COVID-19 has been a giant problem for airline businesses around the world, Singapore Airlines (SIA) notwithstanding. SIA, a national brand and arguably a representative of Singapore’s global image, recently held its AGM. I attended the meeting in the hopes of finding out more nuggets of useful information to evaluate recent performance.

I was disappointed. I personally felt that the management could have given a clearer roadmap and timeline of how the airline plans to navigate its way out of the pandemic and eventually return to profitability. SIA’s AGM Responses to Shareholder Questions are available here, as is their presentation.

Below, I’ve chosen to go over some of the information and add more colour to the details provided. To management’s credit, keep in mind that the company operates in an extremely competitive environment, and it is in shareholders’ best interest to keep competitive information hidden as much as possible.

1. Liquidity

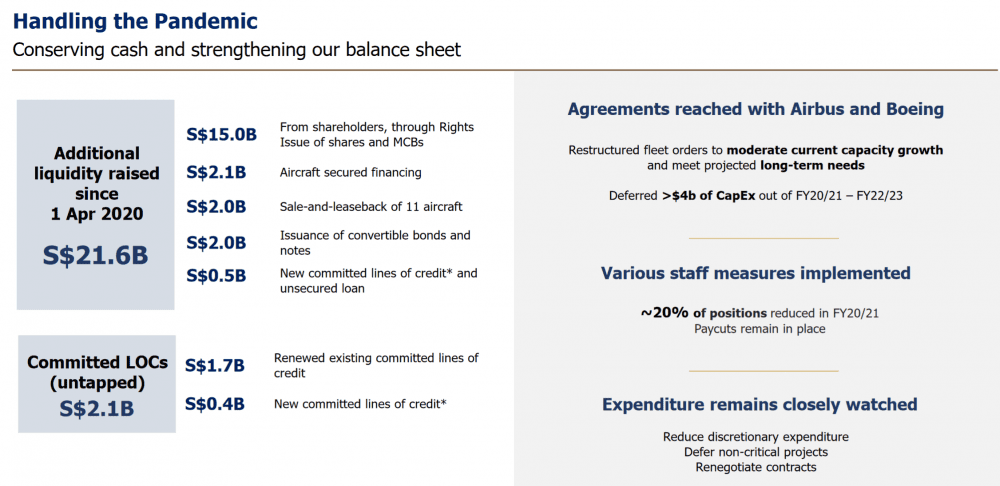

In its presentation, SIA made special note of its liquidity and funding. The aim was to assure investors that the company remained fully able to function and hopefully position itself better for the turnaround.

Based on latest annual reporting numbers, total expenditures pre-pandemic was approximately S$15-16 billion, and about S$6 billion during the pandemic. Rough math implies that the liquidity raised can allow SIA to continue its current mode of operations for approximately 2-3 more years assuming no recovery in passenger travel, which remains its biggest revenue generator. If SIA slashes its monthly operating expenses to S$150 million, then perhaps the S$21.6 billion in raised liquidity could last the company approximately 10-12 years accounting for variations.

To gain a full measure for how deep the cost cutting has gone, we would need another year of results from SIA to be sure that the S$150 million per month cash burn rate is accurate. In my opinion, if passenger uptake rate remains lacklustre, more funding may have to be secured (if we take 2020 operating expenses at face value).

At its current debt-to-equity ratio of 0.92, SIA, if facing yet another cash crunch, is likely to do what it did before — raise rights, sell convertible bonds, and borrow as much as it is allowed to in order to survive until the global reopening of economies.

Both rights and mandatory convertible bonds are dilutive to shareholders; shares outstanding have gone from 1.2 billion in 2019 to 2.9 billion as of latest release. Without profits streaming in, persistent cash burn means that shareholders will see poor returns.

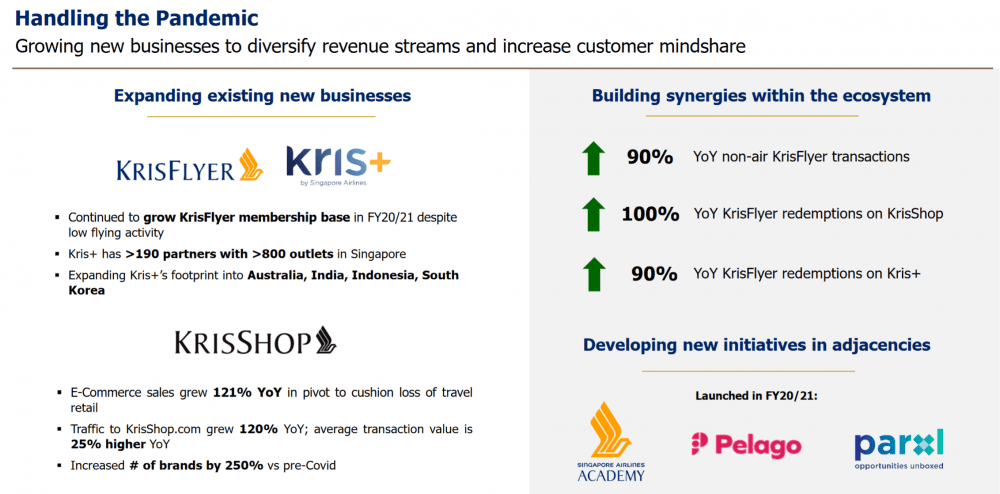

2. SIA’s e-commerce plans: A big unknown

Some of the relativefigures were given regarding SIA’s intent to develop adjacent revenue streams; in particular, KrisShop e-commerce sales grew 121% year-on-year. This was nice to see but remains a big question mark.

Contributions to revenue were not disclosed in detail and the impact on the bottom line is ultimately a big unknown. It is unlikely to have made an impact capable of replacing passenger tickets and remains an adjacent business for SIA.

3. Cargo demand strong but not enough

Part of the pandemic plan to earn revenue was to convert passenger aircraft into cargo carrying aircraft. Management has mentioned: ‘Cargo demand fundamentals remain strong, with Purchasing Managers’ Indices for most key export economies still in expansionary territory and inventory restocking in progress. Overall airfreight demand is expected to be healthy in the coming months, and industry cargo capacity continues to be tight.’

Cargo flown revenue rose by S$758 million (+38.8%) year-on-year to S$2,709 million which helped to offset the plunge in passenger flown revenue. While the extra cargo revenue is positive, ultimately, passenger traffic must recover for SIA to emerge from the pandemic.

4. Oil will continue to impinge profits

When you operate what are essentially massive flying buses requiring vastly more fuel, you are directly exposed to the price of oil. Two things stood out to me:

- SIA has paused its fuel hedging activity as of March 2020 at the onset of the pandemic, so any potential oil price increases could impair profits. (At the same time, SIA’s hedging policy was a lightning rod for criticism at past meetings.) SIA has currently hedged up to 59% of its fuel consumption needs until end-March 2025 at US$74 per barrel for jet fuel.

- The amount of which oil prices will impact operating expenditures has been stated: ‘The jet fuel price risk sensitivity analysis is based on the assumption that all other factors, such as the uplifted fuel volume, remain constant. Under this assumption, and excluding the effects of hedging, an increase in price of one USD per barrel of jet fuel affects the Group’s and the Company’s annual fuel costs by S$13.5 million and S$12.9 million respectively.’

I would keep a close eye on global jet fuel prices if I held shares in SIA.

5. Dividends uncertain

A shareholder asked when a turnaround for dividends could be seen. Management’s response was that any dividends would depend on financial performance and trajectory. Out of the many dark things befalling SIA, it’s good to see the company not give out much needed cash in perhaps its hour of greatest need. I’ve watched one too many midstream companies in the U.S. do a similar thing before declaring bankruptcy. Here, Hyflux should serve as a stark reminder.

The fifth perspective

Airlines — globally, with few exceptions — were seen as a perennially challenging industry pre-pandemic and COVID-19 hasn’t changed that view.

Regarding the exceptions, two airlines have proven capable stewards of shareholder capital for brief periods of time. First Southwest Airlines with its famous low-cost focus, and now Ryanair (though the future remains uncertain). However, it is unfeasible for Singapore Airlines to fully adopt a budget model due to its key role as a symbol and ambassador of Singapore.

Four factors drive the perennially poor performance of most airline businesses:

- Their inability to raise prices

- Their inability to negotiate costs

- High fixed operating expenses

- Annual increments in wages for salaried workers

These factors are a reality for airlines and not a phase that can simply pass. Success as a company within the industry entails working within these factors, not without.

Investors are encouraged to do deeper digging within the sector to find which companies has satisfactory returns on capital, how these are achieved, and whether it is sustainable looking forward. This is especially the case for the investment world, where hindsight proves an unreliable source of learning.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »