Oversea-Chinese Banking Corporation (OCBC) is the second largest financial institution in Southeast Asia with a market capitalization of over S$55.7 billion. Over the years, OCBC has grown its international footprint and now comprises more than 570 branches and representative offices in 18 countries and regions. As of 31 December 2020, OCBC’s total assets comprised more than S$521.3 billion.

I attended OCBC’s 2021 AGM to understand more about the bank and its management. Here are the eight things I learned from the 2021 OCBC Bank AGM.

1. OCBC’s total income fell 7% year-on-year to S$10.1 billion in FY2020 from S$10.9 billion in FY2019. Likewise, OCBC’s net interest income fell 6% to S$6.0 billion from S$6.33 billion a year ago. This drop was due to lower interest rates and a lower loan-to-deposit ratio – LDR in FY2020 was 83.7% compared to 86.5% in FY2019.

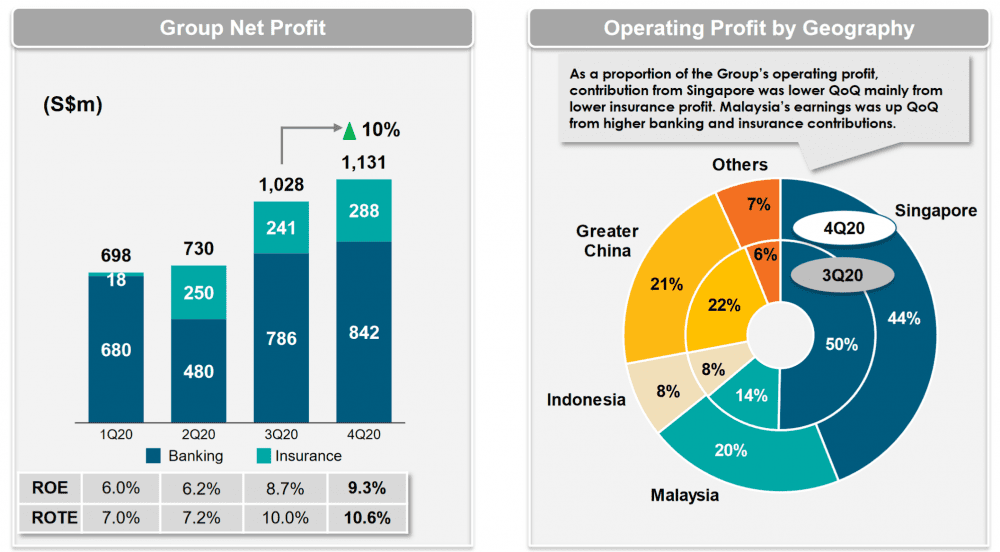

2. Net profit fell 26% year-on-year to S$3.6 billion in FY2020 from S$4.9 billion in FY2019. However, OCBC’s 4Q2020 shows growing momentum with a 10% quarter-on-quarter increase in net profit to $1.1 billion from $1.0 billion in 3Q2020.

With low interest rates, the pandemic affected many financial institutions. However, the outlook is more positive as interest rates nudge higher in 2021.

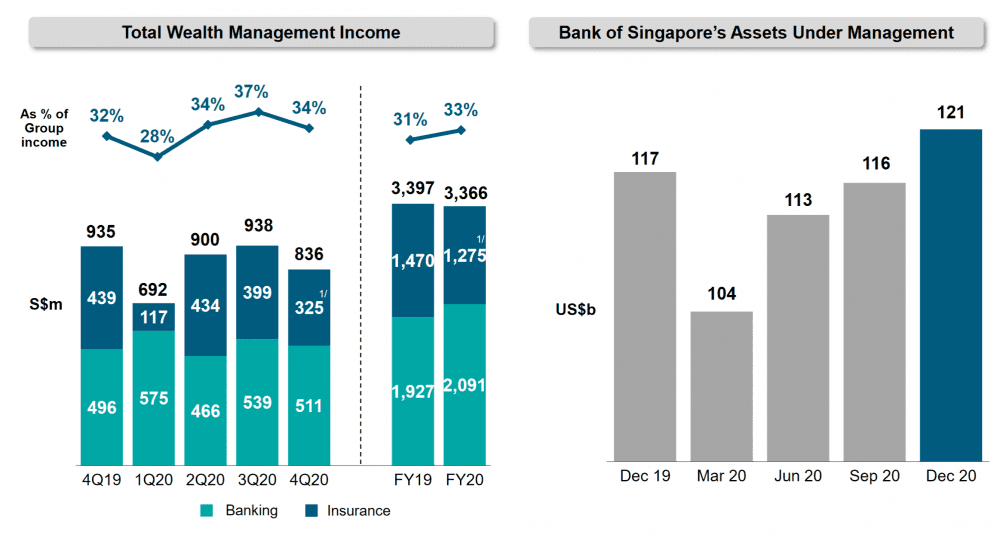

3. OCBC’s wealth management income fell 1% year-on-year to S$3.36 billion in FY2020 from S$3.39 billion in FY2019. Although wealth management income fell slightly below FY2019’s record, private banking assets under management reached an all-time high of US$121 billion.

4. Newly-appointed CEO Helen Wong mentioned that OCBC was rapidly enhancing its digital experience for consumers. In 2020, there were 1.6 times more consumer accounts opened digitally compared to 2019, consumer PayNow transaction volume increased by 2.8 times, and there were 2.3 times more digital wealth transactions. Furthermore, S$3 billion in loans were fully-digitally secured in 2020.

OCBC also uses Big Data, AI, and machine learning throughout the bank’s units in their day-to-day workload. For example, the bank has used data analytics and machine learning to better understand its customers to recommend the right products to them.The CEO added that OCBC is keen to work with fintech startups as partners to improve the overall efficiency of the banking ecosystem.

5. As companies move toward a ‘China Plus One’ strategy, OCBC is looking to capitalize on growing trade and capital flows between Greater China and ASEAN. Based on OCBC’s estimates, 90% of ASEAN trade and capital flows pass through markets that the bank has a presence in. OCBC will look to collaboration with partner banks, including Bank of Ningbo and regional banks, to facilitate and deepen connectivity along the China-ASEAN corridor.

6. A shareholder asked if OCBC would start to accept cryptocurrencies like DBS? Chairman Ooi Sang Kuang said they are keeping a close look at cryptocurrencies. However, they were currently still evaluating the value propositions of such digital currencies.

7. A shareholder highlighted that OCBC’s brokerage site looks outdated compared to newer brokers like Moomoo and Tiger. Deputy President Ching Wei Hong said that a new user interface it is in the works as the migration is under testing, and the application extends across the entire group including the Bank of Singapore, consumer banking, Internet banking platforms. It will be rolled out in this or the next quarter.

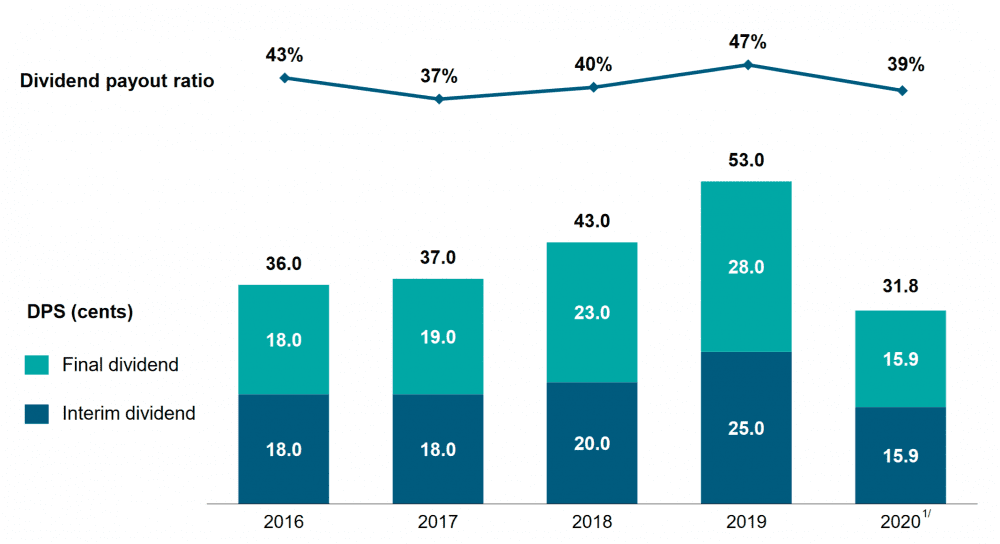

8. OCBC declared a total dividend of 31.8 cents per share for FY2020, down from 53.0 cents the year before. This drop in dividend is in line with the MAS recommendation that local banks cap their FY2020 dividends at 60% of that for FY2019.

Based on OCBC’s share price of S$12.36 (as at 31 May 2021), its dividend yield is 2.6%. Removing the cap and assuming that net profit returns to pre-pandemic levels, OCBC’s prospective yield is 4.3%.

The fifth perspective

OCBC has built a track record of delivering steady growth in earnings and dividends, except for 2020 due to the pandemic. Despite the challenges, the bank has remained resilient and was named the Best Managed Bank during COVID-19 by The Asian Banker.

OCBC’s dividend yield might be depressed at the moment, but income investors who are prepared to wait things out can expect dividends to increase in the next few years as the pandemic retreats and economies recover around the world.

Watch our roundtable: Are Singapore Banks Still Undervalued in 2021?

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Thank you so very much keep me more informed of Asia. Will you be writing about DBS as you did on OCBC?

Keep up the good work.

Thanks Barbara! Unfortunately, we did not get to attend this year’s DBS AGM.