only bank that can do such facility purely online?

2. I just installed tiger brokers account for purpose of investing in div stocks in SG. So is it to say i can directly use the cimb sg account as a div income receiving account? Reason being, for any sg stocks that pay me dividends, cgs cimb charges me fees for getting the dividends which is not worth it.

Hi Li Feng,

Thank you for supporting The Fifth Person!

1) Yes, CIMB Singapore is the only bank that accepts online applications from Malaysians.

2) Your dividend will be deposited into your Tiger Brokers account. You can then transfer your dividend income from Tiger Broker to CIMB SG without incurring any charges.

Hi , 1) can I transfer online money from Cimb Sg account to my Malaysian Cimb account , do I have to pay charges.

2) if I have to pay tax on dividend received and to whom

Thanks

Richard

DM Pro member

Hi Lee,

1) Yes, you can transfer money from CIMB SG to CIMB Malaysia without any charges.

2) Dividend received from Singapore and Malaysia companies are tax-free.

Hi. Is there any steps for Malaysian to open Maybank Singapore account? Thank you.

Hi KKS,

You need to visit a Maybank branch in Malaysia to open up a Singapore bank account.

Hi, your article is really helpful 🙂 May I know is the CIMB MY account and CIMB SG account sharing the same card? Thank you.

Hi YHC,

CIMB MY and CIMB SG do not share the same bank account. CIMB SG does not provide an ATM/debit card, the account is intended for online transactions only.

Can i use the Singapore account to store multicurrency? I am thinking to open a multi currency account in Singapore.

Hi Wong,

CIMB Singapore does not support multi currency , only SGD

sdg1000 INITIAL DEPOSIT can be withdraw afterward?

Hi Firo,

Yes, the initial deposit of SGD $1000 can be withdrawn once your application has been finalised.

Hi, I’m currently receiving a medical treatment in Spore, can I use this account to make my medical payment transaction?

Hi Lina,

Yes absolutely, as long as your treatment provider accepts standard bank transfers or PayNow payments.

Since SG bank account only for online transaction, can I withdraw money from SG CIMB branch service counter.

Hi W25,

Yes, you will be able to withdraw money from the CIMB SG branch counter.

Hi, can I as a Singaporean open a Malaysian cimb account? What are the steps / documentation required?

Hi Jeremy,

Generally speaking you will need a residency visa such as work/ student visa to open a bank account in Malaysia .

If you have a valid residency visa, just bring along your passport to any CIMB bank branch to open a bank account .

Hi Choon,

It has been more than a week after i deposited 1sgd from msia cimb acct and 999 from bigpay account but i still not receive any call and code from singapore, what could i do?

Hi Alan,

You can contact CIMB Singapore,

(65) 6333 7777 (open Mondays to Sundays between 9am and 7pm), or send an email to ATYOURSERVICE@cimb.com

Hi Choon Leo,

Is the interest earned from this Fastsaver SG account, taxable in Malaysia? Appreciate your clarification.

Hi Leslie,

Interest earned from this Fastsaver account is not taxable in Malaysia.

Hi will we be taxed on the income in our CIMB sg account if we are Malaysian?

Hi Daniel,

Interest income is tax exempt both in Singapore and Malaysia for Malaysians.

hello choon leo wang , may i know if im malaysian and i dont have tax id , but my future boss ask for it to apply singapore bank account for my wages . what should i do if i dont have ? i try to call lhdn but couldn’t reach them many times

Hi Nadia, if you work in Singapore, you can easily open a Singapore bank account.

Hello Choon,

I am a Malaysian citizen. Does CIMB accnt report income to Malaysian Tax authority deposited to my Singapore account for tax purposes in Malaysia? I would receive income from outside Singapore to my CIMB account, I live in Malaysia.

Thanks you!

Asri Abdullah

I would like to know too

Hi Aris,

CIMB Singapore does not automatically report income deposited into your account to the Malaysian tax authorities. As the account holder, you are responsible for disclosing any income you receive from outside Malaysia , if it is necessary for tax purposes in Malaysia.

Hi Choon,

Im a Malaysian..Is it compulsory to provide my TIN during account opening? What is the purpose of the bank requesting for this info? What if I did not provide?

Hi An,

In general, it is not compulsory to provide your TIN when opening a bank account. I personally did not provide a TIN when I opened my account either. The main purpose of requesting this information is to ensure compliance with anti-money laundering (AML) and counter-terrorism financing regulations. However, it’s important to note that if you choose not to provide your TIN or any other requested information, the bank may have the right to refuse or limit the services it offers to you.

1) Are your firm Tiger Broker ? what the full company name?

2) If your brokerage firm able to invest or buy / sell share in USA, China Hong Kong and Singapore stock market online ?

3) I am interested in USA China Hong Kong and Singapore Stock market. How to contact you via phone / mobile / email ?

4) Is CIMB Singapore Bank account the only bank acceptable in order to start share investing or trading online ?

Kindly reply.

Hi Steven,

1) Tiger Brokers is one option for a broker. You can compare the rest of the Malaysian brokerage options here: https://fifthperson.com/buy-shares-malaysia-open-malaysian-brokerage-account/

2) You will need to check if a broker gives you access to the U.S., China, Hong Kong and Singapore markets

3) https://fifthperson.com/contact/

4) CIMB Bank is a bank. It is better to use a broker to trade.

After opening a Fastsaver SG account, can we also open a Fixed Deposit SG account for better interest rates? For Malaysian

Hi Jack,

Unfortunately, Malaysians are not eligible to open Fixed Deposit SG accounts even after opening a Fastsaver SG account.

You mean as a malaysian with fastsaver account, we cnanot apply for FD from the account?

Hi April,

Yes , Malaysian cannot apply for FD with the Fastsaver account