FSM Invest Expo 2026: A deep dive into market trends and opportunities

As the financial landscape continues to evolve, staying ahead of emerging trends and seizing the right investment opportunities has never been more crucial. FSM Invest Expo 2026 offered a unique platform for industry experts, financial professionals, and retail investors to gather and discuss the latest developments in the world of investment. Held at Suntec Expo and Convention centre the event provided a comprehensive look at diverse market strategies, economic forecasts, and the ever-growing importance of multi-asset portfolios.

FSM Invest Expo 2026 also provided an excellent opportunity for retail investors to interact and understand from the fund houses how they could leverage various mutual funds to build a more resilient and diversified portfolio. The event also featured multiple excellent panel discussions which provided critical insights into how investors can navigate the markets in 2026 by seasoned investors.

A vision for the future: Insights from FSMOne

The expo kicked off with You Weiren, CFA, Senior Portfolio Manager at iFAST Singapore, who presented “iFAST Market Outlook for 2026“. Despite the turbulence of 2025, which was marred by geopolitical tensions and economic volatility, markets such as Japan, Europe, and Singapore reached record highs. The U.S. stock market remained resilient, largely driven by AI innovation, particularly in data centers, semiconductors, and AI software. However, You highlighted potential risks in the U.S. economy, including rising delinquency rates in auto loans and weak consumer sentiment, suggesting a deceleration of growth into 2026.

You recommended avoiding the S&P 500, focusing instead on technology sectors using a sector-based approach which would be more effective, technology stocks particularly Microsoft, Amazon, and Alphabet which are central to AI infrastructure would continue to rise benefiting from the rising AI adoption. While U.S. semiconductors benefited from the AI boom, their high valuations leave little room for error. For those seeking exposure to this trend, Asian semiconductor companies like TSMC were mentioned by You to be a more attractive investment proposition due to their relatively lower valuations and similarly essential role in AI chip manufacturing as well as using the Invesco NASDAQ Internet ETF to get exposure to the internet sector.

On the Asian front, China’s outlook remains positive despite economic challenges. With a shift towards supporting the private sector, China’s AI spending is significant, and its tech companies are innovating at an accelerated pace. BYD, a leader in the EV sector, has overtaken Tesla in sales, signalling China’s growing market influence. For investors seeking China exposure, You suggested products like the Lion Global China Growth Fund.

Additionally, he mentions that Singapore continues to stand out as a prime investment opportunity for 2026, bolstered by policies like EQDP, which enhance the appeal of Singapore’s equity market. You recommended the Lion Global Singapore Trust Fund, emphasizing the country’s growing market potential and the fund’s strong ability to track and capture gains from the market.

Opportunities in Asia tech: A strategic alternative

The ongoing enthusiasm for AI has driven U.S. tech stock valuations to record highs, especially within the semiconductor sector, yet Asia’s tech market remains undervalued, presenting an attractive alternative. Hu You, Research Analyst at iFAST Singapore, emphasized that AI growth is grounded in the solid financials of AI companies, reducing systemic risk. For investors seeking opportunities outside the U.S., she recommended the iShares Hang Seng Tech ETF as a worth consideration for investors looking to be exposed to the key AI and technology market investment.

Yeo Hui Shi, Portfolio Manager at iFAST Singapore, further stressed the undervaluation of Chinese tech companies, particularly in comparison to their U.S. counterparts. TSMC, a semiconductor manufacturing leader, remains a strong investment, though any slowdown in AI investments could cause volatility. To hedge this risk, she recommended South Korea’s memory chip companies, despite their cyclical nature. ASML was also flagged for its strong fundamentals and long-term growth potential, with the Global X Asia Semiconductor ETF highlighted as a promising ETF for investors to consider.

Tan De Jun, CFA, Portfolio Manager at iFAST, echoed the concerns about the impact of AI investment slowdowns on TSMC but suggested that investors looking to be exposed to the AI wave can look at South Korean memory chip companies for diversification. ASML was also recommended for its potential growth, presenting a solid strategy for investing in Asia’s rapidly evolving tech sector.

Singapore equities: Tapping into “New Singapore”

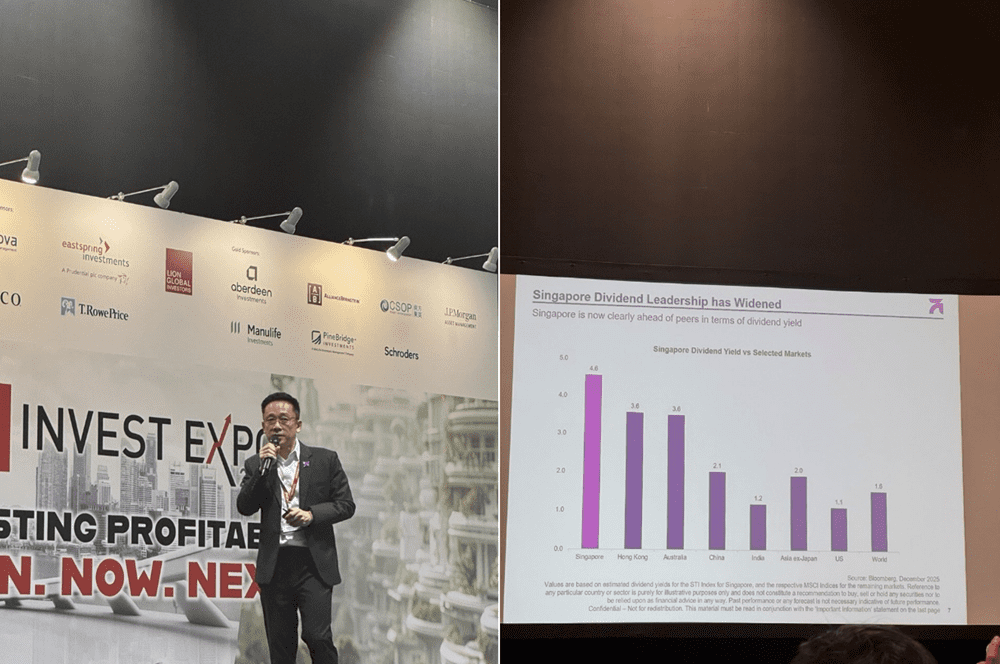

Kenneth Tang, Senior Portfolio Manager at Amova Asset Management, highlighted the evolution of Singapore’s equity market, which is now offering new opportunities beyond traditional sectors. Companies focusing on innovation, sustainability, and digitalization are leading the charge. Despite global volatility, Singapore remains resilient, buoyed by strong industrial activity, rising dividends, and selective sector flows especially in banking and industrials.

Looking ahead to 2026, Tang identified key growth themes in real estate, technology, data, and logistics, all of which are expected to thrive. He stressed the importance of focusing on growth-oriented dividend plays, noting that dividend growth in Singapore is currently outpacing capital growth. Tang also proposed a new investment thesis: tapping into “New Singapore” growth sectors such as advanced manufacturing, biotech, data centres, and renewable energy.

Interest rates and S-REITs outlook

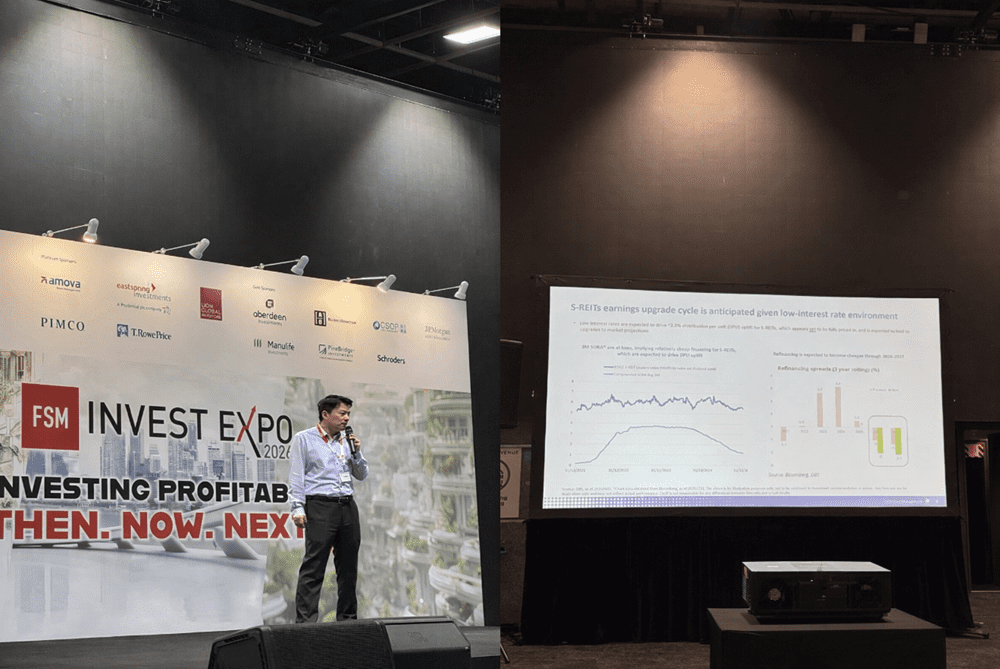

S-REITs were a major topic of discussion at the expo. Despite global growth uncertainties and interest rate fluctuations, S-REITs remain a strong investment option. With attractive dividend yields, solid fundamentals, and a positive macroeconomic outlook, S-REITs offer low volatility and diversification.

Bruce Zhang, CFA, Head of Fixed Income at CSOP Asset Management, emphasized that S-REITs still have room for growth on the back of the upcoming earnings upgrade cycle as a result of the low-interest rate environment, with an expected rebound of around 5% in 2026. M&A activity and EQDP continue to support Singapore’s real estate market, offering strong tailwinds for S-REITs.

S$5 billion revival of SGX: A game-changer for investors

A standout panel discussed the Monetary Authority of Singapore’s (MAS) S$5 billion investment aimed at revitalizing the local stock market. This initiative promises significant opportunities, especially for retail investors focusing on small and mid-cap stocks.

1. Surge in small and mid-cap stocks

Historically, small and mid-cap stocks in Singapore have been undervalued and under-researched, despite their potential for growth. Geoff Howie, Market Strategist at SGX, highlighted that the MAS-backed revival will provide a much-needed catalyst for these stocks, positioning them for a significant re-rating. Many of these companies have survived through difficult market cycles and have emerged stronger, with improved business fundamentals and growth trajectories. With the government’s S$5 billion backing, these hidden gems are now positioned for market recognition. Retail investors who can identify these stocks before their valuations catch up with their growth potential stand to benefit handsomely. This is a prime opportunity for investors looking to tap into stocks that are often overlooked by the broader market.

As the market dynamic shifts, these companies are likely to attract more attention from both institutional and retail investors. The increased research coverage, coupled with the anticipated surge in liquidity, will give these companies the chance to shine, offering investors opportunities for capital appreciation.

2. Liquidity boost: Easier entry and exit

One of the most significant outcomes of MAS’s investment will be the enhanced liquidity in the market. Increased liquidity ensures that retail investors can enter and exit positions more easily, without experiencing significant price slippage. This is particularly advantageous for smaller and mid-sized stocks that traditionally suffer from wider bid-ask spreads and low trading volumes.

Higher liquidity also means a more dynamic market, where price movements are more reflective of underlying fundamentals rather than speculative swings. Retail investors can now execute trades with greater confidence, knowing that they can easily buy or sell stocks without worrying about price manipulation or liquidity constraints. This increased market fluidity enhances investors’ ability to capitalize on both short-term price movements and long-term growth opportunities.

3. More research and insights empowering informed decisions

With the influx of capital and resources, SGX is committed to ramping up research coverage on small and mid-cap stocks. Over 100 new stock initiations and more than 300 research reports are expected to be released, providing retail investors with an unprecedented amount of information.

This increased research will make it easier for investors to assess the fundamentals of smaller companies and make informed decisions. For years, many of these companies were overlooked due to a lack of accessible research, which made it difficult for retail investors to gauge their true potential. With the new wave of research reports, investors can now better understand the risks and rewards associated with these stocks. This access to high-quality research will level the playing field and empower retail investors to uncover investment opportunities that were previously hidden behind opaque valuations.

4. MAS expects continued IPO opportunities

In addition to boosting liquidity and research, the MAS initiative is expected to fuel a wave of new IPOs. Over 20 IPOs are anticipated this year, creating an excellent opportunity for retail investors to get in early on promising companies before they become mainstream.

While IPOs inherently carry risks, they also provide the potential for significant returns if the company performs well post-listing. Historically, some of the most successful companies in the market began their journeys as IPOs, and the MAS-backed revival will open up more avenues for investors to gain early access to these high-growth opportunities.

By identifying the right IPOs early on, retail investors can position themselves to benefit from the growth of companies that could become the next market leaders. The increased research and liquidity in the market will also provide better transparency and valuation benchmarks for investors, reducing the risk of overpaying for shares during the initial offering.

5. Safe haven status: Stability amid geopolitical uncertainty

Kenneth Ong, Portfolio Manager at Lion Global Investors, highlighted Singapore’s status as a safe haven during times of geopolitical uncertainty. This factor makes the local market particularly appealing to retail investors, as it provides a stable environment for investing even in the face of global market volatility.

Singapore’s strong economic fundamentals, political stability, and robust legal framework have long made it an attractive destination for long-term investors. The country’s dividend-centric market adds another layer of security, as investors can enjoy regular income even if stock prices experience short-term fluctuations. This stability means that retail investors can feel more confident about the long-term value of their investments, knowing that Singapore’s economy is resilient enough to weather global uncertainties.

6. Valuation gap persists versus U.S. peers

Terence Lin, Group CFO at iFAST Corporation, drew attention to the significant valuation gap between Singaporean stocks and their U.S. counterparts. The Straits Times Index (STI) is currently trading at a P/E ratio of 15, compared to the U.S. market’s P/E ratio of 28. This discrepancy suggests that many Singaporean stocks are still undervalued when compared to their U.S. peers, providing retail investors with an opportunity to invest in companies that offer better relative value.

This valuation gap also presents an excellent opportunity for those looking to diversify their portfolios with international assets at a more attractive price point. Retail investors who can spot these undervalued stocks will have the chance to invest in high-quality companies at a discount, maximizing their potential for long-term returns.

7. Singapore market presenting opportunities for investors

The S$5 billion MAS-backed revitalization of SGX signals the beginning of a new chapter for Singapore’s stock market. The enhanced liquidity, research coverage, and influx of IPOs present significant opportunities for retail investors to diversify their portfolios and access previously untapped growth potential. As more capital flows into the market, particularly into small and mid-cap stocks, investors will have a wider array of options to choose from, allowing them to tailor their strategies according to their risk tolerance and investment goals.

With increased access to information, more opportunities for early-stage investments, and the backing of a strong and stable market, retail investors are well-positioned to benefit from the upcoming transformation of the Singaporean stock market. The potential for strong returns has never been more tangible, and retail investors who capitalize on these opportunities now will be poised to ride the next wave of growth in the years to come.

The fifth perspective

The FSM Invest Expo 2026 underscored the importance of strategic investment in a rapidly changing market. Experts across multiple panels emphasized the need for adaptability, diversified portfolios, and an active approach to investing especially in Asia’s tech sectors and Singapore’s evolving market. With the MAS revival of SGX, retail investors are set to benefit from a wealth of opportunities in undervalued stocks, increased liquidity, and robust research coverage. In 2026, investors must stay ahead by recognizing emerging trends and making informed decisions based on comprehensive market analysis.

🔎 Invest in FSM Invest Expo 2026 insights

FSMOne has gathered all the Funds and ETFs showcased at the FSM Invest Expo 2026 and put them in a promotion where you can earn cashback. Whether you’re eyeing any of the Funds or ETFs, you can now enjoy cashback and enjoy 3 processing fee-free trades during this limited time promo with FSMOne.

▶️ Missed a session? Catch the replays!

Missed the live action? Catch the insights from the presentations and panel discussions from FSM Invest Expo 2026 to sharpen your 2026 portfolio.

Watch the FSM Invest Expo 2026 replays »

🏛️ Secure your legacy with FSMOne

Take the hassle out of estate planning with FSMOne’s Beneficiary Account: A simple but powerful feature that helps you protect what you’ve worked so hard to build. By naming your beneficiaries upfront, you ensure your investments can be passed on more smoothly and quickly to the people who matter most, with fewer delays and less paperwork for your loved ones. It’s an easy step that gives you greater peace of mind, strengthens your long-term financial plan, and ensures your portfolio doesn’t just grow — it stays protected for the future.

Open your FSMOne beneficiary account here »