Following up on the “Battle of the Telcos” series and my previous Singtel analysis, this week, I’ll be covering M1 and five important things you need to know about the company. But before we dive into that, here’s a background on M1’s business model.

The Business

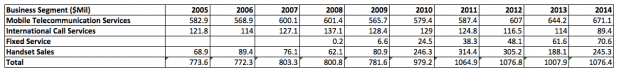

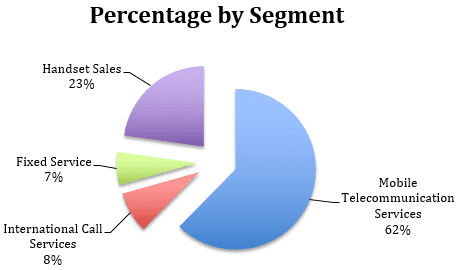

M1 has three major shareholders: Axiata Investment (28.42%), Keppel Telecommunication & Transportation (19.15%), and Singapore Press Holding (13.32%). M1’s revenue generation is derived from four business segments which are mobile telecommunication services, international call services, fixed services, and handset sales.

Mobile Telecommunication Services

The major contributor is mobile telecommunication services which accounts 62% of total revenue generated. Mobile telecommunication services comprises M1’s postpaid and prepaid mobile services. Postpaid sales account 88.1% of mobile telecommunication services’ revenue.

Handset Sales

Handset sales are the second largest revenue contributor (23% of total revenue). This segment focuses on retailing smartphones from brands like Apple, Samsung, LG, HTC, Sony, Asus, Blackberry, Huawei, Oppo, Xiaomi, and Lenovo. All handsets are sold through their distribution network of fourteen M1 shops and M1’s online store.

International Call Services and Fixed Service

International call services and fixed service are M1’s smallest revenue contributors which account 8% and 7% of revenue respectively. International call services generates its revenue from international call charges and overseas roaming services. Fixed service is the company’s fixed internet broadband service. Fixed service average revenue per user is $43.90.

Besides these four areas, M1 also provides other service offerings like MiBox, M1 Learning Centre, KyLinTV, Games Online, mLover, Toggle Prime, and M1 Security Suite, but they contribute a negligible amount to its total revenue at the moment.

Now that you have a brief overview of M1’s business model, let’s move on to…

5 Things You Need to Know about M1:

- M1’s market share in Singapore’s mobile segment has been decreasing for the past 10 years from 29.3% (2005) to 22.9% (2014). The decrease in market share is mainly due to stiff competition and the introduction of mobile number portability in 2008. Mobile number portability allows a subscriber to keep their existing mobile numbers when switching between telco service providers. Before this was introduced, a subscriber might stay with one telco due to the inconvenience of changing numbers. Now customers are free to choose the telco that offers the best service offer and value. M1 has fared badly in this regard and has trouble retaining its subscribers.

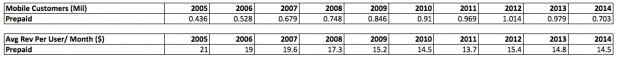

- Despite consistent growth in prepaid mobile subscribers from 0.436 million (2005) to 0.703 million (2014), M1’s prepaid average revenue per user per month decreased from $21 to $14.5 in the same time period. M1’s prepaid mobile customers actually peaked at 1.014 million in 2012 but a change in regulation by the Infocomm Development Authority of Singapore reduced the number of prepaid SIM cards a customer could own from ten to three. M1’s prepaid customer numbers fell 30% from its peak thereafter.

- Due to overall competition and mobile number portability, M1 has had to increase its marketing efforts to win new customers. Due to this, M1’s acquisition cost per post-paid customer has ballooned 3.4 times from $103 (2005) to $355 (2014).

- M1’s growth in the last ten years has come mainly from its fixed service and handsets sales segment. Fixed service (introduced in 2008) had an average annual growth rate of 165.9% — mainly due to it starting from a low base amount. Handset sales grew 15.2% on average annually over the last ten years due to the increasing demand for smartphones. Revenue jumped 204% in 2010 due to introduction of the iPhone 4 and Samsung Galaxy S releases. M1’s mobile telecommunication services only had an average annual growth rate of 1.6%. International call services revenue started to decrease due to the rise of smartphones and VoIP (voice over internet protocol) which allows users to make international calls through internet services like Skype and Viber.

- M1 launched their new mobile point of sale (mPOS) in June this year. M1’s mPOS, in collaboration with CIMB, MasterCard, and Wirecard, transforms smartphones and tablets into terminals that allow merchants to accept payment via credit, debit and prepaid cards. The mPOS industry is a growing one as more startups and SMEs seek ways to accept cashless payment from customers. M1 charges $5.35 a month for the service and is tied to an M1 data-bundled mobile plan. The real money is made not from the minimal monthly fee but from a percentage cut of every transaction made through the system. This industry could be a possible growth driver for M1 as it finds ways to diversify its business beyond the traditional telecommunication segments, but at the moment it is still new and we have to wait and see how this pans out for M1.

The Fifth’s Perspective

This wraps up my analysis of M1’s business model and how well-positioned they are to handle the entry of a fourth telco in Singapore. Next up, I’ll analyze StarHub and see how well they’ll hold up. So stay tuned!