CapitaLand China Trust (CLCT) is a China-focused REIT that invests in real estate assets used primarily for retail, office, and industrial purposes. Listed on the SGX since December 2006, the REIT’s current portfolio comprises 12 shopping malls and five business parks located across 10 Chinese cities.

At the CLCT’s 2021 AGM, CEO Tan Tze Wooi addressed thematic issues brought about by the COVID-19 pandemic, the REIT’s financial performance, and its plans moving forward.

1. The CEO said CLCT started FY2020 by having to respond to unprecedented COVID-19 challenges as health and safety issues took priority. The REIT provided rental reliefs and worked out flexible and mutual solutions for its tenants. It also accelerated its digitalization efforts, building a stronger omnichannel retail ecosystem to widen customer outreach while at the same time drawing deeper consumer insights to ‘future ready’ its business.

2. Notwithstanding these efforts, CLCT’s FY2020 financial performance was negatively impacted. CLCT reported a gross revenue of RMB1,056.2 million (S$210.5 million) and net property income of RMB678.2 million (S$135.2 million), a year-on-year decrease of 11.6% and 18.2% respectively. Distribution per unit for the year was at 6.35 Singapore cents to unitholders, declining 32.5% year-on-year.

The CEO attributed this to measures taken to support their tenants’ business recovery, lowered effective occupancy rates, the absence of contribution from CapitaMall Erqi after its divestment, and a fall in sales activity as certain malls underwent periods of restrictive training days in collaboration with local authorities to combat against COVID-19.

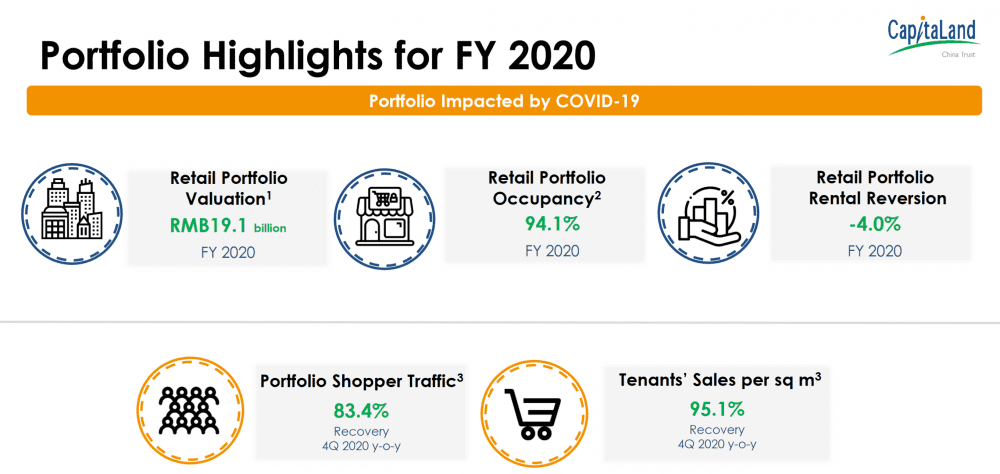

3. CLCT’s retail portfolio valuation displayed resilience, as its valuation as at 31 December 2020 stood at RMB19.1 billion, a marginal downward adjustment of 1.5% compared to a year ago. Occupancy closed at 94.1% while rental reversion was at negative 4%, owing to a higher volume of non-routine lease turnovers amidst a cautious retail outlook.

Shopper traffic and tenant sales rebounded steadily quarter-on-quarter to recover to 83.4% and 95.1% respectively in Q4 02020 via wide ranging collaborations with tenants to roll out promotions, and by streaming and cross leveraging of offline and online initiatives.

4. The CEO said that CLCT secured a competitive cost of debt, kept loan covenant ratios at a comfortable level, and maintained a well-staggered debt maturity profile. The REIT’s gearing ratio was 31.8%, providing a debt headroom of S$1.6 billion before reaching the 50% gearing limit stipulated by MAS. CLCT’s average cost of debt was 2.76%. Interest coverage ratio was 3.7, while the average term to maturity was 2.97 years (as at 31 December 2020).

The CEO also said that CLCT will continue to actively manage interest rates through hedging instruments while progressively taking onshore borrowings as a natural form of currency hedge. He added that CLCT also tapped into its first perpetual securities issuance in 2020, adding to its range of diversified funding sources.

5. CLCT’s expanded investment mandate covers retail, office, and industrial assets which include business parks, logistics facilities, data centres, and integrated developments. CLCT’s latest and largest acquisition to date is the acquisition of five business parks and the balance 49% interest in Rock Square for RMB4,945.0 million (S$1,005 million) in November 2020.

According to the CEO, the newly acquired business parks have trended positively since the start of 2021, with newly signed leases and improving occupancy rates. The CEO added that sector diversity and income resilience from the business parks will contribute accretively towards CLCT’s expanded stable of 12 malls and five business parks.

6. The CEO highlighted that CLCT stayed on course with its strategy to monetize mature assets with plans to unlock the value of its assets with selective enhancement initiatives. CLCT divested CapitaMall Erqi for RMB777.0 million (S$150.8 million) at 20.5% above valuation in May 2020. This was followed by the divestment of CapitaMall Minzhongleyuan, for RMB458.0 million (S$93.4 million) in February 2021. The divestment of CapitaMall Saihan is also expected to be completed in 2Q 2021.

In the near term, the CEO said the management will focus on generating value from its assets, with plans to recover the anchor tenant of CapitalMall Yuhuating by 3Q 2021, improve net lettable area efficiency in Rock Square, and study the redevelopment potential of Xinsu North Belt.

7. CLCT remains bullish on the long-term attractiveness of the Chinese market. China’s 1Q 2021 GDP grew by 18.3% year-on-year and retail sales have also experienced recovery, reflecting the outlook of increasing domestic consumption. Led by domestic demand, and the onshoring of higher value technology and enterprises, CLCT is confident of benefiting from China’s new economic push and is positioning itself to capture future growth opportunities from China’s fourteenth Five-Year Plan.

8. Unitholders asked for insights on logistics assets and data centres in China as CLCT sponsor, CapitaLand, does not have a pipeline for logistic assets and data centres in the country. The management responded that China’s new economic sectors present many compelling opportunities with logistics and data centres forming an integral portion of China’s economic emphasis. It expects these two asset types to maintain their growth momentum as businesses accelerate the digitalisation of their operations and shift towards e-commerce and data.

Their response also stated that CapitaLand has a data centre business unit with competencies in data centre design, development and operations, and that the CLCT is open to onshore partnerships with third-party property managers who have the expertise to run these new economy assets.

The fifth perspective

CLCT’s longer-term goals are to achieve a balanced portfolio that rides upon China’s consumption-driven and innovation-led economy. The REIT is aiming for an asset class mix of around 40% integrated developments, 30% retail, and 30% new economy sectors. (Its current asset class mix is 85% retail and 15% business parks as at 31 December 2020).

The presence of 12 malls spread across Tier 1 and 2 cities in China provides geographical diversification. CLCT also affirmed its strategy of expanding into the new economy asset classes with its latest business parks acquisitions. However, more concrete developments with regard to logistics facilities and data centers remain to be seen.

CLCT also continues to review asset lifecycles within its portfolio to unlock value and redeploy capital to pursue growth. The REIT’s assets under management stand at S$4.5 billion (as at 31 December 2020) — a new high over the last five years.

For investors seeking a China-focused REIT, CLCT provides the option of being the only China-focused Singapore-listed REIT that offers investors the opportunity of a long-term China play to ride upon the wave of China’s future growth.