China’s economy is slowing down. The country delivered enviable double-digit annual growth for the past decades but now growth has significantly shrank to 7%.

This concern bothered a unitholder and he decided to to raise this question at this year’s AGM.

“What impact would that (China’s slowdown) have on Mapletree Greater Commercial China Trust?”

It was a valid question considering Mapletree Greater China Commercial Trust owns a property, Gateway Plaza, in Beijing. A few months ago the REIT also acquired another property in Shanghai — Sandhill Plaza.

“Let me take a step back to set the scene since the question is very broad.”

Frank Wong, Chairman of Mapletree Greater China Commercial Trust answered over the microphone.

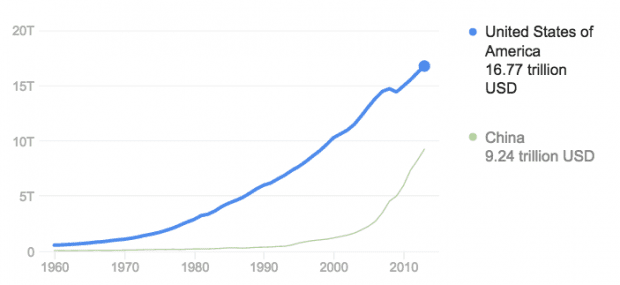

“When China had a growth rate of more than 10% ten years ago, the gross domestic product was around US$2.5 trillion to US$3.5 trillion. Today, the value is about close to US$10 trillion, second place after the United States.

Source: World Bank

He continued:

“If the base has gone up so much, you can’t expect China to deliver more than 10% on a US$10 trillion base. That’s quite clear to most people. At 7% growth rate on a US$10 trillion base, that’s incremental value of US$700 billion a year! That’s the problem – the size – that China faces today. In the end, what’s most important for the government is job creation, health care, and insurance for the people.”

CEO Cindy Chow then shed more light on the ground through sharing her personal experience:

“China is going through a transition, moving away from investments in fixed-assets to service-oriented business. That would benefit us and this can been seen from the performance of our office asset, Gateway Plaza in Beijing, which has been doing well, enjoying double-digit growth in rental income. In other words, our tenants in Beijing are doing well too.”

As far as the management did a good job of addressing the question of China’s slowdown, there were other important points discussed at the AGM.

[*Investing in S-REITs? – Get The Latest S-Reit Data Here, Including Yields, P/B, Gearing Ratio, Share Price]

Here are…

6 Things I Learned from Mapletree Greater China Commercial Trust’s AGM 2015

- With a direct connection to Kowloon MTR (mass transit railway) station, Mapletree Greater China Commercial Trust’s key property asset, Festival Walk, enjoys a strategic location that led to a positive rental revision of 22% this year. Thus, distribution per unit increased by 10.4%. The management expects this asset to continue performing well despite a slowdown in retail spending in Hong Kong. According to the CEO, retail spending for Festival Walk was unaffected during the SARS outbreak in 2003 and the financial crisis in 2008/09. Why so? Besides its great location above the MTR, it is a suburban mall which relies mainly on local spending which is a lot less volatile than tourist spending (which only accounts for 15-17%).

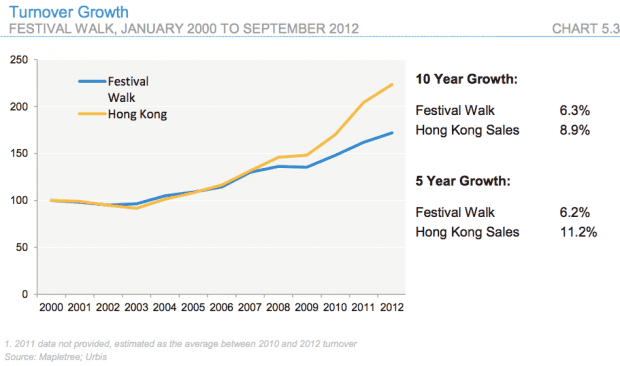

For comparison purposes, I pulled out the graph above from Mapletree Greater China Commercial Trust’s prospectus dated 2013. While it is true that retail spending on Festival Walk has been resilient and growing, its growth was lower than Hong Kong’s overall retail spending from 2000 to 2012. Festival walk also benefited from the Occupy Protest last year as both locals and tourists flocked to non-affected malls. According to the Hong Kong Census and Statistics Department, Hong Kong retail sales in FY14/15 declined 1.9% yet Festival Walk delivered growth in tenant sales of 5.8%.

For comparison purposes, I pulled out the graph above from Mapletree Greater China Commercial Trust’s prospectus dated 2013. While it is true that retail spending on Festival Walk has been resilient and growing, its growth was lower than Hong Kong’s overall retail spending from 2000 to 2012. Festival walk also benefited from the Occupy Protest last year as both locals and tourists flocked to non-affected malls. According to the Hong Kong Census and Statistics Department, Hong Kong retail sales in FY14/15 declined 1.9% yet Festival Walk delivered growth in tenant sales of 5.8%.

“Festival Walk is always 100% occupied since 2000. In fact, I do not see any voluntarily tenant who would say, ‘I want to leave Festival Walk and go to another shopping mall.’ The list of prospective tenants is very long.” Cindy Chow, CEO

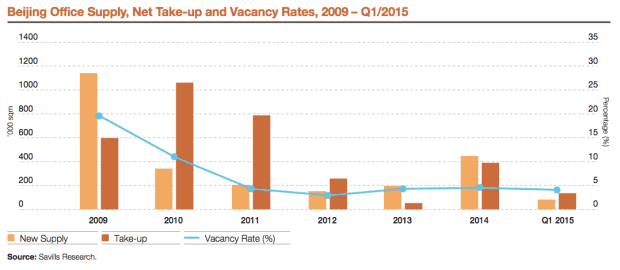

- Beijing is one of the top, if not the best, market to be in for office property investment. The city has the lowest office vacancy rates across China; less than 5%. This demand would naturally translate to growth in rental income.

According to Savills Research, there is no large supply of office space coming up in Beijing from 2012 to 2014. The little amount of office space that is coming up is only 29% of the average supply between 2007 and 2009. Rents within the Lufthansa Area (where Gateway Plaza is located) is expected to remain stable over the next three years.

According to Savills Research, there is no large supply of office space coming up in Beijing from 2012 to 2014. The little amount of office space that is coming up is only 29% of the average supply between 2007 and 2009. Rents within the Lufthansa Area (where Gateway Plaza is located) is expected to remain stable over the next three years.

“With only 95,000 square metres added to the market over the preceding five years, new supply in the Lufthansa Area is expected to remain limited over the next three years, with only three projects expected to enter the market, bringing annual supply of just 76,000 square metres.” Savills Research

- With strong demand, a shortage of office space in Beijing, and the list of long-staying tenants that Mapletree Greater China Commercial Trust has, positive rent reversion at Gateway Plaza is likely to continue — except at a rate of probably less than 30%. The tremendous growth in rental was already seen when leases were signed back in 2011 and those leases are up for renewal this year.

- Acquisition of Sandhill Plaza in Shanghai in June 2015 will be fully funded by debt and is expected to be yield-accretive. The distribution per unit is expectedly to grow from 6.542 cents to 6.55 cents. According to the CEO, other that its strategic location, Sandhill Plaza has a potential for positive rental reversion since its existing portfolio was leased at an average rent of RMB4.82 psf. Compared against the current market rate of RMB5.36, unitholders can expect positive rent reversion when existing rents are up for renewal this year and, thus, a higher distribution per unit.

- Borrowings of $1,984 million is higher than the previous year’s figure of $1,852 million. CFO Jean Low pinpointed that the rise in borrowings is not because the REIT borrowed more money but was solely due to the appreciation of the Hong Kong dollar against the Singapore dollar. Investors need to take note that investments in foreign markets not only affects borrowings, but also the value of assets when it is converted back to the company’s home currency.

- Duration of listing is essential to secure a lower rate of financing. Mapletree Greater China Commercial Trust has only been listed for two years and its cost of debt is 2.6%. On the other hand, Mapletree Logistics Trust has been listed for ten years and is able to secure a lower all-in cost of financing of only 2.1% despite the two REITs having the same credit rating (‘Baa1’ with stable outlook) from Moody’s.

Love these summary updates on companies? – Get more AGM updates from your favorite companies here.

For comparison purposes, I pulled out the graph above from Mapletree Greater China Commercial Trust’s prospectus dated 2013. While it is true that retail spending on Festival Walk has been resilient and growing, its growth was lower than Hong Kong’s overall retail spending from 2000 to 2012. Festival walk also benefited from the Occupy Protest last year as both locals and tourists flocked to non-affected malls. According to the Hong Kong Census and Statistics Department, Hong Kong retail sales in FY14/15 declined 1.9% yet Festival Walk delivered growth in tenant sales of 5.8%.

For comparison purposes, I pulled out the graph above from Mapletree Greater China Commercial Trust’s prospectus dated 2013. While it is true that retail spending on Festival Walk has been resilient and growing, its growth was lower than Hong Kong’s overall retail spending from 2000 to 2012. Festival walk also benefited from the Occupy Protest last year as both locals and tourists flocked to non-affected malls. According to the Hong Kong Census and Statistics Department, Hong Kong retail sales in FY14/15 declined 1.9% yet Festival Walk delivered growth in tenant sales of 5.8%.

According to Savills Research, there is no large supply of office space coming up in Beijing from 2012 to 2014. The little amount of office space that is coming up is only 29% of the average supply between 2007 and 2009. Rents within the Lufthansa Area (where Gateway Plaza is located) is expected to remain stable over the next three years.

According to Savills Research, there is no large supply of office space coming up in Beijing from 2012 to 2014. The little amount of office space that is coming up is only 29% of the average supply between 2007 and 2009. Rents within the Lufthansa Area (where Gateway Plaza is located) is expected to remain stable over the next three years.