SATS is a food solutions and gateway services provider, which is best known for managing most of the ground-handling services and in-flight catering at Singapore Changi Airport. Since SATS’ initial public offering (IPO) in 1999, the company has been paying a steady dividend over the years before the pandemic shut down global air travel.

In Q1 2021, SATS reported a 36% increase in revenue and net profit of SS6.4 million. However, without government reliefs, Q1 net profit would have been a loss of S$35.6 million. I attended SATS’ recent AGM to understand how the management plans to navigate the company out of the pandemic. Here are seven things I learned from the 2021 SATS annual general meeting.

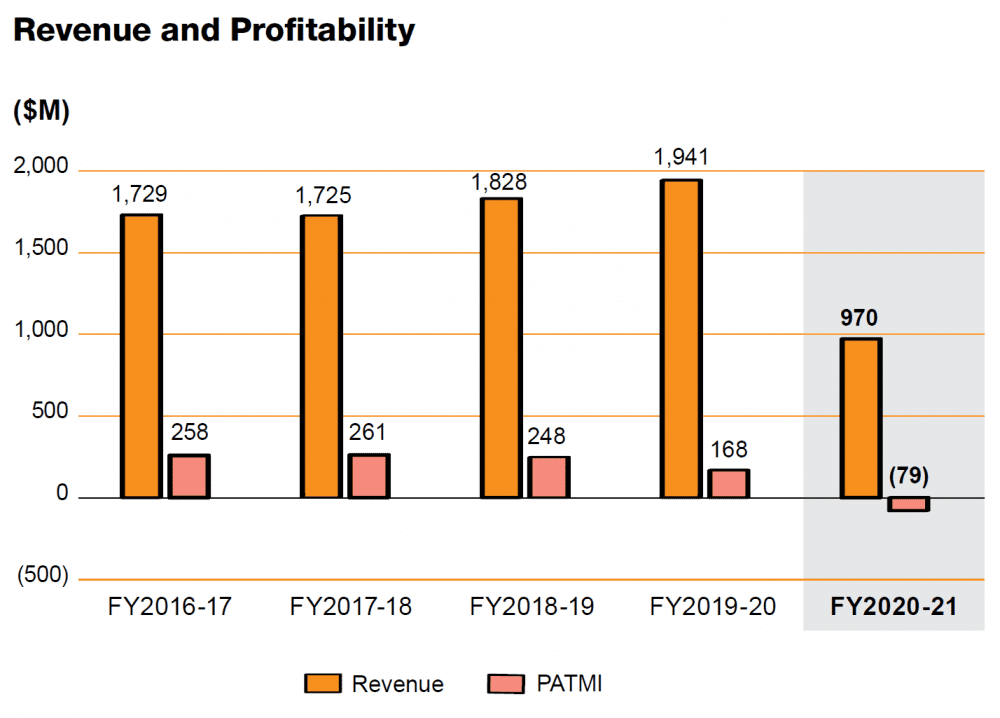

1. As SATS’ financial year ends on 31 March, FY2020-21 took the full brunt of the pandemic where revenue declined 50% to S$970 million, from S$1.9 billion the year before. The pandemic hugely affected SATS as airlines suffered a sharp decline in air travel demand following widespread travel bans and restrictions.

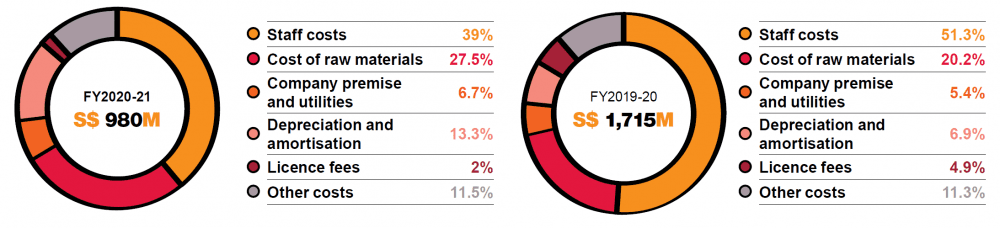

2. SATS took the opportunity to reduce its spending during the pandemic. SATS operating expenditure decreased 42.9% year-on-year to S$980 million in FY2020-21, from S$1.7 billion in FY2019-20. Staff costs decreased S$497.2 million due to lower salary related costs from a reduced workforce and lower contract services.

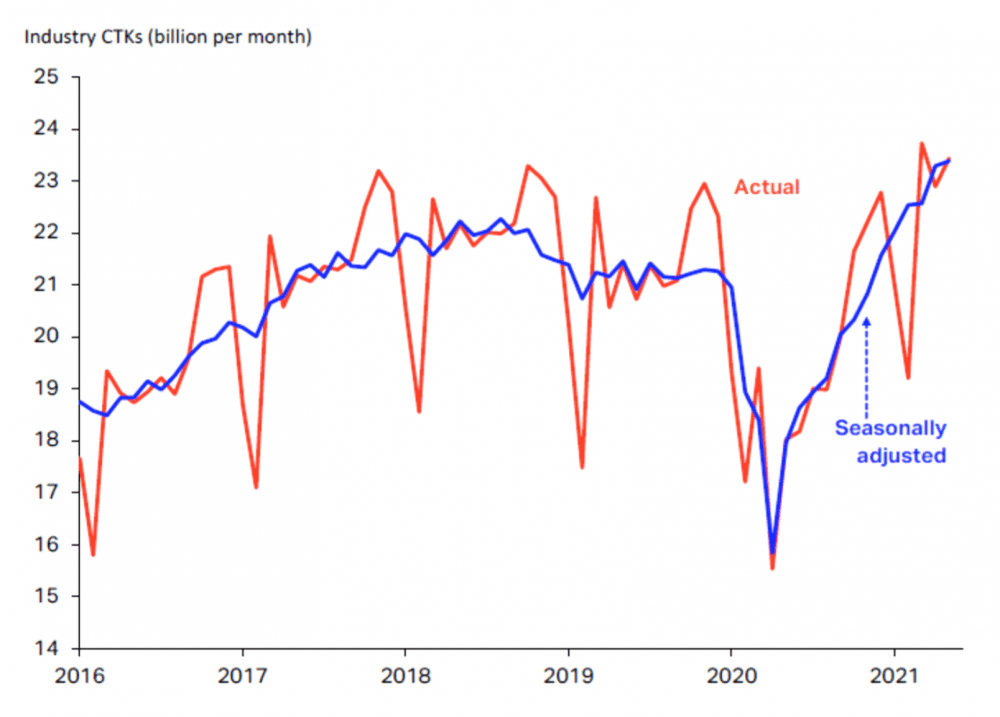

3. With the growth in eCommerce as well as shipment of healthcare and medical supplies, air cargo continued to show sequential growth. According to data from IATA, global cargo tonnage recovered from a sharp dip in the first quarter to levels that are now higher than before the pandemic. SATS also increased its market share in the air cargo space against larger players such as China Postal and Shun Feng Airlines.

4. SATS is continues to grow its non-aviation segment; non-aviation revenue increased 32% year-on-year to S$433 million in FY2020-21, from S$337 million in FY2019-20. Non-aviation currently makes up 44.9% of SATS’ total revenue. However, this is due to the significant decrease in aviation revenue which may continue to stay depressed in the next 1-2 years.

Due to evolving consumer preferences and rapid urbanization, Asia’s ready-to-eat market is expected to grow 5% annually from 2021 to 2025). SATS recognized this emerging opportunity and was able to tap onto it through wholly-owned subsidiaries Country Foods, SATS Kunshan and Monty’s Bakehouse as well as associates like Taj SATS in India.

The CEO also mentioned that in China, SATS Kunshan attained double-digit growth from key customers such as Yum China, Alibaba, Dingdong Maicai, and Costa Coffee. In Singapore, Country Foods is also gaining ground in the retail market through distribution of new brands such as Europastry and Growthwell. SATS also launched Home Chef ready-to-eat meals in 7-11 stores, along with new products in Cheers and FairPrice outlets.

5. SATS’ cash reserves remain strong at over S$880 million. To cater for the uncertainties of the pandemic, SATS built up their cash reserves using a mixture of short-term money market borrowings, bank loans, and medium to long-term bonds.

6. A shareholder asked how the management is reprioritizing capex to balance the needs of liquidity and cashflow. CEO Alex Hungate mentioned that SATS will continue to ringfence capex investments for transformational projects that will increase the company’s efficiency and productivity to provide better services for customers. He added that SATS will continue to look for potential acquisitions to gain market share in non-aviation and aviation services across Asia.

7. Chairman Eileen Goh mentioned that SATS will not distribute a dividend this year considering the significant challenges caused by the pandemic. She added that the cash will be used for preserving jobs as well as pursuing strategic opportunities to sustain growth for the future of the company.

The fifth perspective

COVID-19 has severely impacted SATS revenue and it will take a few years for the company to recover to pre-pandemic levels. On the bright side, SATS showed great adaptation during the pandemic to expand its non-aviation segment which has helped to cushion the blow.

Although SATS suspended its dividend in FY2020-21, we can reasonably expect dividends to resume once business returns to normal. Based on SATS share price of S$3.99 (as at 10 August 2021) and assuming dividend per share returns to 19.0 cents pre-pandemic, SATS’ expected yield is 4.75%. However, this may take a few years to play out as air travel is only expected to recover to pre-pandemic levels in 2024.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »