We arrived at around 8:15 a.m. to attend UOA Real Estate Investment Trust’s (UOA REIT) 2017 AGM but unitholders/proxies had already formed two long queues to register themselves. While queuing up, we overheard a unitholder complaining that the number of unitholders for this year’s AGM had doubled compared to the previous year.

Another unitholder replied, “Huh? You’re not aware of the current trend?”

The first unitholder gave a puzzled look before her friend explained that many unitholders were only interested in the freebies and a free meal – and were not keen to actually attend the AGM at all. This proved true as we later saw more unitholders rushing to attend another AGM for more freebies. At the end, only a handful of unitholders stayed on until the meeting’s conclusion.

But we digress…

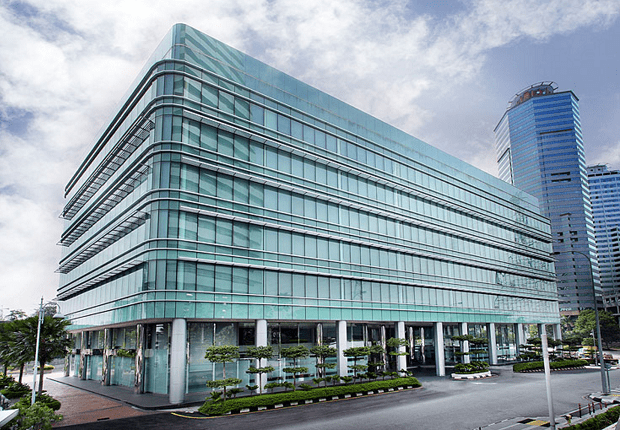

UOA REIT was listed on Bursa Malaysia in December 2005. It owns six office buildings with a total net lettable are of 1.49 million square feet (excluding carparks): UOA Centre Parcels, UOA II Parcels, UOA Damansara Parcels, Wisma UOA Pantai, Wisma UOA Damansara II, and Parcel B- Menara UOA Bangsar. As at 31 Dec 2016, UOA REIT’s total portfolio is worth RM1.19 billion. The REIT is managed by UOA Asset Management.

Here are eight things we learned from UOA REIT’s 2017 AGM.

- Net rental income decreased 3.6% year-on-year to RM66.5 million. Income after tax fell 55.0% from RM110.3 million in 2015 to RM49.6 million in 2016. However, this is mainly due to a one-off fair value gain on investment properties of RM64.1 million which inflated the income after tax in 2015.

- From 2005 to 2016, UOA REIT’s net asset value (NAV) per unit has increased from RM1.05 to RM1.67. Its total NAV as at 31 Dec 2016 was RM704.6 million. Including distributions, UOA REIT has given an annualised return of 12.54% its since IPO in 2005.

- As at 31 Dec 2016, UOA REIT’s gearing ratio stands at 33.6% and its cost of debt is 3.35-3.55%. CEO Kong Sze Choon shared that UOA REIT’s cost of debt actually fell because Bank Negara reduced its overnight policy rate in July 2016.

- UOA REIT’s portfolio occupancy rate is 75% and its weighted average lease expiry is only 1.24 years. The occupancy rates of each property are listed in the table below:

Property Occupancy Rate Parcel B- Menara UOA Bangsar 98% UOA II Parcels 90% UOA Damansara Parcels 88% UOA Centre Parcels 79% Wisma UOA Damansara II 79% Wisma UOA Pantai 56%

The reason for Wisma UOA Pantai’s low occupancy rate is because a key tenant moved out of the building as they purchased their own building and the REIT has yet to fill the vacancy. - A unitholder voiced her dissatisfaction with the annual report especially since she had already raised her views last year. She pointed out that the report had no photos of the board of directors, no breakdown of the tenants by industry, no figures on the net lettable area of every property, and no information on upcoming lease expiries — whereas these are all provided in the annual reports of other REITs. The CEO said the annual report fulfils the minimum requirements of the Securities Commission but took her comments into consideration. As for the photos of the board of directors, he said that it wasn’t a critical issue and results are what matter at the end of the day. He joked that if she was keen take a photo with them, they could take selfies after the AGM at which point the room burst into laughter.

- A unitholder asked the board about UOA REIT’s competitive advantages moving forward. To which the CEO replied: “Honestly, I would like to tell you all more but the thing is I do not know who is from Sunway, Tower REIT, etc.” and received a round of laughter around the room. He then shared that the development of public transport in the Damansara areas has helped; ever since the MRT started, there have been more enquires coming in. The CEO also highlighted a co-working space tenant at Wisma UOA Damansara II that recently won an award by Digital Hub. By extension, he feels that Wisma UOA Damansara II is benefitting due to the publicity of co-working spaces right now. As the start-ups in the co-working space grow in size, they will seek larger offices and if so, Wisma UOA Damansara II might become a priority. Besides this, the management is also planning to carry out asset enhancement initiatives to improve their buildings in Jalan Pinang and the Damansara area.

- Another unitholder asked if the management was facing any difficulty in securing renewals and maintaining yield in this competitive environment. The CEO admitted that the office sector in Kuala Lumpur has been very competitive over the past few years. As such, the management has had to lower rents to win new tenants and keep existing ones. But he added that the good location of their properties helped to secure tenants who were looking for offices in prime areas. At the moment, UOA REIT’s rental yield ranges around 7-8% based on their evaluation.

- The CEO mentioned that its property management team has worked very hard to reduce UOA REIT’s carbon footprint and electricity usage from its buildings. He did not give details but believes that environmental initiatives like electricity conservation and water harvesting can be a competitive advantage by reducing cost.

With additional article contributions by Mitra Chen.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Learn how to pick the best value-growth investments using one 4-step formula.

Last week UOA REIT decided to sabotage their own property and reputation by causing the Menara UOA Bangsar to be without a JMB due to some dispute with smaller proprietor. This is a blantant irresponsible behavior of the highest order. Please let your reader or investor know to stay away from this tyranny corporation.