Ascott Residence Trust (Ascott REIT) is a hospitality REIT that owns a portfolio of 73 serviced residences and rental housing properties in 37 cities across Asia-Pacific, Europe, and the United States. As at 31 December 2018, Ascott REIT’s portfolio was valued at S$4.89 billion.

Nowadays, companies are jumping on the bandwagon of targeting Millennials. According to Nielsen Media Research, that’s anyone between the age of 21 and 37 years old (yes, I’m a millennial too). Together we gave birth to the sharing economy. Companies like WeWork, Grab/Uber, and Kickstarter thrive on our collaborative nature, introducing concepts such as co-working, co-riding, and co-funding. It’s not revolutionary. But one thing is for sure, my ‘co-co’ generation loves it!

Ascott REIT decided to jump on the bandwagon last year, acquiring a prime site at one-north for S$62.4 million which they plan to develop into a 324-unit co-living space that’s slated to open in 2021. It’s an attractive location for foreign students or expats that like dormitory-style living – small rooms with communal kitchens, fitness areas, and laundromats for them to socialize.

Singapore is a highly-competitive market with a supply of options for foreigners to choose from. I’m sure many are willing to pay less for a bigger space that’s a thirty-minute train or bus ride away. Additionally, occupancy rate for Ascott’s one-north property could decline in a downturn if its tenant mix is mostly made up of expats. It’s too early to tell if there will be a demand for co-living spaces.

For now, I’m just going to stay tune and find out more.

With that, here are seven things I learned from the 2019 Ascott Residence Trust AGM:

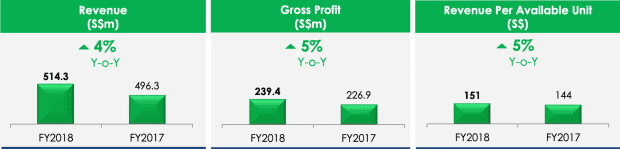

1. Ascott’s revenue increased 4% year-on-year to S$514.3 million in 2018. This was mainly due to the acquisition of Citadines City Centre Frankfurt, Citadines Michel Hamburg, DoubleTree by Hilton Hotel New York – Times Square South, and Ascott Orchard Singapore in 2017. The increase in revenue was partially offset by the loss of income from the divestment of 18 rental housing properties in Tokyo, Japan in April 2017 and the divestment of Citadines Gaoxin Xi’an and Citadines Biyun Shanghai (which was completed on 5 January 2018).

2. Thirty-one percent of Ascott REIT’s revenue comes from serviced residences on master leases, and serviced residences on management contracts with minimum guaranteed income. From these, Ascott REIT earns a fixed, base level of income despite the level of occupancy. The rest of Ascott REIT’s revenue is derived from serviced residences on management contracts, which would be affected by lower occupancies during tough times.

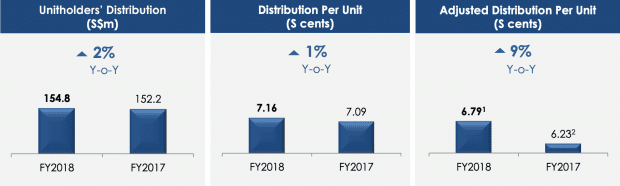

3. Unitholders’ distribution increased 2% year-on-year to S$154.8 million while distribution per unit (DPU) increased 1% to 7.16 cents. The DPU gain was diluted by a rights issue last year. Included within the unitholders’ distribution is a partial distribution gain of $6.5 million from the sale of Citadines Biyun Shanghai and Citadines Gaoxin Xi’an, and another $1.6 million in foreign exchange gain from the divestment of the properties.

4. As at 31 December 2018, Ascott’s gearing ratio is at 36.7%. The REIT has 80% of its borrowings at fixed interest rates and an average debt-to-maturity of 3.9 years. Therefore, Ascott should not be significantly impacted by a sudden rise in interest rates.

5. A shareholder asked what the management plans to do about the lackluster growth in DPU. CEO Beh Siew Kim addressed his concerns saying that the rights issue in 2017 was used to acquire assets such as Ascott Orchard, Citadines Hamburg, and Citadines Frankurt. The rights issue may have a temporary effect on DPU but, in the long run, the acquisitions will strengthen the portfolio and increase income to unitholders. So far, the valuations of Citadines Hamburg and Citadines Frankurt have gone up by 3% and 10% respectively since the acquisition.

6. A shareholder asked the management whether Airbnb will be a threat to the business. The CEO replied saying that 80% of Ascott REIT’s customers comes from the corporate sector. Airbnb will more likely affect hotels that are catered for the leisure market. Lee Chee Koon, non-executive non-independent director, chimed in saying that corporations do not want to manage different accommodations that are managed by different owners in the Airbnb space. Corporations wants to ensure that employees have no downtime – making sure that they are safe, insured, and have stable access to the internet when they travel.

7. Lee continued to share more insights on how the hospitality industry in Asia has been growing and how different types of products satisfy different types of demand. China on its own generates about 5 billion domestic trips and 200 million outbound tourists annually. With the rise of middle class in India and Indonesia, there are not enough hospitality products out there to meet their needs – especially when travelling has become so affordable with the growth of budget airlines and high-speed rail. These are driving the demand for accommodation products. Originally, Japan used to attract about 10 million tourists a year, but in the last 5-7 years, that has gone up to 30 million. In the beginning, the Japanese government allowed the Airbnb format to accommodate the large growth in visitors. However, as hospitality inventory caught up, the government started to impose rules and regulations, and restricted Airbnb lodging to certain areas.

This article is written in support of the SIAS Q&A on Annual Reports initiative to raise the standards of AGMs, and encourage minority shareholders to ask questions, engage, and interact with the management of listed companies. Founded in 1999, SIAS is a registered charity, Institution of Public Character, and industry watchdog that aims to promote exemplary standards of corporate governance among Singapore-listed companies to ensure that investor rights and interests are protected.

I’m not sure I totally agreed with the management response on item 6. A lot of big corporates actually allow their people to book their own accommodation, and AirBnB are definitely starting to court the business customer. I’m an enthusiastic user of AirBnB myself, having had 95% excellent experiences (we prefer to stay in a good AirBnB than a 5 star hotel – the better AirBnB’s are really fantastic). If just 20% of customers migrate to these services it’s going to result in serious margin erosion for the underlying business. AirBnB is certainly controversial, but it isn’t going away. Interestingly, I’ve found that a lot of AirBnB hosts only want longer-stay clients, i.e. a minimum stay of 90 days. Not just that, AirBnB is reportedly spawning copycats, which could probably allow hosts to circumvent AirBnB’s maximum of 90 days per year letting limit.

Ascott’s strategic response to these developments needs to consider local letting laws. Maybe keeping to investments in markets that are relatively controlled (like Singapore and Paris etc)?