In 2024, despite easing inflation, the Federal Reserve cut interest rates by only 1%, surprising the market, which had anticipated a more substantial reduction. This limited cut, coupled with Trump’s election victory, triggered a sell-off in interest rate-sensitive REITs. The market feared that Trump’s policies, including tariffs and the mass deportation of immigrant workers, could have inflationary consequences, potentially forcing the Fed to maintain higher interest rates for an extended period.

Amid a high interest rate environment, several Singapore REITs have been struggling to maintain their financial health. In 2024, REITs such as Manulife US REIT (MUST), ARA US Hospitality Trust, and Lippo Malls Indonesia Retail Trust (LMIR) faced challenges in meeting the regulatory requirement of a 2.5x interest coverage ratio. This was due to a combination of falling rental incomes and rising borrowing costs.

The impact on these REITs has been significant, with MUST and LMIR experiencing share price declines of over 90%, while ARA US Hospitality’s shares have dropped by more than 70% since the pandemic began five years ago. To provide some relief, the Monetary Authority of Singapore (MAS) revised the minimum interest coverage ratio requirement to 1.5x, aiming to ease the financial burden on these struggling REITs.

Truth be told, some of these troubled REITs had been offering double-digit yields in recent years. However, we have consistently warned our Dividend Machines members to steer clear of such high-yield offerings. These yields often prove unsustainable, leading to significant capital losses for investors, along with potential dividend cuts. Our focus should remain on high-quality REITs that can deliver both sustainable income and long-term capital appreciation. Based on my years of tracking REIT performance, the Singapore REIT market has fortunately demonstrated a strong track record, with more winners than losers.

I first wrote about the long-term performance of Singapore REITs (S-REITs) in 2016, and this time, we will revisit their performance by incorporating the latest share prices as of 31 December 2024, along with distributions paid out to unitholders up to the same period. To accurately assess the overall underlying performance, REITs need to have at least 10 years of listing history. I also make necessary adjustments, such as accounting for pre-consolidated units and distributions, to provide a clearer and more accurate picture of their long-term performance. This year’s only new entry is BHG REIT, which was listed in 2015.

Income investors should focus on long-term performance rather than daily price fluctuations. Short-term evaluations can lead to missed opportunities, while a 10-year horizon offers a clearer view of a REIT’s ability to deliver sustainable income and growth across market cycles.

Once again, we will assume that John (a fictional character) invests $10,000 equally in each of these REITs from the day they were listed. Since John is a hardcore income investor who wants to keep all his cash, he doesn’t contribute additional funds to subscribe to any rights issuances and is prepared for any share dilution. Let’s also assume that John forgets to sell his nil-paid rights, missing out on potential profits.

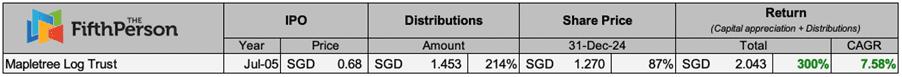

For example, if John invested in Mapletree Logistics Trust (MLT) during its IPO, his initial $1,000 investment would have grown to $1,870 (+87% in capital gains) as of 31 Dec 2024. On top of that, he would have collected total dividends of $2,140 (+214% in distributions).

From the table above, John would have made a solid return with MLT, as his initial $1,000 investment would have grown to $4,000 (+300% in total return), including dividends received over the years. If John had invested $10,000, his investment would have grown to $40,000, and a $100,000 investment would have turned into $400,000. Essentially, the more he invests, the more he stands to gain—and the longer he holds, the more dividends he will collect. Overall, his annualised return from MLT alone is 7.58% from July 2005 to December 2024.

After investing for over 10 years, here are the top 10 best-performing REITs for John, ranked by annualised return from lowest to highest.

Note: We’ve excluded brokerage costs, currency exchange gains/losses, and any taxes that might apply to foreign investors.

10. CDL Hospitality Trust (Annualised return: +6.13%)

Since 2006, a $10,000 investment in CDL Hospitality Trust would have grown to $10,400. Including dividends, the total value of that investment would have increased to $29,200.

9. CapitaLand Ascott REIT (Annualised return: +6.54%)

Since 2006, a $10,000 investment in Ascott REIT would have grown to $12,800. Including dividends, the total value of that investment would have increased to $31,300.

8. CapitaLand Integrated Comm Trust (Annualised return: +6.92%)

Since 2002, a $10,000 investment in CICT would have grown to $20,100. Including dividends, the total value of that investment would have increased to $43,500.

7. Mapletree Logistic Trust (Annualised return: +7.58%)

Since 2005, a $10,000 investment in MLT would have grown to $18,700. Including dividends, the total value of that investment would have increased to $40,000.

6. Mapletree Pan Asia Commercial Trust (Annualised return: +7.77%)

Since 2011, a $10,000 investment in Mapletree Pan Asia Commercial Trust would have grown to $13,800. Including dividends, the total value of that investment would have increased to $26,400.

5. Frasers Centrepoint Trust (Annualised return: +7.82%)

Since 2006, a $10,000 investment in FCT would have grown to $20,500. Including dividends, the total value of that investment would have increased to $38,800.

4. CapitaLand Ascendas REIT (Annualised return: +8.64%)

Since 2002, a $10,000 investment in Ascendas REIT would have grown to $29,200. Including dividends, the total value of that investment would have increased to $61,900.

3. Parkway Life REIT (Annualised return: +9.21%)

Since 2007, a $10,000 investment in Parkway Life REIT would have grown to $29,300. Including dividends, the total value of that investment would have increased to $44,700.

2. Mapletree Industrial Trust (Annualised return: +10.60%)

Since 2010, a $10,000 investment in Mapletree Industrial Trust would have grown to $23,800. Including dividends, the total value of that investment would have increased to $41,000.

1. Keppel DC REIT (Annualised return: +12.28%)

Since 2014, a $10,000 investment in Keppel DC REIT would have grown to $23,400. Including dividends, the total value of that investment would have increased to $31,800.

In summary, here is John’s overall performance:

The most impressive REIT in John’s portfolio, in terms of absolute return, is CapitaLand Ascendas REIT, one of the longest-listed REITs in Singapore. A $10,000 investment in CapitaLand Ascendas REIT would have grown to $61,900! His net gain from Ascendas REIT alone is more than enough to offset losses from five other REITs: BHG REIT (our new entrant this year), OUE REIT, LMIR, IREIT Global, and AIMS APAC REIT (formerly known as MacarthurCook Industrial).

Most importantly, John remains highly profitable without having to contribute any additional capital to subscribe to rights issues. However, if he had subscribed to them (including excess rights), he would have earned even more, as rights are typically offered at significant discounts. Compared to last year, the overall performance of REITs has slightly declined, but the dividends have remained steady. John’s REITs continue to pay regular dividends, which now account for 90.1% of his total returns, as S-REIT share prices remain depressed right now.

At the end of the day, John continues to receive regular dividends from his Singapore REITs, both in good times and bad. However, it’s important to note that you shouldn’t buy or avoid a REIT solely based on the data above, as past performance is not necessarily indicative of future results.

The bankruptcy of Eagle Hospitality Trust in 2021 (after just two years of being listed), along with the struggles of U.S. office REITs and LMIR, serve as reminders that not all REITs are created equal. In a high interest rate environment, it’s crucial to have a proper investment process in place to help you identify and invest in quality REITs—those that will not only survive rising rates but also continue to provide passive income and potential capital gains over the long term.

Announcement! Enrollment for Dividend Machines is open until 2 March 2025, 11:59 PM. If you’re looking to learn how to invest in dividend stocks and REITs while building multiple streams of passive income, we highly recommend checking out Dividend Machines before applications close! Once the deadline passes, Dividend Machines won’t reopen until 2026. So, if you miss this round, you’ll have to wait a year (or more) before we accept new applications again.

Happy investing and we hope to see you on the inside! ????

Wish to know more!

Hi Wilfred, you can also check out the recent REIT webinar we hosted here.