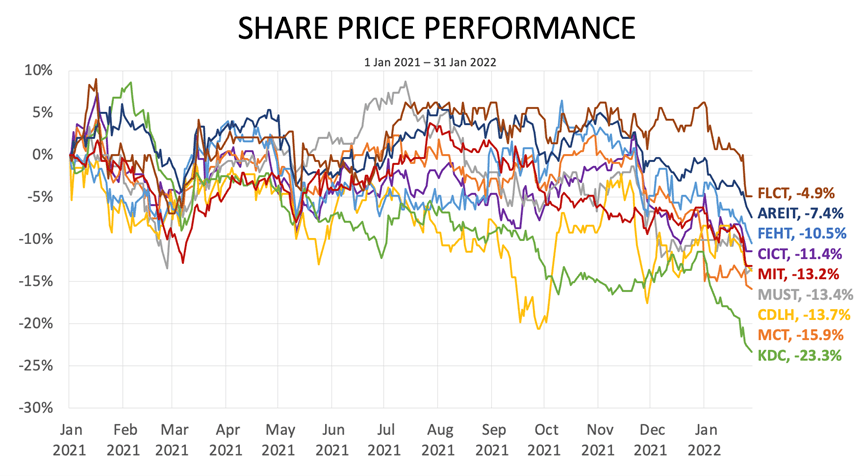

2021 wasn’t a great year for REITs. When everyone thought that the worst was over, the new variants Delta and Omicron emerged. This resulted in the tightening of pandemic measures in Singapore and the rest of the world.

The new variants caught everyone by surprise, especially investors with exposure to REITs. REITs with a heavy concentration in the retail and office sectors remained laggards in terms of recovery as workers continued to work from home. Travel bubbles have helped but it wasn’t sufficient to stage a full recovery of tourist arrivals, so hospitality assets remain depressed. Industrial REITs with logistics and data centre assets, which benefited from lockdowns in 2020, did poorly in 2021.

The returns in the chart don’t consider the distributions paid during the year. If adjusted, then the returns would be higher but, overall, REITs still underperformed. So then does it make sense to invest in REITs when they haven’t done so well recently?

Don’t miss the forest for the tress

Income investors should measure the long-term performance of their investments. If we measure REITs on a month-to-month or even year-to-year performance, we will miss the forest for the trees. So, a good yardstick will be ten years.

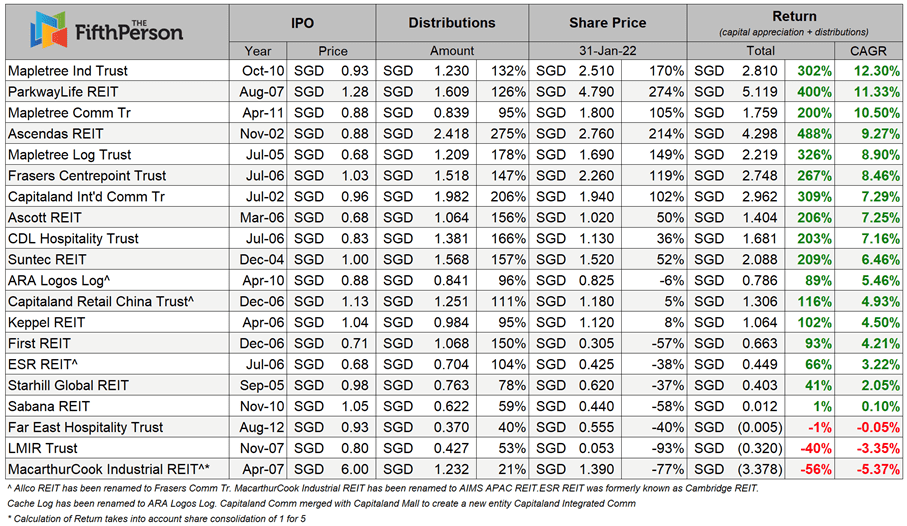

I first wrote about the performance of S-REITs in 2016. This time around, I will revisit their performance by taking into account the latest share prices as at 31 January 2022, and distributions paid out to unitholders up to same period. I also make adjustments such as pre-consolidated units and distributions to get a more accurate picture. In my opinion, REITs need be listed for at least 10 years to properly evaluate their long-term underlying performance.

There are 25 Singapore REITs that were listed 10 years ago or more, but five of them will be excluded. Saizen and Fortune REIT have since been delisted from SGX. Likewise, CapitaLand Commercial Trust, Frasers Commercial Trust, and Ascendas Hospitality Trust as they have merged with sister REITs. This year’s new entry will be Far East Hospitality Trust which now qualifies as it has ten years of being listed.

Once again, we will assume that John (a fictional character) invests $1,000 in each of these REITs equally from the day the REIT listed. Since John is a hardcore income investor and wants to keep all his cash, he doesn’t want to come out with any more money to subscribe to rights issuances (if any) and is prepared for any share dilution. Let’s also assume that John also forgets to sell his nil-paid rights from which he can obviously make a profit from.

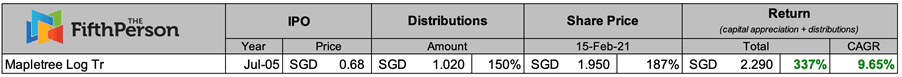

For example, if John invested in Mapletree Logistics Trust (MLT) during its IPO, his initial investment of $1,000 would’ve grown to $2,870 (+187% in capital gains) as at 15 February 2021. On top of that, he would have collected total dividends of $1,500 (+150% in distributions).

As shown in the table above, John would’ve made a nice return in MLT as his initial investment of $1,000 would have grown to $4,370 (+337% in total return), including the dividends received over the years.

If John invested $10,000, then his investment would’ve grown to $43,700. Similarly, $100,000 will turn into $437,000. Basically, the more money he invests, the more he is going to make. And the longer he holds, the more dividends he is going to receive. All in all, his annualised return from MLT alone is 9.65% from July 2005 to January 2021. Such a return is certainly many times better than what the bank can offer us if we deposited the same amount in the bank.

After investing for more than ten years, here are the top 10 best-performing Singapore REITs for John. (Note: We’ve excluded brokerage costs, currency exchange gains/losses and taxes that might be applicable to foreign investors.)

10. Suntec REIT (Annualised return: +6.46%)

Since 2004, every $1,000 investment in Suntec REIT would’ve turned into $1,520. Including the dividends, every $1,000 would cumulatively become $3,090

9. CDL Hospitality Trust (Annualised return: +7.16%)

Since 2006, every $1,000 investment in CDL Hospitality Trust would’ve turned into $1,360. Including the dividends, every $1,000 would cumulatively become $3,030.

8. Ascott REIT (Annualised return: +7.72%)

Since 2006, every $1,000 investment in Ascott REIT would’ve turned into $1,500. Including the dividends, every $1,000 would cumulatively become $3,060.

7. Capitaland Integrated Comm Trust (Annualised return: +7.29%)

Since 2002, every $1,000 investment in CICT would’ve turned into $2,020. Including the dividends, every $1,000 would cumulatively become $4,090.

6. Frasers Centrepoint Trust (Annualised return: +8.46%)

Since 2006, every $1,000 investment in FCT would’ve turned into $2,190. Including the dividends, every $1,000 would cumulatively become $3,670.

5. Mapletree Logistic Trust (Annualised return: +8.90%)

Since 2005, every $1,000 investment in MLT REIT would’ve turned into $2,490. Including the dividends, every $1,000 would cumulatively become $4,260.

4. Ascendas REIT (Annualised return: +10.05%)

Since 2002, every $1,000 investment in Ascendas REIT would’ve turned into $3,140. Including the dividends, every $1,000 would cumulatively become $5,880.

3. Mapletree Comm Trust (Annualised return: +10.50%)

Since 2011, every $1,000 investment in Mapletree Comm would’ve turned into $2,050. Including the dividends, every $1,000 would cumulatively become $3,000.

2. ParkwayLife REIT (Annualised return: +11.33%)

Since 2007, every $1,000 investment in ParkwayLife REIT would’ve turned into $3,740. Including the dividends, every $1,000 would cumulatively become $5,000.

1. Mapletree Industrial Trust (Annualised return: +13.96%)

Since 2010, every $1,000 investment in MIT would’ve turned into $2,700. Including the dividends, every $1,000 would cumulatively become $4,020.

In summary, here is John’s overall performance:

The most impressive REIT in John’s portfolio, in terms of absolute return, is Ascendas REIT. Every $1,000 investment in Ascendas REIT would’ve turned that into $5,880! His net gain in Ascendas REIT alone is more than enough to cover all his three other losses.

Most importantly, John is still very profitable without having to come out with any additional capital to subscribe to any rights. However, if he had subscribed to them (including excess rights), he would have made more money since rights are usually sold at a larger discount. At the end of the day, John continues to receive regular quarterly dividends from his Singapore REITs in good times and in bad.

As you can see, REITs remain a good choice for anyone who wants to build a steady and consistent stream of passive income. However, please note that you shouldn’t buy or avoid a REIT just based on the data above as past performance is not necessarily indicative of future results. The bankruptcy of Eagle Hospitality in 2021 (listed record of only two years) serves as a warning that not all REITs are created equal. That’s why it is important to have a proper investment process to help you identify and invest in the best REITs that will give you a continual stream of passive income and capital gains down the road.

Announcement! Applications to join Dividend Machines reopen until 6 March 2022, at 23:59 hours. If you’re looking for a way to learn how to invest in dividend stocks and REITs and build multiple streams of passive dividend income, then we highly recommend you check out Dividend Machines before applications close!

Once the deadline has passed, Dividend Machines will only reopen in 2023. So if you miss this round, you’ll have to wait a year (or more) before we accept new applications again.

Happy investing and we hope to see you on the inside! 😊

Would you recommend REIT ETFs instead of stock/REIT picking?

You can consider a REIT ETF if you prefer a more passive way of investing.