I recently decided to switch my mobile provider from Maxis to Digi.com. This was after years of using a mobile provider that hardly provided me with any coverage most of the time. However, when I made the switch to Digi.com, it got me thinking about the telecommunications industry. I remembered when I was young, there were only two telcos in Malaysia: Celcom and Maxis. Digi.com was then a small telco startup with bad coverage and bad service.

Yet, in the last 20 years, Digi.com has grown to be on par with the two incumbents, with revenues close to RM6.6 billion in 2016. Although Digi.com Berhad (Bursa: 6947) is now one of the largest companies listed on Bursa Malaysia with a market capitalization of about RM39.0 billion, the company might still be worth a look at for investors. In fact, here are five reasons why I think you should keep this company on your watch list:

1. Strong track record

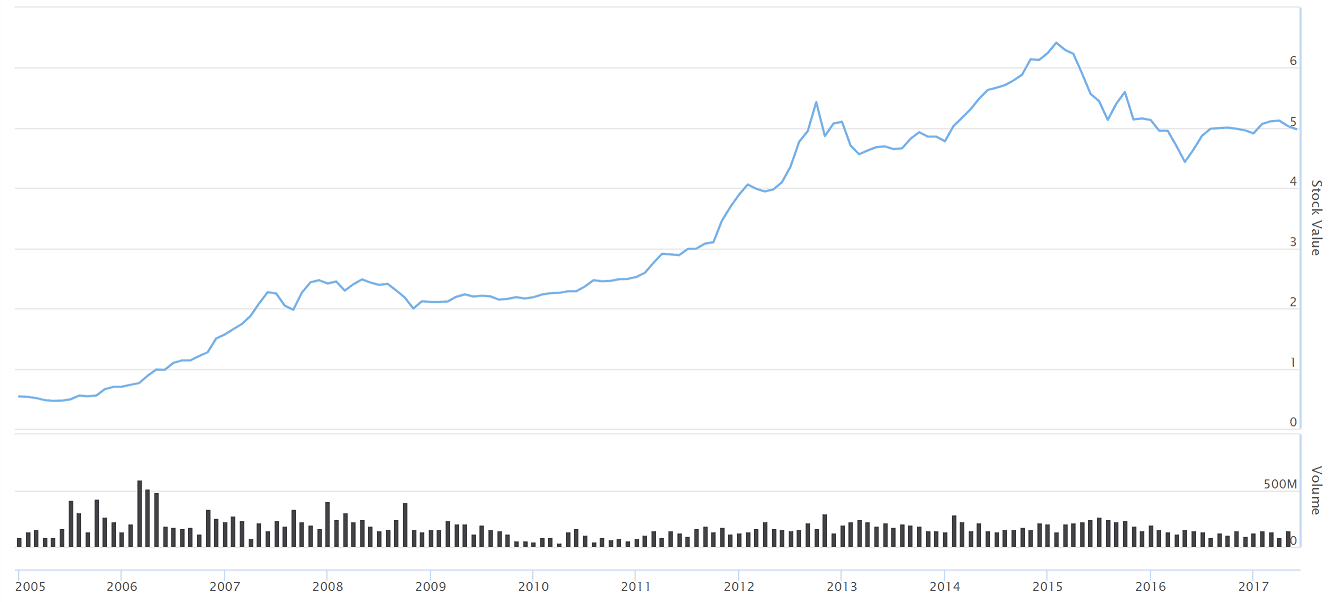

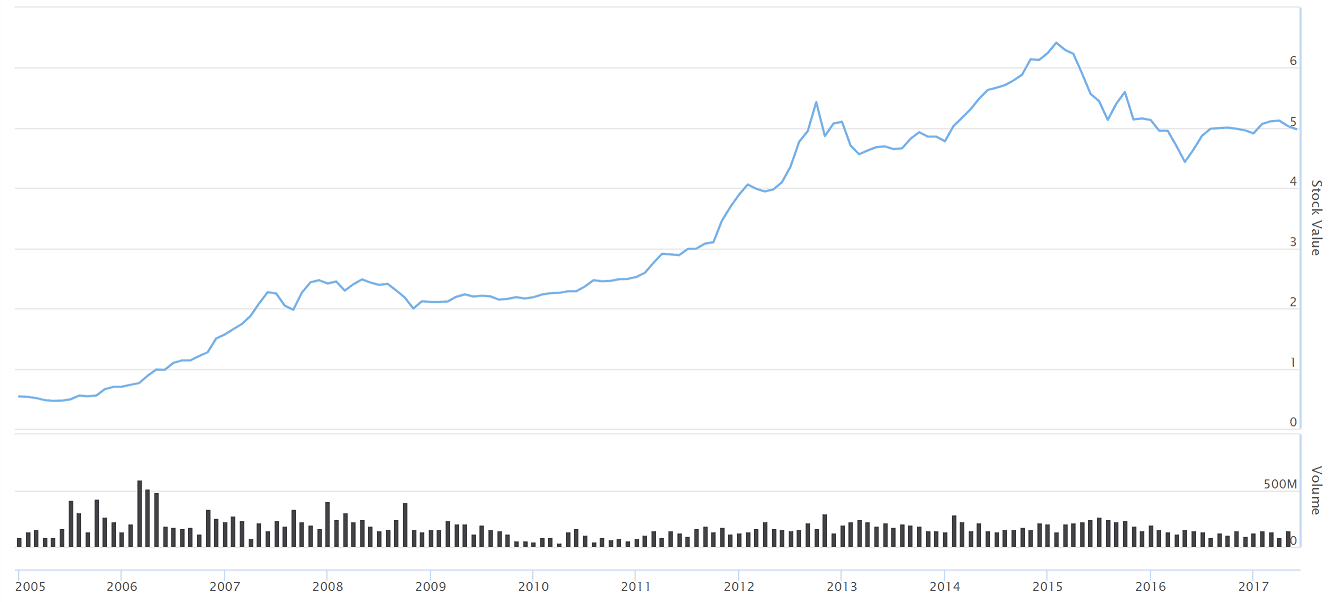

Digi.com has come a long way from being a new telco startup in the 1990’s to now standing side by side with Celcom and Maxis. Its long rise to success is also reflected in its stock price. Its stock price has increased from a mere RM0.50 back in 2005 to about RM5.00 today. That is an annual growth rate of about 20% a year over the past twelve years. It has a team that has proven to be able to grow the company and produce great returns for shareholders.

Digi share price 2005-2017. Source: BursaMarketPlace.com

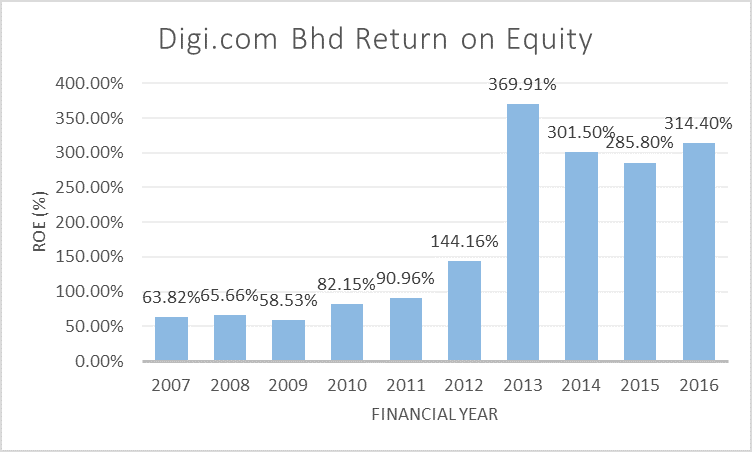

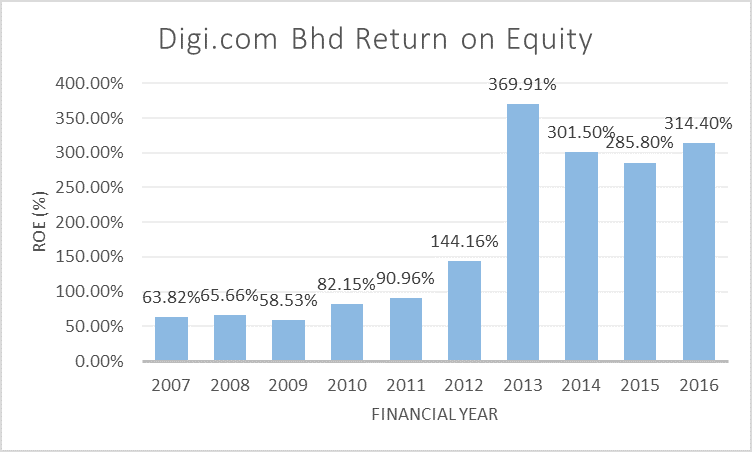

2. Eye-watering ROE

Due to its stable and strong free cash flow business model, the company has chosen to fund most of its operations with debt. Together with a high net income margin of about 24.7% in 2016, the company generated a return on equity (ROE) of more than 310% for its shareholders. This means that for every dollar of equity the company has, it produced a net profit of more than $3.10! That is a eye-watering ROE figure that only a handful of companies in Malaysia is able to produce.

Source: Morningstar

Interestingly, even with such high leverage, Digi.com has quite a low solvency risk. This is because its interest coverage ratio is still above 30 times for its financial year of 2016. Interest coverage ratio is a common ratio to measure the amount of annual profit a company makes to cover its annual interest payments. Digi.com generates more than enough profit to cover its interest payments by 30 times and shows that the company faces a relatively low solvency risk.

3. To judge a kid, look at the parents

One of the reasons why Digi.com is able to grow so successfully in Malaysia is partly due to the solid support from its biggest shareholder, Telenor ASA. Telenor is a Norwegian telecommunications company with a presence in many markets in Europe and Asia. Telenor still owns about 49% of Digi.com. Although Digi.com is technically just an associate of Telenor ASA, many directors and top management of Digi.com are still representatives from Telenor ASA.

Telenor has been very successful in building its presence in Asia. At the moment, the company is one of the key telecommunications providers in countries such as Thailand, Pakistan, and Myanmar. Telenor has a market capitalization of about US$23 billion. The success that Telenor has in so many markets could be very valuable for Digi.com in terms of knowledge and resource-sharing among Telenor’s group of companies.

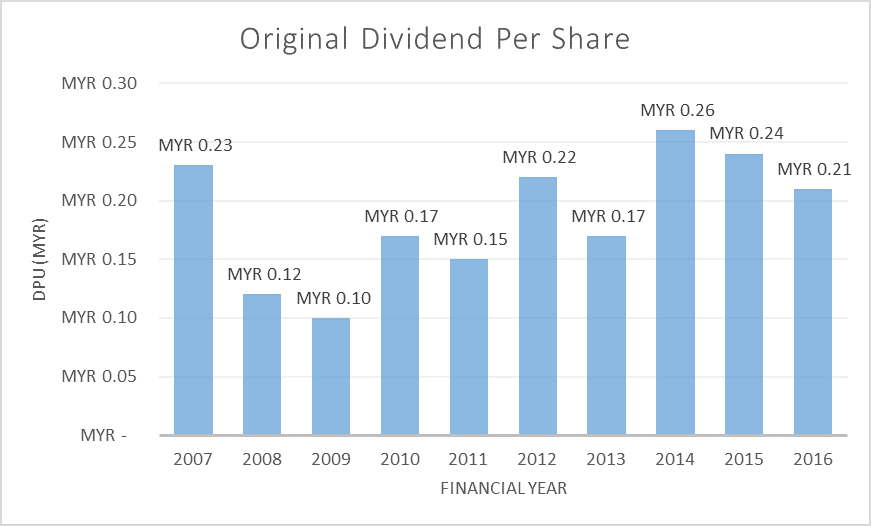

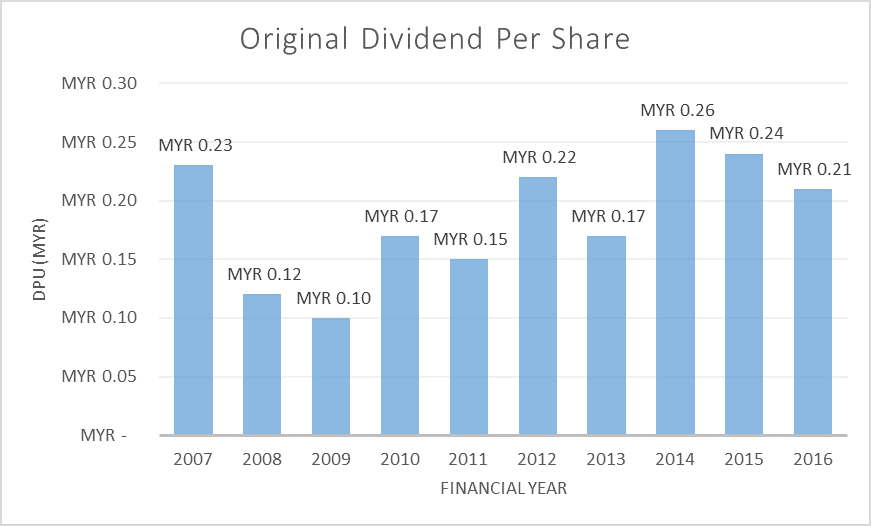

4. Solid dividend yield

Digi.com is currently offering a dividend yield of about 4.1%. That is higher than what both its competitors, Maxis Berhad and Axiata Group, are offering. It is also slightly higher than the 10-year government bond yield in Malaysia.

Source: Morningstar

5. Market dynamics

As a developing country, mobile users in Malaysia are still largely on prepaid plans. As the country progresses, more users will typically switch from prepaid to postpaid plans. This is good news for the company because postpaid customers generally have higher average revenue per user (ARPU) compared to prepaid customers. Thus, as users increasingly switch from prepaid to postpaid plans, so might the revenue for Digi.com increase as well.

Moreover, Digi.com gained market share in the postpaid segment in recent months (my switch certainly helped). This highlighted the company’s effective strategy against its competitors.

Hold your horses

However, if you are now thinking that Digi.com is the perfect stock with no challenges, I am here to burst your bubble. In fact, there are many challenges facing the company and the industry at this moment. The rise of smartphones means that data usage is replacing other more profitable services like voice calls and SMS. This is a huge challenge for telcos and Digi.com needs to plan how to continue growing in this new technological age.

Based on the company’s latest quarterly report in Q1 2017, it saw a 4.8% decline in its revenue year on year to just RM1.57 billion. The reduction in revenue also affected its bottom-line as the company experienced a 6.5% drop in its profit after tax to RM373.1 million.

As demand for more data becomes more prominent from consumers, competition might be heating up for Digi.com in the future as well. There are other internet data providers in Malaysia besides the telcos like Maxis, Digi, and Celcom. These providers offer data services through the WiMAX-based technology. These companies have also started offering mobile data plans to the public. If we combine all the companies in Malaysia that have the ability to offer mobile data services, Digi.com might be looking at close to 10 competitors. That is a huge increase in competition for the company.

The fifth perspective

Digi.com has many signs of a great investment. It has a long and strong track record. Its business continues to generate huge profits and cash flow for shareholders. The company has good support from its major shareholders and is offering a high dividend yield to investors. However, that does not mean Digi.com is a stock without risk. For one, the company has not been able to grow its revenue in recent quarters. The overall landscape of the telecommunications industry in Malaysia is also changing and Digi.com might need to deal with many more competitors in the future.

(Photo: Kelvin & Frank Reid)