CPF now among the top 8 pension funds in the world

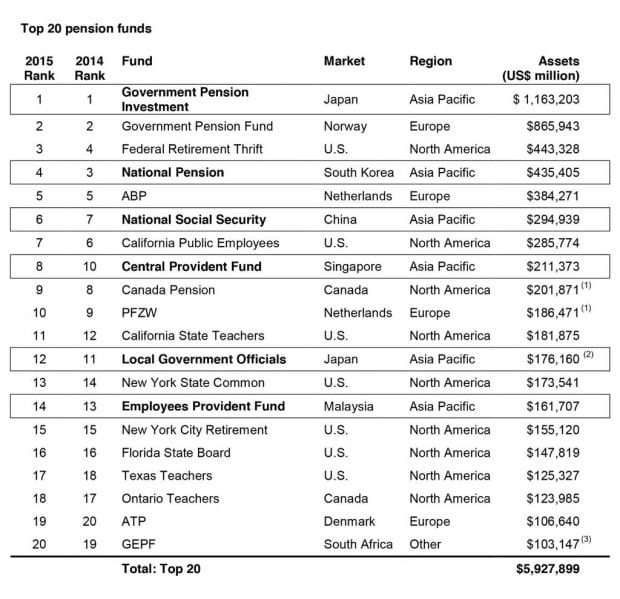

Singapore’s Central Provident Fund (CPF) has leapfrogged over Canada Pension and PFZW of the Netherlands to become the eighth-largest pension fund in the world, with assets worth some US$211.4 billion ($286.8 billion) as at Dec 31, 2015.

This is according to research released on Monday by US investment newspaper Pensions & Investments and global advisory firm Willis Towers Watson.

Data sourced from Willis Towers Watson.

In the Asia-Pacific region, CPF ranks as the fourth-largest pension fund, behind Japan’s Government Pension Investment with US$1.2 trillion, South Korea’s National Pension with US$435.4 billion, and China’s National Social Security with US$295.0 billion.

Total assets of the world’s largest 300 pension funds fell – for the first time since the 2008 global financial crisis – by over 3% in 2015 to a sum of US$14.8 trillion overall.

Asia-Pacific, however, saw an increase of around 1% during the year.

In the five-year period from 2010 to 2015, Singapore’s CPF grew 7.9% in US dollar terms – the fourth-highest growth in the top 20 funds globally. In local currency terms, Singapore funds experienced growth of 10%.

The highest growth in the top 20 funds globally in US dollar terms was experienced by China, which gained 17.8%, followed by the funds in Norway up 9.5% and South Korea up 8.5%.

“It has become clear that good investment governance is the key determinant in producing the competitive edge necessary to transform portfolios and succeed in the ever-evolving mission of trying to pay benefits securely, affordably and in full,” says Naomi Denning, managing director of Investments for Asia Pacific at Willis Towers Watson.

“There has been a fair amount of movement in the ranking in the past five years with winners likely being determined by having fully diversified portfolios that perform well in times of stress and a focus on total rather than relative returns,” Denning adds. “Another differentiator of leader funds is their ability to innovate or be an early adopter; critical in such a persistently low-growth environment.”

This article first appeared in The Edge Singapore Market Report.