Today I am going to let you in on something that many news sources have missed about the real cause behind the current rise in inflation. To do this we have to go back to the pre-pandemic period towards the end of 2019. The economy was buzzing along doing its thing. People were generally happy and prosperous. Then came COVID-19 and the corresponding fear, lockdowns, and restrictions.

The stock market tanked and there was real fear of a possible depression as consumer sentiment was totally anaemic. There was so much panic worldwide that the Federal Reserve and central banks around the world reacted accordingly by slashing interest rates aggressively to prevent an economic meltdown. The Fed used quantitative easing by printing money. In simple words, they flooded the market with cheap money.

Now, back to the present day. The Fed is now barking about the excessive demand resulting in the excessively high inflation today. They got the high inflation part right, but there isn’t exactly an excess in demand; it is only trying to recover to the good old normal pre-pandemic days. (Yes, there was a pent-up demand spike right after the restrictions were lifted but it is temporary.)

Hence, you may now be asking: ‘Since there isn’t any new excess in demand, why is there persistently high inflation?’

The answer is due to an underlying supply crunch. This is a temporary phenomenon, and we aptly name it the ‘demand-supply lag’.

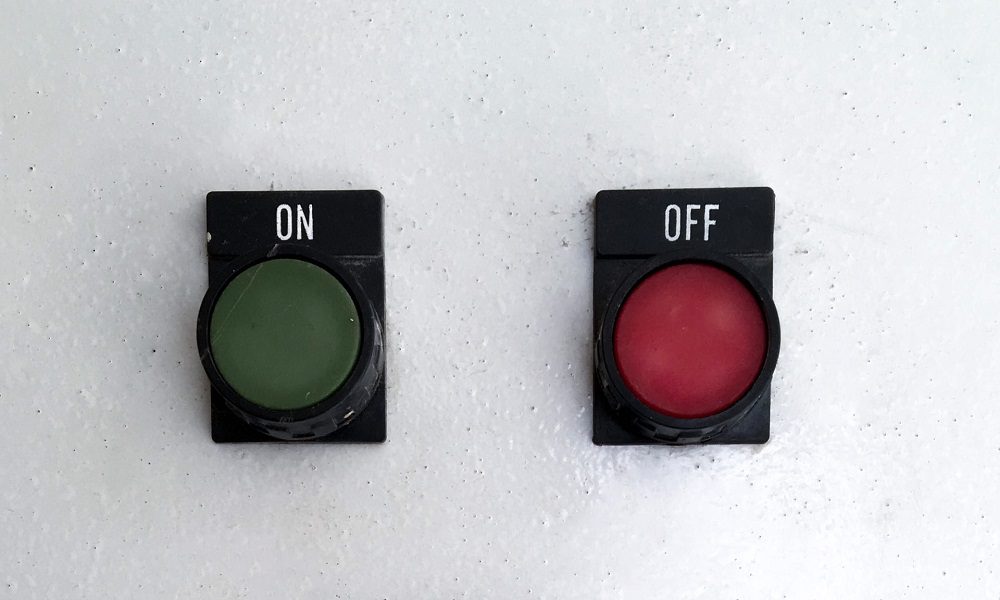

Let me explain this a light switch and thermostat analogy.

The demand switch

Consumer demand is like a light switch, you can turn it on or off almost instantly. Let me give you a couple of real-life examples to illustrate.

Let’s say, you are planning to purchase a family holiday to Greece. The next day you go to work as usual, but unfortunately you hear news that your company is suddenly downsizing staff. You worry that you may lose your job and primary source of income. So, you instantly cancel the idea of buying the vacation. Just like that, your demand has switched off.

On the other hand, let’s say you won a lottery of $200,000. I will leave it up to your imagination to what you can do with the money. Buy a new car? A nice watch? Trip around the world? Just like that your demand has switched on.

I am pretty sure anyone can relate to events that can change your buying behaviour in an instant. Demand can be switched on and off almost immediately; the effects of a change in demand can be felt with almost no time lag.

The supply thermostat

Demand and supply are intimately related. When there is demand, suppliers will produce as much as possible to meet the demand. It also works in the opposite direction — when demand drops, suppliers will be caught out with excess supply and have to sell off their existing inventory at discounted prices. Concurrently, they will also cut production to match the reduced demand. Nonetheless, the key here is that it takes time to reduce your production capacity as you need to lay off staff and shut down supply chains, etc.

On the flip side, when there is a sudden surge in demand, it will also take time and money to scale up production to meet this demand. For example, it takes $10-20 billion dollars and around five years to build a single wafer fabrication plant. So even if the demand for semiconductors surged (like during and post-pandemic), supply cannot keep up immediately. Hence, the takeaway here is that supply acts more like a thermostat than a switch; it takes time to scale supply up and down.

And thus we have our demand-supply lag.

The lingering effects of COVID-19

When the pandemic struck, it killed so much demand that companies were suffering huge losses in almost every industry from hospitality to manufacturing with no apparent end in sight. These companies responded accordingly by shutting down or cutting their supply capacity significantly. Then as the pandemic receded and countries lifted restrictions, demand came gushing in again like a dam bursting. But now supply needs time to scale back up to meet all this ‘excess’ demand. The Russia-Ukraine crisis has made things worse but that was not the true beginning of the inflationary pressure.

Supply chains will eventually catch up with demand and the initial shock due to the demand-supply lag will ease. But the Fed is raising interest rates now in a bid to temper demand. This is a fine balancing act however, and raising rates too high, too fast could cause a hard landing (i.e., a severe recession).

The fifth perspective

Inflationary expectation has hit a decade high as reported in a recent Survey of Consumers by the University of Michigan. I believe that supply constraints will be eventually resolved, and inflationary pressures will be tamed; there is enough productive capacity but the key issue is that it takes time to jumpstart the supply chain. If inflationary pressures subdue earlier than expected, a rebound in the market could happen.

In the meantime, stay calm and continue to invest prudently for the long term.

WHEN PRICE GO UP

WHO IN THE SUPPLY CHAIN BENEFIT

WHEN DEMAND EXPECTATION IS HIGH

HOW DO WE LOWER THE EXPECTATION

Dear Mr OH KEAN SING,

This is Weiyang.

Thanks so much for your question.

In short, when prices go up no one in the supply chain benefits apart from primary commodities producers such as

Russia, Australia, oil producing countries and their respective companies . Everyone else along the supply chain suffers as they will have to try and pass on the higher cost in which they may find stiff resistance and may end up absorbing some or all the cost increases.

One of the most effective way to reduce inflation expectations is to increase the price of money aka interest rates which will dampen demand and that is why you see central banks around the world doing just that.

Hopefully that answers your question.

SO WHICH INDUSTRY WOULD YOU INVEST

IN INFLATIONARY ENVIRONMENT

IS IT TOO LATE TO BUY THE UPSTREAM INDUSTRY

WHEN INFLATION IS CONFIRM BY STATISTIC ?

DOES IT MEAN PLAYERS IN THE MIDDLE LAYER SUPPLY CHAIN

PROFITS WOULD INCREASE WHEN INFLATION IS CONTROLLED

Dear Mr Oh,

Firstly I have to sincerely apologize for this belated response.

As for investment in an any environment, one has to take into account various other moving variables and not only inflation. The central bank responses, current macro conditions, currencies movements etc. It is simply over simplistic to derive investment decisions based on one variable when all variables are interconnected, moving at different speeds and directions.

Adding a curve ball, markets tend to be priced forward 6-12 months ahead and it is possible that the current inflationary environment that you know now may turn deflationary 12 months down the road (there are signs pointing in that direction) and hence the decision to take positions based on inflationary environment may be rendered muted.

Another major point is that the official Inflation data released is historical and should be read with caution. It is better to read forward looking statements in tandem with data points such as freight rates or inventory backlogs which tends to give a forward insight into the state of economic performance.

As for your last question, the answer is generally yes. Mid stream players in the supply chain tend to perform better from stable prices as opposed to inflationary or deflationary environment.

TW ..I l like your writing. If you have an archive of your articles on investing, I would like a link please. Thank you very much and good luck on your financial journey.