How saving just $11 a day can make you a millionaire

Before you think this article is a bunch of hyperbole, I want to say that, yes, it is possible to make a million dollars by saving just $11 a day. The only thing is… it won’t happen overnight. So if you’re looking for a silver bullet or some magical ‘get-rich-quick’ scheme that will bring you eternal riches right now, you’ll have to look elsewhere (and I’m not sure if you’ll ever find it).

But if you’re looking for a steady, no-frills, no-bull method of building your wealth and enjoying your golden years when it’s time to call it day, then we believe that there’s no better way than this.

Although this may take time, the good news is you can speed up this process if you want to. If you’re willing to work harder and be disciplined in your savings and wealth building, you can enjoy the fruits of your labour much earlier. In any case, we want to show you what is possible even if you just start with $11 a day.

(Why 11? It’s an arbitrary number that’s easy to remember, annnnnd it’s my wife’s birthday.)

By now, it should be no secret that our method to building lifetime wealth is to consistently save and invest your money. This is an investment website after all, and we also believe in getting your financial house in order first before you even put your first dollar into the stock market.

Many times, we receive emails from readers saying that they’re not sure if they should even invest. Some of the most common questions we get are:

- Should I invest even if I only have limited capital?

- Do I need a huge sum of money before it’s worthwhile to invest?

- If I only have a thousand dollars to invest and my portfolio gains 10% in one year, I’ve only made $100. It seems too little, too slow.

Do you ask some of these questions yourself? Even if you do, it’s entirely normal because we get this all the time. And I too had the same doubts when I first started investing.

But the thing is, if you never start now, then when?

And if you never have enough to invest, then how will you ever have enough if you don’t invest now?

It looks like a catch-22 situation but it isn’t. The answer is to just start small and grow it from there. Even if you only have $11 a day to set aside.

Is it possible? Let’s have a look.

Savings

First, is it possible to save $11 a day? By most measures, it should be reasonable for most people to save $11 a day. Which means you can save approximately $330 a month or $4,015 a year.

Read more: 6 ways to reduce your monthly expenses… without compromising on your lifestyle

So how much can you grow your wealth if you continue to save $11 a day until the day you retire? Assuming a normal person starts work at 25 and retires at 65, saving $11 a day will give you:

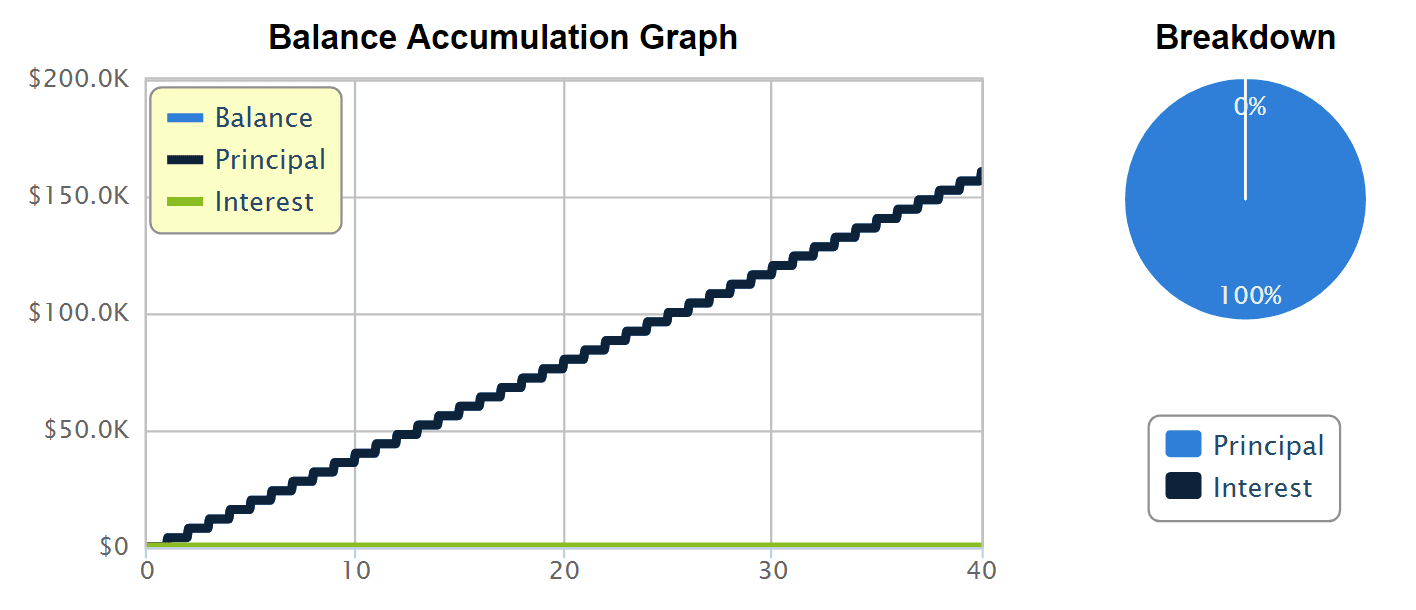

$4,015 x 40 = $160,600

Saving $11 a day for 40 years.

After 40 years, that’s not much at all and most definitely not enough to fund your retirement.

We all know this: savings alone are not going to save us. (Pun totally intended.) We need to invest and grow that money as well. So let’s park our money somewhere safe where it can grow.

Fixed deposits

How about fixed deposits? Notwithstanding promotional rates, the current annual fixed deposit rate from DBS Bank is 1.2% — and that’s if you lock your money up for at least five years.

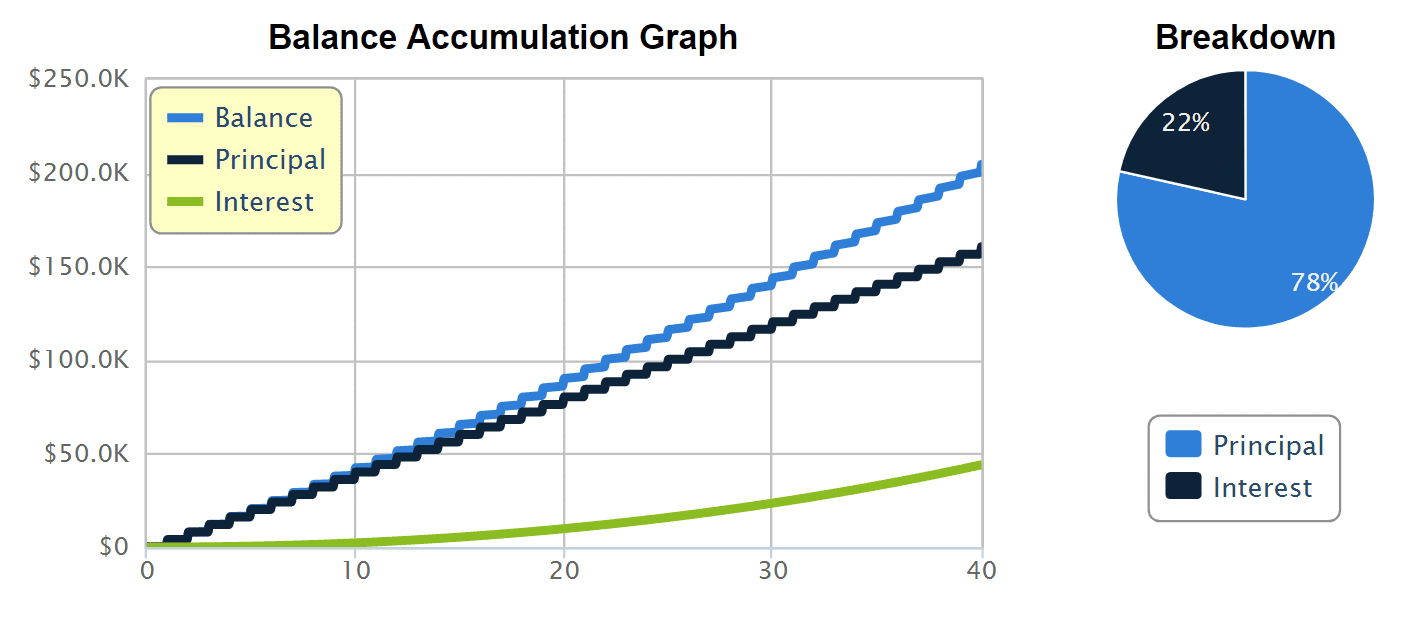

Assuming the interest rate doesn’t move, how much will you earn if you save $11 a day and lock it in a fixed deposit for 40 years?

Investing at 1.2% p.a. for 40 years.

About $204,585.

As you can see, the total amount now comprises 22% earned in interest. That’s better than keeping all your savings under your mattress or hidden in your Milo tins, but we’re still far from a million dollars and sipping piña coladas at a nude beach in St. Martin at 65 with other sexagenarians. (That’s not a dirty word by the way.)

We know Singapore banks are notorious for offering some of the lowest interest rates compared to foreign banks. For example, Malaysian banks offer higher fixed deposit rates at around 3%. Using the same scenario, that will give you around RM302,736 after 40 years – but, yes, you have to invest in ringgit.

Bonds

Ok, instead of fixed deposits, how about bonds? We receive a higher fixed interest rate and bonds are still considered relatively safe.

Well, some bonds are considered extremely secure like AAA-rated government bonds. But there also are so-called junk bonds (rated BB or lower) which are high-yield, high-risk instruments.

We’ll steer clear of junk bonds because this money is for our savings and retirement and we’ll pick a AAA-rated sovereign bond from a financially stable, well-governed, well-managed country like… Singapore! (Surprise.)

The easiest way to invest in Singapore government bonds is through the Singapore Savings Bonds (SSBs). Besides offering higher interest rates than Singapore bank fixed deposits, SSBs also extend other benefits and advantages to investors.

As of the time of writing, the current 10-year interest rate for SSBs is 2.1%. (The 10-year yield has been between 2% to 3% most of the time.)

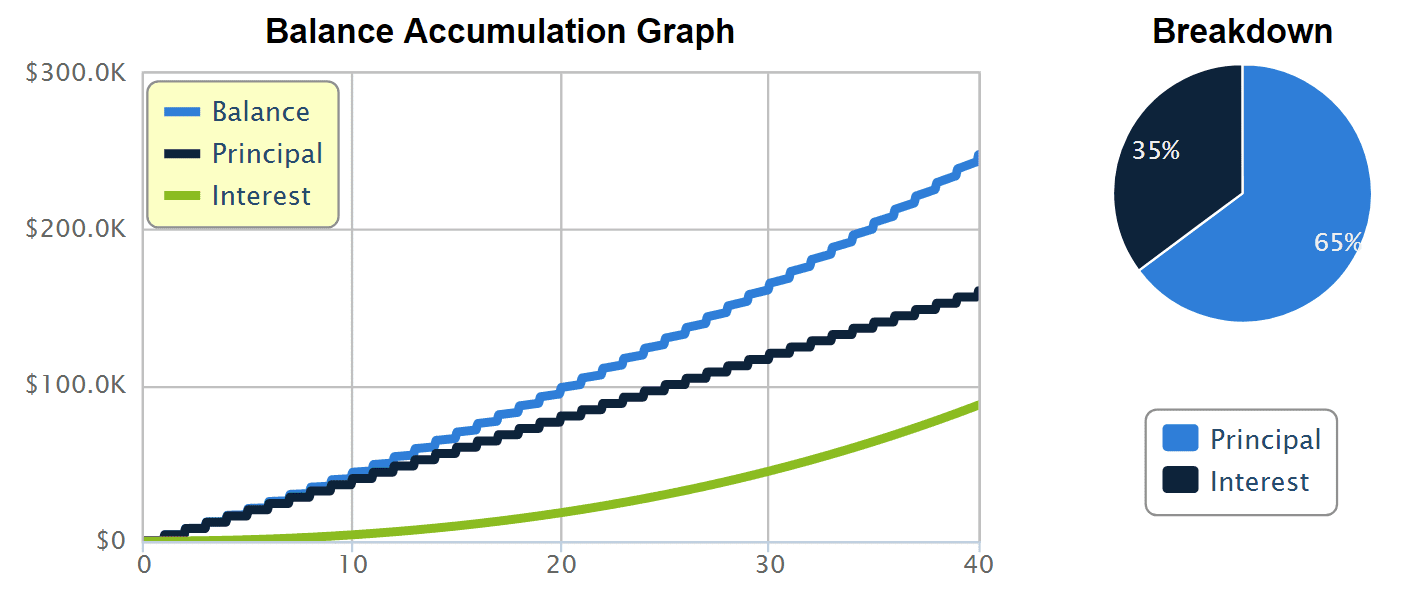

So assuming the interest rate doesn’t move, how much will you earn if you save $11 a day and invest in SSBs for 40 years?

Investing at 2.1% p.a. for 40 years.

About $247,841.

As you can see, the total amount now comprises 35% earned in interest – your money is working harder for you to make more money.

(Side note: The Singapore government currently allows an individual to only invest a maximum of $100,000 in SSBs, but for the purpose of simplicity, we will assume an individual can invest beyond that limit in this example.)

Comparatively, 10-year Malaysian government bonds offer an interest of 3.9% (as of writing) and have ranged between 2.87% and 5.35% over the last 16 years. While you net a higher yield, the Malaysian government bond is rated A-.

But let’s be honest, investing in bonds alone isn’t going to help the average person retire comfortably. So unless you’re ultra-conservative and you have a large pile of cash sitting somewhere which you can use to invest in AAA or AA-rated bonds, we’re still more than three-quarters away from our million dollar goal.

Read more: 3 reasons why bond investing is a negative art

Stocks

If the bank and bonds can only provide you with around 1-3% growth per annum, what about stocks?

Well, stocks have historically outperformed bonds over the long term. According to this New York University study, if you invested $100 in the 10-year U.S. treasury bond from 1928 to 2016, your total compounded returns would be $7,110.65. That’s a 71 times return. Amazing.

But if you invested the same $100 in the S&P 500 from 1928 to 2016, your total compounded return would be… $328,645.87 — a 3,286 times return.

That’s a HUGE difference. And although the data is from the U.S. markets, I’m pretty sure the same holds true: that most equity markets around the world will historically outperform bonds over the long term.

Let’s find out.

In Singapore, we have the Straits Times Index (STI) which comprises the 30 largest companies listed on the Singapore Exchange. If you invested in the STI from April 2002 – when the SPDR Straits Times Index ETF was first launched – to May 2017, your annualized return over the last 15 years would be 7.28%.

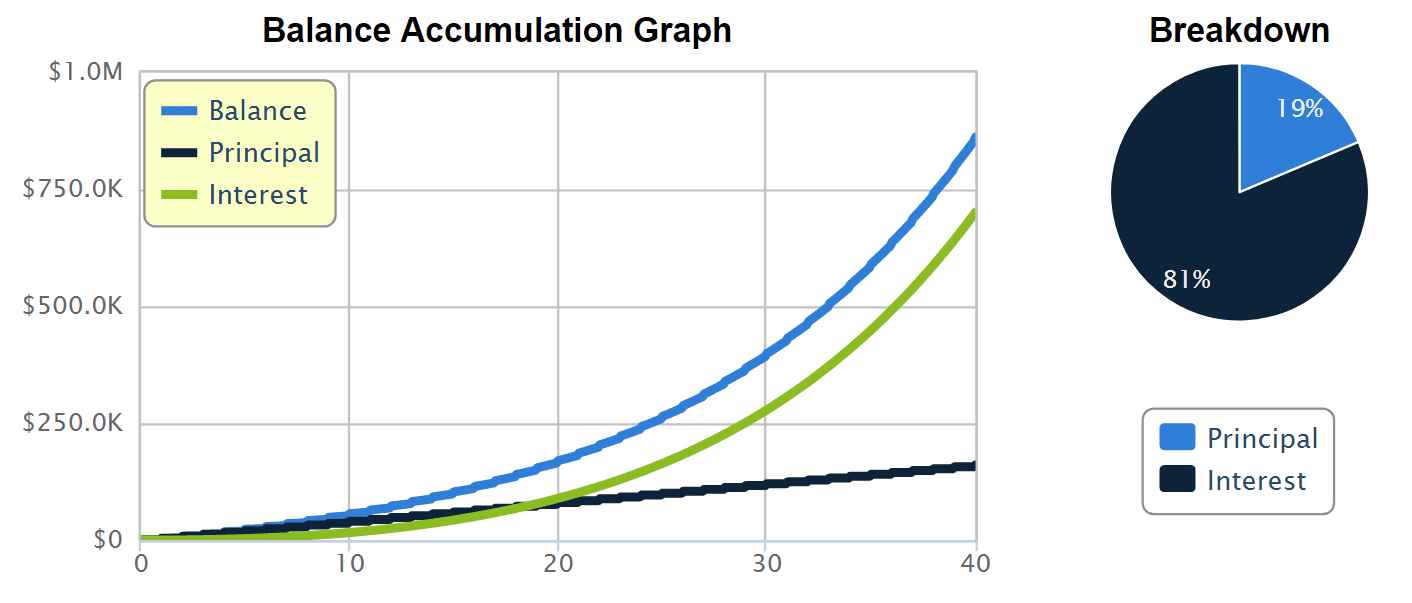

Assuming that the STI’s average annual returns will remain around 7% for the long term, how much will you earn if you save $11 a day and invest in the STI for 40 years?

Investing at 7.28% p.a. for 40 years.

About $861,712.

That’s more than triple your returns if you invested in SSBs. We’re not at a million dollars yet, but we’re almost there. However look at the principal/interest breakdown — 81% of this amount is earned from interest. Your money is really working hard for you now!

What about the Kuala Lumpur Composite Index (KLCI) in Malaysia? From 1977 to 2016, the KLCI rose from its original base of 100 points to close at 1,642 at end of 2016. That’s an annualised return of 7.25% over 40 years. Remarkably similar rate of return to the STI.

The Hang Seng Index (HSI) in Hong Kong also has a similar long-term average annual return of 7.69% from 1987 to 2016. But that slight extra makes a sizeable difference – you’ll have $958,843 after 40 years from just saving $11 a day and investing in the HSI. That’s already almost a million.

What about the S&P 500? From our earlier study, we know the long-term annualized return of the S&P 500 from 1928 to 2016 is 9.53%. Assuming the S&P 500’s average annual returns will remain around 9.5% for the long term, how much will you earn if you save $11 a day and invest in the S&P 500 for 40 years?

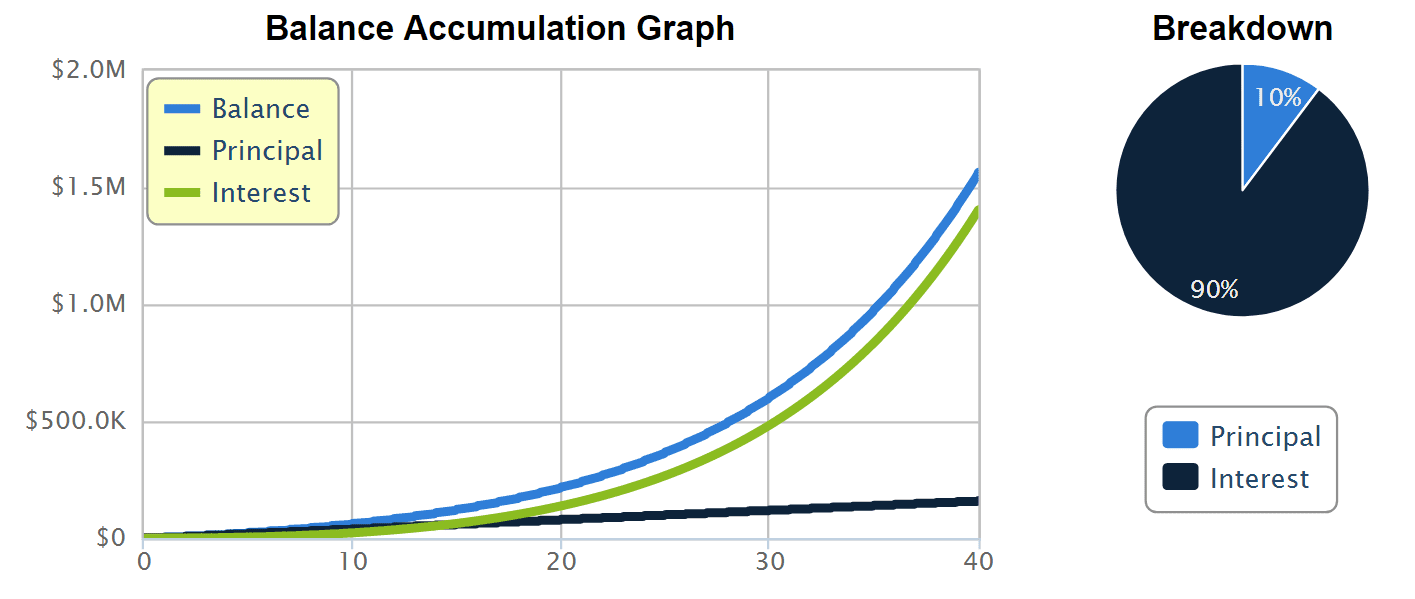

Investing at 9.53% p.a. for 40 years.

$1,564,500.93.

We’ve hit our goal of a million dollars and then some.

In fact, to hit one million dollars, all you need to do is to just save $11 a day and invest at an average annual return of 7.8%. And we’ve seen how achievable this is by just investing in the index. You don’t even have to do any stock picking; just buy the whole market!

I know past performance is no indication of future results. But if you believe in human endeavour and that there will always be newer, more successful companies to replace older, fading companies in the future (which is essentially what the index is), then we should expect the stock market to continue growing in the long run.

The fifth perspective

The idea of this whole article isn’t to dumb down the process of investing or play down the challenges you’ll face – yes, the stock market doesn’t go up in a straight line, there will always be another stock market crash, and you may sometimes find yourself barely breaking in the short term. You’ll also need tons of discipline and the commitment to save and invest for decades until you decide to retire. (By then, you might love it so much, you’ll continue investing.)

At the same time, we want to prove that it is possible to make a million dollars or more if you’re willing to stick it out for the long term.

And if you think saving and investing for 40 years is too long to make a million, remember you can always increase the amount you save every year (especially when your income rises) or improve your returns by learning how to invest better – all of which will get you to your goal faster. For example, if you save $20 a day and compound your money at 10% a year, you will reach a million in 28 years.

Even if you only invest in the index, you can also potentially increase your investment returns by only buying when market valuations are low – like during a market crash – and selling when valuations hit historical highs.

So even if you don’t have a large amount to start with now, you can always start small — even if it’s just $11 a day.

(All charts: Calculator.net)

Dear Adam Wong, your article “How saving $11 a day can make me a millionaire” is realistic to follow. However, it only applies to those who start early probably at age 25 after passing out of college. How about retirees like me (age 72)? Any hope of becoming a millionaire? Fat hope equals No hope.

Hi Kwie Siew,

I can’t comment much since I don’t know your personal financial situation. But while your goals and time horizon in your seventies will be very different from someone in his twenties, I think it’s still important to manage our finances, save and invest even at 72. We might end up living till 90!

If you’re retired, you can still give someone a head start by investing. Half of the money I invest actually came form my parents, who had the foresight to save and invest (but quite late.. runs in the family lol.) My grandparents invested late, my parents invested late, I invested late, but now my nephew will be a multi-millionaire.

The whole point of investing is so that your next-of-kin won’t have to suffer like you.. not for anyone to be millionaires or whatever.

If you live in Malaysia, I think pretty much everything is cheap, and the interest rates are pretty okay. One million you want to do what? char koay teow also can’t buy.

One million dollars will not make Bovril ever contain beef extract. One million dollars will not pay anyone enough to churn fresh butter from a cow. One million dollars will not buy a good medium-rare steak (unless you want to fly and deal with the jet lag, which btw one million dollars will not protect you from.)

Money is a medium of exchange, but it fails when there’s nothing much to exchange it for. You may be a millionaire, but your quality of life is not much different from a poor man.

You have money to buy but nobody has anything of value to sell you. So you end up buying companies. At least, you think, my descendants will know better than me what to do with all this money.

So you continue making money, and then die rich and pass it over. What else can you do?

Dear Adam,

Thank you for this excellent article.

Every person below 35 should save and invest as per your advice.

Best wishes.

Thank you! Glad you liked the article.

Over 35s also can!

The millionaire achievement is based on the assumption that future returns on stocks will be similar to past performance. In the past we had rapid growth due to industrialization and globalization. Today, it looks like globalization is taking a pause or even taking a backward step. Moreover, ageing demographics in developed world and China lowers potential growth of economies. As such, returns are likely to be reduced going forward and one may have to save more than $11 a day to gain millionaire status via stocks.

Yes, I agree. While China looks to be slowing down (notwithstanding its One Belt, One Road initiative) and the US and UK pulling back due to Trump and Brexit, I have the personal view that the world (i.e. us humans and our economies) will continue to grow, innovate, and prosper in the long run.

50 years ago, humans had only ever set foot on Earth, Intel hadn’t been founded, and ARPANET — the precursor to the Internet — was still 16 years away from being invented.

Now we’re shooting for Mars, we carry mini-supercomputers in in our pockets, and we’re heading into the realms of artificial intelligence, virtual reality, and gene editing. Unless nuclear war wipes us out, who knows what we (and our greedy corporations) might achieve by 2067?

For your data and assumption, do you assume you save as you invest or you got the lump sum at the very start? Given the rigorous frequency of contriution, transaction costs are going to add up.

HI DW, for this article, you save $11 a day and make periodic deposits of $4,015 annually. So you only invest that sum once a year.

If you’d like to include fees, using the $25 that most local brokers charge per trade, that is 0.6% in transaction costs.

@kwie siew- in all honesty, I know someone who invested in shares all his life but only truly earned a significant amount when he became a full time investor at 60. He became multi-millionaire in few years time.

So in reply to your question, yes very do-able with the correct skills. Most of us have no time or knowledge to invest- this is the only barrier.

Wow. Thanks for sharing! Kudos to your friend!

One caveat is that the returns curve will not be as plotted. To earn the higher returns with stocks, one must be able to stomach their networth halving overnight and not sell out. Some times its more about the mindset than knowing the potential returns.

Nonetheless, your post is food for thought for many. Maybe useful to point readers to related materials such as DCA and lump sum investing and the volatility of the market.

Looking forward to some thing that provides exposure to something like the Vanguard Total World Stock ETF or S&P without all the hassle and high associated expenses.

Thanks Desmond! We may cover those in future articles soon 🙂

There are some funds in Malaysia and Singapore that track the S&P.

I’m 28 this year. What if I don’t want to wait until my golden years to achieve that level of wealth? What if I want to achieve my first million in my thirties? Is this strategy scaleable or better to do business?

Hi Shin,

While there are investors who make it big in the markets over a shorter period of time, not everyone has the skill, aptitude or time to be a superinvestor.

If you want to make a million by your thirties, there are many ways to achieve that; business is one of them. But whichever path you choose, I think it is still important to know how to invest and preserve the wealth.

Hi

Your example of investing in stock such as the STI or the s&p 500 which are so expensive and require a huge starting capital. I am currently 23 years old and if i start saving 11dollars a day. How long will it take for me to have enough capital to invest in then.

Hi KW,

A single lot of 100 shares of the STI ETF costs S$330.

A single share of the S&P 500 ETF costs around US$240. (Yes, you can buy one share in the U.S. market.) So I wouldn’t think that is too expensive.

But, of course, I wouldn’t buy just one lot/share because of broker fees. Considering that most local brokers charge $25 per trade, the minimum I would invest at one go is $2,500 — that would keep my fees at 1%.

Using the example laid out in the article where you save $11 a day/$4,015 a year, you don’t have to wait too long before you have enough capital to start investing.

You can put the money in a unit trust at the end of the month. That’s what most people with no money and no time do.

Hi,

Are there any platforms that can allow me to invest in Vanguard ETF with minimum monthly amounts such as RSPs?

How can I invest in S&P 500 with limited capital and at lowest costs

Please advise.

Thanks

Hi Ben,

The cheapest way to invest in the Vanguard S&P 500 ETF (or any Vanguard ETF for that matter) is through a Vanguard brokerage account. There is no commission, minimum account balance, or minimum investment requirement. Quite awesome, really.

https://investor.vanguard.com/etf/fees

Vanguard also offers automatic investment plans through their platform:

https://investor.vanguard.com/investing/portfolio-management/regular-investments

Hope this helps!

Hi,

I am 18 this year and actually new to investing and i’m not quite sure how does your assumption works. As most said for ETFs ,i should just invest in a monthly basis and at long term and only get the returns from dividends but i don’t see how dividends for investing $330 monthly would eventually led to that much return . I have been looking closely at Nikko AM STI ETF and have been considering to try it out using POSB’s invest-saver to avoid brokerage fees and so on . May i ask for your opinion about it ?

Hi Lu,

Always good to see someone take an interest in investing at a young age! The index returns are based on total returns (capital gains + dividends).

You can certainly choose to use a monthly plan like POSB Invest-Saver to invest in the index. This way you ignore market fluctuations and simply rely on dollar-cost averaging.

The other option is to invest only when the stock market is ‘cheap’. But this depends on how you interpret the valuation ratios and whether it’s an appropriate time to enter the market 🙂

1)Do we have any platform like the Vanguard to invest in ETF in Malaysia?

2)If I have a stock investment account in HLB which I open thru’ my remisier how can I do online trading (buying and selling shares) without going thru my remisier as the fees are more expenses compared to going online.

Hi Julia,

Thanks for asking!

1) Yes, you can have a look at the list of ETFs provided on Bursa Malaysia. The ‘main’ one would be FTSE Bursa Malaysia KLCI ETF that tracks the FTSE Bursa Malaysia KLCI Index.

http://www.bursamalaysia.com/market/securities/equities/products/exchange-traded-funds-etfs/

2) You can ask your remisier about online access. If not, you can always go directly to the brokerage.

How/where can I start buying s&p 500 that you have mentioned?

Hi Fion,

You can consider that SPDR S&P 500 Trust ETF. Besides the NYSE, it is also listed on the SGX:

http://www.spdrs.com.sg/etf/fund/spdr-sp-500-etf-S27.html

Hi ,

Does the compound interest means putting your returns back into your investments? For example , investing $1000 in an 10% return PA , does the $100 return have to be invested as well for the compound to work? Are there any schemes that automatically reinvest the returns ? Or do we have to do that transaction again by ourselves and having to pay the $25 fee?

Hi Lu,

Yes, ‘compound interest’ is interest earned upon interest.

But in the above examples, you don’t have to do any reinvestment because the returns are based on capital gains (which are already automatically ‘reinvested’) which compound larger and larger as the years go by.

However, if a stocks pays you a dividend, then you’d need to reinvest it if you want to compound your dividends as well.

I’m 50+.is it ok for me to start trading? I’m wondering weather to go for short term or quarterly trading.Pls advice. Tq.

Hi Athi,

I can’t advise you on trading on whether you should trade for income. All I can share is that just like any other worthwhile skill to pick up, it requires learning, time and effort to be successful at it 🙂

Thank You Adam for the impressive Sharing.

I am a Happy Retiree, Will definitely buy ETF when market are down for my grandchildren .

You’re most welcome, Grace!

Hi!

Thanks for the article, I found it really informative! I’m turning 21 this year, and have some money saved up from NS/working while waiting for uni. I plan to set aside a small amount each month to invest (probably in the STI ETF or S&P 500), and I just wanna ask if this is advisable compared to saving up to repay my student loans at the end of uni. I don’t think the 6-7k I have saved up currently will make much of a difference in repaying the tuition loan (~150k) so I thought it would be better to use it to gain experience in managing my investments. Also, does the information above take into account brokerage fees? And which brokerage would be the most sensible for someone planning to only invest a small amount of 200-300 SGD each month? Sorry if I’m asking a lot of questions, but I’m really new to all this. Thanks!

Hi Yw,

What is the interest on your student loan and what is your plan to repay it?

Like you say, it might be reasonable to set aside a small amount early to gain experience in managing your investments. At the same time, I think your focus should be first reducing and eliminating your student debt before you start funding a large sum of money to your investments.

There’s risk in the markets and you can lose money! You don’t want to be caught in a situation where you’ve lost a significant amount which you could have used to to pay down your debt instead.

The above doesn’t take into account fees. If you’re looking to invest a small monthly amount into an ETF, then something like POSB Invest Saver is suitable.

Wow, sure didn’t expect such a quick reply considering this post was almost 2 years ago, I really appreciate it, and thanks for the advice!

Ideally I would get a bursary/scholarship which would take most of the burden off tuition fees, but there aren’t much for local medicine so I’m most probably going to have to source for a tuition loan instead. I was looking at the MOE tuition loan fee since it doesn’t charge interest for the duration of my studies, and I don’t think I’ll have much trouble repaying that as the pay for that field is quite good. Because of my career choice I doubt I’ll have much time to monitor the market closely, which is why I thought it was a good idea to put in a small sum each month during university to see how it works out before I actually start earning proper money, but I was worried that the brokerage fees would mean that I wouldn’t actually earn anything since I was investing so little.

Hi Adam,

May I ask the “annualized return of the S&P 500 from 1928 to 2016 is 9.53%”. This 9.53% includes capital gain + dividends? or just dividends? Capital gain means having need to sell away the stock right? Does this means we have to sell it away and reinvest it every year? If just include dividends, it will not be auto invested right as the dividends proceeds will go straight into our account?

Another question is, as China will be rising in future, (having a real chance to take over the US as the number 1 economy) would it be better to invest in the Hang Seng index as it have exposure to China stocks too, or it is still better to invest in the S&P 500? For the past years as US is the number one economy, even if they fall, they can still rise back and thus achieving an average return of 9.53%. But since China is coming up greatly, which would you choose to follow for a period of 40 years if start now? The China Shanghai Composite Stock Market Index, Hang Seng Index, or still the S&P 500 Index?

Thanking you in advance. It is a very great article!

Hi Lee,

The S&P 500 returns include capital gains and dividends, with dividends are not reinvested. You don’t need to sell the stock; a performing asset will continue to grow in value regardless of whether you sell it or not.

No one really knows if the S&P 500 will continue to return at 9.5%; we can’t predict the future. We only use the index’s track record over the past 80 years to give us an indication of its long-term performance.

I don’t think you have to choose just one index to invest in. You can certainly invest in all three — the S&P 500, Hang Seng, and SSE — as long as you believe in their respective country economies and growth stories. Hope this helps!

Hi Adam,

Thanks for your reply. However if we want to invest in the long term without selling it, shouldn’t we just concentrate on the dividends returns? Because if we use the 9.5% (which include capital gains), it is not really 9.5%?

Example if i invested $1000 at the start of this year, and just for example sake of 9.5%, I expect my returns to be $1095 at the end of the year. And this $1095 to be brought forward next year and continue to be compounded at 9.5%.

But if I do not sell it, where to get 9.5%? If I do not sell it for capital gains and just relying on the dividends and using it for reinvest, the annual average returns should be just an average of 2% only over the years of dividends it gave. If I wish to get the 9.5%, I have to resell it every year and reinvest it again. Isn’t it right?

The calculation should be $1000 X 2% = $20. And $1020 will then be brought forward next year again to be compounded at another 2%. So the returns should be 2% and not 9.5%? Hope you can clear my doubt and correct me If I am wrong, thanks a lot.

Hi Lee,

You don’t have to sell to reinvest your capital gains because the gains are already reflected in the asset price; it is automatically ‘reinvested’. For example, if a stock’s price grows 10% annually:

Year 1: $100 x 10% = $110

Year 2: $110 x 10% = $121

Year 3: $121 x 10% = $133

The growth in price reflects your annual compounded capital gain.

Dividends, on the other hand, have to be reinvested in order to be compounded because they are ‘extracted’ from the asset and paid to you in cash.

In order to compound your dividends, you have to use that cash to buy more stock so that it can continue to grow.

https://www.investopedia.com/terms/c/compoundinterest.asp

https://www.investopedia.com/articles/investing/090915/reinvesting-dividends-pays-long-run.asp

Hi Adam,

I’m sorry but i still do not understand. If don’t sell to reinvest the capital gains, how to compound it? All are just paper gains only. Unless we sell and lock in the profits.

Good morning Adam!

I would like to know the formula used to find 7.25%.

Sincerely

Hello, I’d like to understand how you got to those results?

If I apply the compound interest formula, I don’t get the same results:

(11*365)*(1+0.07)^40=60122.45$

Hi Julia,

You need to use the annuity formula because you’re saving and investing an additional $4,015 a year.

FV = PMT(1+i)((1+i)^N – 1)/i = =4015*(1+0.07)*((1+0.07)^40-1)/0.07

dear adam, thank you for taking the time in writing and gathering the info for this article. ummm, so do you buy the index at one go or on a monthly basis, lets say on pay day. thanks 🙂

Hi Michael,

You’re most welcome. I would personally accumulate my funds and only buy the index when it’s suitably undervalued. But some investors may prefer to not do this and simply dollar cost average every month or quarter.

sorry for the delayed reply adam but how do I know when it’s suitably undervalued. in the past I have missed entries as I waiting for it to reach a certain support but it didn’t and took off. I also bought too early and it corrected by quite a bit after. hmmmm

No worries. I like to look at the index P/E ratio to give me an idea of how cheap/expensive the overall market is.

For example, the S&P 500’s historical mean and median P/E is around 15. So one strategy is to save up your funds and only invest in the index when it is trading below the long-term average — which is what I did in 2016 with the Hang Seng index when it’s P/E was only around 8.

https://fifthperson.com/2-etfs-to-watch-as-hang-seng-index-falls-below-its-net-asset-value/

ok thank you for the kind reply adam. and I wish you and family a happy n prosperous lunar new year

Hi Adam,

Does it means that the $4,150 saved per annum will be used to buy the index?

example if the index price at end of year is $3,000, which means I am able to buy 1.38 units of the index?

Hence,based on the numbers by this link that you gave:

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

using $4150 to buy per year, I will have 90,443 units at the end of 89 years, and using the final price on 2016 at $3,287, I will get $297 million.

But if i used the compound interest of 9.5% per annum and also using $4150 to add on per year, I will get only $153 million.

How does it work actually? Thanks.

Hi Xiao Ling,

You can’t buy the index directly but you can invest through an index ETF like the SPDR S&P 500 ETF that tracks the index. Each unit of the SPDR S&P 500 ETF is roughly a tenth of the index value. For example, the S&P 500 is currently at 3,257.85 and one unit of SDPR is at $324.87.

I’m not sure how you reached the figure of 90,443 units, but you don’t need to calculate the number of units into your returns; simply use the total dollar amount invested and compounded over time. Therefore, your second calculation is the correct one.

Realistically, no one will live long enough to invest that long and there’s no guarantee that the index will always continue to perform at its historical rate. But it shows how a consistent, prudent, long-term investment plan can earn impressive returns given enough time.

Hi Adam,

Got it, thanks!!

Super article, super concept for the beginner to focus on passive indexing (maybe only f.ex. Vanguard VOO SP500 or iShares SP500 ETFs is – almost – all one needs). As to stock picking: evidence (studies) seem to show that even professionals rarely (or in reality never ?) long-term beat the market, so maybe for the individual stockpicking is not a realistic concept, possibly.

My own thinking is, given Your mentioning of tech superiority recently, that the SP500 ETF approach (though many tech stocks already included into it) could be pepped up by large and relatively cheap Tech/Biotech heavy ETF investing. These could be amongst others:

VGT, QQQ, XBI, FBT, CQQQ.

Other options being: SKYY, SOXX, FDN, ARKG, IBB.

More risk tolerance & volatility should be expected. The topic inflation should possibly also be given a thought.

Thank You for Your excellent services

What about the Kuala Lumpur Composite Index (KLCI) in Malaysia? From 1977 to 2016, the KLCI rose from its original base of 100 points to close at 1,642 at end of 2016. That’s an annualised return of 7.25% over 40 years. Remarkably similar rate of return to the STI.

how did you get this annualised return of 7.25% .?

Hi Ibrahima,

Yes, I mentioned the KLCI in the article as well. The STI return was based on the SPDR STI ETF from inception to May 2017 around when this article was published.

best explanation of compounding and time value of money that I have seen so far (at the seedly event) – thanks for keeping it simple for newbies 🙂

Thanks nis! Appreciate that you attended my keynote and glad you liked it!