ST Engineering is an integrated engineering company with four key segments: aerospace, electronics, land systems, and marine. It provides products and services for both commercial and military applications, which means that its financial figures usually demonstrate more resilience than its less diversified peers.

I attended ST Engineering’s 2019 AGM thinking that there wouldn’t be anything too interesting; I was expecting it to be boring, actually. You can’t blame me — revenues grew at a CAGR of 0.2% over the past five years, while earnings fell over the same period. It seemed like a stable blue chip having immense difficulties with growth.

While the company’s growth is still lackluster, I left ST Engineering’s AGM with a radically different view of the company. In my opinion, the company’s management team has made some good moves over the past year. But more importantly, they are focused on executing a growth strategy going forward.

Here are 11 things I learned from the 2019 ST Engineering AGM:

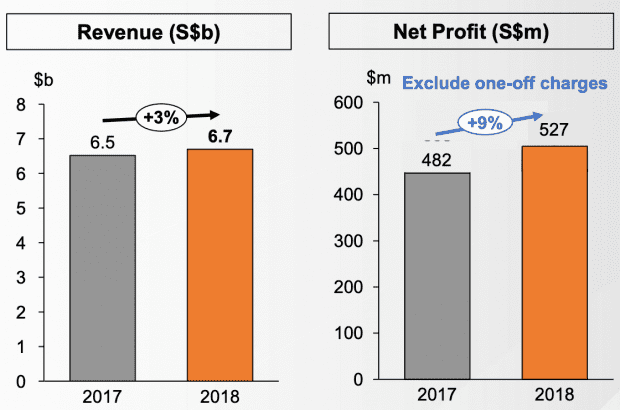

1. Revenues grew 2.8% from S$6.52 billion in 2017 to S$6.70 billion in fiscal year 2018, while net profits fell 1.7% from S$502.6 million to S$494.2 million. According to CEO Vincent Chong, the company’s 2017 profits included a S$20 million tax benefit that resulted from the 2017 U.S corporate tax cut. On the other hand, the company’s 2018 profits were impacted by one-off transaction costs related to the company’s acquisitions and divestments. Adjusting for these one-off items, net profits grew 9% from S$482 million in fiscal 2017 to S$527 million in fiscal 2018.

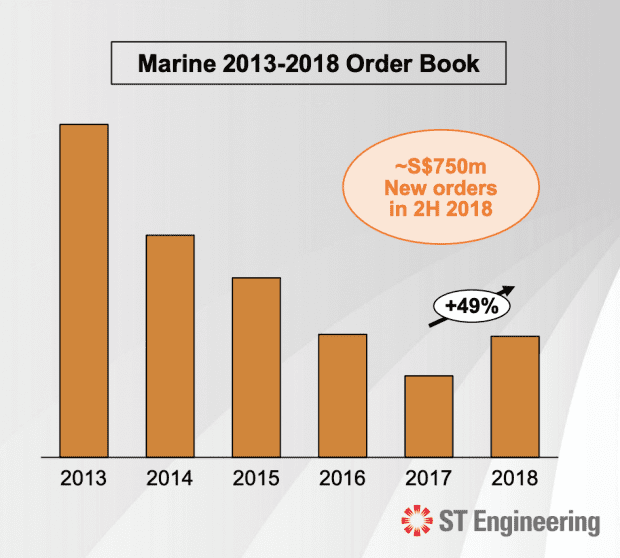

2. ST Engineering ended fiscal year 2018 with an order book of S$13.2 billion, roughly twice the company’s annual sales. This provides revenue visibility for the company over the next few years. In fact, the CEO expects that S$4.9 billion of these orders will be delivered in 2019. He placed special emphasis on its marine business, which is in an industry that has been facing a challenging environment for a few years now. After four consecutive years of declining orders, there was a 49% year-on-year increase in the marine business order book in fiscal 2018. He was especially encouraged by the fact that the second half of 2018 yielded S$750 million worth of orders, a sign that a recovery could be beginning.

3. In 2018, ST Engineering acquired Middle River Aerostructure Systems (MRAS) for US$506 million in cash, the company’s largest acquisition to date. MRAS is a manufacturer of nacelle systems, which are cylindrical casings you might have seen under the wing of commercial aircraft. These nacelle systems hold the airplane’s engine, and are essential because they contain thrust reversals that reduce the plane’s momentum during landing. This acquisition enables ST Engineering to climb up the value chain to become an original equipment manufacturer (OEM) for a valuable system that is required by all aircraft manufacturers. In his prepared remarks, the CEO mentioned that this acquisition fits well with ST Engineering’s strategy to upscale its businesses. More importantly, it complements ST Engineering’s existing capabilities in the airframe business.

4. MRAS likely would not have been up for sale if its parent company, General Electric (GE), were not in financial trouble. GE’s well-publicised financial troubles stem from concerns that cash flows will not be sufficient to fulfill pension obligations and GE Capital reserve requirements. In light of that, GE’s management team has embarked on a turnaround plan that incorporates the divestiture of non-key business segments. According to Chairman Kwa Chong Seng, GE sees its aircraft engine business as a core operation, but MRAS’ nacelles are part of an aircraft’s airframe and not the engine.

5. A key growth driver for MRAS is the increasing popularity of narrow body aircraft like the Airbus A320neo. MRAS manufactures two types of nacelles: legacy nacelles used in older aircraft like the Boeing 747 and 767; and newer nacelles designed for narrow body aircraft like the Airbus A320neo, Boeing 737 MAX, and the Comac C919. Narrow body aircraft are seeing increasing popularity due to the rise of low-cost carriers, which is buoying the order books for both Boeing and Airbus. For instance, Airbus is currently producing about 50 A320neos a month, but they are looking at increasing production by about 40% to 70 planes a month.

6. The CEO also gave some details on its proposed acquisition of Belgium-based Newtec Group for €250 million. Newtec designs and manufactures satellite communications (satcom) equipment, and holds a number of patents for vital satcom technologies. Newtec equipment are predominantly ground-based systems that receive satellite signals and establish ground networks. According to the CEO, Newtec’s capabilities complement ST Engineering’s existing portfolio of products and solutions in the satcom space. The deal, which is expected to close in the second half of 2019, is expected to yield S$200 million in cost synergies. However, the company expects to bear some transaction and integration costs in the year after the acquisition, so it will only be earnings accretive after that.

7. The CEO reinforced the company’s commitment to its five-year plan. During the company’s 2018 Investor Day, management laid out an ambitious plan to double its smart city revenues from S$1 billion in 2017, to at least S$2 billion by 2022. Besides this, the company is pursuing growth that is two to three times faster than global GDP growth for its remaining segments. With global GDP growth normally in the 2-3% range, this means that ST Engineering is gunning for revenue and profit growth of 6-9% over this time period. The CEO added that he expects roughly two-thirds of this growth to come from the company’s overseas markets, which explains why the company’s acquisition targets have been overseas companies.

8. A shareholder asked about the growth opportunities that will arise from the recent increase in Singapore’s defense spending. The CEO replied by saying that this development is positive for the company’s defense business. However, the management team was unable to comment on the specifics as it is unclear how the government will spend its defense budget.

9. Another shareholder enquired about the potential market for ST Engineering’s new unmanned aircraft initiatives, and the timeframe for implementation. The CEO responded by saying that unmanned aircraft are already being used in the form of unmanned aerial vehicles and drones. However, the company is currently working on semi-automating the process of flying an aircraft, which includes trialing solutions for single pilot freight aircraft. Despite this, he admitted that commercial applications for fully unmanned aircraft would take some time. There would likely be a lengthy approval process by the U.S. Federal Aviation Administration, and travellers would have to overcome their mental hurdle before feeling fully comfortable on unmanned passenger planes.

10. Another shareholder asked about the company’s financial liabilities should its autonomous mechanisms meet with an accident. The CEO replied that the company is suitably insured against such situations. More importantly, the company actively ensures that the technology it rolls out has sufficient safeguards. He cited the success of previous rollouts of autonomous mechanisms like the mobile hospital robot, which has been successfully implemented in over 140 hospitals in the United States. However, for higher risk areas like autonomous buses, the company is currently working with regulatory authorities to develop a regulatory framework.

11. The management team also revealed some interesting details about its US$150 million corporate venture fund. Unveiled in 2017, this fund aims to invest in ‘promising technology start-ups developing new technologies or creating innovative solutions’. The company has deployed capital in six startups but is far from reaching its upper limit. The CEO laid out three fundamental criteria a start-up needs to meet before the company will consider an investment. First, the technology needs to be differentiated; second, it has to be complementary to ST Engineering’s existing set of solutions; and lastly, the business model must be financially viable. CFO Cedric Foo stressed that the company is not focusing on the financial returns these investments can yield in the short run. Instead, it aims to eventually collaborate with start-ups that are developing technology that the company is lacking in. This enables the company to stay ahead of the curve, and minimise the impact of disruption over the long term.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »