Like most normal days, I love to do my work at Costa Coffee – a nice, cosy place where I can concentrate on my research. On one such visit, while I was waiting to purchase my favourite Green Tea Creamy Cooler, I couldn’t help but notice four big letters on the payment terminal by the cashier counter. The word was “NERA” and I vaguely remembered always seeing this name at most payment systems in Singapore. Being curious, I googled “nera” to check if it was a company listed on any particular stock exchange, and yes, it was – NeraTel was listed right here on the Singapore Stock Exchange (SGX).

Nera Telecommunications Limited (SGX: N01) operates in 16 countries – including Singapore, Malaysia, China, India, Australia, Morocco and Norway – and offers a range of products and services in the areas of wireless infrastructure networks, satellite communications, network infrastructure and payment solutions. Of these business areas, NeraTel’s payment solutions business was the one that piqued my interest the most as I delved deeper into the company (you’ll soon find out why below).

As is our advice that we best attend the AGMs of the companies we invest in, I attended NeraTel’s most recent AGM in April looking for information that might give me an edge in my analysis of the company and I wasn’t disappointed to say the least.

[**Do You Love Dividend Stocks? Click Here To Download This List of 10 Super Dividend List**]

So here are six quick things I learned from NeraTel’s AGM 2014:

1) NeraTel is a High Dividend-paying Company

Investors, in general, love high dividend stocks and NeraTel fits the bill.

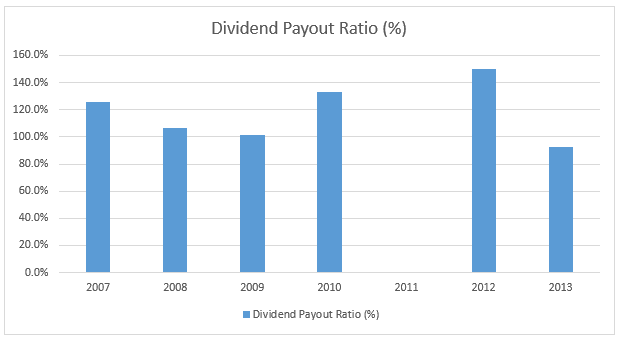

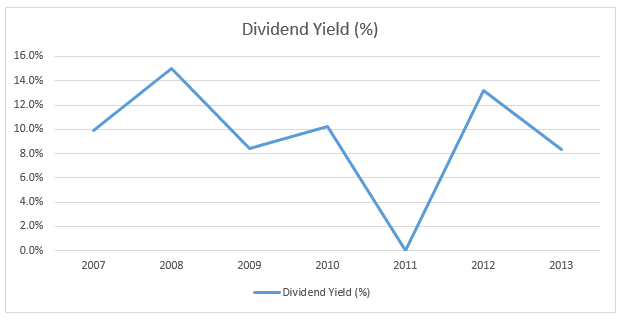

Except for 2011, NeraTel has a dividend payout ratio of 90% or higher from 2007 till now.

If you have bought NeraTel at any time from 2007-2013, you would have easily got a dividend yield of more than 8%. In comparison, the average dividend yield for the 30 component stocks in the STI over the last ten years is approximately 3%.

2) NeraTel’s Payment Solutions Business Segment is Growing

NeraTel’s payment solutions business segment (which account 21% of total revenue) is growing at 20%-30% per annum for the past 3 years. The reason payment solutions has been growing so fast is due to three things:

- a rise in debit and credit card spending

- government initiatives to go cashless

- banks outsourcing their point-of-sale infrastructure in order to focus on their core business activities.

When it comes to payment solutions, NeraTel offers their clients two options:

- NeraTel sells the point-of-sale (POS) terminals to their client and charges them recurring maintenance fees and percentage fees for every transaction made

- NeraTel leases the POS terminals to the client and charges them recurring rental fees, maintenance fees, and percentage transaction fees for every transaction made.

Either way NeraTel always nets a stream of stable, recurring revenue month after month, year after year. A company that has stable, recurring revenues that is highly predictable is hugely attractive to investors.

3) NeraTel is Increasing its Capital Expenditure (CAPEX)

As I mentioned above, companies with high, stable recurring revenues are hugely attractive to investors because of the predictability in their earnings. Because of that, the stock prices of these companies tend to trade at a premium and a higher P/E.

Currently, 21% of NeraTel’s revenue is recurring in nature and comes primarily from their payment solutions business. The company’s CAPEX is being used to increase the number of POS terminals in anticipation of expanding their payment solutions market share.

If the plan works out, NeraTel should see its overall revenue increase and, more importantly, the proportion of their recurring revenue as well, and we could see the stock slowly trading higher and higher.

4) NeraTel’s Payment Solutions are Easy to Scale

NeraTel’s POS terminals are all running on one base software they created themselves. It is extremely easy for the business to scale – they just need to add more POS terminals which connects to the same base software regardless of where the POS terminal is situated.

This means NeraTel can expand into different countries with the same set of terminals using the same software without having to create anything anew – saving a lot of time and money. This ease of expansion means the company can scale very quickly and potentially increase their revenue significantly over the next few years.

5) NeraTel’s POS Terminals Accept Both EZ-Link and NETS

NeraTel’s POS terminals in Singapore are the only ones that accept payment from both EZ-Link and NETS. Because of this convenience, we could see more merchants choose NeraTel over their competitors so as to provide more easy payment options for shoppers.

This slight competitive advantage could mean a lot to NeraTel in the long run especially if they establish themselves as the dominant player in the industry in Singapore.

6) Capital Restructuring is Highly Unlikely as of Now

A company like NeraTel is a good bet to undergo capital restructuring and include more debt financing in its capital structure because:

- Its revenue streams are increasingly becoming recurring in nature

- It has zero debt on its balance sheet

Debt financing has its advantages: a company can drastically increase its returns and ROE by using other people’s money (debt) to grow the business rather than using their own (equity). And as I wrote previously, a company with a higher ROE has a higher sustainable growth rate. But taking on too much debt can be risky. However for companies with stable, recurring revenues, the risk and debt obligations are more easily managed. Hence, NeraTel’s high potential to undergo a capital restructuring.

At the moment though, NeraTel is highly unlikely to do so because the company currently requires $20-$30 million in working capital and they cannot afford the capital reduction that a capital restructuring would bring.

[**Do You Invest For Income? Download This List of 10 Super Dividend Stocks Every investor Must Have In Their Watchlist – Click Here To Download Dividend List**]

Hi Victor,

I notice that their “Other Operating Income” is significantly lower due to “to the significantly lower accounts receivable collection fee.” as described in its Quarterly report 1Q2014. What does it mean by “Lower receivable collection fee” ???

Thanks.

Hi YJ,

Accounts Receivables are monetary obligations owed to the company by debtors or customers. Other Operating Income is income generated not related to a company’s core business. So in this case here, the lower “account receivables collection fee” may be not related to Neratel’s core business at all.

Hi

Nice article!

Actually I tried to look for word “NERA” on payment terminal but can’t find any.

Most are “Ingenico”. How do we know if the payment terminal is served by NERATEL and not other services? And in Singapore, how many other players are there? I’m seeing increasing trend of NETS flash terminal too.

Hi TK,

The payment solutions industry is a fragmented market with multiple players in the industry. But what I do know is that once a client uses NeraTel, they seldom leave them because it is extremely tedious to do so. The switching costs are high when it comes to payment solution systems.

As for the reason why you may not see NERA’s name on various POS terminals, it’s because NeraTel buys its hardware from a third party but it all runs on NeraTel’s software and systems. If you notice any OCBC or UOB terminals around, you’d probably see NERA on it. In some cases, you might see Verifone on a UOB terminal but that also runs under NeraTel’s software.

there are much talk on high dividends, but not much discussion on the ability to keep up with dividends. specifically, they have never hit 21 mil in profit before last year, so you are taking it that this is a ‘new paradigm’ which basically means not thinking about margin of safety in the purchase.

recurring revenue they are targeting 45% but what does that mean? if the margin is only 2-3%? it will just be a small part of their overall contribution vs infocomm and telecom. the company didnt provide information on that.

its strange that for a value proposition the talk is about linking revenues and stock trading higher. this seems more attune with trying to sell a story to be good like what a lot of the companies ceo does.

if this is a value proposition in payments, why not indicate the exceptionally high moat in payments by showing no one can take away this market share from them that their payment segment fcf or profit keep going.

Hi Kyith,

It is our honour to see an established financial blogger like yourself commenting on our site. It is always great to have others give feedback from different perspectives in case we may have missed out on any certain blind spots.

1) Regarding NeraTel’s dividend, the company has been generating $16-$26 million in cash flow from 2008 to 2013. Their average CAPEX has been around $3-$4 million (except in 2013 when they invested more in their payment terminals). Their annual of dividend of $0.04 works out to around $14 million. My opinion is that NeraTel shouldn’t have an issue maintaining this level of dividend payout. But of course, any higher though, without a corresponding growth in revenue and cash flow, wouldn’t be sustainable.

2) I agree. As you have pointed out, NeraTel’s main revenue at the moment comes from their infocomm/telecomm equipment sales business segment, while the recurring portion of their revenue is only 21% of the total right now. Equipment sales are generally lumpy in nature because the company has to constantly seek new orders from customers. In order to “smoothen out” the lumpy nature of their revenue, NeraTel is focused now on increasing their streams of recurring revenue.

I do not totally avoid low-margin businesses: I’d take a look if a company has the size and scale that might more than compensate for the low margins.

3) I would say yes – in general, companies with higher revenues and profits trade at higher stock prices; a company that is more profitable is more valuable, all things being equal. Based on my personal experience, companies with a high proportion of recurring revenues tend to trade at higher relative P/Es due to the predictable nature of their earnings.

4) I would say NeraTel is still in the process of building their competitive moat as the payment solutions industry is still fragmented. I know most investors prefer to invest in companies that have already built a strong competitive moat. For me, I enjoy looking for companies that are still in the process of building that moat because I believe that’s where the bigger growth lies.

Once again, thanks for dropping by and asking your questions! Everyone definitely learns and benefits more through them 🙂

thanks for the reply.

i would have thought the high dividend stated indicate that it is value to purchase at this price because a 6 cent dividend, which translates to 7.8% at 76.5 cents is attractive. if its 5 cents its 6.5% (18 mil) if its 4 cents is 5.2% (14 mil). 4 cents looks sustainable provided a 2009 doesnt happen, and its an leveraged yield. some how the share price does not equate to much margin of safety. it implies at 76 cents, there are much growth in earnings/fcf embedded to it, failure which it will not subtantiate the share price.

it is interesting that you cite that equipment sales are lumpy. neratel don’t seem to indicate that and rain or shine their “order wins” have been consistent. i wonder if you have found out the business reasons for that. do they have a starhub-telechoice relationship going that a person lacking competency like me fails to see.

its not right to look at low margin as not good, but what i meant is that they could have need a lot of capex, lease them out only to bring in proportionately less free cash flow. we wonder that is good enough. if i look at PAX global, they seem to be only selling the payment systems, their gross margins is 30-40%, and operating margins are around 15% for their main markets in china. perhaps they cannot hit that high of a margin, but i struggle to see how much additional they can bring in.

a business that has a recurring revenue may tend to trade at higher PE, and if we look at it that way, we perhaps are talking about buying something like SATS with a recurring revenue stream, but not taking a look if competition have result in a business needing to earn more revenue to make the SAME amount of profit. there are a few examples namely micromechnics. good managers but they face that reality.

was there a moat to neratel? my gut tells me there simply isn’t and perhaps like i reiterated there isn’t an ah ha moment reached for me.

how would you value a good price to purchase with margin of safety?

Hi Kyith,

I wouldn’t say that there is value to purchase any stock based on dividend yield alone. What I do think is that NeraTel at its current price of 76 cents fetches a very decent dividend yield of 5.2% when compared to the 3% average dividend yield of the STI and keeping in mind the potential growth we might see in the company if their payment solutions segment grows substantially. I’m personally comfortable with the margin of safety at this price: If NeraTel’s payment solutions growth plans pan out as expected, I assume to see a gain in my capital returns and dividends down the line. If not and NeraTel presumably remains stagnant at its current level, you still net a 5.2% dividend yield (4 cents looks sustainable) or if you’re seeking more growth, you could divest and move your capital somewhere else.

Yes, equipment sales are lumpy precisely for the reason that their order wins don’t seem to be consistent; NeraTel’s equipment sales are generally up-and-down and they come in “lumps”.

I personally don’t think NeraTel will overspend on its capex to a point where the expectant growth in cash flow from the leasing revenues and the volume of transaction fees from their POS terminals isn’t able to justify the expenditure. I would think the management has got a good handle on this.

Is there a huge competitive moat around NeraTel? Not currently; they are still in the process of building it – which is exactly what I’m looking for. I personally enjoy looking for companies that are still in the process of building that moat because I believe that’s where the bigger growth lies.

Thanks for the questions and spending time on our site. Hope to see you more around here 🙂

thanks for the answer. i wonder whether there is a moat to build up at all. perhaps you are expecting the selling of the terminals to be rather sticky. just better hope the new wireless ibeacon kind of payment methods just don obliterate them. could the moat be a rather cosy tie up with some telcos who will ALWAYS spend?

i don’t come in a lot due to too much marketing. and there are much stuff to read.hope you understand