Investing in developed vs emerging markets: Which is better?

One of the decisions investors often face is whether to focus their portfolio on developed markets like the U.S., Japan, and Western Europe or seek out higher growth opportunities in emerging markets such as China, India, and Brazil. Both paths have potential advantages and risks that need to be carefully evaluated.

Developed markets tend to be more mature and stable economies, with stricter regulations governing financial markets providing a higher degree of legal protection for investors. While growth may not be as explosive, developed markets experience lower volatility overall.

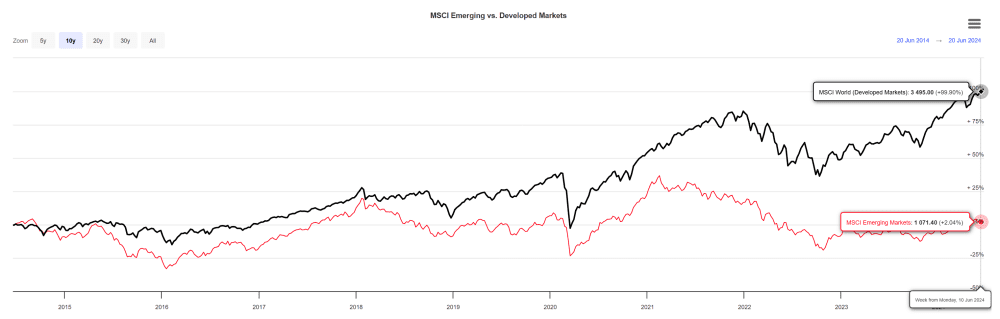

On the other hand, emerging markets are typically characterised by faster economic growth rates fuelled by factors like younger workforces and an expanding middle class. These markets have more potential for more significant investment gains. However, they also carry higher risk due to less stringent regulatory oversight and more economic instability.

This article will explore the key factors investors should consider when allocating their investment capital between these two market types. We’ll examine the important trade-offs related to growth potential versus risk tolerance.

Advantages of investing in developed markets

Developed markets’ main advantages are their stability and strong regulatory frameworks. These markets tend to have robust systems that provide investors with security and predictability. For instance, countries like the United States are well-known for their well-established legal frameworks that protect investors’ rights. Additionally, companies listed in the United States must report earnings every quarter, compared to only semi-annually in some emerging markets. This higher frequency of reporting leads to greater transparency and better corporate governance.

Developed markets also tend to experience less drastic fluctuations compared to emerging markets. This relative stability is mainly due to these markets’ long history of economic development and track record of consistent growth, along with robust political systems, strong institutions, and well-defined property rights, which provide a secure environment for businesses to operate and investors to allocate capital.

Overall, strong regulatory frameworks, transparency, mature financial systems, and economic diversification make developed markets attractive for investors seeking relatively stable and predictable returns while still offering growth opportunities.

The appeal of emerging markets

For adventurous investors seeking potentially explosive growth, emerging markets beckon with the allure of untapped potential waiting to be unleashed. These dynamic regions are often fertile ground for substantial returns on investment, driven by rapidly expanding economies and the tantalising possibility of unearthing hidden investment gems.

The appeal of emerging markets lies in their potential for rapid economic growth, fuelled by favourable demographic trends and an expanding consumer base. These markets often boast a growing young population, translating into a larger workforce and increased consumer demand. As disposable incomes rise, the burgeoning middle class drives consumption, creating opportunities for businesses to capture new market share and revenue streams.

Furthermore, emerging markets frequently offer lower labour costs and fewer regulations, attracting foreign investment and fostering entrepreneurial activity. This environment can lead to the emergence of innovative companies and industries, allowing investors to identify and capitalise on these emerging leaders before gaining widespread recognition.

Moreover, companies listed on emerging market exchanges often lack visibility and analyst coverage, presenting the intriguing possibility of uncovering undervalued or overlooked investment opportunities – veritable hidden gems ripe for the taking by well-informed investors willing to go against the herd mentality.

However, the path to riches in emerging markets is seldom smooth. These high-growth regions are often surrounded by elevated volatility, and for every emerging market success story, there tend to be a multitude of failures. Emerging market performance can vary significantly from year to year and from country to country. As such, active management and a keen eye for potential risks are essential to successfully maintaining and cultivating an emerging market investment portfolio over the long run.

Developed vs emerging market returns

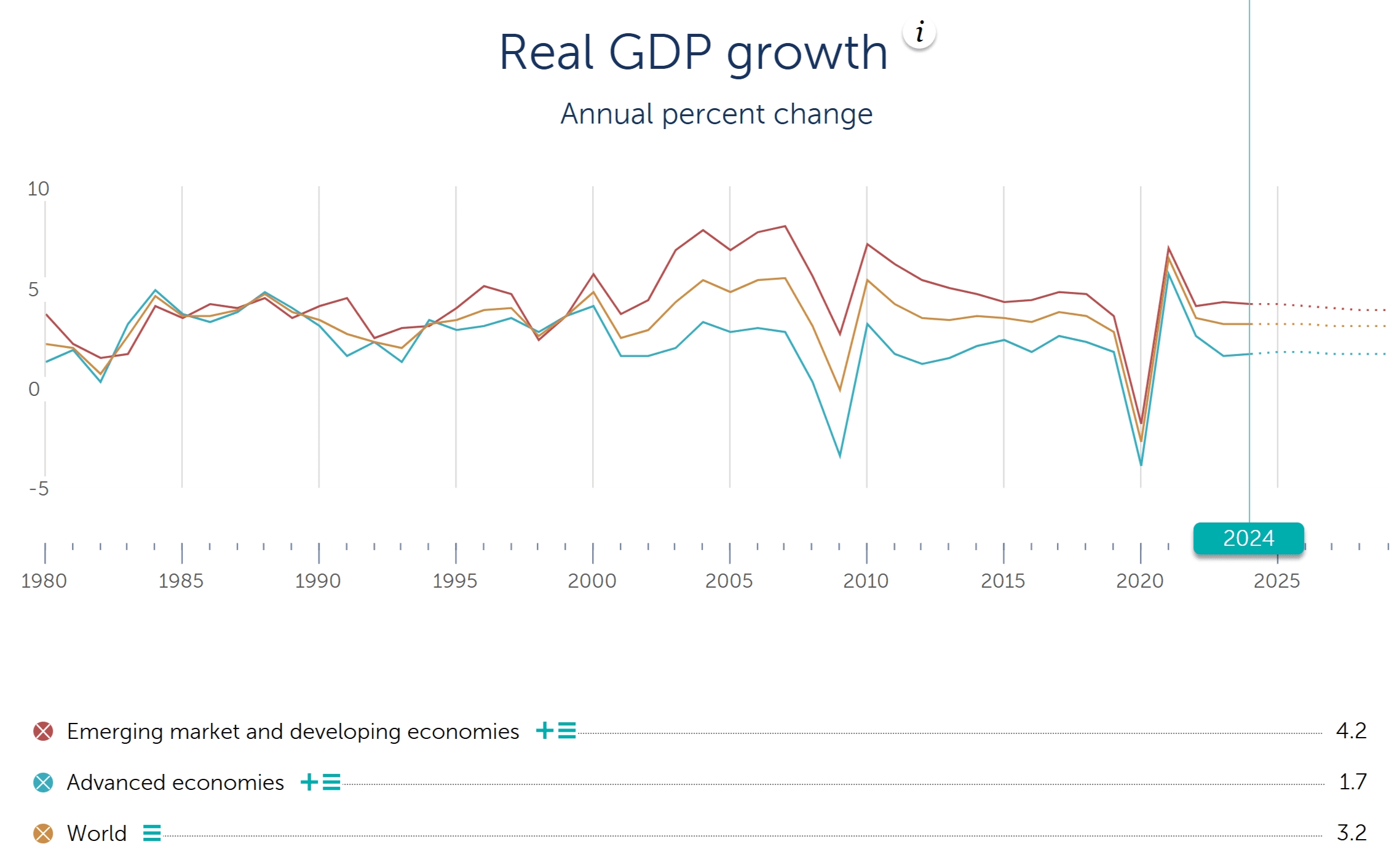

Since its inception in 1988, the MSCI Emerging Markets Index has outperformed the MSCI World Index due to the rapid economic growth and development in emerging markets, driven by factors such as industrialization, urbanization, and favorable demographic trends. These markets offered higher growth potential compared to developed economies, attracting significant investment inflows.

However, in the last 10 years, the MSCI Emerging Markets Index has underperformed the MSCI World Index. This underperformance is attributed to a combination of slower economic growth in key emerging markets like China and Brazil, geopolitical tensions, and higher volatility. Additionally, developed markets, particularly in the U.S., have seen robust performance driven by technological advancements and accommodative monetary policies, outpacing the growth in emerging markets.

Risks associated with emerging markets

Political instability can cast a shadow over investments in emerging markets, raising concerns about the security of assets. The 2019 political uprising in Chile, once considered an attractive emerging market destination, is a prime example. Investors saw their confidence shaken as protests against economic inequality erupted, impacting financial markets and investment prospects. Understanding the delicate balance between political stability and profitability is crucial when navigating these regions.

Emerging economies are also susceptible to global financial shifts and government interference. During the 1997 Asian Financial Crisis, several Southeast Asian countries experienced severe currency depreciations. Malaysia, for instance, implemented capital control measures to prevent investors from withdrawing their capital from the country. This vulnerability and possibility of interference underscore the need for investors to closely monitor international economic trends and prepare for potential external interference. Knowing such historical instances can guide investors in devising robust risk management strategies.

More recently, China’s stock market has experienced notable underperformance due to a confluence of factors. The trade war with the United States introduced significant uncertainty, leading to disruptions in trade flows and investor sentiment. Domestically, the Chinese government’s regulatory crackdowns on major technology firms and other industries have further eroded investor confidence. Additionally, the COVID-19 pandemic severely impacted economic activities, leading to slower growth rates and disrupted supply chains. The property sector’s debt issues, highlighted by the Evergrande crisis, have also contributed to market instability. These combined factors have resulted in subdued market performance, with persistent volatility and lower investor enthusiasm.

Currency depreciation is another key factor to consider. Investments in emerging markets are typically made in local currencies, which can be affected by fluctuations in exchange rates. This can impact the total return on investment when converting back to the investor’s domestic currency. For example, a Singaporean investor would need to achieve at least a 5.67% return on investment in 2023 alone to compensate for the depreciation of the Malaysian ringgit against the Singapore dollar.

The fifth perspective

Investing in emerging markets presents both opportunities and risks, offering potential for higher returns compared to developed markets. These regions can provide significant growth prospects for investors willing to accept higher volatility and uncertainty. However, this approach requires careful research, strong conviction, and the ability to endure market fluctuations. For many investors, developed markets may offer a more balanced approach, providing a more stable and accessible investment option with a reasonable trade-off between risk and return.

???? Looking for undervalued growth stocks in developed and emerging markets? Discover how to identify and invest in high-quality growth stocks that can 3X-5X your returns with Alpha Quadrant. First 100 people to sign up receive a bonus gift! Enrolment for 2024 closes after Sunday, 30 June 2024.