Frasers Hospitality Trust (FHT) is a stapled trust comprising Frasers Hospitality REIT and Frasers Hospitality Business Trust. FHT owns a portfolio of 15 hotels and serviced residences across nine cities in the UK, Germany, Malaysia, Singapore, Japan, and Australia. As at 30 September 2020, FHT’s portfolio was valued at S$2.25 billion.

Operating in the hospitality industry, FHT’s hotels and serviced residences operations would have been badly hit by the COVID-19 pandemic. Hence, I attended FHT’s 2021 AGM to find out how FHT is planning to recover from the fallout that was caused by the pandemic.

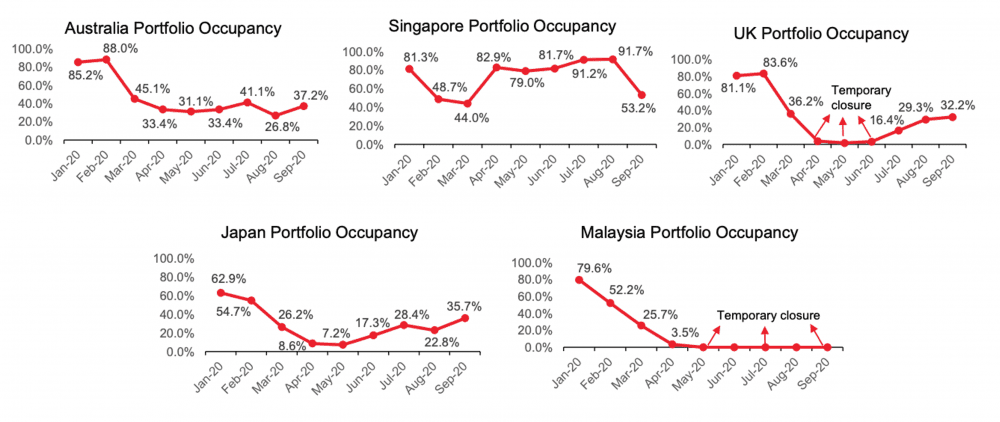

1. FHT CEO Colin Low shared that COVID-19’s impact on the global hospitality industry varied by country. As countries in the Asia-Pacific region had contained the pandemic better which led to the easing of lockdown measures quicker, Asia-Pacific hotel occupancy rates posted a less severe decline than that of Europe. The recovery of Europe’s hospitality industry was marred by the resurgence of the virus during winter. However, as COVID-19 vaccines have started to enter the market, this should lead to a gradual increase in consumer confidence and an easing of domestic and international travel restrictions.

2. FHT’s gross revenue and net property income both decreased by over 40% year-on-year in FY2020. Following which FHT’s distribution per stapled security decreased by 68.3% year-on-year in FY2020. FHT’s FY2020 would have been much worse if not for the decent performance FHT posted in 1Q FY2020, just before the world felt the full force of the pandemic. Further, FH-REIT was entitled to the contractual minimum/fixed rent under the master lease structure when some of its properties temporarily suspended operations or were badly affected.

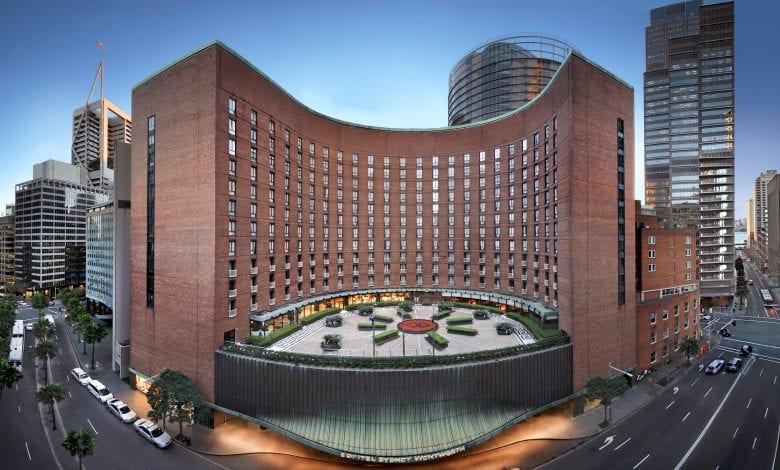

3. FHT was one of the first movers in the isolation/quarantine business to cushion its fall in revenue and profits. For example, FHT’s Sofitel Sydney Wentworth property hosted returning Australians serving quarantine for the entire second half of FY2020. Low shared that only 15 out of 390 hotels in Sydney were selected to serve as isolation facilities, a testament to the good reputation of the property.

FHT’s Novotel Melbourne on Collins property also served as an isolation facility for five months in the second half of FY2020. Both properties have secured further contract in the isolation business starting from October 2020. In Melbourne, only 11 out of 364 hotels were selected to serve as isolation facilities.

4. FHT had also pre-empted and promoted various initiatives to capture different market segments. Low shared several of such rather interesting initiatives:

- At FHT’s InterContinental hotel in Singapore, the management had installed The Green Room, which allows users to have a virtual background while they make international conference calls.

- At FHT’s Novotel Sydney Darling Square, FHT received permission from the New South Wales authorities to extend their dining area with a 60-seater Alfresco-style dining.

- At FHT’s Sofitel Sydney Wentworth hotel, two concerts were held at its courtyard in 2020 to bid farewell to guests who were completing their two-week quarantine. The FHT management is looking to hold weekend concerts at the courtyard to drive room and food and beverage revenue.

5. To preserve cash and mitigate cost, FHT has scaled down its operations by closing F&B outlets, amenities, rooms; scaling back services; and reassessing supply and service contracts. Low also shared that FHT is in close contact with its hotel operators so that FHT is able to respond to any matters on the ground as quickly as possible.

All of FHT’s UK properties were ordered to suspend operations from April to June 2020 by the British government. Since then, all of its UK properties except one have resumed operations from July 2020.

FHT’s Kuala Lumpur property The Westin was also temporarily closed from May 2020 to conserve cash, before reopening on the 18th of December 2020. While the Malaysian government again placed Kuala Lumpur under another movement control order (MCO) from 13 January 2021 to 26 January 2021, vaccination in Malaysia is expected to start from February 2021 onwards.

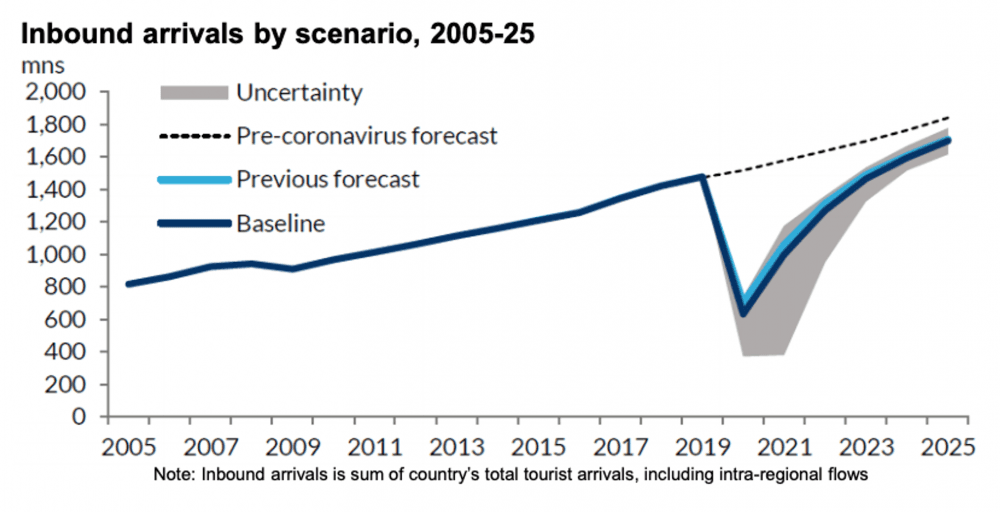

6. FHT’s recovery is highly dependent on the recovery of international travel. According to the World Tourism Organisation (UNWTO), international arrivals will only recover to 2019 levels by 2024. Of course, this is assuming the gradual recovery of the pandemic, the successful roll-out of COVID-19 vaccines, and improvement in consumer confidence to travel. As Low mentioned, this is very much crystal gazing — while there is much to be hopeful for, uncertainties still remain. The road to recovery for FHT is indeed a non-linear one.

7. Low feels that though the hospitality industry has been the most challenged in this pandemic, its upside in recovery is also the greatest. This is due to the pent-up travel demand for both leisure and corporate purposes. Humans are experiential creatures, so international travel is also unlikely to be superseded by any technological trends that have accelerated due to the pandemic.

As domestic travel restrictions are expected to loosen up sooner than international curbs, the UNWTO expects domestic tourism to return faster and stronger than international travel. As FHT derives a significant portion of its gross revenue from Australia, Japan, and the UK, a rebound of the sizable domestic tourism markets in these countries is likely to provide a boost to FHT.

The fifth perspective

Low believes that the established quality of FHT’s properties allows it to recover strongly once the pandemic subsides. The management is looking at fundamental shifts in the hospitality industry, emerging trends, and their potential impact on FHT’s properties. From there, this prompts a rethink on how FHT can better offer experiential and multi-use of its hospitality real estate.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »