Listed in 2013, KLCCP Stapled Group is the largest listed REIT in Malaysia. It owns landmark properties around the KLCC precinct, including the PETRONAS Twin Towers, Menara ExxonMobil, Menara 3 PETRONAS, Kompleks Dayabumi, Suria KLCC, the Mandarin Oriental Kuala Lumpur (MOKUL Hotel), and a 33% stake in Menara Maxis. The Group is also involved in asset management services such as facility and car park management. Following the COVID-19 pandemic, it had a strong year in 2024.

Here are eight things I learned from the 2025 KLCCP AGM.

1. Revenue grew 5.7% year-on-year to RM1.7 billion in 2024, which is a record high since its listing in 2013. Distribution per stapled security increased 9.9% year-on-year from 40.5 sen in 2023 to 44.5 sen in 2024 as operating costs remained stable during the year.

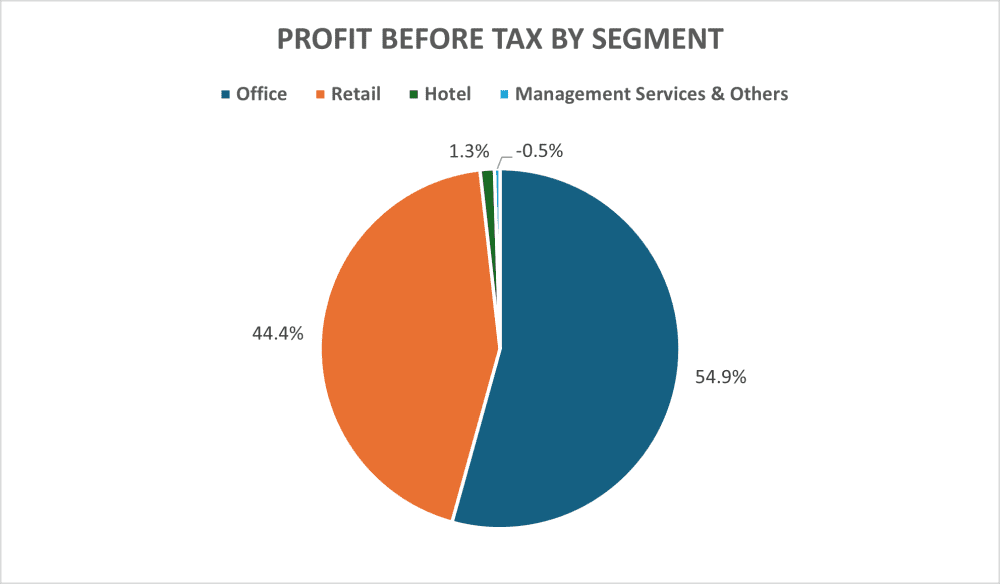

The office and retail segments were the two dominant contributors, accounting for nearly all of the Group’s profit before tax in 2024. In contrast, the management services and other segment recorded a loss before tax after financing costs were deducted.

2. The office segment delivered a stable performance in 2024, with all office assets fully occupied and primarily leased to tenants under long-term triple net leases. The segment also recorded a positive rental reversion for the PETRONAS Twin Towers in October 2024.

3. Suria KLCC is the Group’s sole retail asset. In 2024, it achieved higher base rents, supported by positive rental reversions from renewing tenants and favourable initial rates from new tenants. Occupancy improved from 96% in 2023 to 99% in 2024, while footfall rose 4.2% year-on-year, from 48 million to 50 million. However, total tenant sales declined 7% year-on-year.

4. In 2024, the Group acquired the remaining 40% stake in Suria KLCC that it did not previously own for approximately RM2.0 billion. The acquisition yield was around 6%, making it yield-accretive and higher than the Group’s distribution yield of about 5.6% at the time. The purchase was financed through the issuance of Sukuk Wakalah in April 2024, at an average interest cost of 3.8%. As a result, the Group’s gearing rose from 17.7% in 2023 to 31.6% in 2024—still at a manageable level. Nearly 91% of the borrowings are on fixed rates, and the average debt maturity was extended from 2.3 years in 2023 to 4.6 years in 2024. Management also expressed confidence in refinancing the RM388.2 million term loan maturing in Q2 2025 at a lower cost.

5. MSWG highlighted a RM4.1 million decline in revenue from the Menara 3 PETRONAS retail podium, following a drop in occupancy from 88% in 2023 to 80% in 2024. The CEO attributed this to a moderation in luxury retail sales after the post-pandemic ‘revenge spending’ trend subsided. Additionally, inflationary pressures affected consumer behavior, dampening the performance of luxury retailers, which form a significant portion of the podium’s tenants. Nevertheless, the podium accounted for only about 6% of total retail revenue, making its overall impact minimal.

6. The Group recorded higher management services revenue in 2024, driven by increased maintenance activities, newly secured facilities management contracts, and an expanded car park footprint.

7. The hotel segment delivered improved performance in 2024, supported by increased group stays and banqueting activities. Revenue per available room (RevPAR) rose 20.8% year-on-year to RM610, while occupancy increased from 55% to 58%, with foreign guests making up 79% of total occupancy.

Although MSWG noted that MOKUL Hotel’s 9M2024 occupancy rate of 58% lagged behind Kuala Lumpur’s five-star hotel average of 72%, management emphasized its focus on maximizing RevPAR within the premier luxury segment. This strategy was validated by a record-high RevPAR in 2024 and the hotel’s ability to generate a RM3.0 million profit before tax in 2023 at just 55% occupancy. The CEO also highlighted that MOKUL’s RevPAR remains ahead of peers.

8. With an appraised value of RM821.0 million in 2024, a unitholder suggested that the management consider divesting MOKUL and reallocating resources to more productive areas. In response, the management stated its intention to continue pursuing MICE (meetings, incentives, conferences, and exhibitions) opportunities to enhance the segment’s performance.

The fifth perspective

KLCCP Stapled Group acknowledged a dynamic operating landscape shaped by geopolitical tensions, supply chain disruptions, domestic political shifts, economic volatility, and global trade complexities. It also highlighted sector-specific challenges, including office oversupply, evolving tenant expectations, shifting consumer spending patterns, and increasing competition and costs in the hotel segment.

Despite these headwinds, the Group remains confident in its continued strong performance. This optimism is supported by long-term office leases, the enduring appeal of its iconic assets such as Suria KLCC and the PETRONAS Twin Towers, and the premium positioning of its hotel offerings.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »