How to earn monthly passive income from your Singapore Savings Bond

The Singapore Savings Bond (SSB) was introduced in 2015 by the Monetary Authority of Singapore (MAS) as a way to help people save for their long-term goals. It offers a guaranteed interest rate higher than most other fixed-income products in the market and is open to all Singaporeans and Permanent Residents aged 18 years and above. Since its launch, the SSB has gradually gained popularity with investors, especially risk-averse investors.

SSBs work like a fixed deposit, where you can invest from as little as S$500 up to S$200,000 for a tenure of 10 years. The interest will be credited to your account semi-annually. The interest payments we receive from the SSBs are tax-free. The only caveat is if you have a large pile of cash to invest in SSB, you are limited to a maximum investment of $200,000.

The SSB is currently paying an annual interest of 2.97% (January 2023), and which went as high as 3.47% the previous month. This makes it an attractive investment option for many people looking to park their money in a safe and guaranteed investment.

The Singapore Savings Bond has unique features that differentiate it from other investment products. Firstly, the SSB is a low-risk investment product backed by the full faith and credit of the Singapore government. These bonds are capital protected, which means that your investment is guaranteed not to lose value. Secondly, if you need to access your capital for any reason, you can do so without penalty, making SSBs a flexible investment option.

Bond laddering your Singapore Savings Bonds

Bond laddering is a strategy that investors can use to minimise interest rate risk and stablise cash flow. By investing in bonds with different maturities, the investor can create a ‘ladder’ of bonds, which can help to smooth out the effects of interest rate changes on the overall portfolio.

For example, an investor laddering bonds could invest in a mix of short-term, medium-term, and long-term bonds. This way, if interest rates rise, the short-term bonds will mature and can be reinvested at higher rates, while the longer-term bonds will provide stability and a locked-in interest rate. Laddering can be a valuable tool for investors who want to maintain a steady income stream while also taking advantage of higher interest rates over time.

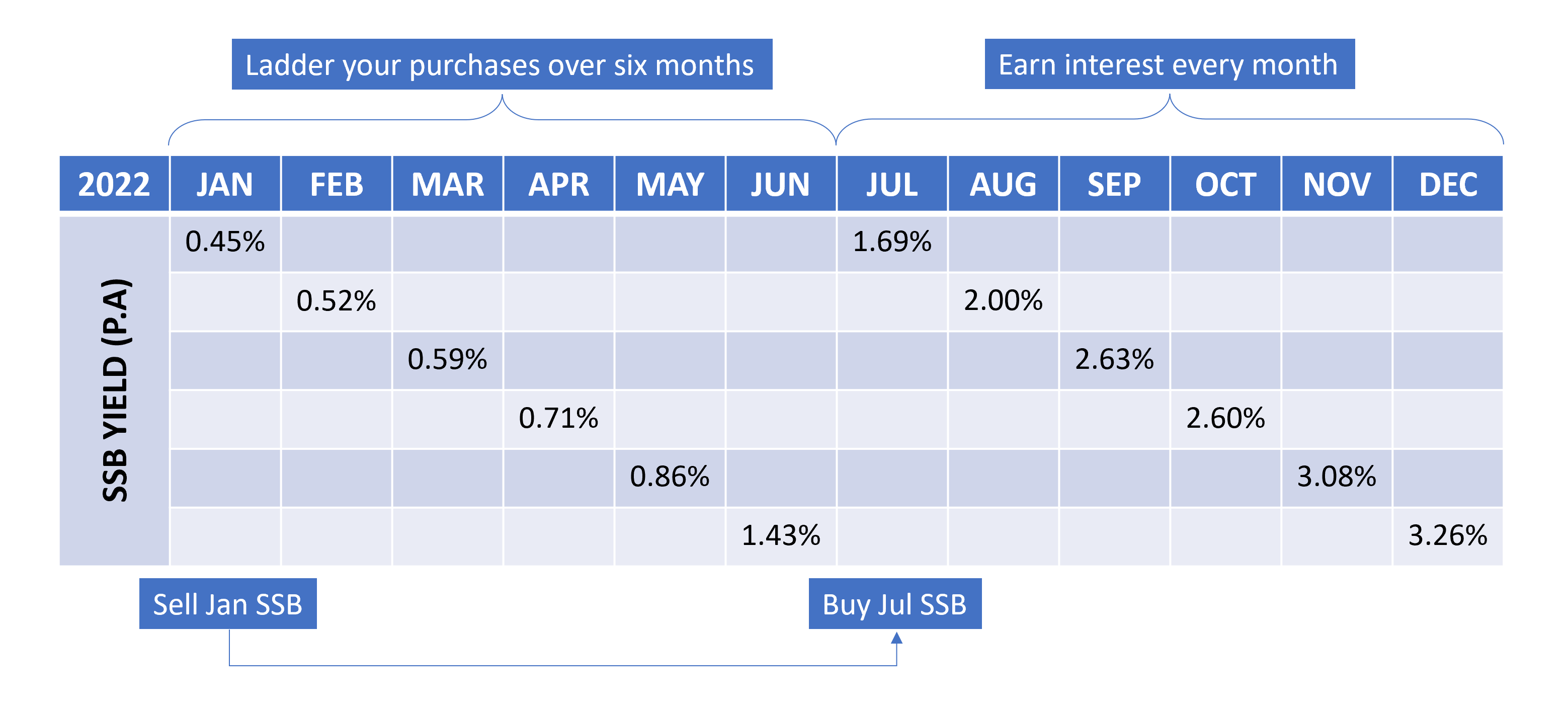

SSBs are a great way to ladder your bonds because they are available every month. Since interest is paid every six months, if you purchase SSBs for six consecutive months, you will have a bond with an interest payment due every month. This is ideal for those who desire a steady income stream, as the bonds mature at different intervals and provide a constant monthly income.

Laddering SSB also offers the additional benefit of having the ability to withdraw old bonds without penalty to be reinvested at a higher interest rate. Investors could therefore withdraw their capital in full from older SSBs and reinvest it in the newer SSB at a higher interest rate (if available). This makes the SSB an ideal investment for those looking to preserve capital while maximising return, as investors can enjoy higher interest rates while remaining confident that their money is safe.

How to get started with Singapore Savings Bonds

The application for SSBs begins on the first business day of the month and closes on the fourth last business day of the month. If you wish to apply for that month’s SSB, your application must be made within the window.

Before you begin investing in Singapore Savings Bonds, you need to make sure that you have an account with one of the three local banks in Singapore (DBS/POSB, OCBC, or UOB).

You will also need to have a CDP securities account with direct crediting services. This will allow the interest earned from your SSB to be credited into your account – just like your dividends.

Once you have your CDP account, you can submit your SSB application at your nearest bank ATM. Alternatively, if you’d prefer to do it online, you can do so through your internet banking.

Steps for applying through ATM:

- Login to your account with your card and password

- Select ‘Invest/Investment’

- Select ‘Singapore Government Securities

- Select ‘Singapore Savings Bonds

- Confirm your CDP account

- Enter application amount

Steps for applying through Internet banking:

- Login to your Internet banking account

- Select ‘Invest/Investment’

- Select ‘Singapore Government Securities

- Select ‘Singapore Savings Bond’

- Select ‘Cash’

- Enter your CDP account details

- Confirm your application

When successful, you will be notified of the amount of SSBs allocated.

The fifth perspective

For those looking to earn a steady stream of passive income, laddering Singapore Saving Bonds is a great way to do so. The bonds are highly accessible and offer a guaranteed rate of return, along with the flexibility to invest in multiple bonds with different maturity dates and ability to withdraw without penalty, making them an ideal choice for those looking to build a nest egg. On top of that, the bonds are backed by the Singapore government, making it an extremely low-risk investment option.

Is the procedure for withdrawal and reinvest SSB *without penalty* the same as applying for SSB the first time?

Hi Vincent, yes pretty much the same: https://www.dbs.com.sg/personal/support/investment-ssb-redeem.html