The United States government entered its latest shutdown on October 1, after Congress failed to pass the funding bill before the September 30 deadline. The shutdown is expected to furlough roughly 750,000 federal workers, and various government services will be disrupted. For investors watching nervously from the sidelines, the one question looms: Should we be concerned? In this article, we will explore what the recent government shutdown is about, its historical patterns, and whether we should be worried.

Understanding government shutdowns

A government shutdown occurs when Congress fails to pass appropriation bills, or, in other words, there are no continuing resolutions to fund federal operations. When this happens, non-essential government services cease (e.g., those of lawyers and accountants), federal employees are furloughed or work without pay, and various government functions come to a halt. Throughout U.S. history, shutdowns have occurred periodically, most often triggered by partisan disagreements over budget priorities, policy riders or spending levels.

The most notable recent shutdowns include the 35-day shutdown (the longest in U.S. history) from December 2018 to January 2019, which stemmed from disputes over border wall funding (U.S.-Mexico border). The 16-day shutdown in October 2013 was related to the disagreement over the Affordable Care Act. These shutdowns affected hundreds of thousands of federal workers, delayed government services, and created ripple effects throughout the economy. The impacts extend beyond just government employees to include contractors, businesses dependent on federal operations, and even the delay of small businesses’ loans.

| Funding ended | President | Duration (in full days) |

| December 21, 2018 | Donald Trump | 34 |

| January 19, 2018 | Donald Trump | 2 |

| September 30, 2013 | Barack Obama | 16 |

| December 15, 1996 | Bill Clinton | 21 |

| November 13, 1995 | Bill Clinton | 5 |

| October 5, 1990 | George HW Bush | 3 |

| December 18, 1987 | Ronald Reagan | 1 |

| October 16, 1986 | Ronald Reagan | 1 |

| October 3, 1984 | Ronald Reagan | 1 |

| September 30, 1984 | Ronald Reagan | 2 |

| November 10, 1983 | Ronald Reagan | 3 |

| December 17, 1982 | Ronald Reagan | 3 |

| September 30, 1982 | Ronald Reagan | 1 |

| November 20, 1981 | Ronald Reagan | 2 |

| September 30, 1979 | Jimmy Carter | 11 |

| September 30, 1978 | Jimmy Carter | 17 |

| November 30, 1977 | Jimmy Carter | 8 |

| October 31, 1977 | Jimmy Carter | 8 |

| September 30, 1977 | Jimmy Carter | 12 |

| September 30, 1976 | Gerald Ford | 10 |

2025 shutdown

The current shutdown began after lawmakers failed to reach an agreement on funding legislation by the September 30 deadline. The disagreements are specifically on health insurance subsidies, proposed cuts to Medicaid and government health agencies. As negotiations continue, the Americans are already experiencing some tangible effects. Air travel has faced disruptions, with Transportation Security Administration (TSA) employees working without pay, an increase in air traffic controllers calling in sick, and many flights being delayed. Furloughed federal workers may not even receive back pay after the shutdown.

A particularly concerning aspect for investors is the delay in the release of critical economic data, including job reports and the Consumer Price Index (CPI) report. The absence of these data complicates Federal Reserve decision-making, especially at this time when policymakers are carefully adjusting their interest rate policies. Without the timely employment and economic indicators, both the Fed and market participants are forced to navigate with limited visibility.

Market impact and historical performance

Despite the political drama, financial markets have shown remarkable resilience during this shutdown. At the time of writing, stock markets have continued to hit record highs, despite the government remaining closed. It looks like the investors are viewing it as just a temporary political issue rather than an economic crisis.

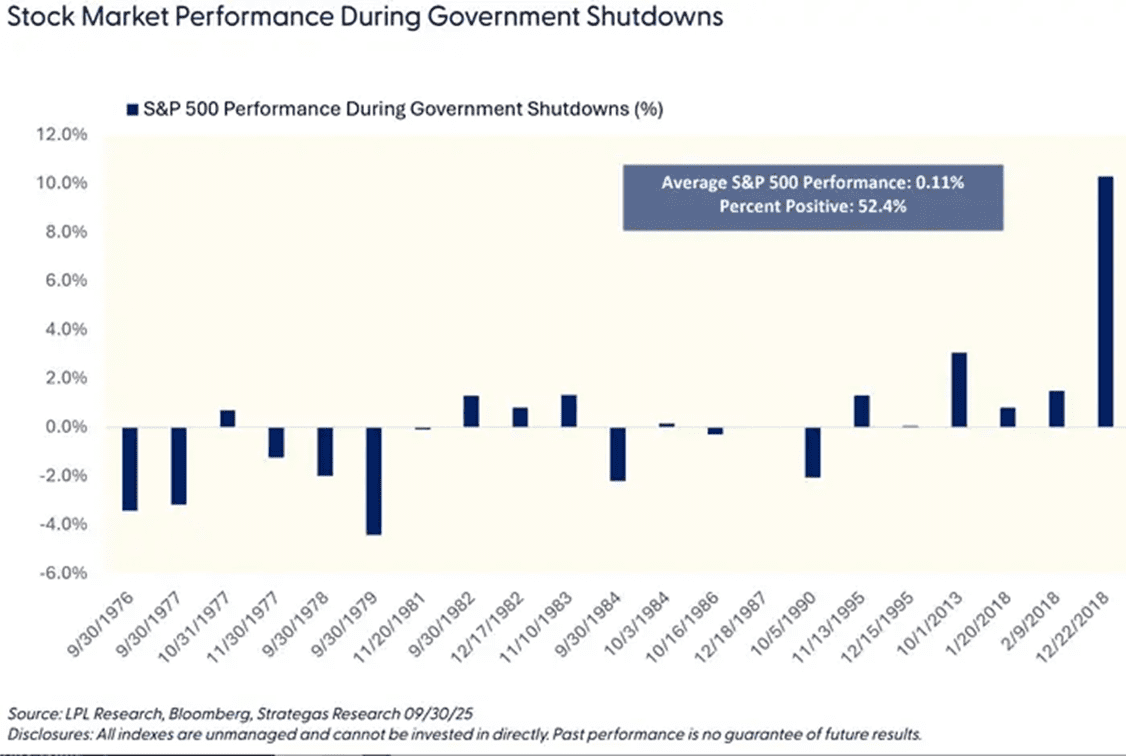

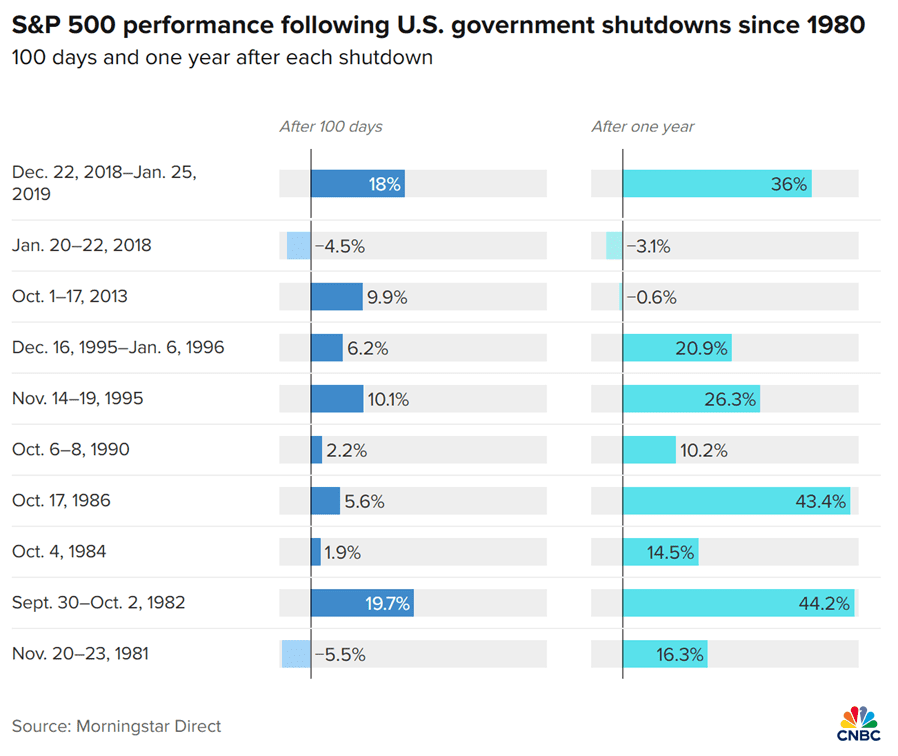

Historical data also tell similar stories. Even though shutdowns could decrease GDP growth due to reduced government activities, the chart above shows that the S&P 500 recorded positive returns during most of the previous shutdown periods. Even after 100 days or 1 year, the S&P 500 tends to stay in positive return as well.

The key determinant of market impact appears to be duration rather than the shutdown itself. Lengthier shutdowns raise more concerns about economic consequences. Under current conditions, markets could struggle to price the likelihood of any incoming rate cuts given the data blackout, and uncertainty grows about whether planned rate decisions will proceed as scheduled.

The fifth perspective

These government shutdowns remind us that political dysfunction could create headlines, but at the same time, financial markets demonstrated their resilience through similar historical episodes. For us as investors, the key is avoiding panic decisions and maintaining our long-term strategies. Unless shutdowns extend for many weeks or coincide with other economic stress, their market impact should remain limited. The critical factor to watch is duration, as quick resolutions typically allow markets to refocus on the economic fundamentals.