The recent weakness of the U.S. dollar (USD) has sparked debate among investors and economists. Amid growing concerns about the current administration’s trade policies, rising inflation, and escalating geopolitical tensions, many are questioning whether America’s currency is heading toward a significant devaluation. In this article, we explore these dynamics, which are crucial for anyone with a stake in the U.S. market.

The U.S. dollar’s dominance

The USD has a long history of dominance in the global market. This prominence stems from America’s status as the world’s largest economy, accounting for approximately 26% of global GDP. The United States has consistently honoured its debt obligations and has never experienced hyperinflation. Its deep and liquid financial markets make it easy for global investors to buy and sell dollar-denominated assets. This reliability, underpinned by a strong rule of law and the independence of the Federal Reserve, has earned the dollar decades of international trust. Moreover, the dollar serves as the primary currency for pricing essential commodities such as oil, meaning countries around the world require dollars to purchase these goods.

Additionally, the historical momentum from the post-World War II Bretton Woods system, which pegged the USD to gold and other major currencies to the dollar, firmly established the dollar’s central role in global finance. A powerful network effect has since made it increasingly difficult for countries to move away from the dollar. Many nations continue to hold the USD as a reserve currency; as of the end of 2024, it accounted for 58% of global foreign exchange reserves. In times of crisis, both investors and governments consistently turn to dollar-denominated assets as a safe haven. This creates a self-reinforcing cycle in which the dollar’s dominance is both a reflection and a driver of U.S. economic and geopolitical power. However, this privileged position now faces growing challenges, as rival powers actively seek to reduce their reliance on the dollar.

What’s causing the U.S. dollar to devalue?

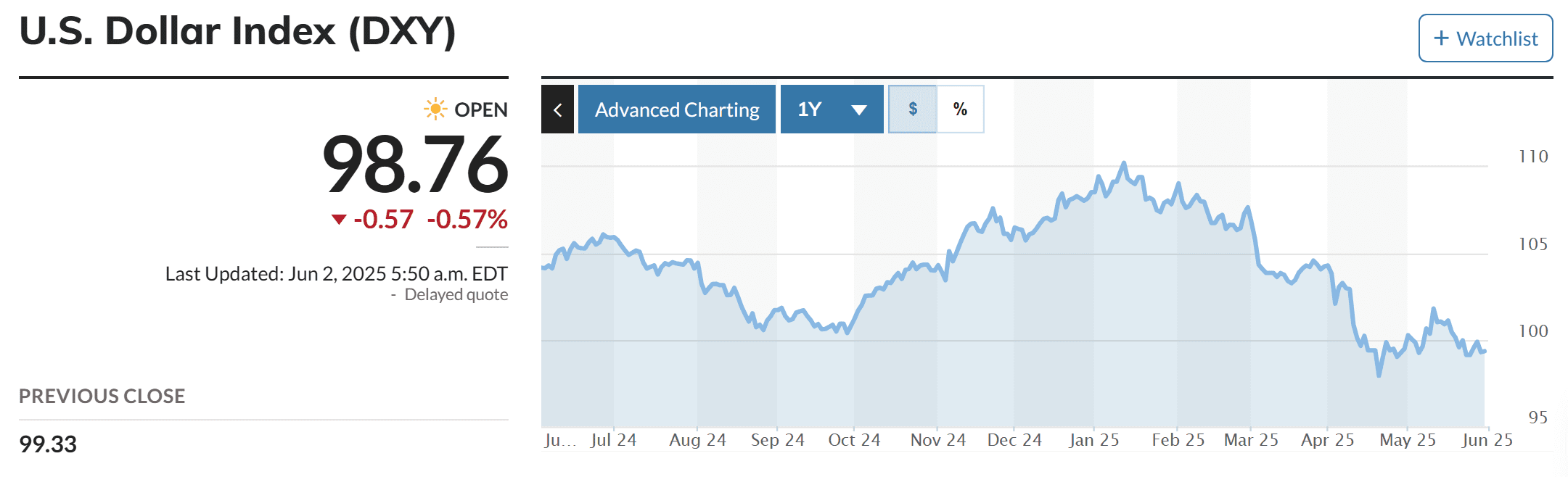

Several factors are converging to put downward pressure on the U.S. dollar. Aggressive trade policies—most notably the 2025 Liberation Day tariffs—along with an increasingly unpredictable policy environment, have created uncertainty about the direction of the U.S. economy. These moves triggered significant capital outflows, with foreign investors selling U.S. stocks at record levels, contributing to a 10% drop in the S&P 500 over just two days. Investor sentiment around the U.S. economic outlook and institutional stability has also weakened. Concerns about the Federal Reserve’s independence and the risk of political interference have made U.S. assets less appealing to global investors.

Meanwhile, ballooning budget deficits and rising national debt have raised further red flags, particularly regarding the sustainability of U.S. fiscal policy. As a result, investors are increasingly cautious about holding U.S. Treasury bonds. Moody’s recent downgrade of the U.S. sovereign credit rating added to the growing perception that ‘Brand USA’ is losing its global appeal. The ‘sell America’ trend has re-emerged, with speculators increasingly betting against the dollar.

Adding to the pressure, softer inflation data, such as the April Consumer Price Index, has heightened market expectations that the Federal Reserve will cut interest rates to support economic growth (source). Lower interest rates typically reduce the yield on U.S. assets, making the dollar less attractive relative to other currencies.

At the same time, de-dollarisation efforts among major economies are gaining momentum. More countries are actively seeking alternatives to reduce their reliance on the dollar in international trade and finance. While the dollar still accounted for 58% of global foreign exchange reserves at the end of 2024, that figure was 70% in 2000, a notable long-term decline. J.P. Morgan has warned that continued de-dollarisation could lead to the underperformance of U.S. assets compared to global markets.

Implications for U.S. equities

The relationship between the weakness of the USD and U.S. stocks is complex and likely sector-dependent. Companies with significant international exposure, such as technology, often benefit from a weaker dollar as their products become more competitively priced abroad. These exporters can see revenue boosts from overseas operations.

Conversely, import-dependent businesses will face serious headwinds. Companies such as retailers and electronics manufacturers encounter higher costs for raw materials and goods, thus squeezing their profit margins. Not only that, the inflationary pressure caused by the weaker dollar also reduces consumer purchasing power, hurting companies that rely on domestic demand.

Foreign investment dynamics add another layer of complexity. A cheaper dollar can initially attract overseas investors seeking bargains in U.S. equities, as they are effectively cheaper. However, a prolonged depreciation often signals economic instability, ultimately leading to capital outflow.

The dollar’s eroding safe-haven status has increased volatility in the equity market. Combined with the recent devaluation of the USD, investor confidence has decreased, and Vanguard projects a muted return of 4.4% to 6.4% for unhedged U.S. equities over the next decade due to stretched valuations and currency headwinds.

What should investors do

Rather than panic, investors should take some measured steps to protect their portfolios if they are genuinely concerned about the current situation. Considering allocating portions of your portfolio to diversify into international stocks might be a good idea. BofA Global Research observed in early May that investors had sold U.S. stocks over the past week and had flocked to Japan and Europe.

For equity investments, focus on companies with significant overseas revenue streams that will benefit from a weaker dollar. Try to avoid heavily import-dependent businesses unless they have strong pricing power.

Traditional alternatives, such as gold, have historically served as hedges against currency debasement. The price of gold has increased by approximately 25% since the beginning of the year. Some investors are also exploring alternative options, such as foreign currencies, cryptocurrencies, and international equity markets, to diversify their portfolios. However, no asset class is without risk; even gold can be volatile, cryptocurrencies remain speculative, and foreign investments carry their own currency and political risks.

Most importantly, maintain a long-term perspective. Currency movements are notoriously difficult to predict, and knee-jerk reactions often lead to poor investment decisions.

The fifth perspective

While the U.S. dollar is facing legitimate challenges, predicting its collapse remains premature. Its deeply entrenched role in global finance continues to provide significant staying power, even amid mounting pressure. Nonetheless, investors should be prepared for continued volatility and potential shifts in the global currency landscape.

1.The best ETF for global market exposure is….?

I am a Singaporean.

2. Use which on line brokerage to buy?

3. I am a newbie.

4. Thank you for your help.

Hi Ing Hong,

I would consider the VWRA which is listed on the London Stock Exchange. Interactive Brokers, Saxo, and FSMOne all offer access to the London Stock Exchange. Hope this helps!