As I’ve probably mentioned before, at The Fifth Person, we prefer businesses which are simple, profitable, and preferably recurring. One of the key examples of such a business is the franchise business model.

At a basic level, franchises are simple to understand. Let’s imagine you started a highly successful business. It generates significant amounts of cash, and you can use that cash to expand. But remember expanding requires opening a new store. Renovations, electricals, wiring, etc. (Many franchises are traditionally physical businesses because a purely digital company would typically not need a franchise business model — a la Google, Facebook. However, digital franchises are also a thing).

All the above expansionary efforts require money. Lots of it. So, growth can be achieved but is slow. You can most likely expand a single restaurant at a time. But time is money. A successful restaurant concept does not take long to replicate by potential competitors with financial backing. That is why today McDonald’s is not the only fast food franchise in the world.

So how do we speed up our expansion given the constraint on our money?

Franchises solved that problem. You pick a location, new owners come in but provide their own capital to build the place, but you own the intellectual property rights, the logistics and the distribution system.

In return, as the original owner, you earn royalty rights, expand your brand without any upfront spending, earn franchising fees, and get to increase the efficiency of your distribution channel (more restaurants using the same food distribution routes = greater efficiency).

But just how powerful is the franchise business model anyway?

Well, I’d argue that if a business model is capital light or takes very little money to run/expand, then profit margins must be suitably high. For a restaurant business, most would be lucky to make upwards of 8% returns on capital ($8 of profit for every $100 of capital invested).

In fact, in some Compustat research previously reported by financial studies, many companies in general struggle to even make upwards of 8% returns on capital, much less food service businesses where margins are thin and rents generally high.

Shake Shack: A ‘shaky’ business?

Shake Shack is an American fast casual restaurant chain based in New York City. It started out as a simple hot dog cart inside Madison Square Park in 2001. Today, it has over 300 locations globally.

But did you know that the majority of Shake Shack’s locations are company operated (i.e., not franchised)? As of end-2020, 183 out of 205 Shake Shack stores in the U.S. are company operated. Its international stores (106) are all franchised. Overall, 59% of all Shake Stores are company operated.

So how profitable is Shake Shack really?

| Shake Shack | 2016 | 2017 | 2018 | 2019 | 2020 |

| Net Income (USD millions) | 12.4 | -0.3 | 15.2 | 19.8 | -42.2 |

| Return on Capital | 9.8% | -0.2% | 7.7% | 7.6% | -11.9% |

Not very. And note the volatility in earnings. We can excuse the last year due to the pandemic, but note that return on capital dipped in 2018 and continued dipping into 2019 before the pandemic began.

Shake Shack is a premium brand, focused on customer expectations, trying to produce the best burgers, make the best food and encourage social gatherings. In other words, it’s doing everything it can to make itself a better place to eat and socialize. Yet its profitability leaves much to be desired.

McDonald’s: I’m loving it

What about McDonald’s? Operating in 119 countries, McDonald’s has 39,198 restaurants, of which 36,521 are franchised (93%). And its profitability seems to bear this out.

| McDonald’s | 2016 | 2017 | 2018 | 2019 | 2020 |

| Net Income (USD millions) | 4,686 | 5,192 | 5,924 | 6,025 | 4,731 |

| Return on Capital | 17.8% | 21.0% | 21.1% | 17.4% | 10.7% |

McDonald’s was also impacted by Covid (as with almost all other food service companies), but it remained profitable during the pandemic. Its baseline return on capital is also higher and more consistent. A higher return on capital usually means a higher cash flow per share, which implies a higher share price.

The fifth perspective

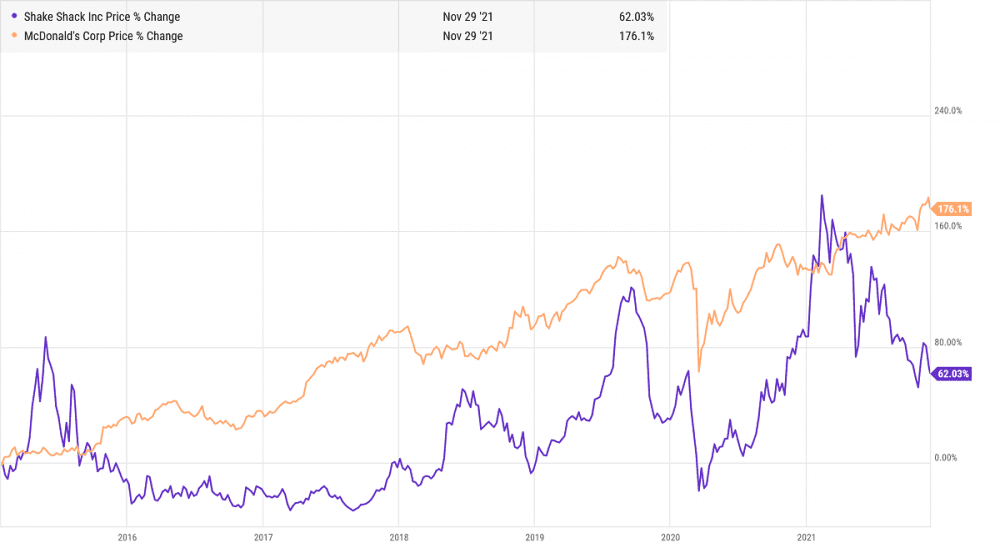

How has this translated over time in the long run for Shake Shack and McDonald’s shareholders? I believe the proof is in the pudding.

Since Shake Shack’s IPO in 2015, it has returned 62%. In comparison, McDonald’s has grown by 176% despite it already being a much larger business. (It’s much easier to grow from a smaller base than a larger one.)

Now, this article is not meant to an exhaustive analysis of Shake Shack and McDonald’s; there are many other factors which contribute to the performance of their respective businesses. However, all things equal, a successful profitable franchise model will enable a company to supercharge its growth with a lower amount of capital.