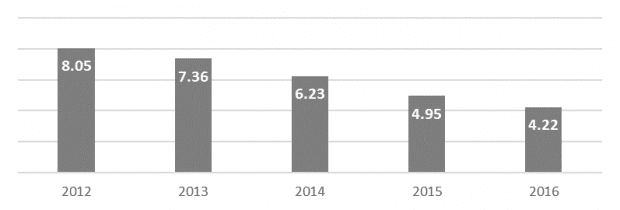

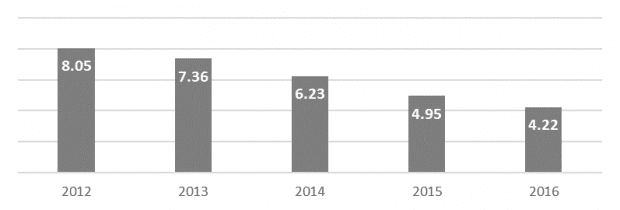

Bedok Point, one of the Frasers Centrepoint Trust’s (FCT) suburban malls located in the east of Singapore, has been losing its charm ever since a new shopping mall, Bedok Mall, located right next to Bedok Point, came into operation in 2013. The poor performance of Bedok Point is reflected in its net property income from 2012 to 2016:

Bedok Point Net Property Income (in SGD millions)

Bedok Point was acquired from FCT’s sponsor, Frasers Centrepoint Limited (FCL) in 2011. Now everything seems to be going downhill after the change of ownership. On hindsight, it seems that FCT overpaid to acquire this property and the acquisition is no longer yield accretive.

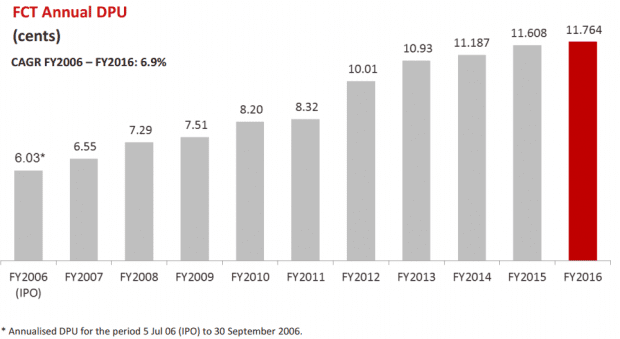

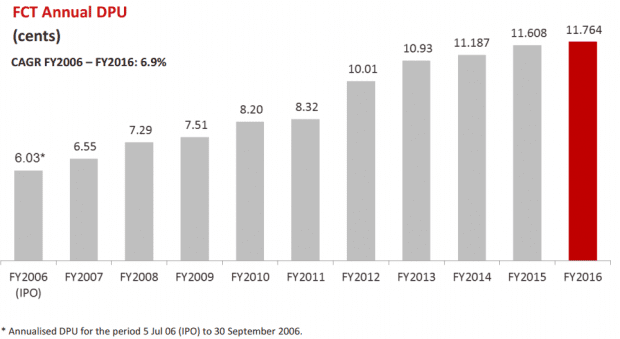

Despite Bedok Point’s poor performance, several unitholders praised the management for doing a fantastic job at FCT. And it’s easy to see why – FCT has been rewarding unitholders with growing dividends over the last 10 years since IPO:

FCT’s historical DPU performance is remarkable considering the challenges the Singapore retail industry has been facing the past few years. But one struggling acquisition hasn’t impaired FCT’s performance thus far.

So how did the Bedok Point lose its charm?

According to Dr Chew Tuan Chiong, CEO of FCT, a suburban mall can be highly successful if it is large enough and close to an MRT station. When there was a land sale next to Bedok MRT station, they knew it was going to be a threat to Bedok Point. Unfortunately, their sponsor, Frasers Centrepoint Limited, didn’t win the bid.

Today, Bedok Mall is Bedok Point’s largest direct competitor as the former is more than two times larger and is directly connected to Bedok MRT and Bedok Bus Interchange. To make matters worse, the manpower crunch and poor retail sentiment in Singapore have hit tenants hard and cause others to slow their expansion plans. As a result, mall occupancies have dropped.

Dr Chew continued to explain why the management is having a hard time turning the asset around: “Some retailers in Bedok Point are doing well but because of the lack of manpower, they’ve had to consolidate and pull out from the mall. When you have vacancies at the mall, visitor numbers drop as there are fewer shops, and the vicious cycle follows.”

At this point, the management is still trying all means to turn the mall around, but the REIT would explore the options if it received any third-party offers to acquire the property. Luckily, Bedok Point constitutes only 3% of FCT’s total asset portfolio and isn’t going to affect FCT’s dividends significantly.

Here are some important things to take note:

- Every dollar invested in FCT in 2006 would have grown to $2.90 in ten years. Of this, dividends contributed almost half of the total return. This goes to show that the dividends you receive over the years play a significant role in your overall investment returns.

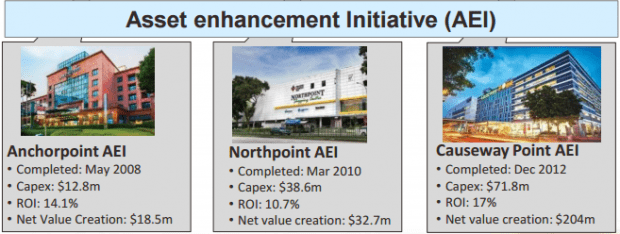

- Asset enhancement initiatives (AEIs) were the biggest contributor to the DPU growth over the years. Dr Chew explained to unitholders present at the AGM that the growth in DPU was driven by a combination of organic growth in rental incomes, acquisition of yield-accretive assets, and AEIs of FCT’s existing properties. Of the three, AEI was the most important. FCT has carried out major AEIs on three malls: Anchorpoint in 2008, Northpoint in 2010, and Causeway Point in 2012. All three malls have since generated a double-digit return on its investment as shown below:

Moving forward, FCT is carrying out another substantial AEI for Northpoint at an estimated CAPEX of $60 million. The AEI, which started last year, will seamlessly integrate Northpoint Mall with Northpoint City, which is currently owned by FCT’s sponsor. Expected completion is Sep 2017 and Dr Chew believes the AEI will deliver another positive return on investment and increase the sustainability of FCT’s DPU in the long-term.

- The AEI at Northpoint has caused the occupancy rate at the mall to temporarily drop from 98.2% to 70.9%. As Northpoint contributes nearly one quarter of FCT’s overall net property income, the impact on DPU is likely to be greater than Bedok Point. Accordingly, investors should not have too high an expectation that FCT’s DPU will grow this year. However, there are ways to ensure that DPU remains stable for unitholders. For example, FCT managed to keep its DPU stable when Causeway Point underwent major AEI in 2012. There are a couple of tools the manager can employ to stabilize its DPU. Firstly, property tax comprises a huge amount of a REIT’s expenses. When a mall is under renovation, the vacant units qualify for property tax relief. So while the REIT earns a lower rental income when vacancies rise, it also has lower expenses. Secondly, the REIT manager may elect to receive its fees in units instead of cash. According to Dr Chew, the management typically receives 80% of its fees in cash but may choose to lower this percentage during an AEI to free up cash for distributions. However, he acknowledged that electing to receive fees in units is not sustainable in the long term. Therefore, it is important to ensure the AEI is successful.

- Despite the tough retail environment, FCT achieved positive rental reversions of 3.6% to 18.9% for its malls excluding Bedok Point. This was achieved because malls like Northpoint and Causeway Point (both comprise 70% of FCT’s portfolio) are strategically located in suburban areas and connected directly to an MRT station. Therefore, the demand for leases is still extremely high. According to Dr Chew, tenants would rather pay a higher rent in a mall that gives them higher sales and a better profit margin than one that has a lower rent but makes them less sales and profit. The consolidation of the retail market will only speed up this process as tenants increasingly focus only on malls located in prime location which are likely to benefit from positive rent reversions despite the tough market conditions.

- The occupancy rate at Changi City Point is relatively low at 81.1%. On weekdays, office workers visit the mall. On weekends, the crowd mainly comes from shoppers visiting Singapore Expo for events. Therefore, the shopper profile at Changi City Point isn’t well defined. With the upcoming Jewel Changi Airport mall located only one train stop away from Singapore Expo, some potential tenants are adopting a wait-and-see approach. That’s why things are not looking good for Changi City Point at this point.

Looking to invest in S-REITs? Find out how to identify the best S-REITs for your REIT portfolio.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

(Photo: Frasers Commercial Trust)

Good article Rusmin, a lot of useful information in not a lot of words. I highly recommend The Fifth Person to my friends!

However, don’t most of us agree that there’s a massive oversupply of retail space in Singapore and the ongoing effect of eCommerce seems like its going to make the situation even worse? With some exceptions almost all the malls have quite a few empty units. When it gets over 10% it starts to look unhealthy.

Thanks for your support and kind words, Jonathan.

E-commerce is certainly disrupting certain retail malls in Singapore. Far East Plaza is one of the few victims that have been disrupted as more and more people shop online for clothes (blogshops) and electronics (Qoo10, Lazada, and Amazon) and those tenants constitute the majority of Far East Plaza’s NLA.

However, some malls continue to experience positive rent reversions despite the credit crunch and e-commerce threat. NorthPoint is one good example that continues to hold a strong monopolistic position in the Yishun area. I still think the mall has its own unique identity and, besides, the manager of most retail REITs have shifted their focus toward food and lifestyle which is something can’t be replicated online.

Regarding the oversupply situation, I am less concerned for local malls as the government seems to control the supply pretty well. However, take note that the Jurong area seems to be experiencing some headwind for mall operators as there is plenty of supply being built to cater for the High Speed Rail connecting Singapore and KL.