I am pretty sure much of your portfolio is in the red right now (mine is redder than ang pao), but if it’s at least some consolation, you probably outperformed Cathie Woods! Year to date, the S&P 500, Nasdaq, and Dow Jones Industrial Average have fallen by 14%, 22%, and 11% respectively. But you must be asking… what is causing all this market mayhem? Are we really truly staring down the tube of an economic abyss?

Before we start making future guesses, let us first throw some colour on the current events.

China’s zero-COVID policy

Most if not all major economies have lifted their COVID-19 restrictions. Unfortunately, the world’s factory, aka China, is still pursuing its zero-Covid policy much to the chagrin of the huge manufacturing sector and in the process strangling the global supply chain. The problem is that China literally makes almost everything. Now when China sneezes the whole world catches a cold (i.e., a supply shock leading to high inflation).

Russia-Ukraine crisis

I am sure that you are aware of Russia’s ‘special military operation’ in Ukraine. Political righteousness aside, how has this unprovoked war really affected us globally? The collective imposition of sanctions on the Russian energy sector has driven the price of oil and gas up exponentially. What happens when the price of energy goes up? Cost increases at almost every stage of the supply chain which ultimately leads to higher manufacturing and shipping cost. Guess who will be footing the bill – the consumer (you and I) will be paying.

Fed’s quantitative tightening

Recently, global headline inflation has been reaching unprecedented levels. It was reported that the U.S. headline inflation surged to 40-year highs as the CPI rose to 9.1% in June 2022 which was the highest rate since November 1981. This exceeded economists’ predictions of an 8.8% inflationary rate. Additionally, core CPI (excluding food and energy prices) increased by 0.7 percentage points and is now at an annual rate of 5.9%.

One of the primary remits of the Fed is to keep inflation at a target rate of below 2%. So, what do they do when inflation exceeds the target rate? They carry out quantitative tightening and take an extremely hawkish stance. The Fed recently hiked the interest rate by 75 basis points which is the most aggressive increase since 1994. This hike clearly demonstrates the Fed’s determination to rein in inflation at all costs with subsequent 50 to 75-basis-point hikes expected this year. With the Fed being extremely hawkish, there is a material risk of a severe recession.

Suppressed economic sentiment

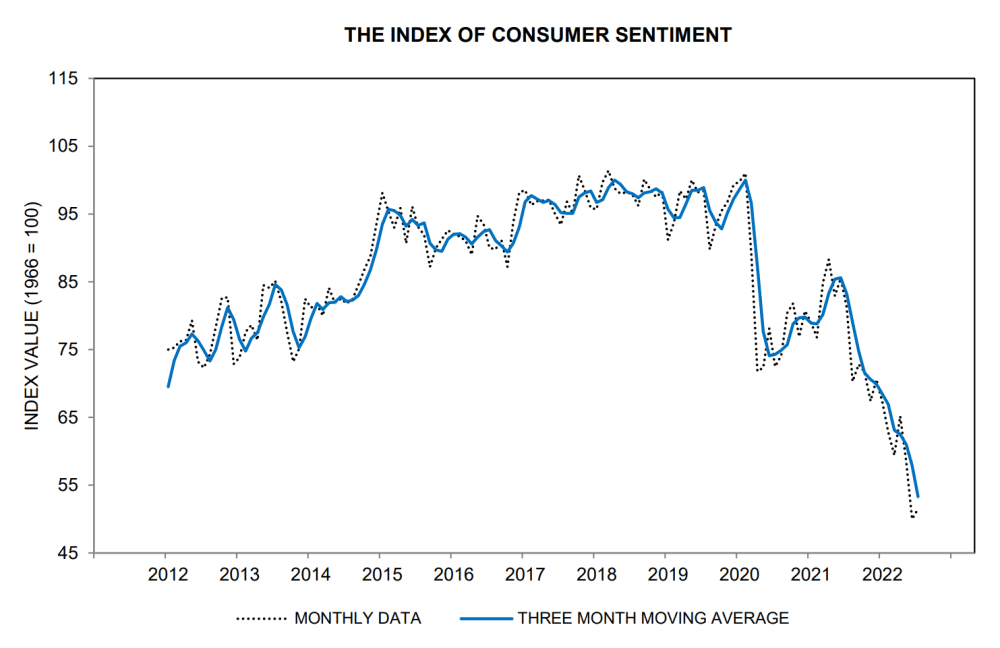

Rising inflation up is damaging both consumer and business sentiment. Consumers’ purchasing power has been severely eroded and businesses are equally reluctant to invest for future expansion. Just to give you some anecdotal evidence. In June 2022, the University of Michigan Index of Consumer Sentiment fell to a record low (since records started in the 1940s) of 50.0.

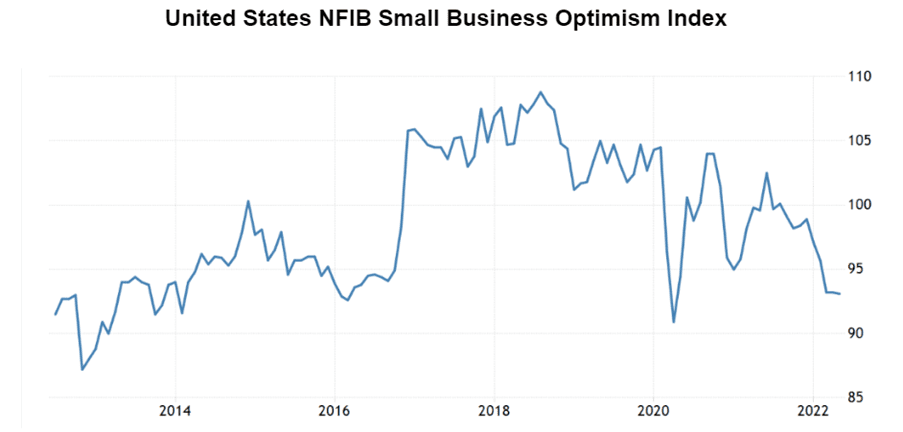

A similar negative sentiment is being felt by business owners. The United States NFIB Small Business Optimism Index fell to 93.1 in May 2022, a figure which has not been seen since the beginning of the global Covid-19 lockdown crisis (in April 2020). This means that small business owners remain very sceptical about the likelihood of the current macroeconomic and geopolitical crisis easing by the end of the year.

It was only two years ago that people were talking about negative interest rates. Today, it is a 180-degree reversal where interest rates are at the highest they have been since 2014.

Google Search Trends for the word ‘Recession’ is projected to reach all-time highs (since this data started recording in 2004). The ominous downbeat signs are everywhere, and the U.S. promptly slipped into a technical recession (two consecutive quarters of negative economic growth) in the second quarter of 2022.

Capital market sentiment

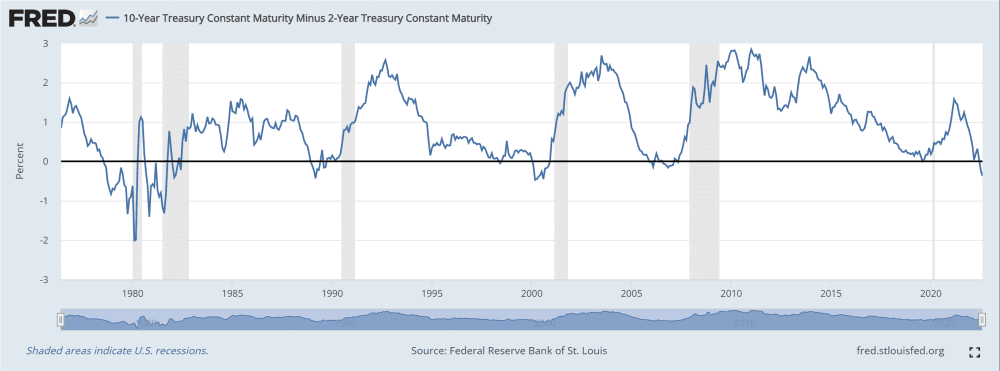

Below is a chart of the 10-year treasury yields minus the 2-year yields. As at July 2022, it has a negative value of 0.08. This is significant as the yield on the long-term treasury fell below the short term. This phenomenon is called the inverted yield curve.

Inverse yield curves are akin to a canary in a coal mine (danger ahead) as it has been an incredible predictor of upcoming recessions. Data collected since the 80s eerily demonstrates that yield inversions generally precede recessions by six to 18 months.

How these events affect the stock market

1. Multiples compression

In a normal market, Wall Street typically prices in a forward P/E ratio of 15 or thereabouts. In a bull market, a forward P/E of 20 is normal. However, if the general outlook darkens for (street talk of a looming recession), a forward P/E of 12 for is not unlikely.

2. Earnings compression

In a typical cyclical downturn, we have what is termed earnings compression. As a side effect of rising rates, Wall Street analysts have been scrambling to revise their previous valuation projections which were previously based on lower discount rates. Now that rates have been increasing, the present valuations look very rich which leads to downward revision of target prices. Adding salt to the wound, the previous earnings forecast for the S&P 500 is looking increasingly optimistic as the global economic outlook darkens.

One of the biggest sectors of the stock market that was significantly affected by rising rates is the ‘full-of-hype-yet-unprofitable’ tech companies. Since money was practically free during 2020 and 2021, these unprofitable companies were given extremely rich valuations by Wall Street analysts. Some investors got really excited and pushed these companies to trade at exceedingly high forward multiples. Guess what? These companies have seen their stock price come crashing down to earth.

3. The fear gauge

Lastly, the infamous VIX index aka the fear gauge! The CBOE Market Volatility Index (stock market’s expectation of volatility based on S&P 500 index options) had gone up as high as 97% year-to-date as of June 2022. (It has since tapered down as of August.) It is a simple reference point to estimate whether the market is generally optimistic or pessimistic. The higher the index, the higher the fear which conversely results in a market selloff. A lethal combination of subdued consumer sentiment, anaemic business sentiment, fears of a recession, and previous abnormally high valuations have been mixed together to produce a market crash in the first half of 2022.

The fifth perspective

The silver lining? Maybe this timeless quote sums it up best:

‘Be fearful when others are greedy and greedy when others are fearful.’ – Warren Buffett

When it comes to investing, you can either have a good price or a good outlook; and not both at the same time. Take advantage of the current downturn in the market to dollar cost average or buy great companies selling at a bargain.

It also pays to remember that the stock market is forward looking, but all economic indicators are backward looking (it takes time to collect all that data). So even though we can feel like we’re in the midst of a recession, the stock market can also trend upward because the market is pricing in future expectations. (Indeed, the stock market has rebounded slightly in the past two weeks despite the negative economic sentiment swirling around now.)

So will the U.S. and, by extension, the global economy have to brace for a hard landing? Or is there a chance that inflation will ease up and a long-drawn recession is avoided? I believe one of these following scenarios could help:

- First, subdued consumer demand may already be putting the brakes on inflationary pressure. This in fact may already be starting with the recent downward trend of prime commodities which typically signifies a slowdown ahead.

- Second, if Russia secures the entire Donbass region, Putin may attempt to negotiate a ceasefire as the ongoing invasion is a political and economic cost for his country. Putin needs an off-ramp, but it has to be perceived domestically as a Russian victory. An end to the conflict will help bring energy prices down.

- Third, if China’s government eases on its zero-COVID restrictions, its economy is likely to come roaring back after it passes the initial wave of infections. This means that the world’s factory can run at full throttle again which will mitigate supply chain disruptions substantially.

If inflationary expectations will be subdued, the Fed will have reason to pause rate hikes and maybe even cut them for fears of a deep recession. Everything is looking uncertain now but as always, keep calm and continue investing.