DBS Group’s share price has somewhat stablised over the past month since the COVID-19 crash. Last Thursday, the bank released its first quarter results for FY2020. In short, it was a tale of two halves. The first two months saw the bank strongly on track to achieve its targets, while the final month revealed the stresses of current times. Management indicated that operating income remains robust, with a record quarterly income of S$4.0 billion that was up 13% over the previous year. Nevertheless, net profit declined 29% to S$1.2 billion primarily due to preemptive loan loss provisions.

While it is tempting to accept the resilience of the bank’s business given this quarter’s operating performance, I remain hesitant due to the sheer uncertainty of how deep and prolonged this recession will be.

Management provided detailed explanation on several tail risks that could affect financial performance, which greatly helps in framing the known unknowns. At the same time, there are a few other issues which deserve attention.

The (not so) good

Operating income set a record of S$4.0 billion in the first quarter. This can be attributed to a 7% rise in net interest income, 14% rise in fee income, and the clincher: a 39% rise in other income. Given current headwinds, DBS estimates weaker second to fourth quarter performance but overall FY2020 operating income to be in the region of the S$14.5 billion attained in FY2019.

The following reasons lead me to wonder if this is achievable: considerably lower net interest income and flatter growth in fee and other non-interest income.

On net interest income, the bank guided to between a S$500-600 million overall decline from the previous year. This is due to the fall in benchmark SIBOR and SOR interest rates, leading to lower interest income. On the flip side, the benefit from lower interest expense is somewhat limited as most of the bank’s deposits are savings accounts which are already close to zero and fixed deposits which are sensitive to competitive pricing. Looking at the steepness of the fall in SIBOR and SOR of between 60-80 basis points since January, I believe the guidance on net interest income can be flexed more to the downside especially given the Fed’s unprecedented liquidity injections.

On fee income, it was interesting to note the reaction of DBS’s wealth management clients’ activity during the market sell-off. In general, greater wealth management client transactions from either the rush to cash or the repositioning of portfolios led to higher fees. The 14% growth is therefore largely due to heightened market volatility in February, and in the absence of further price swings, there is likely to be normalisation in client activity and therefore fees earned.

Finally, on other non-interest income, this was the significant 39% growth which helped to cement DBS’s record quarterly operating income. Income from this line is typically attributable to trading activities from the Treasury and Markets division. I appreciate how this is a source of counter-cyclical income as higher market volatility during recessionary periods leads to higher trading income. However, it was mentioned that a portion of the income was due to the harvesting of investment book gains. Such gains are typically the result of a discretionary choice taken by management. I am not sure how much of total book gains were released this quarter and how much of unrealised gains there is left, but it is important to note that the profit released this quarter from the investment book will not be available in future quarters.

The bad

The concept of tail risk was frequently cited by DBS CEO, Mr. Gupta, during both the media and AGM briefs. Tail risks are low probability events that could occur. In general, when making plans or budgets, management would do so based on what has the highest likelihood of happening. At the same time, it is important to consider tail risks to know how to react should they occur. Especially for tail risks with a huge negative impact (i.e. black swans) it is even more important to have insurance against such events.

DBS’s main tail risk is that its stock of nonperforming loans ends up being significantly more than what is expected. How large that becomes depends entirely on the depth and length of this economic downturn, which unfortunately no one can predict. One can therefore think of the significant increase in loan loss provisioning done this quarter as insurance against declining credit quality. The bank expects a total of between S$3-5 billion in loan loss provisions to hit the income statement in the next two years.

Top of everyone’s minds when it comes to credit risk is probably the Hin Leong saga and DBS’s exposure to oil and gas companies. However, the actual amount of specific loan loss provisions set aside for this oil trader is more than manageable when viewed in context of DBS’s operating income. What remains to be concluded is whether this is an idiosyncratic event or a foreboding of more large companies from other industries going under.

There are multiple measures one can utilise to assess a bank’s health. One which I closely monitor is a measure of core capitalisation, specifically the Common Equity Tier 1 (CET1) ratio. DBS’s CET1 ratio was 13.9% as of March 2020 and compares well to banks globally. The bank’s target CET1 ratio is between 12.5-13.5%, which creates a comfortable buffer above the current regulatory minimum of 9.1%.

While current core equity buffers seem robust, I am not so sanguine when looking ahead at the potential evolution of capital. The factors leading me to believe this are:

- Negative pressure on operating income

- Higher than expected specific loan loss provisions

- Downward credit migration which increases risk weighted assets (the denominator in the CET1 ratio)

- Pressure to maintain dividends

In addition, it must be noted that in this quarter, management elected to transfer S$404 million in non-distributable regulatory loss allowance reserves (RLAR) into retained earnings. This is not in contravention of MAS’s rules (Notice 612), but the transfer of RLAR in this quarter means that it will not be available in future quarters, especially when most needed should tail risks come to bear.

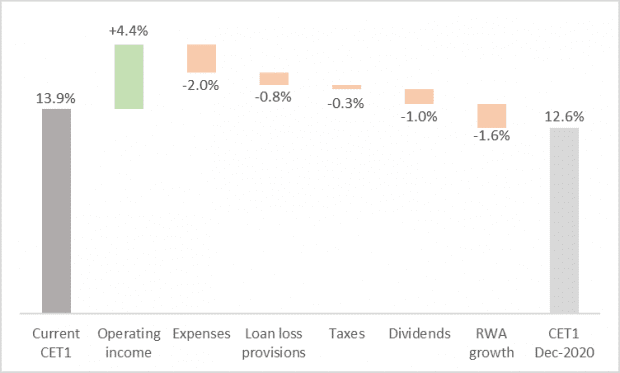

Following management’s guidance on operating income, loan loss provisions, current dividends, and a 10% annual growth in risk weighted assets, estimated CET1 ratio already comes out at the lower end of the target range at the end of FY2020. While a CET1 ratio of 12.6% (Exhibit 1) is still a safe distance away from anything precarious, this is before factoring any further downside risk materialising in subsequent quarters.

Exhibit 1: Estimation of CET1 ratio at the end of FY2020

Source: DBS and author’s estimates

And hopefully not the ugly…

Finally, some thoughts on DBS’s capital management as I can’t help but reflect on the bank’s decision to maintain their sizeable quarterly dividend. At current levels, annual dividends consume roughly one percentage point off their CET1 ratio.

Should not the strong capital buffers they enjoy now be preserved for increasing the bank’s capacity to lend to credit constrained borrowers, or to buffer against increasing credit risk?

Is it necessary to distribute S$838 million in dividends this quarter, bearing in mind that they already spent a record amount on share buybacks in this same quarter?

Or is DBS’s strong operating profitability resilient enough to give them the luxury of enjoying both?

Given the significant tail risks as mentioned above, my personal view would have been to exercise greater near-term prudence especially since the path to normalisation remains uncertain. I fully appreciate the share price sensitivity around dividend cuts or even reductions, but could the bank have instead deferred the decision till the second half of the year when more is known?

After all it is also in the shareholders’ interests that the bank remains well-fortified in this time of crisis. With the sort of effective communication Mr Gupta is renowned to possess, I believe the risk of a market fallout could have been well-mitigated.

To provide some context, banks in the UK have suspended dividends worth a total of £8 billion to provide themselves with additional capital to support lending activities to customers. The European Central Bank had also issued a press statement recommending banks not to pay dividends until at least October 2020. In the U.S., banks have suspended their share buybacks, which form the predominant part of their capital distribution programme.

Time will certainly tell how DBS’s capital will evolve, and as perceptively mentioned in Mr. Gupta’s concluding remarks: ‘We continue to assess prospective impact of COVID-19 crisis on financial performance, credit costs and capital ratios, and adjust dividend policy as appropriate.’

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Thanks for your evaluation and comments and indirect recommendations on all those counters on SGX and their EGM.

Keep them coming please.

Andrew /Singapore.