Bitcoin mania has arrived, yet again. Since 1 October 2020, the price of Bitcoin surged +220% to US$34,410 as of 12 January 2021. All in the span of three months. Coincidentally, this mirrors the hype between October and December of 2017 when the cryptocurrency surged +341% in two months to hit a then high of US$18,985.

Is there still room to get in on the bandwagon? Or does the post-hype crash in 2018 provide a cautionary tale of what is to come?

What is Bitcoin

Before getting overly enthusiastic for either camp, it is important to understand what Bitcoin is, besides being the most prolific cryptocurrency in the market.

At its core Bitcoin is a digital currency that is tradeable and can be used to perform transactions. It was launched in 2009 with the original aim to be a means of securing transparent payments over the internet as e-commerce grew. Every Bitcoin transaction that is performed requires verification, and this is achieved via a network of miners who are incentivised with Bitcoin payments for every successful verification.

This entire process essentially creates a long chain of verified transactions which is transparent and immutable. This account of transactions is also called a distributed ledger, or blockchain.

Based on the mathematical model that underpins the creation of new Bitcoins for every successful transaction that is verified by miners, the supply of Bitcoin is limited to 21 million coins. As of 12 January 2021, the supply of Bitcoins in the market stands at 18.6 million.

What determines the price of Bitcoin?

Just as with any asset, demand and supply for Bitcoin drives its price. In Bitcoin’s case, the 21-million-coin theoretical supply limit cements its scarcity.

On the demand side, there seems to be a few major players: 1) Bitcoin agents and proprietors, 2) billionaires, and 3) retail money.

In December 2020, however, financial news reports have been increasingly suggesting that a fourth major player has emerged: institutional money. British fund manager Ruffer Investment Management and U.S. Insurer MassMutual revealed that they bought US$745 million and US$100 million in Bitcoin respectively. This revelation has coincided with the recent surge in prices.

More interestingly, a note from JPMorgan strategists revealed that if pension and insurance funds in the U.S., eurozone, UK and Japan each allocated 1% of their portfolios to Bitcoin, that would amount to an additional US$600 billion inflow. As of 12 January 2021, Bitcoin’s market capitalisation stood at US$657 billion which means its current price could roughly double, assuming supply remains relatively constant post-inflow.

While the longer-term argument towards institutional ownership seems plausible, at least for now, the spectacular rise in the price of Bitcoin points towards speculation rather than a sustained increase in institutional support. The current astronomical rise could be a case of frenzied retail money being crowded in by the wrapper of institutional support.

More worryingly, I would be cautious with Bitcoin being the avenue for the typical pump and dump scheme. Data from Flipside Crypto, a digital currency research firm, reveals that Bitcoin ownership is highly concentrated. The firm notes that 2% of anonymous ownership accounts control 95% of Bitcoin holdings. These owners can easily act in concert to create the impression of a bubble not to be missed, which crowds in unsuspecting retail accounts, before selling at the top to leave retail owners to bear the ultimate losses. To all the newly minted owners of Bitcoin, I say: ‘Buyer beware’.

Why buy Bitcoin

One of the commonly cited reasons for buying Bitcoin is that it acts as a good hedge against traditional asset classes such as equities and fixed income, assets that one would typically have in a portfolio of financial assets. For any asset to act as a good hedge, its value should ideally not move in the same direction as the value of the rest of the portfolio.

The traditional asset that performs this hedge is gold, whose value is typically uncorrelated to the movement in value of traditional financial assets such as equities and fixed income. Commentators have increasingly taken to naming Bitcoin the digital gold. For Bitcoin to act as a good hedge, its value should therefore not move in tandem with traditional financial assets.

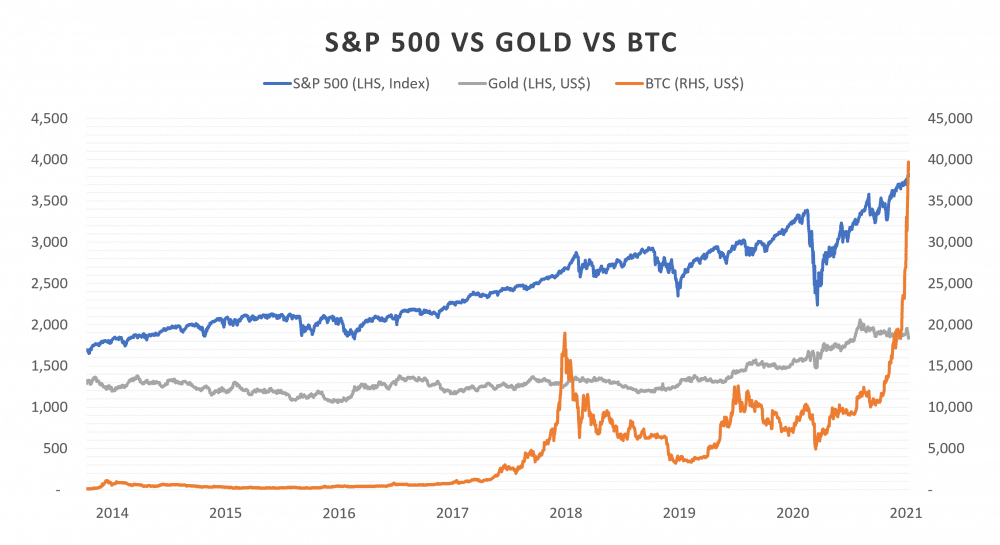

I am not convinced that Bitcoin’s value is uncorrelated with traditional financial assets. The data to date is patchy, in part because Bitcoin does not have a long track record given its launch only in 2009. In addition, taking the S&P 500 to be the measure of the traditional financial asset whose value one is looking to hedge against, the correlation of Bitcoin with the S&P 500 (between Oct 2013 and Jan 2021) is +0.88, while that for gold in the same period stands at +0.75.

In addition, based on price data for rolling 90-day correlations in the past seven years, Bitcoin exhibited zero or negative correlation to the S&P 500 index in 30% of all observations, compared with 50% for Gold. Therefore, I am not certain if I am convinced by the portfolio hedge argument particularly if one compares it with the existing role of gold.

Another reason proponents of Bitcoin cite to buy it is that it is a good store of value. As a digital currency without control over by central banks, Bitcoin is the anti-thesis to the widespread money printing taking place today which threatens the underlying value of fiat currency. With Bitcoin’s limited supply and assuming a stable core of demand, buyers of the cryptocurrency posit that its value can be retained.

While that may be true, my view is that Bitcoin yet remains too volatile to be a good store of value which one can expect to maintain a stable value through time. In that regard, gold, with its longer track record and relatively more stable prices, still proves to be a more reliable store of value.

The fifth perspective

Personally, buying Bitcoin is no more than a gambling punt. If you have spare change and can afford to lose that entire sum of money, then by all means place it in Bitcoin. However, at current prices, I will hesitate to enter if I have not yet done so.

My topmost concern is the possibility that the price of Bitcoin is being manipulated to facilitate the enrichment of a few concentrated owners, at the expense of the masses. Perhaps when and if prices fall dramatically, I might consider purchasing it. But it will not be any more than 1% of my overall financial portfolio. For now, though, I will be avoiding it with a ten-foot pole.

You have hit the nail on the head.

It is without any doubt a pump and dump by the 2% owners of 95% of bitcoin. They have all cashed out multi-millions to give themselves a very nice lifestyle, and now it’s just a huge manipulated game to see just how much more they can take from the punters.

On the way there will be doubtless a few others making money, but in the end it will be all the millions of small wannabee rich punters handing money to the big guys.

It will go down in history as the biggest global financial legal scam ever.

2% doesn’t own 95% of bitcoins…

perhaps you should do a deeper research on how bitcoin is created and distributed, and how price cycles moved throughout its history creating a greater and wider base of people holding, there’s no way 2% of the people own 95% of the supply

Hi wil,

This is according to research done by Flipside Crypto as reported by Bloomberg and Fortune.

https://fortune.com/2021/01/07/bitcoin-price-today-soars-ether-cryptocurrency-marketcap/

https://www.bloomberg.com/news/articles/2020-11-18/bitcoin-whales-ownership-concentration-is-rising-during-rally

And one of the claims is that bitcoin will remove control of the “fiat” currencies from the hands of the democratically elected and publically known and accountable guys, and put it in the hands of “the bitcoiners”.

In this case the totally anonymous and unaccountable two percent guys.

Bitcoin punters are amazingly gullible and naive.

When it was 3 digits = no no what bs is this

When it was 4 digits = its a scam, its a ponzi

When it’s 40k right now = god its too exp and a gamble

lol

Just found this article, must read one! https://crypto-anonymous-2021.medium.com/the-bit-short-inside-cryptos-doomsday-machine-f8dcf78a64d3

tick tick tick