Heineken Malaysia Berhad is one of the leading breweries in the country, known for producing and distributing a portfolio of iconic brands, including Heineken, Tiger, and Guinness, since 1964. With over 60 years of presence in Malaysia, the company is listed on Bursa Malaysia and plays a leading role in the Malaysian alcoholic beverage industry.

The 61st annual general meeting of Heineken Malaysia in 2025 marks the first under the leadership of the new Managing Director, Mr. Martijn Rene van Keulen, who joined in July 2024 after a 24-year career with Heineken across various countries, including Japan, Myanmar, and New Caledonia.

Here are eight things I learned from the Heineken Malaysia AGM.

1. Revenue growth remained solid for FY2024. Heineken Malaysia delivered 6% revenue growth in FY2024, reaching RM2.8 billion. The performance was supported by effective commercial execution, longer festive periods for Chinese New Year, and an early-year-end sale to prepare for the upcoming Chinese New Year.

2. Heineken Malaysia achieved a record net profit of RM467 million in FY2024, marking a 21% year-on-year increase. This strong performance was supported by effective cost management, a recovery in consumer confidence, and tax benefits from reinvestment allowances. Profit before tax rose 14% from the previous year to reach RM584 million.

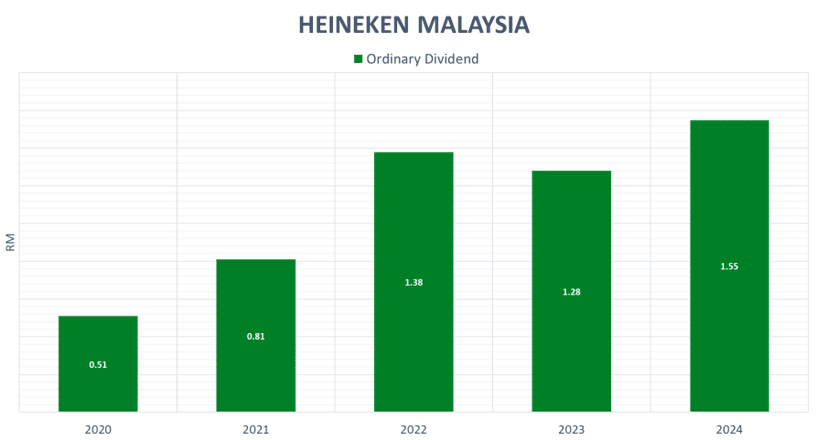

3. Heineken declared a total dividend of 155 sen per share, comprising a 40 sen interim and a 115 sen final dividend. This represents a 100% dividend payout ratio of net profit. Despite a shareholder request during the AGM, management stated that they are not considering and have no plans to introduce quarterly dividends, and will continue to maintain semi-annual dividends.

4. Heineken Malaysia reported a 3% decline in revenue for Q1 FY2025, amounting to RM764 million, mainly due to timing effects related to the Chinese New Year. Despite the dip, profit before tax and net profit remained stable at RM161 million and RM122 million, respectively. According to management, the resilience in profit was supported by effective cost management and financial efficiency.

5. In 2024, Heineken Malaysia continued to innovate with the launch of three new products aimed at younger consumers:

- Tiger Soju Flavoured Lager: A beer-soju hybrid tapping into Korean-inspired trends

- Edelweiss Peach: A sweeter drink tailored for Gen Z consumers.

- Guinness Draught in a Can: Brewed locally with a special nitrogen widget for a smooth, pub-like pour at home.

These moves reflect the company’s effort to stay relevant with evolving consumer preferences, and it has promised to continue with product innovation.

6. Its three flagship brands — Heineken, Tiger, and Guinness — all posted strong growth as signalled by management, with Heineken leading the charge. Throughout the year, notable campaigns like ‘Celebrate Boring’ and tie-ups such as Tiger x Manchester United and Guinness x Premier League boosted visibility and engagement across key demographics.

7. Illicit beer remains a huge issue in East Malaysia, with management stating that around 70% of beer sales in the region may be illicit. Chairman Dato’ Sri Idris Jala noted that this was due to two factors: high excise duties and porous border control. The company is working closely with the authorities to continually improve enforcement and redirect consumption to legitimate channels.

8. A shareholder raised concerns about the potential impact of tariff pressures resulting from global geopolitical tensions. Management responded that Heineken Malaysia is largely insulated, as it neither exports to nor imports from the U.S. directly. However, they will closely monitor the indirect effects, such as currency volatility.

In terms of the 2025 outlook, Heineken Malaysia expects a challenging but manageable environment. Key headwinds include global economic uncertainties, currency fluctuations, and the persistent issue of illicit alcohol. Despite these challenges, management remains optimistic, citing growing tourism and rising disposable incomes as supportive tailwinds. The company plans to continue investing in digitalisation, sustainability, and innovation to drive long-term growth.

The fifth perspective

The 2025 Heineken Malaysia AGM highlighted not only the company’s excellent financial performance but also its commitment to embracing change under new leadership, while staying close to its core values. From sustainability initiatives to innovations targeting new generations, the company is poised to navigate the evolving landscape effectively. Throughout the Q&A sessions of the AGM, I can see that shareholders are appreciative of the consistent returns and strategic direction, reinforcing confidence in the company’s future trajectory.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »