Malaysians love shopping malls in general. Shopping malls are a one-stop solution for most of our shopping, entertainment, and dining needs. Most importantly, they offer free air-conditioning in this tropical region! No matter how much I don’t like crowds, I still somehow end up in a mall once every fortnight.

Still, there are too many shopping malls in the Klang Valley. Retail space per capita in the Klang Valley increased from 7.3 to 9.2 square feet in 2018 and is expected to reach 10.5 square feet in 2020. In comparison, retail space per capita in major cities usually ranges between 7.5 and 8.0 square feet.

Hektar REIT’s portfolio caught my attention as five out of its six shopping malls are located outside the Klang Valley. As at 31 December 2018, its portfolio of six malls has a total net lettable area (NLA) of 2 million square feet and an aggregate value of RM1.2 billion.

I was interested to know more about the REIT and took the chance to attend its recent annual general meeting. Here are seven things I learned from the 2019 Hektar REIT AGM:

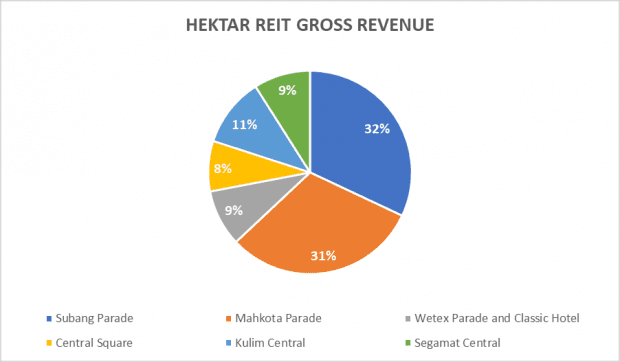

1. Gross revenue grew 7.6% year-on-year to RM135.1 million in 2018. Hektar REIT’s revenue reached a five-year high in 2018. Subang Parade and Mahkota Parade contributed to approximately two-thirds of 2018 revenue.

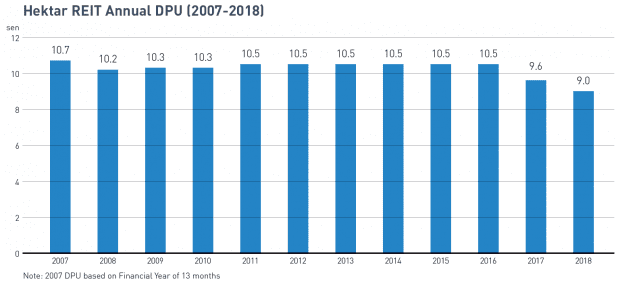

2. Dividend per unit (DPU) decreased by 6.3% year-on-year to 9.0 sen in 2018. Although DPU reached a 10-year low in 2018, Hektar’s distribution yield stood at around 8.1% as its share price has been on a downtrend since 2016. Total income distribution actually increased by 2.7% from RM40.5 million in 2017 to RM41.6 million in 2018, but the issuance of new units pushed the REIT’s DPU down. There was also an increase in operational costs by 8.9% to RM56.4 million mainly due to asset enhancement initiatives (AEIs) at Subang Parade. The management is also planning AEIs at their other shopping centres.

3. A unitholder was concerned about the number of material litigations that Hektar REIT was involved in. Chief Corporate Officer Zarina Halim explained that litigation is part and parcel of business in shopping centre management. She attributed the number of litigations to their large tenant base of 492 tenants – one of which is supermarket operator, The Store. They are currently Hektar REIT’s second largest tenant occupying 13.5% of total NLA and contributing 5.9% of monthly rental income. The ongoing dispute [U4] on tenancy terms with The Store does not negatively impact the REIT’s existing income. The Store continues to pay the rental rate they believe is correct which Hektar REIT disputes. The matter is currently at the Court of Appeal. Zarina added that when they acquire new malls, the tenancy terms inherited from previous landlords sometimes do not align with the REIT’s tenancy standard. Problems usually arise during standardisation of the tenancy terms which can be time-consuming to resolve, particularly with anchor tenants.

4. The same unitholder was worried about the 2019 tenancy expiry which accounts for 38% of total NLA and 45% of total monthly rental income. As at 31 December 2018, Hektar REIT has an overall portfolio occupancy rate of 92.1%. However, the occupancy rate at Segamat Central dropped from 94% year-on-year to 78% in 2018. Zarina shared that a tenancy remixing exercise is currently being undertaken at Segamat Central. A market study was conducted to understand customers and their demographics better. Based on the study’s findings, Hektar REIT brought in a new anchor tenant, TF Value Mart, in November 2018 to help reposition Segamat Central. The footfall traffic has been encouraging so far.

5. The same unitholder carried on with his questions and asked if Hektar REIT had more room for inorganic growth given the fact its gearing ratio stood at 44.4%. Zarina replied that there still has a huge opportunity for retail growth. An internal study showed that more than 36 cities and municipalities in Malaysia are suitable for neighbourhood shopping centres. She believes the gearing ratio is still manageable and they are constantly on the lookout for acquisitions. In terms of future acquisitions, a combination of debt and equity funding would be explored. CEO Dato’ Hisham bin Othman shared that there is still capacity to add new NLA to some of their malls in order achieve higher rental revenue. There is also room for further positive rental reversions, which was 5.4% in 2018.

6. Another unitholder asked about the management’s rationale for acquiring Classic Hotel in Muar, Johor. Zarina explained that Classic Hotel was acquired together with Wetex Parade. The 10-year lease with the previous hotel operator expired in April 2018and the management decided to take over the hotel by refurbishing it. It was reopened in December 2018. As of April 2019, it is the only three-star rated hotel in Muar. Customers can now book the hotel rooms through four online travel agencies: Agoda, Booking.com, Expedia, and Traveloka.

7. A number of initiatives were undertaken in Subang Parade to improve its operational efficiencies, thereby achieving savings in water and electricity consumption. At Subang Parade, some tenancy lease agreements were deliberately unrenewed to allow the tenancy remixing exercise to take place. As a result, there are some empty lots and the occupancy rate in Subang Parade dropped from 90.9% year-on-year to 88.2% in 2018. Hektar REIT aims to introduce more food and beverage tenants, while existing F&B tenants such Nando’s and Esquire Kitchen refurbished their lots to create a better customer experience. On a separate note, the Chief Leasing Officer highlighted that Parkson is doing well in Subang Parade and Mahkota Parade.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Don’t believe everything they say. Go check out the actual malls and buildings and you will see how well or badly managed it is. On the said savings and efficiencies achieved for Subang Parade (I live nearby so I know), they basically did this- where there’s two lifts, turn one off and keep one on; turn off half the escalators so most of the time you have to climb up or climb down the high escalator steps; for some lift lobbies both lifts are not working and you have to walk using the emergency stairs. These are not breakdowns, they are intentionally turned off in order to achieve said ‘efficiencies’. How can you make the mall business better in the long term by treating customers like rubbish?

The share price of Hektar reit has been going down. What causes it and should this cause a concern to not invest in this stock?

Hi Franky,

I took a quick look at Hektar’s 2018 annual report, p. 4, and net income per unit has been dropping since 2015 and distribution per unit has also been on a downtrend since 2016, perhaps that’s why the share price has followed suit. Gearing ratio of Hektar REIT is a bit on the high side.

You may want to dive down into the stock and take a look here before making your final call —

https://fifthperson.com/5-important-factors-you-need-to-consider-before-you-invest-in-any-reit/

Hope it helps 🙂

Regards,

Chee Hoi