Top 3 AI tools to streamline your stock research

In today’s markets, investors face an overwhelming flood of data. The sheer volume of company filings, earnings calls, and analyst reports makes it harder to spot what matters. Artificial Intelligence (AI) is changing that. Instead of replacing human judgment, AI helps investors work smarter by turning hours of research into minutes of insight.

With the right tools, you can quickly pull key metrics from years of financial statements, summarise dense company reports, or sift through regulatory filings for material information on risks and opportunities. Tasks that once demanded endless reading and spreadsheets are now streamlined into clear, focused takeaways.

For new and experienced investors, these tools are not just convenient but are becoming almost essential. Here are three AI solutions that can make stock research faster, sharper, and more effective today.

1. ChatGPT

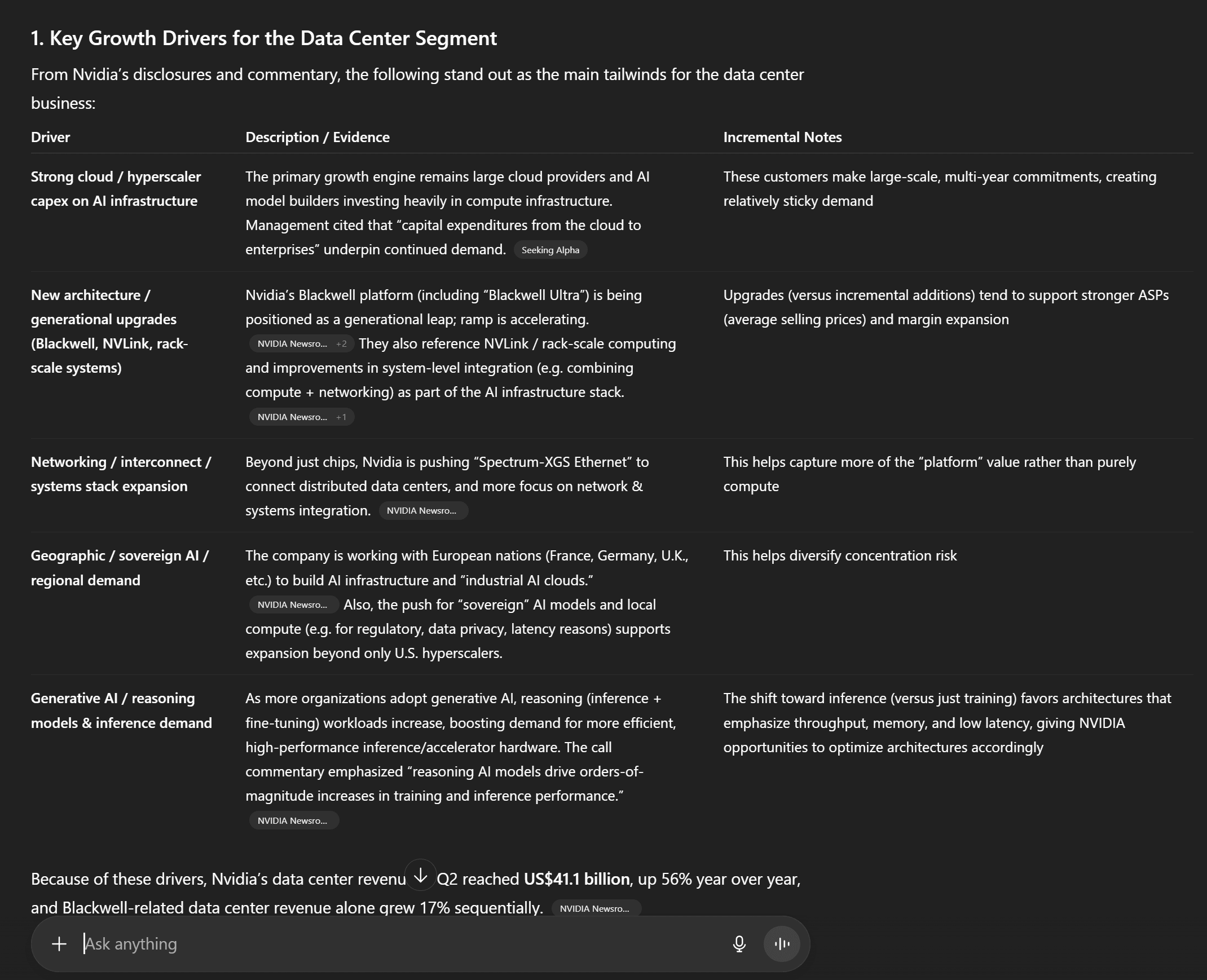

Serious stock research involves digging through company filings, earnings transcripts, and documents. That work is time-consuming and easy to get wrong if you miss a detail. ChatGPT helps by quickly turning long documents into usable insights. You can upload a PDF, whether a press release, a 20-page transcript, or a legal filing, and then request a summary, specific financial metrics, or explanations of technical language. Instead of spending hours reading line by line, you get the key points in minutes. This reduces the chance of overlooking important numbers or legal clauses that could alter an investment thesis.

For example, you might pull out management’s guidance on revenue growth from an earnings call, compare gross margins across several quarters without building a model, or spot new disclosure about pending litigation buried in a document. You can also interact with the document by asking ChatGPT to clarify a confusing section, break down legal risk in plain terms, or highlight trends across multiple reports.

The value is clear for investors: less time wasted on manual reading, fewer blind spots, and faster conviction when making calls. ChatGPT does not replace analysis, but it makes the heavy lifting of research far more manageable.

2. Perplexity

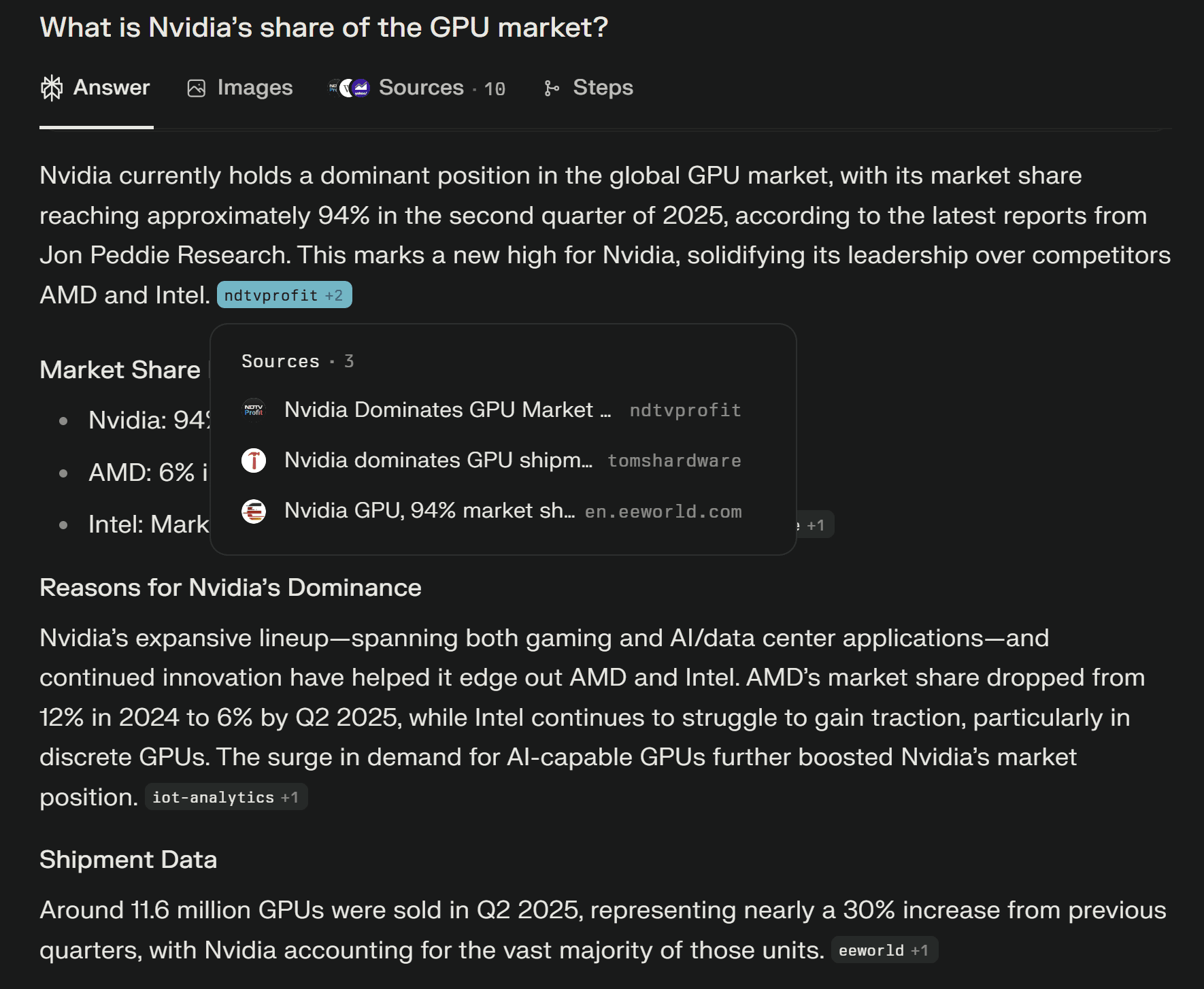

One of the biggest weaknesses of general-purpose AI is hallucination, where the model generates information that sounds convincing but is not factual. Perplexity solves this by grounding every answer in verifiable sources. This reliability is a major advantage in stock research, where accuracy drives conviction.

Unlike traditional search engines that return a flood of unfiltered links, Perplexity aggregates trusted sources into clear, concise answers. Suppose you want to understand the market reaction to a company’s earnings release. Instead of skimming dozens of news sites, Perplexity can show analyst commentary, highlight key numbers from the earnings call, and surface news about management guidance all in one place.

The tool is also useful for deeper research tasks. You could ask Perplexity to summarise sentiment around a new regulatory filing, or to compare analyst outlooks on two competitors after their quarterly results. Every answer comes with citations, so you can verify the source before acting on the information.

For investors, this cuts noise, saves time, and reduces the risk of acting on unreliable data. Perplexity provides a fact-based edge that strengthens any research process in a market where the smallest misinformation can sway a trade.

3. Fiscal.ai

Fiscal.ai is an AI-powered financial data terminal built specifically for investors and analysts. Unlike general-purpose AI models, it has been trained and optimised on financial datasets, making it far more reliable when handling earnings figures, accounting line items, and segment-level disclosures. The platform covers global equities and ETFs and provides APIs for those who want to feed data directly into their own models or dashboards.

The real strength of Fiscal.ai lies in how it simplifies access to first-party investor relations content. Instead of downloading PDFs or navigating multiple corporate websites, users can instantly pull up earnings calls, transcripts, slide decks, press releases, and regulatory filings in one interface. Its chatbot lets you query that data, whether you are looking for company-specific KPIs, year-over-year comparisons, or segment-level disclosures. Work that once meant scanning footnotes and manually extracting figures can now be done with a single prompt in seconds.

This depth sets Fiscal.ai apart from traditional data sites like Yahoo Finance or MarketWatch, which usually stop at headline metrics like revenue and net income. With Fiscal.ai, investors can:

- Track performance by business segment instead of relying on consolidated totals

- Build customized dashboards with alerts tied to filings, earnings releases, or material changes

- Compare financials across companies to surface accounting quirks or adjustments that may distort results

Placed alongside other AI tools, Fiscal.ai’s role is clear. ChatGPT is best for interpreting complex documents and breaking down jargon. Perplexity excels at fact-checked search across the open web. Fiscal.ai complements them by delivering structured, first-party financial data with the precision and depth required for serious investment analysis. According to FinanceBench, the industry benchmark for testing AI on financial questions, Fiscal.ai scores two to three times higher than general-purpose models like ChatGPT.

The fifth perspective

AI is no longer a financial tool for the future; it is already reshaping how investors work. Tools like ChatGPT, Perplexity, and Fiscal.ai do not replace judgment; they simply cut down the hours spent combing through filings, transcripts, and scattered PDFs, freeing more time for actual analysis and decision-making. These tools will not replace critical thinking, and they are no guarantee of superior returns. Their real value comes from how well you integrate them into your process. As AI models continue to improve and integrate deeper into financial workflows, the gap between investors who adapt and those who resist will only widen.

I’m interested.

yes, i am interested