Here’s why we’re checking out FSM Invest Expo 2026

As you may have heard by now, FSMOne, the brokerage platform that is part of iFAST is holding their flagship investment event on Saturday, 17 January 2026 at the Suntec Singapore Convention & Exhibition Centre, Hall 403.

Each year brings sharp insight from their lineup of research analysts and partners and as is typical for their events, you can expect a packed programme with presentations and panel discussions, as well as many opportunities to interact with the people behind their products and services.

We’ve gotten a sneak peak at some of the topics they’ll be covering and here are the ones we think you’ll be keen on!

AI valuations in 2026

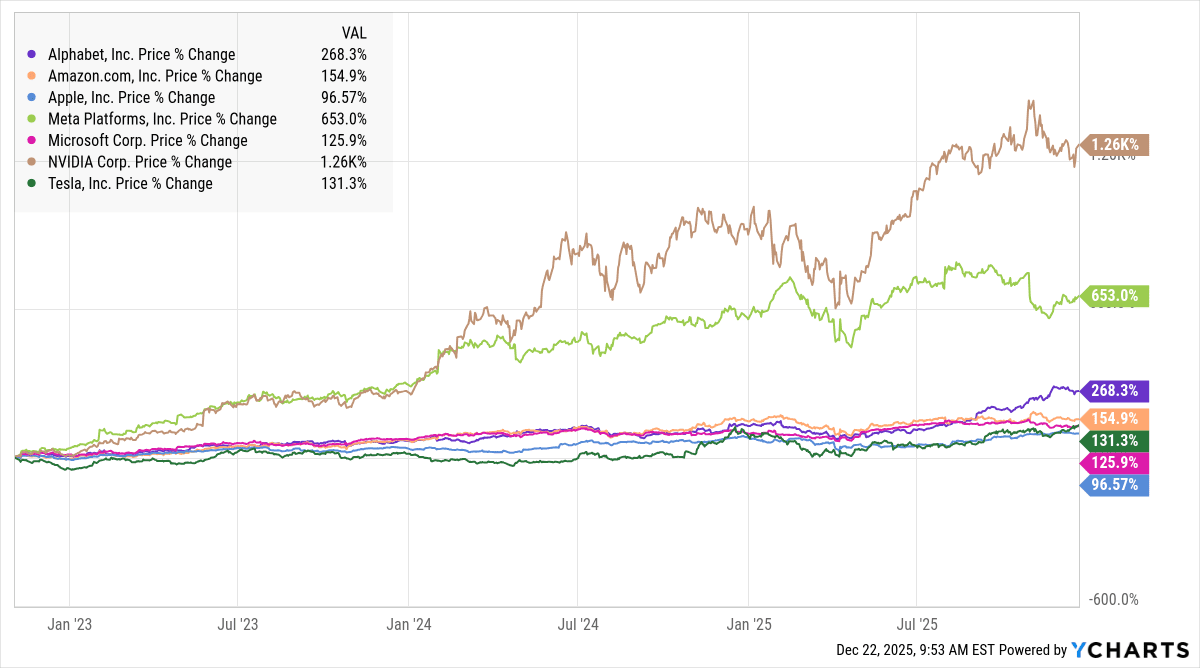

The explosive AI-driven rally of 2025 has undeniably raised expectations as we enter 2026, with investors now questioning how long the momentum can last and where genuine value still exists. While innovation continues to fuel growth in select sectors, early signs of stretched valuations suggest that not every part of the market may be priced for sustainable returns.

At the same time, markets with stronger fundamentals and more reasonable valuations, particularly those closer to home, may offer attractive opportunities for investors seeking balance and stability. We’ve been told this presentation is not-to-be missed if you are a keen investor in the AI space.

At FSM Invest Expo 2026, investors can gain a clearer perspective on navigating potential bubbles, identifying overlooked strengths, and positioning portfolios for a more grounded and informed 2026. For investors evaluating where to deploy capital, you will be keen to hear the fresh ideas that the iFAST Research Team has to offer.

China, Japan & Asia tech

Asia’s major markets are entering 2026 from very different starting points, making comparisons more important than ever. China continues to grapple with structural challenges and slower growth momentum, while Japan benefits from corporate reform tailwinds and renewed investor interest.

Meanwhile, Asian technology markets remain buoyed by demand for semiconductors, AI infrastructure, and digital transformation—yet valuations and earnings expectations vary widely across the region. Understanding these divergences helps investors see beyond headlines and assess whether each market’s risk-reward profile aligns with current conditions.

At FSM Invest Expo 2026, FSMOne will be providing a side-by-side look at how China, Japan, and Asia tech markets stack up in today’s cycle. This comparative approach offers a comprehensive view when considering Asian exposure, helping investors weigh potential upside alongside the risks in the year ahead.

Chasing yields in the bond market

Fixed Income investors take note! As global interest rates begin to trend lower, the bond market landscape is shifting once again, and with it, the search for stable income. After years of elevated yields, falling rates may drive renewed demand for fixed income as investors look to lock in attractive returns before they decline further. Yet the opportunity is not uniform. Differences in duration, credit quality, and currency exposure can influence both yield potential and risk levels. Understanding these trade-offs can help investors seek income while staying mindful of the possible volatility involved.

At FSM Invest Expo 2026, you’ll get info on where the most compelling opportunities may lie across government, corporate, and higher-yield segments, while also highlighting the key risks associated with each. From interest rate sensitivity to default risk and reinvestment challenges, we explore the main considerations shaping bond decisions today. With a clearer understanding of both the potential rewards and the possible pitfalls, investors can better position themselves to pursue income while navigating a shifting rate environment more thoughtfully.

Going for gold

This year, gold has emerged as one of the best-performing asset classes. With markets facing big questions around interest rates, geopolitics and stretched equity valuations, the real question now is: does gold still have room to run and is it worth putting your money into it? Or are we due for a reversion to the mean in 2026?

We’ll be looking out for FSMOne’s take on it, whether as a hedge, a portfolio stabiliser, or an opportunity that still deserves a place in today’s portfolios. An extra reason this segment will be interesting is that FSMOne will be giving out real, actual physical gold as part of their lucky draw with over S$10,000 worth of prizes to be given out over the course of the day.

What to expect at FSM Invest Expo 2026

FSM Invest Expo 2026 will take place on Saturday, 17 January 2026 at the Suntec Singapore Convention & Exhibition Centre, Hall 403, and is FREE to attend!

The event is a great way to kick off the year as it provides attendees a great footing on which to position their portolios. Visitors can look forward to a full day of insightful presentations from the iFAST Research team and a diverse range of exhibition booths featuring globally recognised fund managers and their unit trusts and ETFs, and casual “coffeeshop chats” with analysts and market specialists.

Attendees can also enjoy lucky draws and prizes—from gadgets and vouchers to investment credits—while Diamond-tier investors can relax in the exclusive VIP Zone. And for a fun bonus, adorable plushies will be up for grabs when you open an account and take your first step toward investing with FSMOne, making the experience both educational and enjoyable.

Whether you’re new to investing or looking to sharpen your strategies for the year ahead, this is an opportunity to gain insights, connect with experts, and explore ideas that can support your financial journey.

Register for your FREE ticket today and be part of FSM Invest Expo 2026!

We look forward to seeing you there!