Listed in 2010, Mapletree Industrial Trust (MIT) owns a portfolio of 87 industrial properties in Singapore. It also owns a 40% stake in Mapletree Redwood Data Centre Trust (MRDCT), which owns 14 data centres located across the United States. As of 25 July 2019, MIT is worth S$4.6 billion in market capitalisation.

In this article, I’ll cover MIT’s recent developments, latest annual results, and stock valuation. Here are 15 things to know about MIT before you invest:

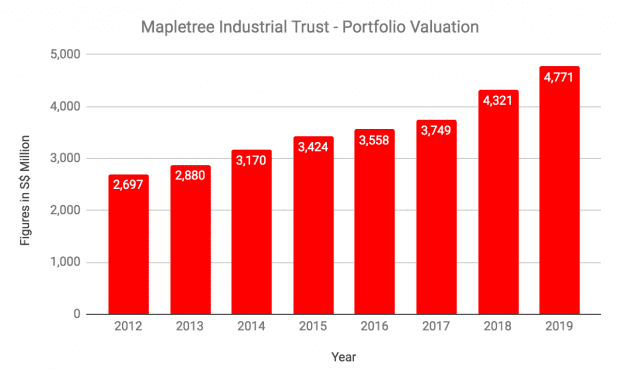

1. As at 31 March 2019, MIT’s portfolio comprised 101 properties worth S$4.77 billion. Since 2012, portfolio value has grown at an annualised rate of 8.5%.

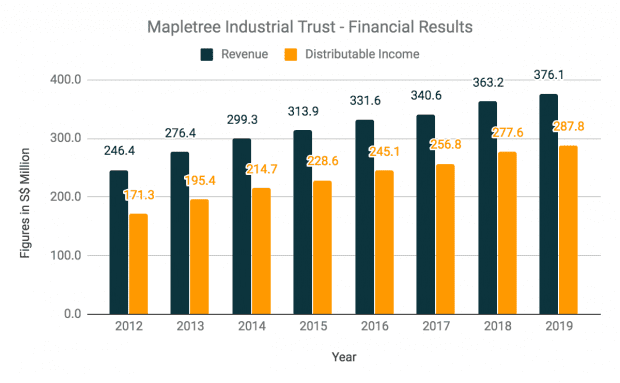

2. Revenue grew 3.5% year-on-year to S$376.1 million and distributable income grew 7.4% year-on-year to S$231.8 million in 2019. MRDCT contributed S$15.2 million in full-year income to MIT, which explains the REIT’s higher distributable income growth compared to revenue.

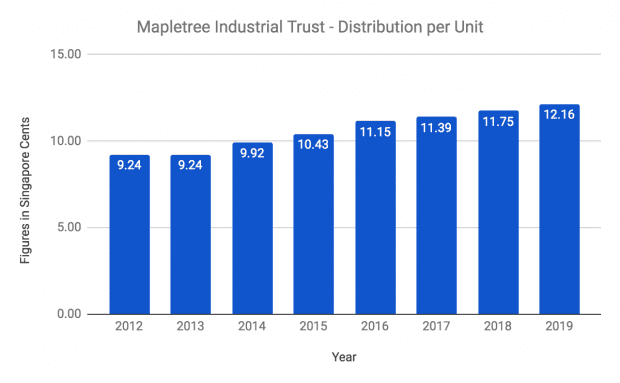

3. MIT reported a 3.5% year-on-year growth in distribution per unit (DPU), up from 11.75 cents in FY2018 to 12.16 cents in FY2019. DPU growth was lower than distributable income growth as the REIT issued 135.9 million new units in a private placement to finance the purchase of 18 Tai Seng Street.

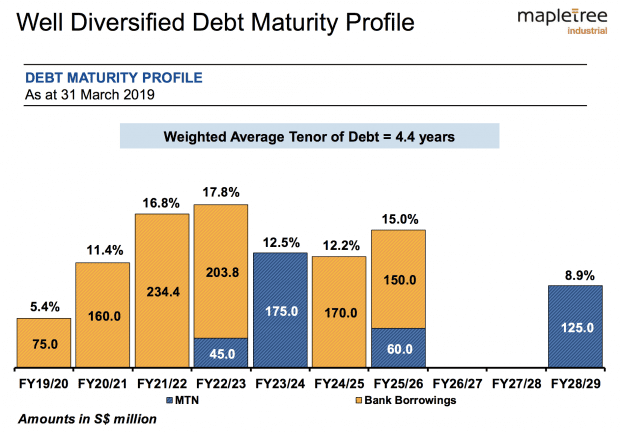

4. As at 31 March 2019, MIT’s gearing ratio is 33.8%. This figure includes the REIT’s proportion of debt in MRDCT. Weighted average cost of debt is 3.0%, and 78.6% of debt is at fixed interest rates. Weighted average debt to maturity is 4.4 years and not more than 17.8% of debt is due in any single year. MIT also maintained its ‘BBB+’ credit rating by Fitch in 2019.

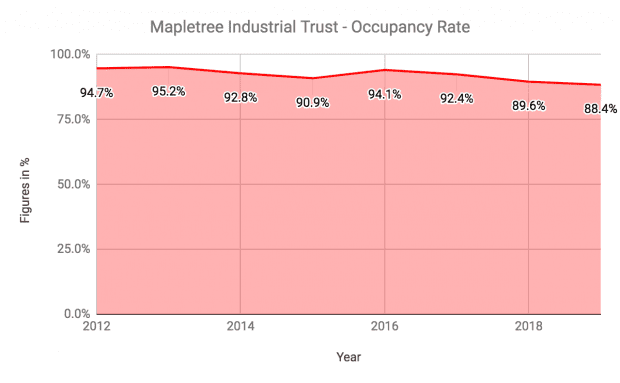

5. As of 31 March 2019, MIT had a portfolio occupancy rate of 88.4%, following a downward trend over the last five years. This is mainly due to large supply of industrial space in Singapore and a slow recovery in the manufacturing sector.

However, this was offset by positive rental reversions for high-specification buildings and investments in new industrial properties, which has enabled MIT to maintain steady growth in revenues and distributable income during the period.

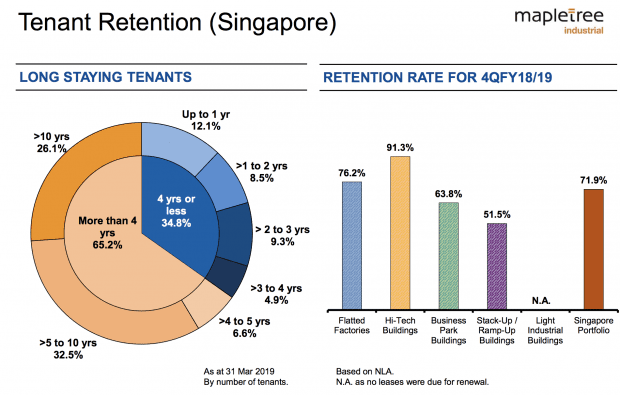

6. As of 31 March 2019, MIT has a total of 2,223 tenants and 3,029 leases. The REIT achieved a tenant retention rate of 71.6% in FY2019. Presently, 65% of its tenants have leased MIT’s properties for more than four years, indicating a reasonable level of stickiness. The REIT’s top 10 tenants contributed 25.2% of total gross rental income.

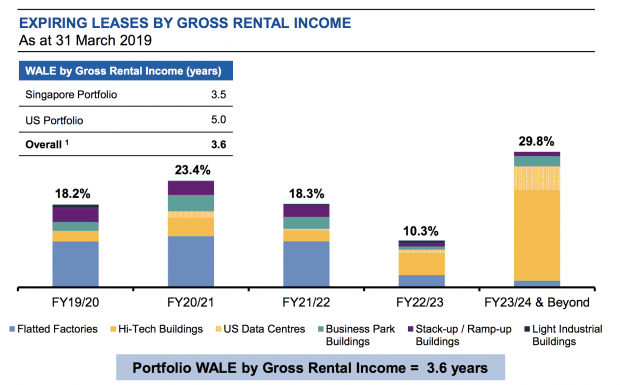

7. MIT’s portfolio weighted average lease of expiry (WALE) is 3.6 years. The WALE for its Singapore portfolio is 3.5 years, while the WALE for its data centre properties in the U.S. is 5.0 years.

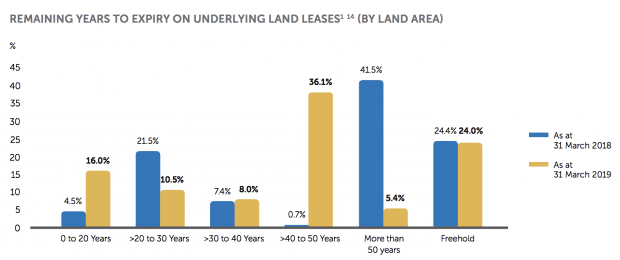

8. As at 31 March 2019, MIT has a weighted average land lease balance of 37.2 years. All data centres in the U.S. are freehold properties and account for 24% of MIT’s portfolio by land area.

9. MIT completed construction of a build-to-suit (BTS) project on Mapletree Sunview 1 in July 2018. Costing S$76.0 million, the property is a six-storey data centre with a gross floor area of 242,000 square feet. It will be leased to a data centre operator starting 1 August 2018 for an initial term of more than 10 years with rent escalations and renewal options.

10. MIT completed the acquisition of 7 Tai Seng Drive, a seven-storey industrial building for S$68.0 million in June 2018. The management has allocated an extra S$27.0 million to upgrade the property to a high-specification industrial building. Upgrading works is slated for completion in mid-2019 and the building will be leased to Equinix Singapore, an information and communications technology provider, for an initial term of 25 years with rent escalations.

11. MIT completed the acquisition of 18 Tai Seng Street, a mixed-use industrial development situated in Paya Lebar iPark for S$268.3 million in February 2019. The property houses 44 tenants and has a committed occupancy rate of 95.3%. The acquisition will contribute its first set of full-year results in FY2020.

12. On 10 July 2019, MIT announced its proposal to redevelop two of its flatted factories at Kolam Ayer into a BTS facility for a German-based global medical device company. Projected to cost S$263.0 million, the redevelopment will commence in 2H 2020 and is scheduled to complete in two years. Gross floor area will increase from 506,720 to 865,600 square feet. The tenant is committed to an initial lease term of 15 years with rental escalations and renewal options for two additional terms of five years each.

13. Mapletree Investments Pte Ltd is the sponsor and main unitholder of MIT with a 31.8% shareholding as of 31 May 2019. MIT has rights of first refusal for all its sponsor’s industrial and business park properties in Singapore (with the exception of Mapletree Business City) and its 60% stake in MRDCT.

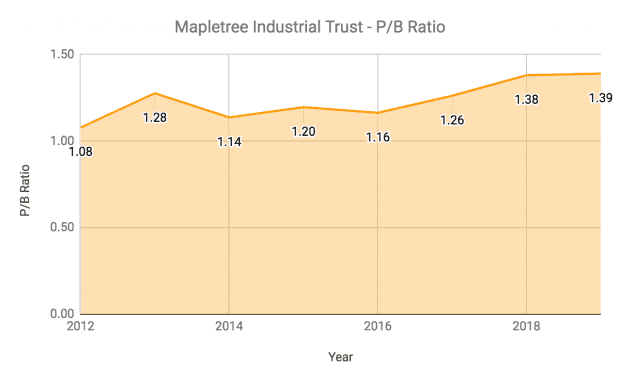

14. P/B ratio: MIT’s net asset value per unit is S$1.51 as at 31 March 2019. Based on MIT’s share price of S$2.27 (as at 25 July 2019), its current P/B ratio is 1.50, the highest over the last eight years.

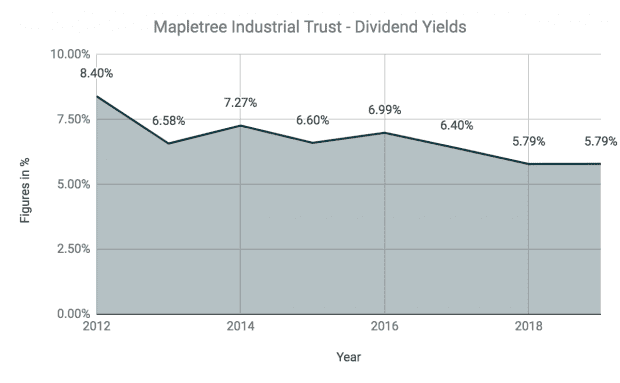

15. Dividend yield: MIT paid 12.16 cents in DPU in FY2019. Therefore, its current dividend yield is 5.36%, the lowest since 2012.

The fifth perspective

Mapletree Industrial Trust has delivered consistent growth in revenues, distributable income over the last eight years. It has a solid track record of building BTS projects and intends to continue with this strategy for the foreseeable future. However, the REIT’s high valuation right now probably means some investors may prefer to stay on the sidelines and wait for a more reasonable price.