When choosing an S&P 500 ETF to invest in, you’ve likely considered factors such as expense ratios, tracking errors, and tax implications. However, did you know you also have a choice between the traditional market-cap-weighted approach and the equal-weighted alternative?

At first glance, equal weighting might seem like the better bet; after all, smaller companies often have more room to grow, right? Yet the reality is far more nuanced. In this article, we’ll explore both strategies to help you make a more informed decision.

Market-cap vs equal weighted

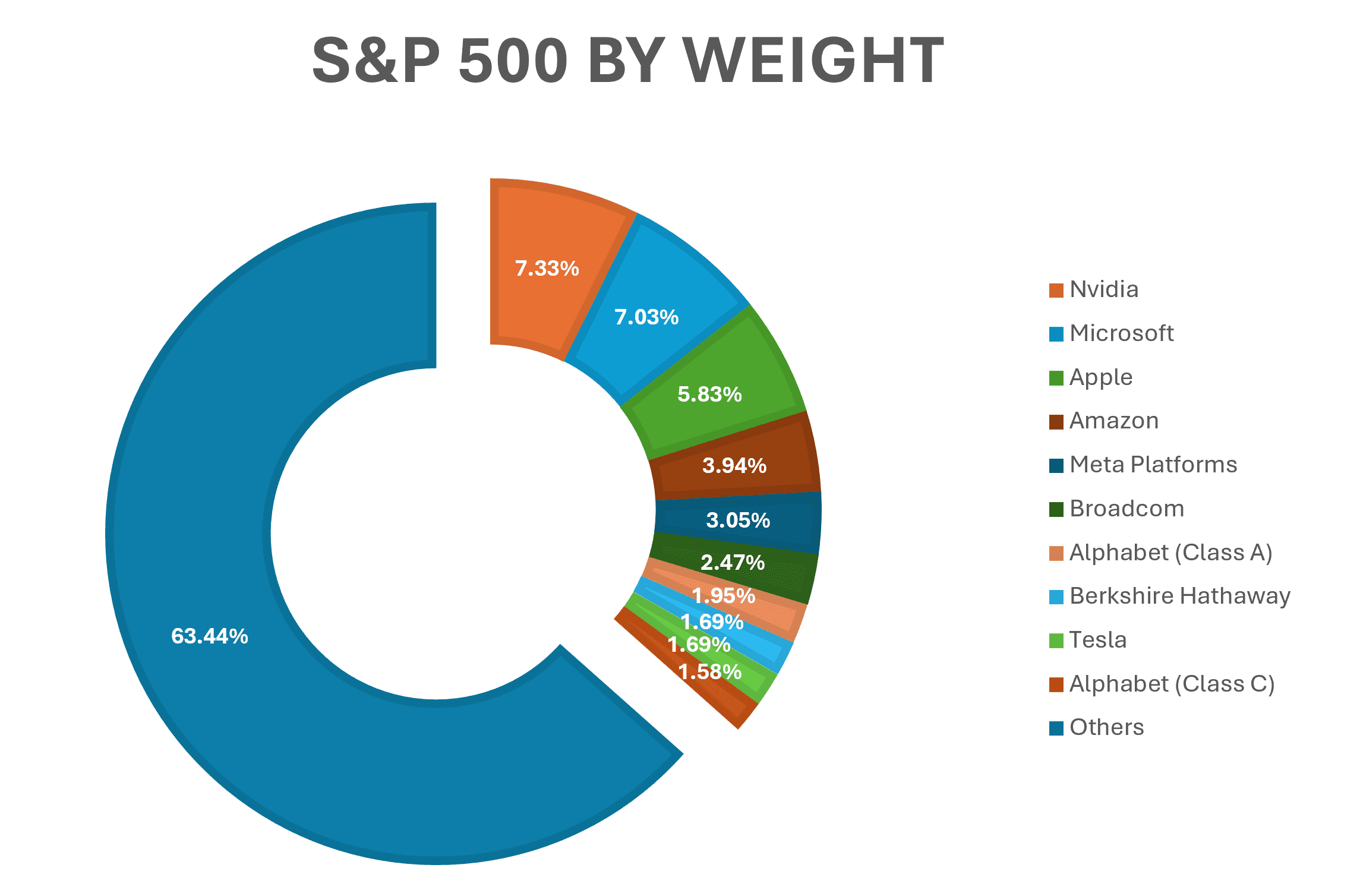

The traditional market-cap-weighted S&P 500 ETFs such as the Vanguard S&P 500 ETF (VOO) allocates investments proportionate to each company’s size (market capitalisation). This means tech giants like Nvidia and Microsoft command outsized influence over your portfolio’s performance. The index naturally rebalances as stock prices move, requiring minimal trading and keeping costs low.

In contrast, an S&P 500 equal-weight ETF, such as the Invesco S&P 500 Equal Weight ETF (RSP), assigns an identical weight to each of the 500 companies, effectively allocating 0.2% of the portfolio to each. This approach requires quarterly rebalancing to maintain equal allocations, resulting in higher turnover and transaction costs. Consequently, RSP has a higher expense ratio of 0.20%, compared to just 0.03% for market-cap-weighted alternatives like Vanguard’s VOO. However, the equal-weight strategy offers a more balanced sector allocation and reduces reliance on mega-cap stocks.

The growth potential paradox

It’s often assumed that smaller companies have more room to grow than already established giants. Historically, we can say that this “small firm effect” has driven the equal-weighted index’s outperformance. The strategy also benefits from a built-in rebalancing mechanism that systematically buys recent laggards and sells winners (as the market cap grows larger), essentially forcing you to buy low and sell high.

However, this growth potential comes with a catch: it often comes with significantly higher volatility and risk. Smaller companies experience larger swings in both directions and are more sensitive to market downturns. Moreover, market leadership will cycle between large and small caps depending on different economic conditions, investor sentiment, and sector rotations, which also result in varying stock price performance.

Performance reality check

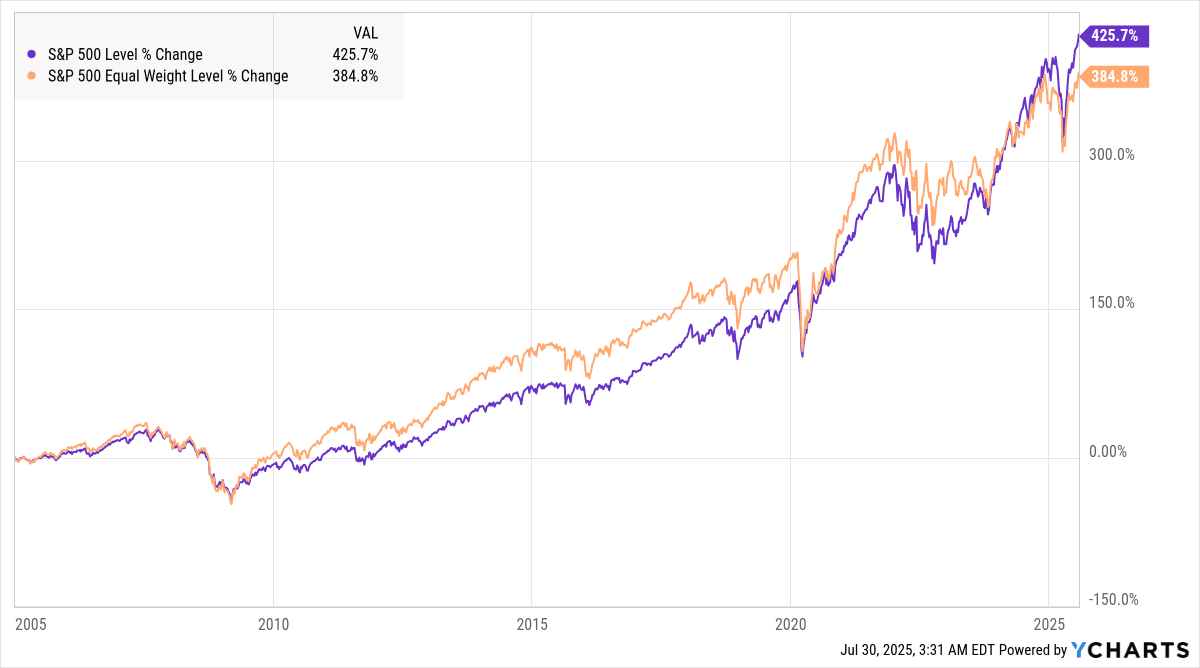

The long-term numbers tell a compelling story for equal weighting. Since its 2003 inception, the equal-weighted index has delivered slightly higher annualised returns, outperforming the market cap version in 12 of the past 21 calendar years. This translates to approximately 1.05% annual outperformance over extended periods until 2023.

But recent years paint a different picture entirely. The market-cap-weighted index has meaningfully outperformed, driven by extraordinary gains from mega-cap tech stocks. In 2023 alone, the cap-weighted S&P 500 outperformed its equal-weighted counterpart by a record gap of about 12.5%. This dramatic difference highlights how the “Magnificent Seven” tech giants (e.g., Apple, Microsoft, Nvidia and others) can denominate market cap-weighted indices while having less impact in equal-weighted versions. The key insight? Stock performance regularly cycles between these approaches depending on which segment of the market is in favour.

Risk and concentration concerns

Each strategy carries distinct risks that investors might overlook. Market cap weighting creates concentration risk, as a handful of mega-cap stocks may potentially drive most of your returns. When these giants stumble, your entire portfolio feels the pain. For example, 35% of the weight in the S&P 500 was in just 10 companies. Not only that, if you already own a lot of the mega-cap companies like Nvidia in your portfolio, owning the market cap weighted S&P 500 might increase your overall exposure in Nvidia, diminishing the diversification effect.

Equal weighting addresses the concentration risk but introduces others. Since it has higher volatility, which means larger drawdowns during market stress periods. Besides, the frequent rebalancing required also generates higher transaction costs and potential tax implications. While you avoid individual stock concentration, you gain exposure to smaller, more volatile companies that may underperform during specific market cycles.

The fifth perspective

There is no universally “better” option; the choice ultimately depends on your investment philosophy and circumstances. Market cap weighting offers simplicity, lower costs, and reflects real market composition. It tends to perform well during trending bull markets led by large-cap growth stocks.

Equal weighting offers enhanced diversification and historically yields higher long-term returns, particularly when smaller companies lead the market. However, it comes with higher volatility, costs, and can lag significantly during concentrated rallies driven by the largest stocks, like what happened in recent years.

In short, both approaches have their own merits, but neither dominates in all market environments. Your choice should align with your overall investment strategy and comfort with the trade-offs each approach entails.

???? Looking for growth ETFs with the potential to soar? Discover how to value and invest in thematic ETFs across emerging sectors like AI, robotics, biotech, and more – giving you diversified growth exposure with lower risk. With ETF Dojo, you’ll learn the skills and strategy to identify tomorrow’s ETF winners today. Enrolment closes by Sunday, 3 August 2025. Don’t miss out!