Xero’s strategic rise: Capturing the cloud accounting market

The rise of cloud technology and the shift towards remote work have made software-as-a-service (SaaS) solutions increasingly vital tools for businesses. Unlike traditional software models, SaaS is a cloud-based model where software is delivered to users over the internet, eliminating the need for installation or maintenance on individual devices.

SaaS companies offer more predictable and scalable business models, driven by recurring revenue streams embedded in the DNA of subscription-based product pricing models. As the SaaS market continues to expand and innovate benefiting from the robust tailwinds of an increasingly cloud based world, SaaS stocks present a compelling addition to our investment portfolio, offering growth potential and stability.

Xero’s background

One SaaS stock that has become essential for businesses is Xero, a global leader in cloud-based accounting. Founded in 2006 in New Zealand, Xero has transformed how small and medium enterprises (SME) manage their finances. The platform’s intuitive design simplifies accounting tasks, allowing SMEs to streamline operations by integrating with a vast ecosystem of API-connected applications, from payment operating systems, inventory management to HR and more.

Xero has also steadily expanded its market presence across multiple geographies building a loyal and growing user base solidifying its reputation in the SME market. Their growth is driven by the ability to provide real-time financial insights and seamless integrations, making Xero the go-to accounting solution in numerous markets worldwide.

Xero’s stock has grown over 30 times since its IPO in 2012 and continues to grow with its share price up 28% year to date. Intrigued by its success, I delved into Xero’s business strategies to learn how the company has managed to thrive in the SaaS space.

Financial growth backed by solid SaaS metrics

In FY2024, Xero delivered a robust fiscal performance, marked by double-digit growth across key metrics such as revenue, subscriber base, and average revenue per user (ARPU)—all fundamental drivers of its business model. The company’s overall revenue surged by over 22% year-on-year, reaching a record NZ$1.71 billion. Subscriber growth remained strong, with an 11% year-on-year increase, bringing the total to 4.16 million subscribers, a testament to the continued momentum from the pandemic. Additionally, ARPU saw an impressive 14% year-on-year growth, reflecting not only the strength of Xero’s product offerings but also the increasing engagement of customers with Xero’s broader suite of features.

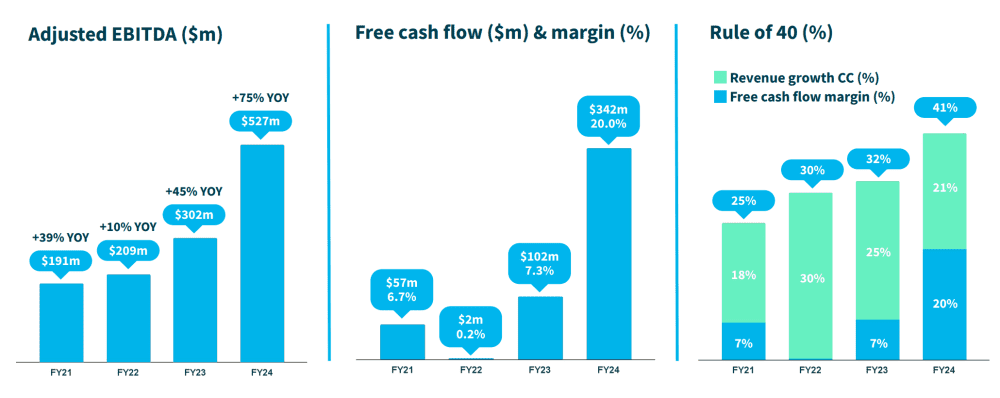

Building on its impressive revenue growth, Xero has also demonstrated strong performance in key SaaS metrics. The company’s Adjusted EBITDA surged by 75% year-on-year to NZ$527 million in FY24, driven by reduced restructuring costs and non-cash impairments. Furthermore, Xero’s ability to enhance its financial efficiency is evident in the significant increase in free cash flow, which rose to NZ$342 million, alongside an improved margin of 20%, up from 7.3% in FY23. This improvement is primarily attributed to higher receipts from customers and increased net interest received.

Xero’s strong execution is further emphasized by its performance in the ‘Rule of 40’, a critical SaaS metric that combines annual revenue growth and free cash flow margin, with a benchmark of 40% or higher. Surpassing this threshold signals that Xero is not only growing rapidly but also generating profits at a sustainable rate.

Xero successfully surpassed this benchmark in FY2024, reflecting its robust recovery from the challenges posed by the COVID-19 pandemic. The company has transitioned from the intense price competition that previously compressed margins, showcasing its competitive advantages with a strong Rule of 40 performance. This underscores Xero’s resilience and positions the company for continued sustainable growth in the SaaS market.

Dominance in Australia and New Zealand (ANZ) markets

Xero’s dominance in the ANZ markets is a crucial driver of its success. With an estimated 75% market share in this region, Xero benefits from a large and expanding total addressable market (TAM) for cloud-based accounting software among SMEs. The TAM in ANZ is projected to be A$1.3-1.6 billion by FY25, growing at 10-15% annually through FY2030. The digital maturity of the SME sector in ANZ is still relatively low, offering Xero significant opportunities to deepen its market penetration.

The company’s strong market position is reflected in its ability to increase ARPU by 11%, demonstrating its pricing power and success in upselling additional features within the Xero ecosystem which acts as a complement to its core accounting product. Additionally, Xero’s low monthly churn rate of less than 1% indicates strong customer loyalty and satisfaction, critical factors for sustained revenue growth in the SaaS industry. These metrics underscore the high lifetime value (LTV) of Xero’s customers, which is a hallmark of leading SaaS businesses.

Xero’s operations in ANZ are also highly profitable, with EBITDA margins in this region at over 50%. This strong financial foundation allows Xero to reinvest in product innovation and expand into other markets, such as the UK and the U.S., while maintaining its leadership in ANZ.

By leveraging its dominant position in ANZ and capitalizing on the ongoing digital transformation among SMEs, Xero is well-positioned to sustain its market leadership and pursue further growth opportunities in the global cloud accounting market.

Strategy to capture large TAMs beyond ANZ

Building on its strong dominance in the ANZ market, Xero is strategically expanding into larger TAMs in the UK and U.S. The SME TAM in the UK is estimated to be 2-3 times that of Australia, translating to potential annual revenues of US$3.5-5 billion, while the U.S. SME TAM is projected at US$10-20 billion. Xero has already made significant inroads, capturing over 30% of the UK market and 5% of the U.S. market, demonstrating its capability to penetrate these high-value regions.

Xero’s growth strategy in these markets taps on its commitment to localized product offerings and strategic partnerships. By tailoring its platform to address the specific needs of SMEs in the UK and U.S. These include compliance with local tax regulations, payroll management, and industry-specific tools. Xero ensures that its solutions are directly aligned with the operational challenges faced by businesses in these regions. This localized approach not only enhances user satisfaction but also strengthens Xero’s competitive edge in these markets.

A key element of Xero’s strategy is its partnership with BILL, which is particularly impactful in the U.S. This collaboration allows Xero to embed BILL’s robust accounts payable capabilities into its platform, offering a seamless bill pay solution that integrates deeply with the Xero ecosystem. This strategic move simplifies financial operations for small businesses, enhances cash flow management, and reduces the manual burden associated with bill payments. By leveraging BILL’s extensive network of 5.8 million members, Xero is also expanding its reach within the U.S. market, positioning itself as a more comprehensive accounting platform for SMEs.

Through these initiatives, Xero is well-positioned to capture a substantial share of the lucrative SME markets in the UK and U.S. from existing incumbents. This will drive significant revenue growth by expanding its customer base, increasing market penetration, and enhancing its competitive position, ultimately leading to accelerated financial performance and sustained long-term growth.

Xero partnerships and ecosystem

Another key driver of Xero’s business model is its strategic use of partnerships to enhance its app ecosystem, positioning itself as a one-stop solution for SMEs’ business needs. A prime example of this is Xero’s partnership with Deputy, a global employee management platform, established during the financial year. This collaboration integrates Deputy’s workforce management capabilities directly into Xero’s platform, seamlessly merging Deputy’s tools with Xero’s payroll and accounting services. This partnership not only strengthens Xero’s service offerings but also minimizes competition, as Deputy was previously a rival to Xero’s own Planday tool.

Deputy’s platform, serving over 350,000 customers globally, is renowned for simplifying critical tasks such as rostering, time sheets, and onboarding. By incorporating Deputy into its ecosystem, Xero is able to expand its value proposition, providing SMEs with a comprehensive, all-in-one platform that addresses a wide range of business needs from accounting to workforce management. This strategic move reinforces Xero’s commitment to delivering an integrated solution that enhances efficiency and reduces the complexity of managing multiple software tools that operate in silos.

Beyond its partnership with Deputy, Xero’s ecosystem is further strengthened by over 1,000 applications that connect directly to its platform, including more than 300 integrations with banks and financial services providers globally. This extensive network enables SMEs to streamline their operations, making Xero an indispensable business tool. Central to this strategy is Xero’s open API, which allows top applications to enter the Xero App Marketplace, continually expanding the ecosystem. This open API approach has been a key strength of Xero’s business model, enabling its subscribers to use Xero as an all-in-one platform for their diverse business needs benefiting from the network effects of the ecosystem.

As the Xero app ecosystem continually expands, with new applications being added each month. This ongoing growth not only bolsters Xero’s appeal to potential new subscribers at a low customer acquisition cost but also enhances retention by reducing churn, as businesses are more likely to stay with a platform that seamlessly connects to a wide range of tools through API connectivity.

Downsides and risks

Despite its strong performance and growth potential, Xero faces several significant risks that could impact its future growth. This includes strategic execution risk, which is a key concern to management. Xero’s ability to effectively implement its expansion strategies particularly in the highly competitive U.S. market is key to its strategic growth plans over the next five financial years. Any delays or mismanagement in executing its plans or integrating new partnerships could derail the company’s ability to meet expected growth targets.

Furthermore, competitive intensity in new markets also pose significant risks. Xero competes with established competitors like Intuit’s QuickBooks, which has a strong foothold in the U.S. market. However, Xero’s ability to continually innovate and leverage on its growing network effects will allow the company to effectively scale its subscriber growth especially in collaborative economies like the U.S.

The fifth perspective

Xero’s achievement of exceeding the Rule of 40 metric in its FY2024 highlights the company’s focus on improving efficiency and sustained profitability. Its strategic expansion into high-growth markets like the U.S. and UK, coupled with a successful playbook of localization and partnerships, positions the company for continued growth in the upcoming years. Xero’s strong financials especially with its robust revenue, ARPU, and subscriber gains signal a strong outlook, despite risks from competition and execution challenges.

Overall, Xero’s strong performance and strategic approach indicates strong growth ahead benefitting from the tailwinds of the digital transformation and an increasingly cloud based business environment.