Established in 1963, Dutch Lady Milk Industries Berhad manufactures and distributes dairy products including growing-up milk powder, liquid milk, and yogurt. Dutch Lady is a household name in Malaysia. It was estimated that almost six out of 10 households in Malaysia consumed Dutch Lady products in 2021.

Here are seven things I learned from the 2022 Dutch Lady Milk Industries AGM.

1. Revenue grew 3.0% year-on-year to RM1.1 billion in 2021 because of continued strong in-home consumption of its products. Its product volume growth was 7% during the year. The dairy manufacturer’s market share improved from 23.7% in 2019 and 25.5% in 2020 to 26.6% in 2021, more than double the closest competitor’s market share of 11.8% in 2021.

Net profit surged more than threefold from RM73.4 million in 2020 to RM248.0 million in 2021. If we had removed one-off items — such as the gain from disposing of its factory in Petaling Jaya, Selangor — net profit excluding extraordinary items would have grown 26.9% from RM66.2 million to RM84.0 million over the same period.

2. Between 2021 and 2025, the company will be investing RM400 million in its new manufacturing plant at Techpark in Bandar Enstek, Negeri Sembilan using its internal cash. When operational by 2024, the new plant will be three times larger than the company’s existing factory in Petaling Jaya while its production capacity is expected to double in the future. The new plant measures 33 acres and is located within an industrial park.

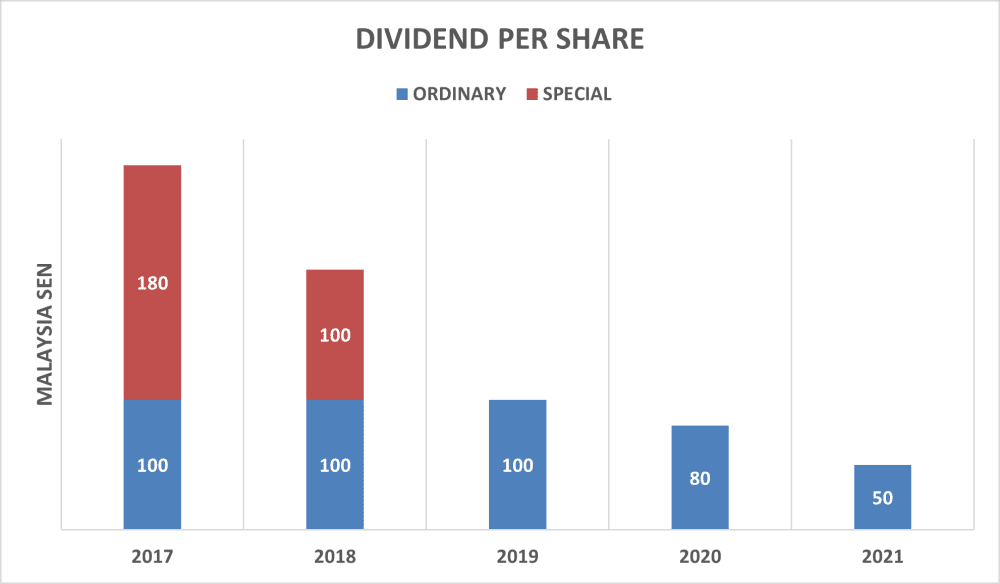

3. Dividend per share stood at a five-year low at 50 sen in 2021 as the management reserved cash for the new factory expansion. Similarly, dividend payout ratio excluding extraordinary items dropped from 77.4% in 2020 to 38.1% in 2021.In my opinion, the company could have raised loans to finance the capital expenditure since it has zero debt and a huge cash pile of RM118.3 million in 2021. In that case, dividend per share could be maintained and its share price would not be hammered.

4. The company faces a number of headwinds in protecting profit margins in the short term. Global dairy raw material prices stood at an all-time high due to supply chain disruptions. The situation was further exacerbated by the weakening ringgit against the U.S. dollar, China’s zero COVID policy, and the Russia-Ukraine crisis. Its operating costs have increased amid the current inflationary environment.

A portion of the increases in raw material costs can be passed on to consumers gradually but not too drastically since consumers are sensitive to price adjustments. In Q1 2022, its revenue and net profit excluding extraordinary items grew 15.9% and 67.3% year-on-year to RM299.9 million and RM21.2 million respectively as a result of higher sales volume as well as price increases in its products.

5. Minority Shareholder Watch Group (MSWG) pointed out that the company’s revenue from the mainstream growing-up milk segment dropped 12% year-on-year in 2021 in line with the industry’s decline. Managing director Ramjeet Kaur Virik explained that the segment targets kids between one to three years old. Mothers whose income was impacted by the pandemic relied on breastfeeding or no longer fed their kids with milk against the backdrop of the nation’s lower birth rate. Ramjeet also explained to MSWG that the company hedges about 70% of its raw materials purchases — that are largely denominated in USD — for six months.

6. In April 2021, the company signed a memorandum of collaboration with the Department of Veterinary Services to boost the nation’s supply of fresh milk locally and promote sustainable farming. It has trained 536 farmers since 2013 and 144 local farmers virtually in 2021. Dutch Lady is the largest purchaser of local fresh milk in Malaysia by purchasing a total of 37.9 million litres of milk locally since 2011.

7. A shareholder noticed that there was a prepayment to a related company amounting to RM125.7 million in 2021. Ramjeet responded that the advanced payment involved purchases of raw materials from a related party at a discount.

The fifth perspective

Investing in Dutch Lady Milk Industries is a longer-term game. The company will face multiple setbacks in the near term as mentioned. Its dividend payment will likely remain lacklustre due to capital expenditure. However, the company is likely to resume its dividend payment to shareholders once the new factory is commissioned.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »