How to take advantage of insider trading… legally!

During my time as an investment analyst co-managing a private fund, I encountered several incidents of illegal insider trades (of which I must state I did not take advantage of and profit from).

These insider trades came from top management including CEOs, directors and even a friend’s father who was good friends with some of the senior executives in one particular company. They were privy to sensitive information the public had no access to. If you possessed the same information yourself, you could have potentially made a ton of money within a very short period of time.

In one such incident, if you acted on the insider news of an “acquisition offer”, you could have easily made over 20% returns in just two months. In another incident, if you had advanced news of a company liquidating its core business and distributing the proceeds as dividends, you’d have made over 127% returns as the company’s stock price moved from 18 cents to 41 cents in a matter of five months!

My advice is if you personally encounter an opportunity to participate in illegal insider trading, stay out of it. It’s not worth making all that extra money only to face jail time, away from your loved ones and family.

Now if you’re starting to question the purpose of my sharing all of this, this isn’t about how to use illegal insider trading to make a quick buck, but rather how to take advantage of legal insider trades when investing.

Illegal insider trading is the purchase/sale of stock by insiders taking advantage of information that is not available to the public. On the other hand, legal insider trading is when that information has been made public and insiders have no direct advantage over other investors.

Insiders are required by law to declare their trades whenever they purchase or sell their company’s stock. And when they do, this can give you clues you can use to your advantage.

How to use legal insider trades to your advantage

To illustrate: After doing your research and you conclude that a particular stock has passed all your fundamental criteria, you decide that the stock is worth buying since it is trading at a discount relative to its intrinsic value.

When you run a further check on insider trades and discover the company’s directors were also buying the company’s shares at the same price range or lower just a few weeks back, it automatically gives you a boost of confidence that your research and analysis is spot on.

But the question is: does this really work? Let’s bring up few examples.

In the Singapore stock market, Goi Seng Hui, director and shareholder of Super Group Limited, started accumulating a large stake of his company’s shares at attractive prices from 23 cents to a dollar during 2003-2009. He now has a total personal shareholding of 15%.

At this time of writing, Super is trading at $3.53 per share: Mr Goh has made at least a 253% return on investment and more considering he was already buying shares at 23 cents onwards. If you had followed him, you would have made a fortune.

Unfortunately I did not.

But in another instance, I did follow the insider trades. Here are my results:

In 2011, John Lim, CEO of ARA Asset Management, spent millions of dollars scooping up his company shares at prices ranging from $1.15-$1.68. To me, it was a signal he believed the stock was trading below its intrinsic value and confident it was worth more.

In May 2012, the Eurozone crisis shocked the market and I took the opportunity to enter ARA at $1.25. As this time of writing, ARA is trading at $1.85 and I am sitting on a paper gain of +48% in 18 months.

Of course, ARA is a great company fundamentally and its stock was always poised to rise, but John Lim’s insider trades and overt confidence gave me the impetus to invest in ARA the moment there was an opportunity to do so.

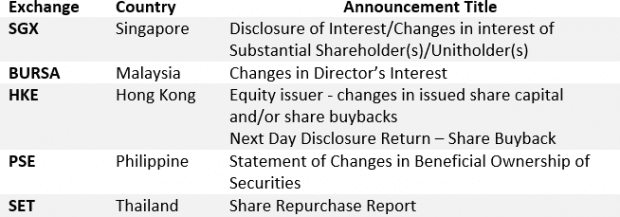

To check insider trades, all you need to do is to go through a listed company’s announcements which is hosted at their respective exchanges. Below is the list of exchanges in Asia and its common announcement format.

The fifth perspective

Insider trades are a great way to spot companies that might be a great investment to come. When you see a bunch of key insiders buying a sizable stake in their companies, it’s something you should take note of. If the company’s fundamentals pass your criteria and there’s an opportunity to invest, then I would say go for it!

Of course, insider trades alone should never be the sole criterion why you should invest in a particular stock, but they definitely increase your odds of hitting a home run.