The suggested minimum amount for a Malaysian to retire gracefully varies from RM240,000, RM600,000, and RM1,000,000. This amount will differ depending on locations, individual needs, and spending habits as well as post-retirement lifestyle. If you are thinking about ways to build up your retirement kitty, here are four ways you can grow your wealth in the long run.

1. Employees Provident Fund (EPF)

EPF is a retirement scheme for private sector workers in Malaysia. It offers a mandatory and consistent ways to accumulate funds for our golden years. Each month, an employee and their employer contribute 11% and 13% of the employees’ salary respectively into their EPF.

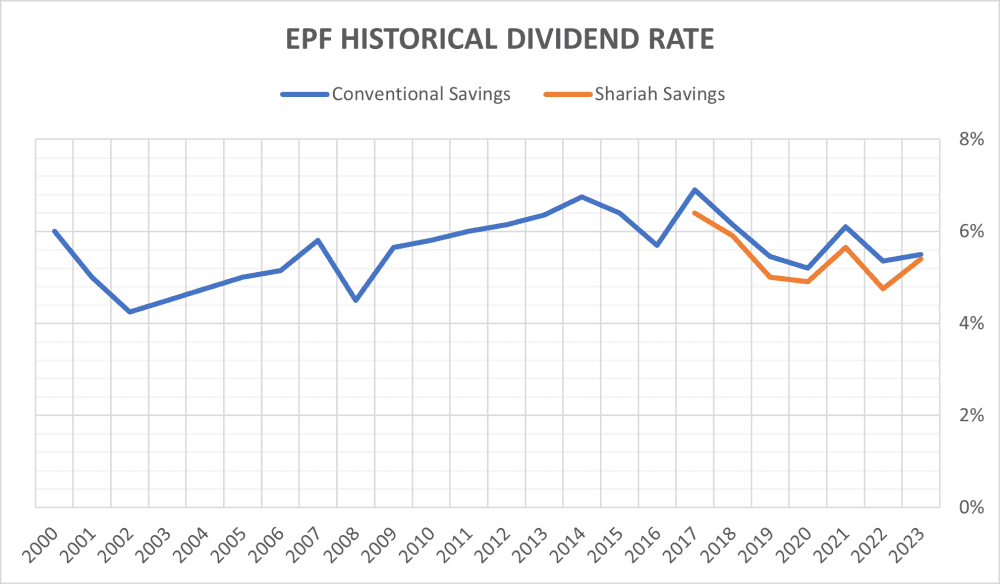

EPF just announced its full-year 2023 dividend rate at 5.50% for conventional savings (5.40% for shariah savings). Between 2000 and 2023, the average dividend rates for conventional and shariah savings were 5.60% and 5.43% respectively.

Is EPF a good retirement tool? Let’s project the potential EPF balance for a fresh graduate by the age of 60 to understand the power of consistent savings as well as compound interest. The average fresh graduate monthly salary in Malaysia was RM2,876 according to Indeed.

Assumptions:

- Starting monthly salary: RM2,500 (conservative estimate amid calls to give fresh graduate a monthly salary of RM3,000)

- Yearly salary increment: 3.0%

- Combined monthly employer and employee EPF contribution: 24.0% (11% employee, 13% employer)

- Estimated average annual dividend rate: 5.6%

- Partial withdrawal of approximately RM33,000 from EPF at age 35 for a home down-payment (remaining down-payment from savings)

| Year | Age | Monthly Salary (RM) | Annual EPF employer and employee Contributions (RM) | Estimated 5.6% Annual Dividend Distribution (RM) | EPF Balance (RM) |

| 2024 | 25 | 2,500 | 7,200 | 403 | 7,603 |

| 2025 | 26 | 2,575 | 7,416 | 841 | 15,860 |

| 2026 | 27 | 2,652 | 7,638 | 1,316 | 24,815 |

| 2027 | 28 | 2,732 | 7,868 | 1,830 | 34,513 |

| 2028 | 29 | 2,814 | 8,104 | 2,387 | 45,003 |

| 2029 | 30 | 2,898 | 8,347 | 2,988 | 56,337 |

| 2030 | 31 | 2,985 | 8,597 | 3,636 | 68,571 |

| 2031 | 32 | 3,075 | 8,855 | 4,336 | 81,761 |

| 2032 | 33 | 3,167 | 9,121 | 5,089 | 95,972 |

| 2033 | 34 | 3,262 | 9,394 | 5,900 | 111,266 |

| 2034 | 35 | 3,360 | 9,676 | 6,773 | 92,466* |

| 2044 | 45 | 4,515 | 13,004 | 16,623 | 313,468 |

| 2054 | 55 | 6,068^ | 16,748 | 39,334 | 741,726 |

| 2059 | 60 | 7,035 | 19,416 | 57,370 | 1,081,832 |

With these assumptions, a fresh graduate could potentially accumulate more than RM1 million in his EPF account by the age of 60. This amount is at the higher end of the minimum retirement amount mentioned at the start of this article.

While the EPF offers significant benefits, its limited accessibility can be a deterrent for some savers. The mandatory contributions are locked in for a long period, with full withdrawal only allowed at age 55. This can lead to hesitation about putting in additional voluntary savings. On the other hand, it can also ‘forces’ those who tend to live beyond their means to save money. EPF contribution is also tax-deductible.

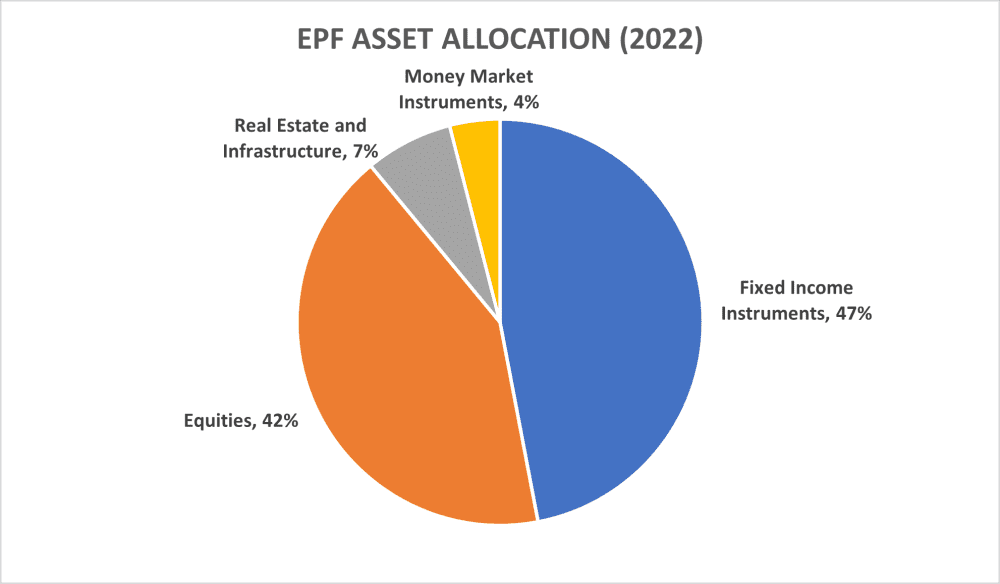

There are some unfounded concerns about the EPF’s financial stability or potential mismanagement. These anxieties seem to stem from a lack of trust in the government, which can be a major obstacle. However, the EPF is a powerful tool for retirement planning in Malaysia, especially when combined with other savings and investments.

2. Stocks

Stocks is one of the best ways to grow our wealth. As shown in a study done in the U.S., the wealth of the rich mostly comprises business interest (stocks), stocks, and mutual funds (still primarily stocks). Over the years, the stock market keeps rising because of inflation, population of growth, technology, and natural selection.

We have consistently emphasized the importance of staying invested regardless of market conditions. The amount of cash we hold varies based on the stock market’s valuation. When the market is overly optimistic, I choose to liquidate a portion of my investments to safeguard my capital and profits, drawing lessons from the fluctuating glove stocks in Malaysia. Conversely, during market downturns, I strategically invest my capital in stages.

I personally like investing in dividend-growth stocks. According to a study conducted by Ned Davis Research on the S&P 500 between 1972 and 2003, dividend growers and initiators were the best performers and outperformed other categories of stocks such as non-dividend payers and dividend cutters or eliminators. If you are team dividend, don’t forget to check Dividend Machines out when enrolment reopens.

In Malaysia, there is a 10% dividend withholding tax on distributions given out by REITs. In Singapore, dividends are tax-free. In Hong Kong and China stock markets, dividends distributed by China A- and H-shares will be taxed 10%. Although the Hang Seng Index may be seen as a laggard based on share price performance alone, it is worth noting that adjustments are not made for cash dividends or warrant bonuses. The reduction of brokerage fees has also broadened Malaysians’ access to foreign stocks.

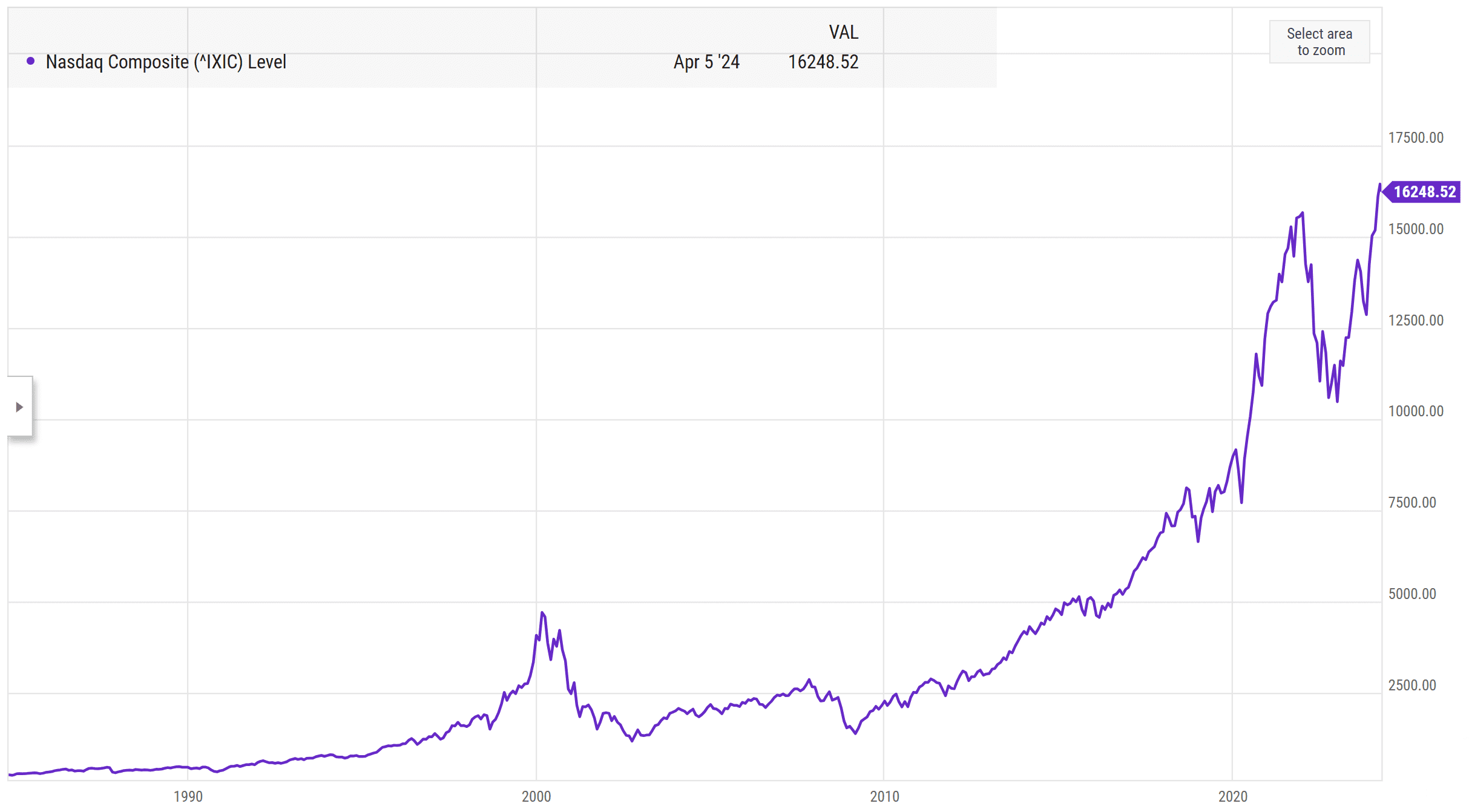

Another investment strategy is focusing on capital growth, particularly in the U.S. markets, which complements the approach of investing for dividends. The tech-focused Nasdaq Composite Index has grown by leaps and bounds. The index has recently been breaking record highs, thanks to the Magnificent Seven: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.

Notably, the share price of Nvidia has risen dramatically. The increasing adoption of artificial intelligence (AI) has opened up fresh growth opportunities for technology companies, particularly growth stocks. If you are into growth stocks, stay tuned when enrolment for Alpha Quadrant reopens.

3. Peer-to-peer (P2P) Lending

In Malaysia, micro businesses frequently face challenges accessing traditional bank loans due to their limited financial records and predominance as cash-based operations. Struggling to satisfy the stringent requirements of banks, these businesses often resort to peer-to-peer (P2P) lending platforms, which have more lenient credit criteria, to bridge their financing needs.

Funding is managed by third-party trustees while P2P lending platforms act as intermediaries that facilitate lending and repayments. They connect micro businesses with a pool of individual lenders who provide funding as working capital, invoice, or general business financing. Only locally registered and unlisted companies can raise funds through these platforms that are recognised by the Securities Commission (SC) Malaysia.

The SC Malaysia plays a crucial role in ensuring investor protection by setting guidelines and regulating these platforms. These platforms are selective, with rejection rates between 20% and 70%. They assess potential issuers through background checks to ensure strong business plans and creditworthiness. Alternative sources of data will be collected to further gauge a lender’s repayment ability.

P2P platforms offer investors higher fixed returns than many other investment products. The interest rate of a loan is based on the risk profile of the borrower and is capped at 18% per annum to limit its risks. It is noteworthy that higher annual returns also come with higher chances of default. Funds will only be released for the project’s use if at least 80% of its total target amount is raised. Otherwise, the funds will be returned to investors.

P2P lending carries the inherent risk of borrower default, with potential write-off rates as high as 10%. This risk intensifies during economic downturns, such as the COVID-19 pandemic, when borrowers may struggle to meet loan repayments. However, this risk can be mitigated by diversifying investments across various industries and businesses in less risky financing options. Since November 2018, I have used the licensed P2P lending platform Fundaztic, which has navigated through the COVID-19 crisis. Should a borrower default, Fundaztic actively pursues recovery through legal actions or by collaborating with borrowers to establish alternative repayment plans, offering compensation for successful collections.

The term of each financing opportunity usually ranges between three months and three years. Basic borrower information (mostly a few pages) includes industry, business details, and funding purpose, and it is not as extensive as the information disclosed by publicly traded companies. Borrowers are kept anonymous to protect their privacy in case of default. Fundaztic uses a risk scoring system to help investors assess each note’s creditworthiness.

Fundaztic provides monthly returns to investors over the course of the financing term. Once your returns accumulate to RM50, the minimum investment threshold, you can reinvest these funds into new opportunities. Fundaztic also offers an automatic investment option that allocates your money based on pre-set criteria. The platform charges a 2% fee on the funds returned. While this investment strategy facilitates compounding returns, it may present liquidity challenges as the money is distributed monthly throughout the financing term, which ranges from three to 36 months. Additionally, a secondary market feature is available, allowing you to sell your investments or loans to other investors if needed.

Between November 2018 and October 2020, I initially invested RM1,500 and have since continued to reinvest my earnings into new financing opportunities. By March 2024, my total investment had reached RM6,900, spread across 124 loans. The loans have an average remaining tenure of 21 months. Assuming I recover the full RM6,900 by 2026, without including interest due to potential write-offs, the compound annual growth rate (CAGR) would be approximately 21.0% from my initial investment, based on a preliminary estimate. Despite a write-off rate of about 9.7% for loans overdue by more than 180 days, the returns remain impressive. On average, I invested RM55.65 per loan.

Please note that is not a recommendation and I share this simply based on my personal experience.

4. Amanah Saham Bumiputera (ASB)

Launched in 1990, ASB is one of the best-performing unit trust funds managed by Amanah Saham Nasional Berhad (ASNB), a subsidiary wholly owned by Permodalan Nasional Bhd. Between 2014 and 2023, ASB recorded an average annual return of 6.46%. ASB is a fixed-price equity income fund sold at RM1 per unit. However, ASB is open for bumiputera only.

| ASB | ||||

| Year | Annual Returns | Bonus (sen) | Additional Bonus (sen) | Total |

| 2014 | 7.50% | 1.00 | – | 8.50% |

| 2015 | 7.25% | 0.50 | – | 7.75% |

| 2016 | 6.75% | 0.50 | – | 7.25% |

| 2017 | 7.00% | 0.25 | 1.00 | 8.25% |

| 2018 | 6.50% | 0.50 | – | 7.00% |

| 2019 | 5.00% | 0.50 | – | 5.50% |

| 2020 | 3.50% | 0.75 | 0.75 | 5.00% |

| 2021 | 4.25% | 0.75 | – | 5.00% |

| 2022 | 3.35% | 1.25 | 0.50 | 5.10% |

| 2023 | 4.25% | 1.00 | – | 5.25% |

| Average | 6.46% | |||

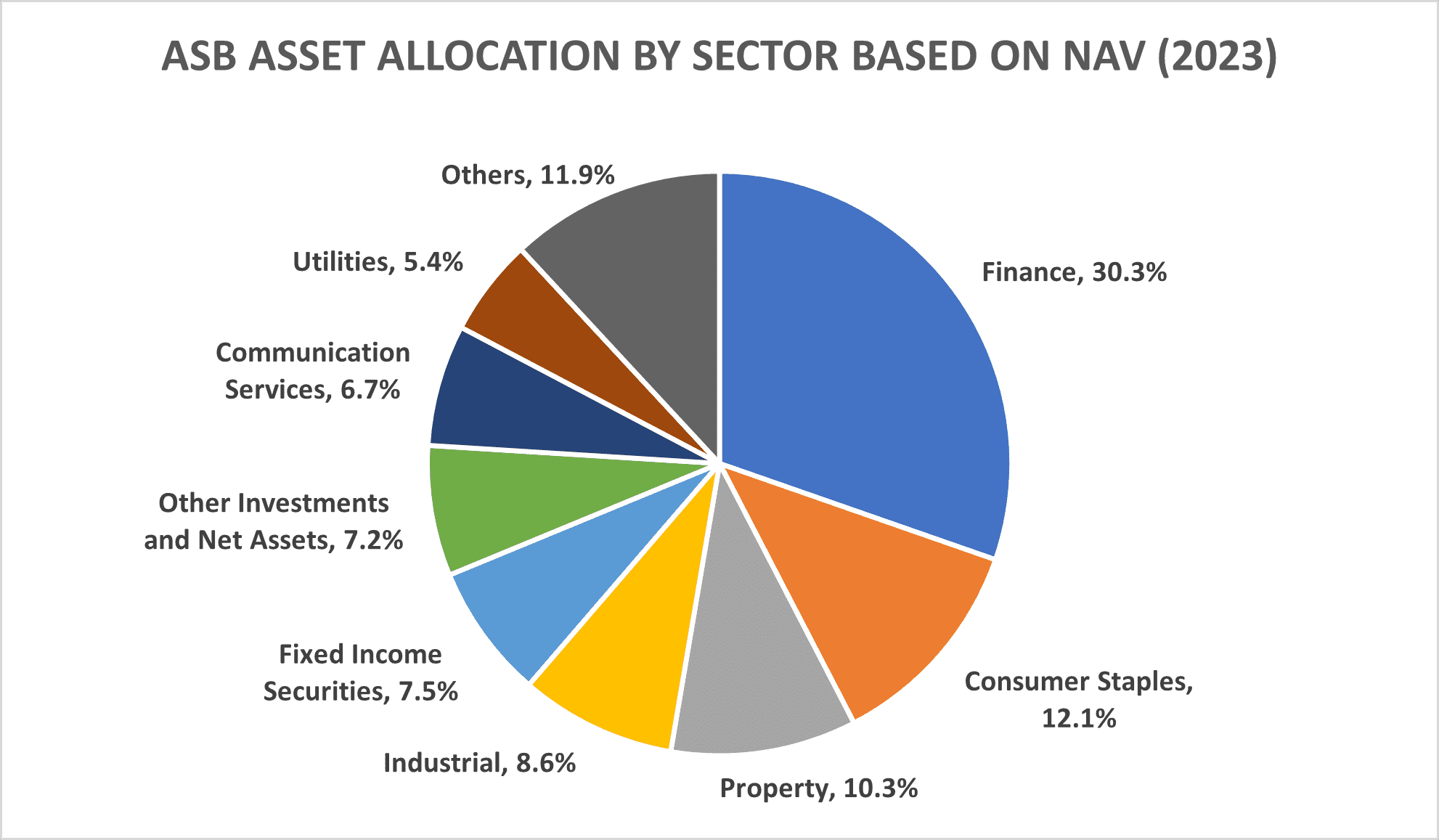

In 2023, the top five holdings of ASB are Malayan Banking Berhad (20.8%), Sime Darby Plantation Berhad (9.1%), Sime Darby Berhad (3.9%), Tenaga Nasional Berhad (3.8) and PNB Capital LLC (2.6%).

ASB’s dividend performance was stronger in its initial five years. As ASB expanded, it required more assets and investments to generate sufficient income to sustain its dividend payouts, making it challenging for ASB to replicate its early dividend achievements. Additionally, from 2014 to 2023, the dividends from Malayan Banking Berhad showed a gradual decline. The FTSE Bursa Malaysia KLCI also experienced underperformance in the past five years. After reaching a peak of 1,895.18 points in April 2018, the index mostly moved sideways. However, there was a recovery recently, with the index climbing to 1,542.39 points by March 2024.

As ASB encourages its members to invest for the long term, the monthly online withdrawal limit is capped at 2,000 units (RM2,000 for ASB). To withdraw additional funds, members will have to visit ASNB’s branches and agents.

There are 16 other funds available under ASNB including variable-price funds as well as unit trust fund Amanah Saham Malaysia that is open to all Malaysians. These funds have either higher management fees (1.0% for ASM) or higher sales charges (for variable-price funds). In comparison, ASB charges a 0.35% management fee, with no sales charges and redemption fees.

Members can invest up to RM300,000 in ASB. Up to 30% of their savings amount in excess of required basic savings (RM52,000) in EPF Account 1 can be used for this investment. Additionally, members can set up automatic monthly salary deduction for their ASB contributions.

The fifth perspective

As clichéd as it may sound, there is no one-size-fits-all method, you will have to pick a mix of investment styles that suit you and that you are comfortable with.

| EPF (self contribution) | P2P Lending | ASB | Stocks or ETF | |

| Minimum Contribution | RM1 | RM1, RM50, RM100 (varied for different platforms) | RM10 | Varied |

| Maximum input limit | RM100,000 | RM50,000 per platform | RM300,000 | – |

| Average annual dividend rates | 5.60% (2000-2023) | Low teens (or less) | 6.46% (2014-2023) | Varied |

While certain investment options such as equity crowdfunding and cryptocurrency can offer potentially higher returns, they also come with increased risks; these are not covered in this discussion. Similarly, some safer, long-term investment options that yield lower returns are also not included here. Investing in real estate in Malaysia, for instance, may present more challenges compared to more accessible options like ETFs. In my view, REITs (real estate investment trusts) serve as a more practical alternative to direct real estate investments. Additionally, it’s important to consider that inflation can gradually diminish the purchasing power of your savings over time.

It is never too late to start saving money and investing. The best time to do it is now in case you have not started. It is good to start early to reap the benefits of compound interest. Most importantly, we should invest in ourselves. With strategic planning and proper diversification as well as by understanding the potential and limitations of each investment product, we can take control of our financial future and plan for a secure retirement.

I am glad you did not list unit trusts as one of the options, especially using EPF savings for unit trusts investments.

Hi CK, yup, personally I am not a big fan of unit trust funds because of the charges