How much cash should you hold in your portfolio during bull and bear markets?

When it comes to investing, we sometimes overlook the importance of holding cash in our portfolio. In fact, it actually plays a pivotal role in your investment strategy, especially when navigating through the unpredictable terrain of bull and bear markets. Hence, understanding what we should do to our cash position during these market cycles can let us better prepare for the opportunities and risks they present.

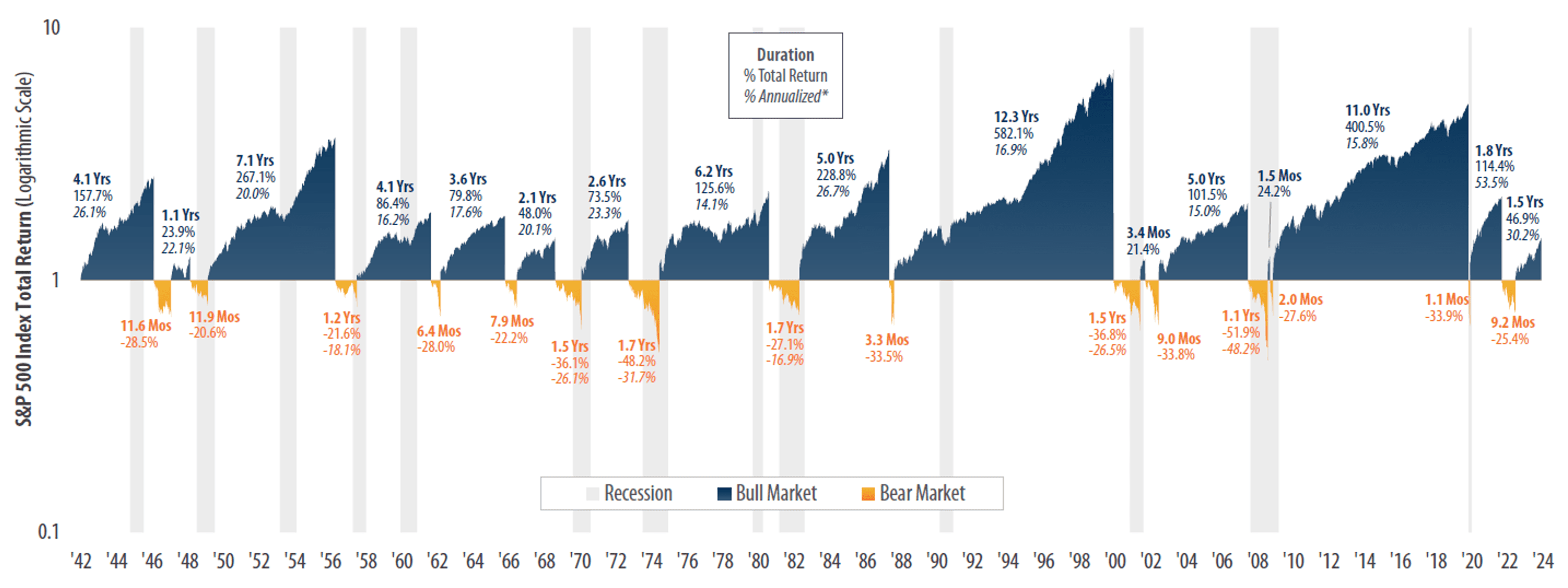

Before moving forward, let us first define what a bull and bear market are. A bear market is defined by a decline of at least 20% from its previous peak, while a bull market starts at the lowest point following a drop of 20% or more and continues until the next high.

The chart below lists the U.S. bull and bear markets since 1942. It shows that the average bull market lasts longer (4.2 years) than the average bear market (11.1 months).

The role of cash in your portfolio

Cash is often regarded as the only ‘true’ safe haven asset during market turbulence. Cash offers liquidity in times of economic uncertainty, providing significant benefits. A key advantage is that it allows for opportunistic purchases when company valuations decline to attractive levels. Additionally, cash also acts as a buffer against market downturns and reduces portfolio volatility.

For instance, a 10% market decline for a fully invested portfolio will result in a loss of the full 10%. By reducing the market exposure to 80% with a 20% cash position, the same market loss results in a portfolio loss of only 8%. It gives you peace of mind, which can reduce the chances of panic selling when the market is volatile.

Factors to consider

The appropriate cash level for your portfolio varies depending on your unique circumstances and market conditions. Below are some factors that can help you determine how much cash you should have in your portfolio:

- Financial goals

- Time horizon

- Spending needs

- Risk tolerance

- Income stream

However, a general rule of thumb suggested by U.S. Bank is that your cash or cash equivalents should range from 2% to 10% of your portfolio, although the right answer for you still depends on your circumstances. After deciding on your cash position range, let’s now see how you should manoeuvre it in different market conditions.

Adjusting your cash position in bull markets

Ideally, when investors see signs of the start of a bull market, they will begin to increase their stock market exposure. As the bull market surges upward, they might consider rebalancing their portfolio and reducing their positions in any overvalued equity holdings.

It’s not always easy to sell or wait on the sidelines during a bull market, as some investors believe that the stock market will continue to rally. But it’s essential to assess whether current valuations are supported by fundamentals or driven by speculation, especially when markets reach peak levels.

As stock valuations continue to rise, undervalued opportunities in the market will become increasingly difficult to find. At this point, it may be wise to consider gradually increasing your cash allocation in your portfolio to provide flexibility and take advantage of the opportunities that may arise during the eventual transition to a bear market.

Adjusting your cash position in bear markets

During a bear market, this is the time when cash is king because it allows investors to take advantage of opportunities when others are selling at distressed prices. Ideally, this is a good time for investors to increase their exposure in the market and decrease their cash holding, as stocks have generally fallen to lower prices.

But often, the fear of ‘catching a falling knife’ will affect some investors. Bear in mind that there is definitely a possibility of buying a stock whose price has fallen to continue falling, and it is unlikely that most investors will be able to call the absolute bottom in the bear market. Hence, investors who purchase stock during a bear market must be prepared for the prices of these holdings to drop further before bottoming out. Therefore, it is recommended that investors buy in tranches, as this strategy provides the opportunity to average down the stock price if it continues to drop.

As the bear market begins to show signs of recovery, continue to reduce your cash allocation and invest in the market to capitalize on the early stages of a bull market, potentially increasing your returns over the long term.

How did Warren Buffett do it?

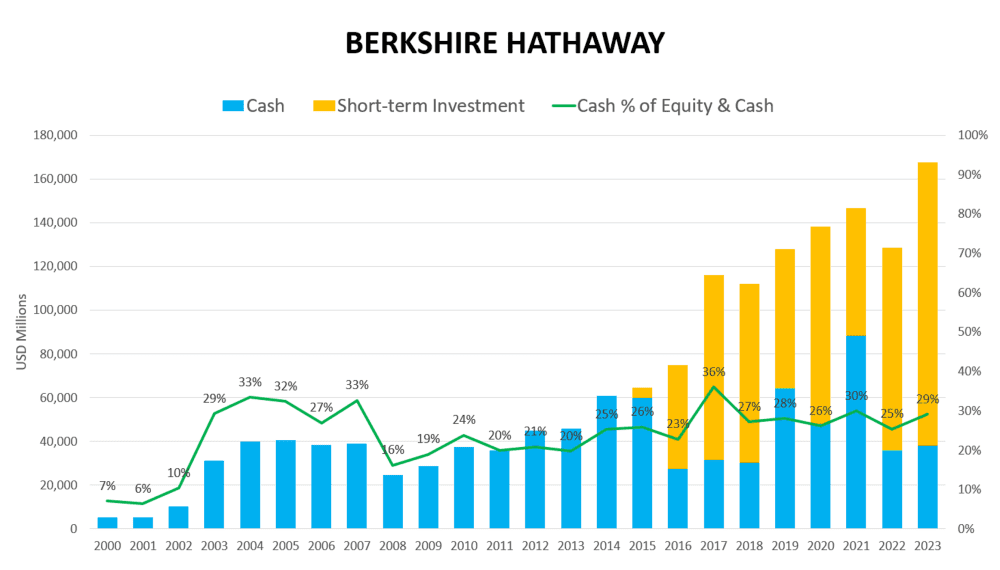

Let us take a look at how Warren Buffett, arguable the greatest investor of all time, manages Berkshire Hathway’s cash position. Below is a chart of Berkshire Hathaway’s cash and short-term investment position since 2000. From it, we have an insight Buffett’s strategy when cycling through bull and bear markets.

For more than 13 years, Buffett has maintained cash-to-equity holdings of over 20%. He reduced his cash and short-term investment holdings in 2008 and 2022, when the S&P 500 declined by over 51.9% and 25.4%, respectively. Generally speaking, during bull markets and brief bear markets, Buffett has either maintained or gradually increased his cash and short-term investments, patiently waiting for opportunities to arise.

The fifth perspective

Managing your cash position to navigate through bull and bear markets can be emotionally challenging. Since we can never perfectly time the market, it ultimately requires a disciplined approach and a long-term perspective.

As Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful.” This highlights the value of having cash on hand to capitalize on investment opportunities during market downturns. By prudently managing your cash position and adjusting it according to market conditions, you can better position yourself to navigate market cycles and achieve your long-term financial goals.